WEEKLY, June 3, 2023

Signs of broader crypto impact, employment + inflation and some epic music...

Hi everyone! You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

If you’re a premium subscriber, much of what I write about here you’ll have already seen in the daily emails, so feel free to skip. And if you’re NOT a premium subscriber, I hope you’ll consider becoming one to support my work and to get a frequent update on how crypto is influencing the macro landscape, and vice versa - it’s only $8/month for now, and there’s a free trial! You’ll get more in-depth and up-to-date market commentary, a daily big picture look at the broader trends influencing crypto adoption, links to interesting articles and podcasts, cute stick figures on charts (when time allows) and a shared enthusiasm for how the crypto industry is no longer a niche topic that appeals to a limited audience.

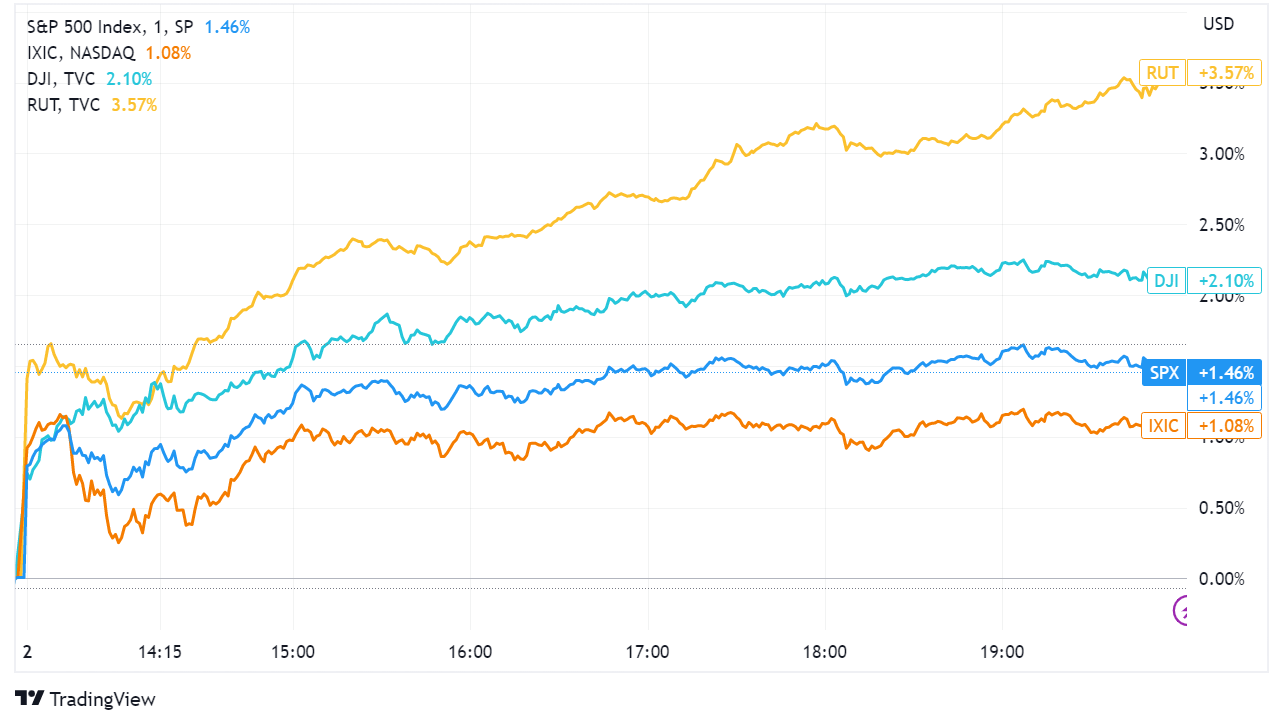

MARKETS

Employment data doesn’t matter

So, apparently all is good again. Economic growth is here to stay, the Fed won’t dare raise rates more than perhaps one more time and the relentless march of technology will bring efficiencies and profits to perhaps not all but certainly an investable few.

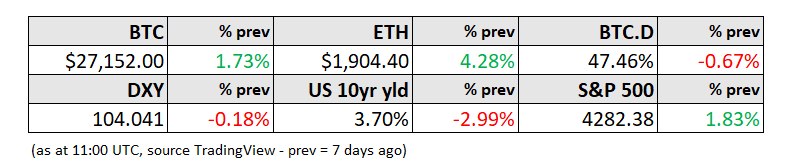

Or at least, that looks like what the stock market is telling us. Friday’s rally injected some spark into an otherwise uninteresting week, with the S&P 500 clocking its steepest one-day gain (1.4%) since April. Unusually, this seemed to be a broad-based rally, with the Dow Jones Industrial average easily outperforming with a 2.1% jump and the Russell 2000 up 3.6%.

