Hello, everyone, I hope you’re all well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week. This will be a short edition as it was a short publishing week – I’ll share some takeaways from the HedgeWeek conference in Monday’s newsletter.

If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get (almost) daily commentaries on the growing overlap between the crypto and macro landscapes, including market narratives, regulatory moves, tokenization trends, adoption news and more.

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Tokenization market size?

South Korean crypto ETFs

Photography and art

Some of the topics discussed this week:

The BTC overreaction

An economy check-in

About that budget deficit

Stablecoins roundup: yield-bearing, raises, Australia

Japan’s stablecoin ecosystem

AI vs Bitcoin power guzzlers

… and more!

Tokenization market size?

Up front, I should disclose that I don’t trust reports from big-name consultants promising that such-and-such an innovation will disrupt a market worth oh-so-many billions of dollars, unleashing untold value for all clients who hire that particular consultancy to help them figure out how.

When it comes to tokenization, we’ve seen so many of those.

Here are just a few from recent months:

In 2022, BCG assured us that the market size for just illiquid asset tokenization could reach $16 trillion by 2030.

The same year, Polaris Research said it would be $12 trillion.

In 2023, Roland Berger said it would be $10 trillion.

Bernstein said $5 trillion. Citi agreed.

Earlier this month, Fortune Business Insights was predicting $13.2 trillion by 2032.

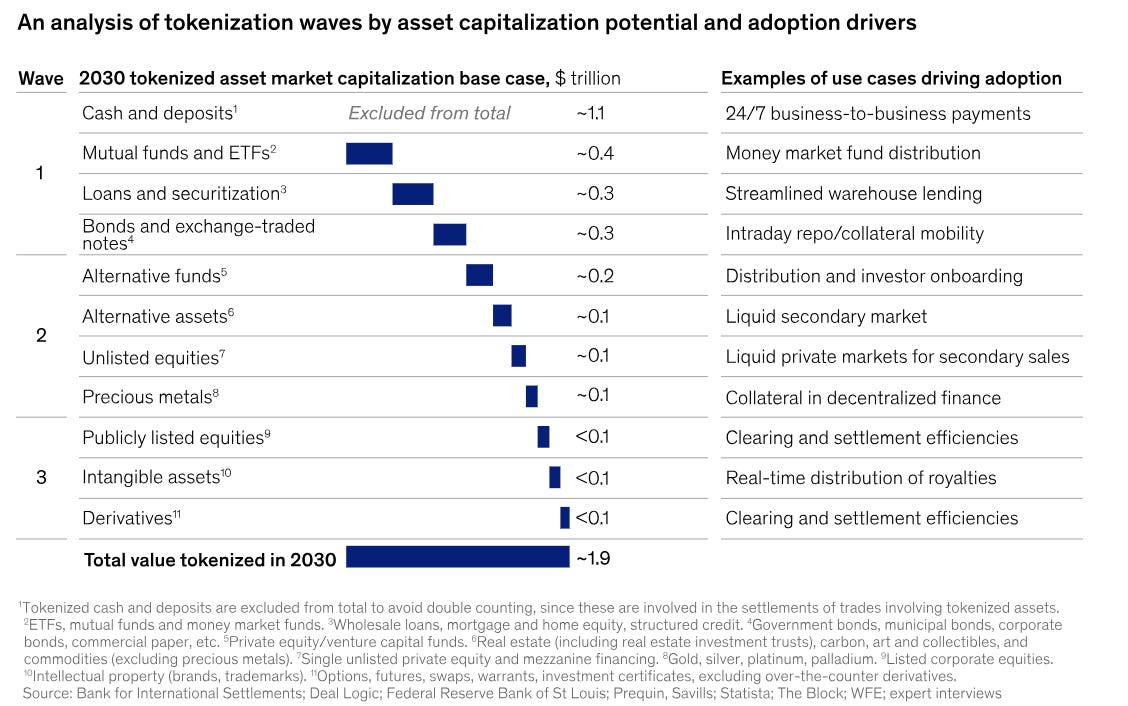

Now, we have a new report from McKinsey saying that the total market cap of tokenized assets (not including stablecoins) could reach around $2 trillion by 2030.

