WEEKLY, June 22, 2024

crypto and wealth, central bank reserves, democratic values

Hi everyone! I hope you’re all doing well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links. If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Wealthy Americans and crypto

Keep an eye on democratic values

Watch those central bank reserves

Some of the topics discussed this week:

Tokenization monthly roundup

BTC patterns and market liquidity

Good news for ETH

The SEC mess

An unusual CBDC trial

A telecoms giant mining Bitcoin?

Exchanges are skeptical of tokenization

More signs of a slowing consumer

Red Sea tension spills over

PicPay’s IPO

China vs US: always question the news

… and quite a bit more 🌺

Wealthy Americans and crypto

This week, Bank of America published its bi-annual survey of investment trends among wealthy Americans, with some interesting takeaways for the crypto market.

First, for purposes of the survey, “wealthy Americans” means those over 21 years old with investable assets valued at over $3 million. More than 70% of respondents were over 57 years old, with millennials accounting for only 12%. The under-43s, however, delivered the bulk of the surprising and encouraging findings, and when it comes to crypto assets, this is the cohort to watch.

It turns out there are some stark differences in how different age groups perceive the world. For instance, almost half of the 21-43yrs bloc thinks the outlook for the global economy is “very good” or “excellent”. That drops to 6% for those who are older. Maybe it’s the different media the two groups consume? The survey indicates that for under-43s, it’s mainly social media, while those older largely rely on online articles – both are good at catastrophising, so maybe it’s the importance given to each? Or maybe it’s life experience, as in those who are older have “seen this before”?

(chart via Bank of America)

What’s more, respondents did not follow market consensus in their interest rate expectations. The survey was conducted in January and February of this year, when swaps were pricing in five-to-six US interest rate cuts. Yet more than half of respondents predicted rates would stay the same or even increase.

(chart via Bank of America)

Now we get to some eye-opening takeaways for digital asset markets:

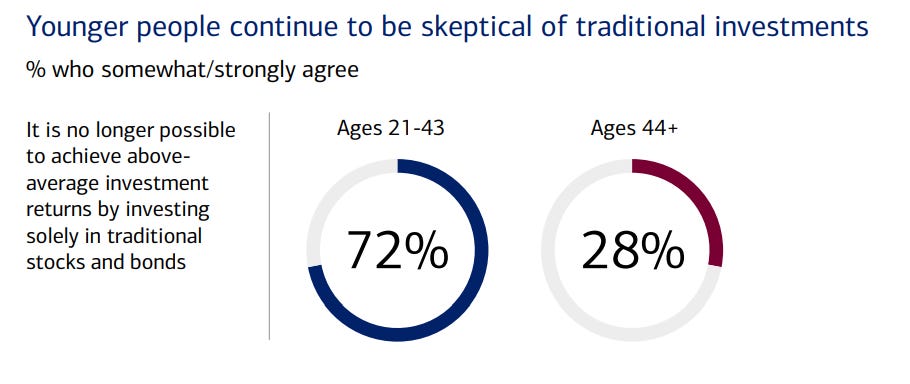

Almost three quarters of the under-43s believe it is no longer possible to get superior returns from traditional assets alone.

(chart via Bank of America)

This group’s preferred asset classes are, in order: real estate, crypto, private equity, personal company/brand, direct investment, and positive impact. For those over 44, crypto is almost at the very bottom of the list.

(chart via Bank of America)

Here, the impact of the transfer of generational wealth matters. According to the report, roughly $84 trillion is expected to be inherited by Gen X, millennials and their heirs over the next ten years.

Let’s do some math: the combined market cap today of BTC and ETH is approximately $1.7 trillion. If the inheriting class follows the pattern suggested by the survey, 24% of the wealth transfer (28% of the younger group favour crypto over stocks and bonds, minus 4% from the older group) could flow into the crypto market. Some of that could go to meme coins or DeFi yield, so let’s be conservative and estimate that only 15% of the wealth moves into BTC and ETH.

That’s $12.6 trillion. Let’s round down and contemplate $10 trillion. That’s more than five times the current market cap of the two leading crypto assets.

There is, of course, plenty that could move this needle adversely in ten years. The outlook for crypto could weaken, new alternative asset groups could climb in favour, and so on. But, even so, we are largely overlooking the wealth transfer impact.

Especially notable is that even self-labelled conservative wealthy investors under 43 years old already have an almost 20% allocation to crypto assets! Over 44 yrs, the weighting drops to practically 0%.