(chart via TradingView)

Yesterday’s strong economic data delivered an even more mixed message than usual, with payrolls beating estimates for the 14th consecutive month and non-management wages rising by the most in six months. Yet the unemployment rate jumped from 3.4% to 3.7%, and average hourly earnings were up by the lowest year-on-year amount since April 2021.

(chart via Investing.com)

Traders took these contradictory signals as confirmation that the Fed is likely to pause rates at the June FOMC meeting, and the CME swaps-priced probability of another pause in July jumped to over 30%.

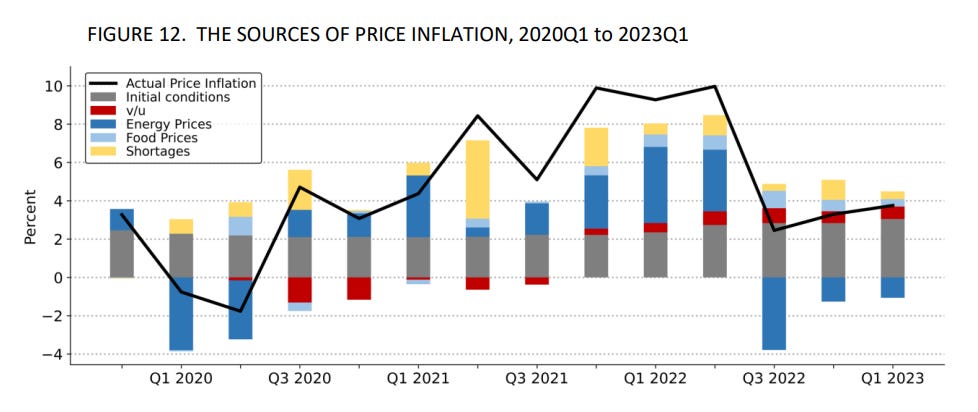

Yesterday I wrote about how, contrary to Fed messaging, the employment data is not that relevant for inflation. A paper published last week by the Hutchins Center for Monetary and Fiscal Policy at the Brookings Institute, authored by Ben Bernanke and Olivier Blanchard, highlights the role of supply shocks in triggering the current inflation crisis. They calculated the impact from the tight labour market (the red box in the below chart – v/u is the vacancy-to-unemployment ratio) in recent inflation data. It’s not very much.

(chart from “What Caused the U.S. Pandemic-Era Inflation?” by Bernanke and Blanchard)

This is further supported by a paper published a couple of days ago by the Federal Reserve Bank of San Francisco that calculated that growth in labour costs was responsible for approximately 0.1 percentage points of recent core PCE inflation. Completely eliminating wage growth will not do much for even the Fed’s preferred inflation index.

And larger-than-expected drops in inflation in Spain, France and Germany this week suggest that natural forces could start to bring US inflation down without further rate hikes. Until recently, I was in the camp that at couple more rate hikes were needed in the US to move the needle on the employment numbers – now, that data seems noisy, and hopefully the Fed will exercise some patience going forward.

Then again, markets need something to obsess over.

Crypto on standby

Crypto assets also joined in yesterday’s good mood, with both BTC and ETH up on the day, although the weekend has kicked off with some market weakness.

(chart via TradingView)

Over the past week, we saw strong outperformance from ETH, possibly due to its declining supply throughout May due to fee burns.

(chart via The Block Data)

Another reason is the continued role of BTC as a liquidity-sensitive macro proxy, and a weaker liquidity outlook now that the debt ceiling has been lifted. What’s more, there has been little movement on the major headwinds holding the market back: regulatory uncertainty, low volumes and few signs of strong institutional or retail interest.

COLUMN

The Broadening Crypto-Macro Overlap

Rather than an op-ed today, I’m going to briefly go over some recent headlines that highlight how the overlap between the macro and crypto landscapes is spreading and deepening. This is, after all, what this newsletter was created to focus on, and while market narratives are fascinating (I do like a good story), I sometimes worry that we’re missing the forest for the trees. So, here are some low-noise high-signal items from the past week:

1) A year ago, Japan became one of the first countries to pass a legal framework around stablecoins, essentially defining them as money and allowing their issuance by licensed banks, registered money transfer agents and trust companies. Yesterday, this law came into force and, on cue, MUFG – the largest financial group in Japan – announced plans to issue native bank-backed stablecoins on multiple public blockchains, including Ethereum, Avalanche, Cosmos and Polygon.

