WEEKLY, June 17, 2023

Two big market movers this week, AI hype, and systemic financial manipulation

Hi everyone! Just when you thought crypto markets were going to start settling back into their unfortunately-now-typical ennui… Macro moves and political positioning obviously had other ideas.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

If you’re a premium subscriber, much of what I write about here you’ll have already seen in the daily emails, so feel free to skip. And if you’re NOT a premium subscriber, I hope you’ll consider becoming one to support my work and to get a frequent update on how crypto is influencing the macro landscape, and vice versa. You’ll get more in-depth and up-to-date market commentary, a daily big picture look at the broader trends influencing crypto adoption, links to interesting articles and podcasts, cute stick figures on charts (when time allows), sometimes a fun video, and always a shared enthusiasm for how the crypto industry is no longer a niche topic that appeals to a limited audience.

Programming note: Due to a conflict, the daily email will skip publication on Monday, June 19th – back in your inbox on Tuesday!

MARKETS

There’s competition for the biggest story this week, and by “biggest” I mean the one with the deepest actual and potential impact on crypto markets going forward. One pushed crypto prices down, the other pulled them up, and the net effect has yet to be worked out.

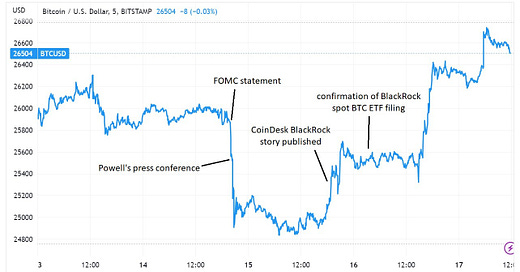

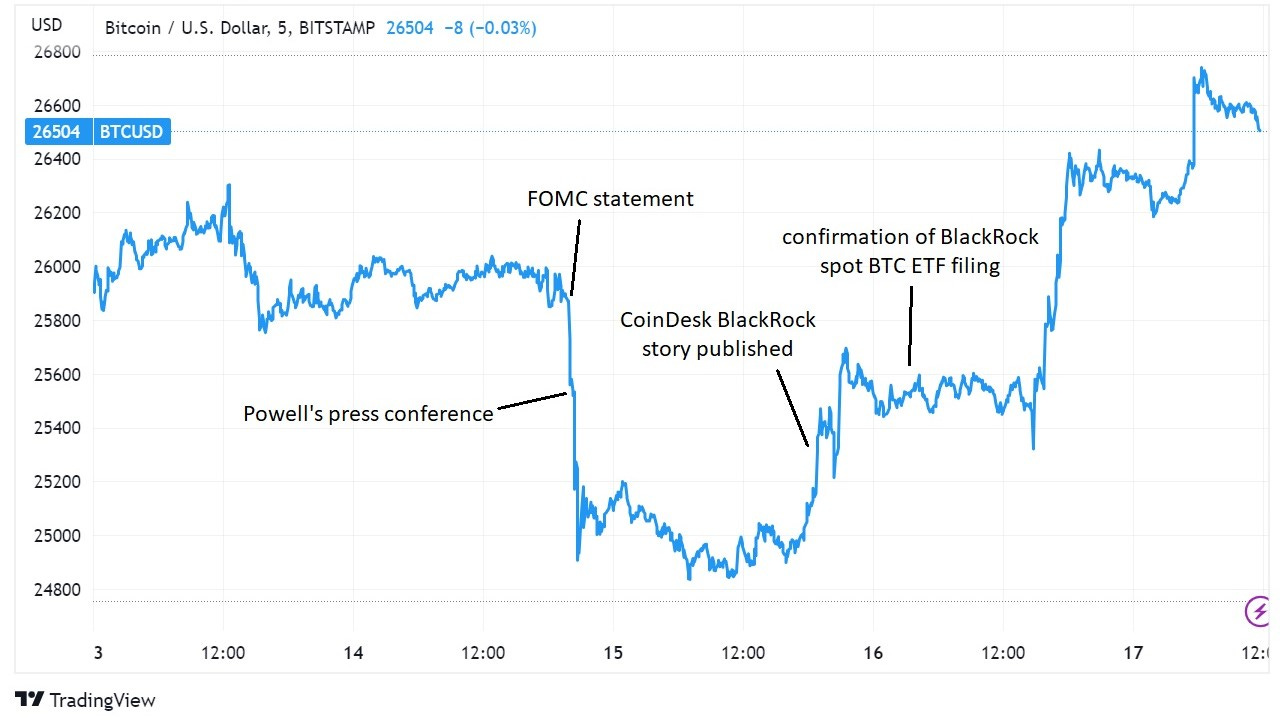

(chart via TradingView)