(chart via Bank of America)

What about the lack of “fundamentals” or cash flow? The younger generation doesn’t care. More wealthy Americans under 43yrs value “sentimental value” more than ESG. A greater percentage would give “significant consideration” to feelings about an asset than to transaction costs or expense ratios. With this criteria, dogwifhat could be as valid a choice as a balanced and inexpensive ETF. And anti-system crypto has a cultural advantage over a selection of industrials.

(chart via Bank of America)

In sum, there is a stark generational divide in portfolio construction, and a significant transfer of wealth in coming years. Markets and investing are going to change, more than even most readers of this newsletter expect. It’s not just new technologies that will change how assets move or new forms of financing or new ways to assign value; it’s also a rewriting of the old rules of portfolio construction, for a new age.

Watch those central bank reserves

The central bank think tank OMFIF has a piece out summarizing two recent surveys that both highlight the main concern of central banks today: geopolitical risk.

This matters for reserves. In times of actual and even potential upheaval, central banks will want more currency on hand in case of FX volatility or other liquidity needs. For some, this will mean upping the amount of US dollars held; for others, it could imply buying more yuan, dirhams or similar. The decision will come down to which currency they are most confident in: the dollar has the greatest liquidity, but also a climbing risk of seizure which complicates the choice of trading counterparty and custody.

We’re already seeing signs of this in bond purchases. This week, the US auction of 20-year bonds went better than expected. And the People’s Bank of China released data showing that foreign holdings of Chinese bonds have reached record levels – no doubt this is partly driven by pricing opportunities, but there’s probably some reserve positioning in there as well.

One factor in the amount and type of reserves to be added is the particular situation of a central bank’s economy and affiliations. Unlike with a US rate cut, for instance, geopolitics does not affect all central banks equally.

Another is what other central banks are doing. If a neighbouring currency is seen to be “safer” due to its reserve stockpile, your currency could be seen as more vulnerable and come under attack. The amount and type of reserve bump may be country-specific, but the general direction is not.

Not mentioned in the article are two key consequences of this, both of which are likely to impact markets. One is the withdrawal of global liquidity an accumulation of reserves implies. All else equal, this should dampen demand for risk assets.

Another is growing interest in “neutral” reserve assets. This goes a long way toward explaining the climb in the gold price, with central banks around the world increasing their holdings of the traditional store of value. It could also encourage interest in gold’s digital alternative BTC. I’ve often said that we’ll see a central bank hold BTC in reserves before long (I thought it would have happened by now, to be honest). But education throughout the decision stack takes time, as does ensuring seizure-proof custody.

Keep an eye on those democratic values

A few days ago, historian Niall Ferguson published on X a thought-provoking thread on what he calls Cold War II and how he’s coming around to the idea that, this time, we are the Soviets. That may sound like a shocking claim, but he cites increasing government involvement in industrial policy, gerontocratic leadership, an expensive yet inadequate military, a plague of “deaths of despair”, the cultural elite doubling down on an ideology no-one really believes in, and more. All this no doubt sounds depressingly familiar to students of history. Of course, he does not mean to suggest that we have adopted the Communist ideology or are likely to resort to the harsh measures of past and even current regimes. But his point holds: key democratic values have drifted.

If you have a subscription to The Upheaval (not cheap, but worth it in my opinion), I recommend following this with N. S. Lyons’ post from last year about how the West is becoming more like China. It’s a long but compelling, sobering and well- written read that highlights the intensifying ideological tone of not just politics but, well, everyday life – education, culture, food, even marriage are now suffused with tribalism and “correct thinking”. Regulatory overreach has pushed us into “managerialism”, public dissent is buried, corruption at high levels is tolerated or politicized. I could go on.

Regular readers will recognize these trends as one of the reasons I believe decentralized crypto is a force for good in the world and, yes, a tool for economic survival even in “advanced” societies.

Note that I specify “decentralized” crypto because, while I’m fascinated by the centralized development of new onramps, products and distributed ledger efficiencies, they are about improving what’s already in place and sometimes about adding new vulnerabilities while amplifying inequality. Bitcoin, DeFi, new types of markets – they’re about new opportunities and a new type of resilience. In a world with those in power getting increasingly desperate to hold on, in a world in which you can have bank accounts closed because of who you work for or what you say, in a world in which almost everything we do is recorded somewhere – we should feel encouraged that digital decentralization is now possible.

HAVE A GREAT WEEKEND!

This week I want to share with you one of the runners-up for Germany’s entry in Eurovision this year. “Ich Kündige” means, apparently, “I quit” – both the song and the video are original, fun, catchy and sublimely cathartic. It is beyond me why this didn’t win, I am certain it would have taken home the trophy. (Watch with subtitles if German isn’t your native language.)

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.