The stablecoins will be issued using MUFG’s Progmat Coin solution, which later this year will be moved into a joint venture entity governed by the 163-member Digital Asset Co-creation Consortium which was set up by MUFG back in 2019 – one of the few sector-wide consortiums that has been both busy and growing.

Rather than be used for trading purposes, these stablecoins are more likely to be used for security token settlement, at least at first. A key aspect will be cross-chain interoperability, and to what extent the banks insist on walled gardens.

What is mind-blowing about this is that the experimentation that has been going on over the years is significant, with an increasing number of big-name participants. And now it has a legal framework! Security token issuance is likely to get a boost, as is client interest.

We could also start to see more crossovers between tokenized securities and NFTs, with potential impact on trade invoices, insurance contracts, asset-backed lending and investment funds, just for starters.

And consider the progress in Japan compared to the paralysis in the US – many stablecoin bills have been proposed, but the chances of anything substantive getting enough bipartisan support to actually make it through are getting more remote by the day as election season nears. At stake is the throne of financial innovation – for now, activity in tokenized securities is still low, but experimentation and trials are being carried out in Asia and Europe, with gathering momentum.

2) In another sign that the regulated stablecoin centre of gravity is shifting to Asia, First Digital Group – a Hong Kong registered trust company – announced the launch of a USD stablecoin. Unlike the ecosystem giants USDT and USDC, First Digital’s FDUSD will comply with Hong Kong’s new legal crypto asset framework as well as trust regulations, and its issuance on BNB as well as Ethereum hints that it could at some stage be listed on and even promoted by Binance, potentially delivering significant liquidity.

3) Still in Asia, Japan’s largest airline is developing a virtual tourism app in order to promote actual trips, produced by the director of Final Fantasy XV. ANA also unveiled an NFT marketplace that will feature 3d models of aeroplanes, which will have some appeal to enthusiasts but which could also evolve into a loyalty program.

4) Beijing published a white paper on “Internet 3.0” that focuses on how China can advance in metaverse development for entertainment, shopping, public services, etc. Blockchain is mentioned, specifically the permissioned Chang’An Chain – this unsurprisingly suggests that the end goal is technology supremacy and data collection rather than creative empowerment. Another technology mentioned is a brain-computer interface, which sounds a bit alarming.

5) India is ramping up its CBDC pilot, including that for a retail-facing digital currency despite low interest so far – at end March, only $600k was in circulation despite 13 banks and 50,000 people participating. The advantage of this CBDC over the UPI payment system is not clear.

6) Russia is reportedly pulling back from its plans to create a national crypto trading platform, but will focus on developing rules to allow private firms to set up central bank-supervised trading. This seems like an intriguing ideological shift (private business vs state monopoly) but could signal an interest in encouraging a robust crypto industry with a view to having a potential way around sanctions. It could also be largely about annoying US regulators by embracing what they are afraid of.

7) Software giant SAP is working on an NFT launchpad to help businesses mint unique tokens in order to boost engagement, spin out new services, etc. This isn’t just about cute pictures – Starbucks’s loyalty program is an example of how successful applications can be.

8) Deutsche Telekom, the largest telco in Europe by revenue, is now a validator on Polygon. This is by no means its first, it also runs nodes on other chains – it has said it sees blockchains as a modern extension of traditional telecom services.

9) At an ETF event, State Street Global Advisors confirmed that the company was looking at tokenized ETFs – this is significant mainly because State Street manages the largest ETF in the market (SPDR) with a market cap of ~$400bn.

10) NFT finance is becoming real. Marketplace Blur launched peer-to-peer NFT-backed lending in early May, and reportedly facilitated around $225 million in loans during the month. There may be some wash in there, but it does suggest growing interest.

Have a great weekend!

In previous weekly emails, I’ve shared videos of gorgeous Mongolian rock and Tibetan techno. Continuing with the genre (if it can be called that), here you have Miracle of Sound delivering drama, music, landscape, power and great hairstyles in a powerful acapella rendition of “Valhalla Calling”.