The Fed is hedging

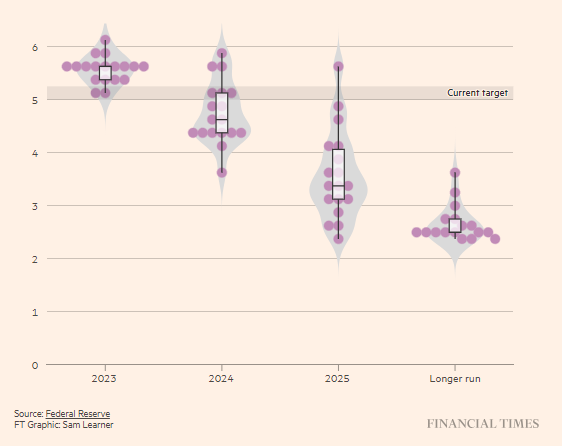

First, we had the surprise increase in the FOMC’s expectation of the fed funds rate for the end of the year, which was raised from 5.1% (in line with the current level) to 5.6%. This came as a surprise because inflation has been showing signs of decelerating, and the messaging from Fed officials before the pre-FOMC blackout had suggested a waiting period would be appropriate, to see what incoming data looked like.

Given that incoming data is showing signs of a slowdown on many fronts, I had thought that the “waiting” would leave the end-of-year expectation steady. Nope, the Fed signalled that it expects two more hikes in coming months.

This has triggered a chorus of criticism about the confusion, the division and the mistaken strategy. Some have asked why the Fed doesn’t just raise if it knows it’s going to. Others have pointed to inconsistencies in the economic forecasts (why leave 2024 inflation expectations flat but lift the forecast fed funds rate? why lift the expected 2023 inflation yet not raise rates now?).

In retrospect, though, the Fed’s move makes sense, and having slept on the idea, I think it was the smart thing to do.

In the new set of economic projections, forecast unemployment moves down from 4.5% to 4.1%, GDP is expected to end higher at 1.0% (vs 0.4% signalled in the March report), and core PCE inflation is no longer pegged to come down to 3.6%, rather it will only retreat to 3.9%.

In sum, the Fed is saying the economy is stronger than it had anticipated at this stage and it wants some leeway to raise rates again should inflation start to tick up again. It is not saying it will raise rates again, and Chair Powell stressed in his press conference that the July meeting was “live”, which means they have no idea what they’ll do. He insisted that the decision to raise rates again has not been taken. But the subliminal message is that they might.

The key word here is “message”. The Fed is signalling that rate cuts are not coming any time soon. It especially does not want the market to take this pause as a sign that the cycle is over. It does not want valuations to continue to skyrocket, it does not want stockholders to feel wealthier and keep services spending high, it does not want rising collateral values to boost lending, and given how “confident” the market has been that rate cuts are imminent (up until very recently), it is probably right in expecting the perma-bulls to misread anything other than a strong hawkish signal.

So, the takeaway is not that there will be more hikes, despite a dot plot that shows all but two officials in favour of them (with one dot suggesting that four more hikes this year would be appropriate!). I don’t think there will be. It’s that rates are not coming down this year, no way, not going to happen.

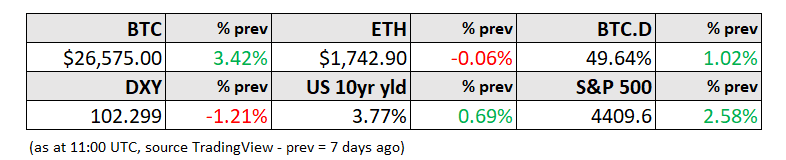

(chart via the FT)

The reason that I don’t think there will be more rate hikes is that inflation is responding. Slowly, but it’s getting there, and raising rates risks adding unnecessary strain to an already fragile banking system that has barely started to process the looming damage from commercial real estate loans.