Wait a minute, that’s a lot less than other figures we’ve seen. And $2 trillion by 2030 does not sound like much. It’s less than the market cap of tech companies such as Microsoft, Apple, Nvidia. It’s less than double the market cap of BTC alone. All this activity in tokenization of assets for a $2 trillion market cap in 2030? Given the number of assets likely to be issued, that suggests a market cap per asset equivalent to some of the smaller, less relevant tokens trading today.

Digging a bit deeper, however, that figure may feel disappointing but is a long way from the current market cap of just over $3.3 billion. It’s a CAGR of roughly 190%, which is… huge by all accounts.

And I generally prefer less hype-y forecasts, especially since adoption of new technologies always takes much longer than even the “experts” will tell you. Kudos to McKinsey for being brave enough to even make a forecast six years out for such a rapidly changing environment.

But I’m still perplexed by the strategy here. If McKinsey wants this research to drum up businesses from clients wanting to waltz into the tokenization space, well, for most of the big infrastructure and sell side players, $2 trillion for the entire market is peanuts.

(chart by McKinsey)

Still, the report talks about “waves” of adoption, and maybe that’s the bigger point. New products, especially in established systems, need momentum. That will come with adoption, which has to build organically. Once a $2 trillion market cap is reached, growth could accelerate, because few would dare suggest that the growth ends with some niche money market funds, bonds or repos. There is not only the tokenization of existing assets to consider, there’s also the emergence of new types of assets such as equity-bond hybrids or bespoke ETFs. Six years is but a blink of an eye in terms of market evolution, and it’s possible that many looking at this space may see $2 trillion less as a target and more as a starting point, a level worthy of new interest.

South Korean crypto ETFs

Following the big splash made earlier this year by the US listing of BTC spot ETFs, markets around the world are gearing up to follow suit. In recent weeks, we’ve seen Hong Kong, the UK and Australia launch similar products with muted success, but the important signal is the spread of convenient onramps which will eventually help mainstream investors dip their toes into crypto markets via familiar formats.

South Korea may well end up being an exception, which is strange given how popular crypto is in the country. Then again, maybe that’s why.

The Korea Institute of Finance recently published a report on spot crypto ETFs, warning that they could be bad for the local economy. As enthusiastic as I am about crypto’s potential, and as much as I care about open access, I do see their point.

According to The Block (I don’t read Korean and Google Translate was not helpful), one of the main objections is that crypto ETFs can divert funds that would otherwise go into more “productive” enterprises such as manufacturing, real estate, etc. Even virtual industries such as gaming, content, etc. can be seen to be more “productive” as they generate local jobs and local revenue (and taxes).

That’s not an outrageous observation, especially given how focused Korean crypto investors can be. Last month, Bloomberg reported that roughly 10% of the country’s population had active accounts on registered exchanges. Average daily crypto trading volume in Korea grew 24% last year. So, it’s not a stretch to think that a more convenient onramp could divert a significant amount of retail funds into a volatile market.

That brings up another point the report makes, that a heavy weighting in crypto could destabilize the economy by wiping out retail savings in a downturn. More than the economy, that could also destabilize politics.

Then again, this is just a think tank’s point of view, and the politicians will have to balance stability concerns with public calls for the ETFs they see other countries getting. The Democratic Party, winner of April’s presidential elections, has promised to review the current ban on crypto spot ETFs – but that’s not the same thing as promising to get them listed.

Meanwhile, Korean investors do have choice – there is no talk of banning crypto investment outright, as far as I am aware. So, the report’s bigger impact is to remind us that markets can have political consequences. But so can curtailing opportunity.

HAVE A GREAT WEEKEND!

Regular readers will know that I love to share gorgeous images from photo contests, especially those that remind us of one of the key aspects of art, in my opinion: it makes you feel. We’re so used to thinking of feeling as a noun, as in “this gives me a good feeling”, or “I have a bad feeling about this”, that we lose sight of the word’s impact as a verb – to feel as an action, rather than to have feelings thrust upon you. Art helps us to flex this verb, to take the action out for some exercise, to reconnect with the most vital of human states. I find it especially does so in photography because the feelings the images produce are linked to a sense of connectivity, an awareness of shared space, a recognition of things seen before but not like this.

The competition I’m linking to this week is the Color Photography Contest of the 1839 Awards, named for the year photography went mainstream. So many stunning images, it was hard to choose which three to share, so do click through and take a look at the other entries.

(photo by Mahendra Bakle)

(photo by Alexandrena Parker)

(photo by Matteo Redaelli)