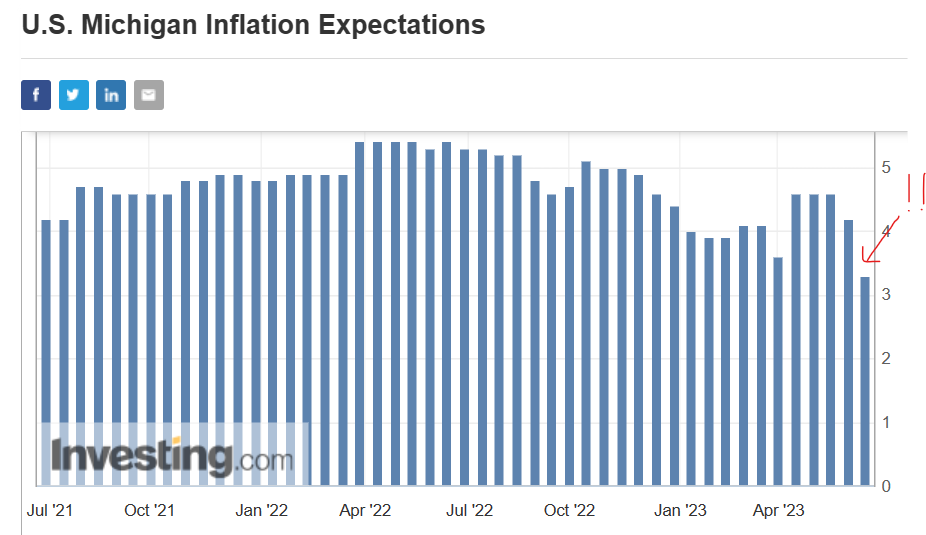

Yesterday’s University of Michigan inflation expectations survey came in much lower than forecast, at 3.3% vs 4.4% expected, and consumer expectations influence behaviour. Thursday’s US retail sales for May ended up being higher than economists had predicted, but still showed moderation vs last year, and other releases showed that factory production was sluggish and unemployment claims were heading up.

(chart via Investing.com)

The economy is still surprisingly strong but slowing, and I doubt that the Fed would want to risk triggering a wave of bankruptcies and financial system turmoil unless inflation shows signs of heading up again.

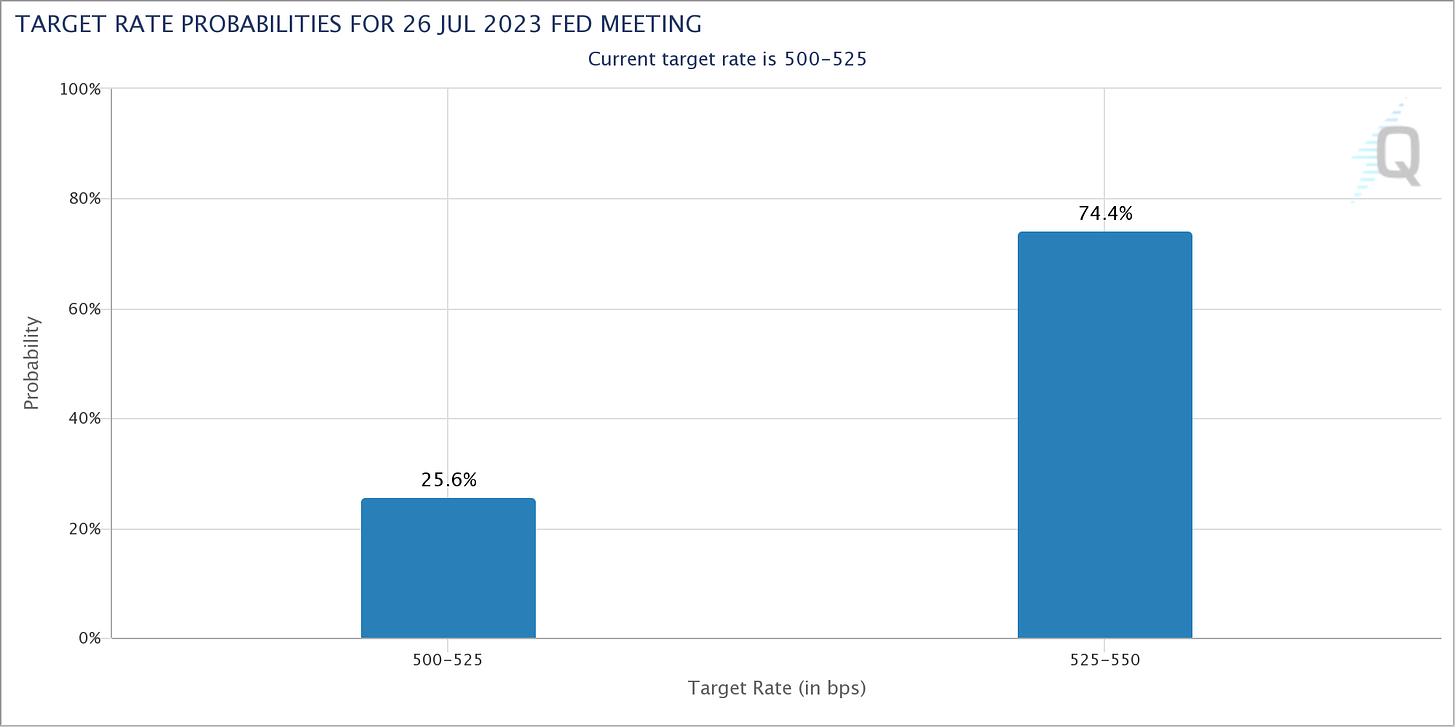

Then again, inflation might do that – a lot depends on the oil price, which has been low recently but could head up fast given supply constraints and potential summer demand squeezes. The Fed has stressed that, going forward, it will be “data dependent”. So, before we assume there are more hikes coming, let’s watch the same data the Fed will be watching. For now, the bond market is assigning a 75% probability to another hike in July. It will be interesting to see how this changes over the course of the next few weeks.

(chart via CME FedWatch)

BlackRock’s strong move

The second major market impact this week came from an unexpected source. Yesterday, BlackRock surprised the market by filing papers with the SEC for a spot BTC ETF. This is astonishing on many fronts: SEC Chair Gary Gensler has been clear in his discomfort with the idea of a strong crypto market in the US, and we’re talking about BlackRock here, the largest asset manager in the world.

What’s more, there is strong speculation from smart people who understand ETFs that this proposal has a chance of getting approved. It appears to “solve” for Gensler’s criteria of surveillance sharing agreements, and has some other structural quirks that apparently give it better odds than previous attempts.

It still seems very unlikely to me – the surveillance sharing solution in the proposal is between the ETF listing exchange CBOE BZX Exchange and the CME, whose bitcoin futures use the same index as that proposed for the ETF. There’s still plenty of scope for Gensler to deny the application on the grounds that the underlying spot market does not have that agreement.

Yesterday, I shared my theory that this was a political statement on the part of BlackRock. Its CEO Larry Fink is a prominent Democrat, and this filing seemed like a message to Gary Gensler’s bosses that BlackRock did not support the SEC’s approach to bringing crypto into regulatory compliance.

This smart and detailed thread from Justin Slaughter, however, suggests that Larry Fink had plenty of other avenues to convey such a message, without going through the expense of a filing. Justin does have a good point there. He thinks that BlackRock expects Grayscale to win its suit against the SEC, and wants to be in with an ETF should that happen. That would be amazing.

Other encouraging signs are that BlackRock have only ever had one ETF proposal rejected, out of 576 submitted. We can assume they have done their homework here.

Either way, it is a very welcome positive development, and puts further pressure on the SEC to clarify its crypto stance beyond “come in and register”. The political battle around the future role of crypto markets in US financial innovation is getting heated, but is far from burning out.

COLUMN

Save us from the hype

We’ve seen this before. A radical technological breakthrough spins off applications that promoters insist will revolutionize whatever industry they happen to be targeting. Breathless conferences promise that nothing will ever be the same again. Funding floods in at back-of-the-envelope valuations based on exponential growth. I could be talking about the crypto circuit circa 2016-17. But today, I’m talking about artificial intelligence (AI).

It’s hard to not be mesmerized by the AI attention and perhaps motivated by the inflated promises. The impact, even at this early stage, is exciting: the ability to interface with computing power using natural language is a massive productivity unlock, and the creativity boost through almost instant images and prose is both helpful and entertaining. And that’s just scratching the surface.

But the hype we’re hearing around AI now is reminiscent of the hype we heard around crypto and blockchain years ago. That was misplaced, as is today’s. The impact of crypto and blockchain is real and will continue to evolve; it’s just not what some tried to sell the public in the early days. The same will happen with AI – the impact will be considerable, but the hype is setting the field up for disappointment.

Last week, venture capital firm a16z published a document on the topic, written by Marc Andreessen himself. He’s smart – I thought his January 2014 piece for the New York Times titled “Why Bitcoin Matters” was excellent, laying out the potential while not ignoring the risks and focusing on how the technology combines with market forces.

But this AI piece has many cringe moments.

Here are some quotes from the post:

“An even shorter description of what AI could be: A way to make everything we care about better.”

Am I the only one that sees the possibility that AI could get involved in everything we care about somewhat dystopian? And what does he mean by “better”? Better for whom?

“The AI tutor will be by each child’s side every step of their development, helping them maximize their potential with the machine version of infinite love.”

Oh my. This is scary.

“Every leader of people – CEO, government official, nonprofit president, athletic coach, teacher – will have the same. The magnification effects of better decisions by leaders across the people they lead are enormous, so this intelligence augmentation may be the most important of all.”

I’m crying.

“I even think AI is going to improve warfare, when it has to happen, by reducing wartime death rates dramatically.”

The internet was going to do that by moving warfare online. That didn’t work out, and let’s fervently hope no authority walks up to red lines thinking it’s okay because there will be fewer deaths.

Other claims I’m hearing attributed to AI that echo those bestowed upon blockchain and even the internet back in the day:

AI will “permanently disrupt” education. The internet arguably did this, but are people happy with the state of education these days?

AI will predict medical problems before they happen. Obviously, this would be wonderful, but would better predictions improve diagnoses, or could they introduce more risks? If AI-powered medicine can save even one life then I’m all for it, but I worry about the general anxiety cost and the missed diagnoses because the predictive algorithm didn’t flag anything.

AI can help fight climate change. Faster information processing can deliver useful maps of trigger areas that could help focus prevention efforts. But what about all those guzzling data centres?

AI combined with nuclear fusion will make us a super-species. And facilitate intergalactic travel.

We will never have to worry again. This is from Sam Altman, the CEO of OpenAI.

I could go on…

Perhaps I sound like a crypto enthusiast who hates the idea of another hot technology stealing our ecosystem’s thunder. Far from it – I hated the early-stage crypto hype as well, the promises that “blockchain will change everything!”, “everything will be tokenized!”, “bitcoin is the future!” (and yes, I know that we’re still hearing some of these). I’m excited about AI, see the problems as opportunities, and am looking forward to experimenting more over the summer to see how it can help with the newsletter.

I’m also supportive of the migration of VC attention. You’ll probably have seen some of the tweets/post/interviews of prominent Silicon Valley representatives saying things like “If you’re in crypto, pivot to AI”. By all means, those venture capitalists that chase the latest technology should definitely do that. This would significantly reduce funding in the crypto ecosystem, but the crazy money that was being flung around a couple of years ago led to unrealistic valuations, unsustainable structures and some really bad behaviour. A tighter funding environment will hopefully mean that those startups or later-stage operations that do get funding will have a stronger product/market fit, run a leaner operation and as a result have a better chance of survival while not burning through easy VC cash.

The AI field is welcome to the hypesters as well: the techno-utopians convinced that technology brings out our better natures, the visionaries that believe funding should be based on faith rather than utility, the consultants that want to frighten you into paying for their services.

If AI deflects the “hot” funding, diverts the hyperbole and siphons off those that were only in it for the money, the crypto ecosystem will be stronger for it. Blockchain promises will become more focused. The expected value can get more real.

The crypto ecosystem will also benefit from potential overlaps, and there are many. Easier coding for blockchain-based apps, decentralized storage for vast pools of data, shared incentives for sustainable power solutions for data centres are just the tip of an exciting pyramid of possible synergies.

I venture that another overlap could be applying lessons learned from the crypto hype. Vast opportunity is exhilarating, and if we don’t reach high, we’ll never know how high we can go. But too many broken promises weakens credibility, disillusions investors and gives detractors plenty of fuel. The AI field probably has to go through the process, though, and learn this for itself.

I applaud genuine excitement for the motivation it spreads and the hope it delivers. My concern is when that excitement becomes opportunistic and manipulative. Those who care about our collective future, with all the solutions and risks technology can bring, deserve better.

HAVE A GOOD WEEKEND!

This morning, I breezed through the BBC Radio 4 series “The Lowball Tapes”. Recorded last year, they are the summary of Andy Verity’s multi-year investigation into the LIBOR rigging scandal (his book on the topic, “Rigged”, was published earlier this month). Several traders went to jail for rigging the interbank benchmark interest rate – even though Andy’s investigation shows that they were following standard industry practice. In the US, all of the parallel convictions were overturned because what they did was not against the rules. The UK has not yet done so, despite (or because of?) the Bank of England being heavily implicated.

It’s an eye-opening and at times jaw-dropping account of financial manipulation embedded in the system, and the coordinated protection of those running that system. A strong recommend.