WEEKLY, Mar 11, 2023

What a week... the crypto reaction to SVB, the real catalyst behind crypto policy shifts, and a lot more

Hi everyone! So much for the idea of a restful weekend… You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice! This is a long one, but there’s a really cool video at the end, so it’s worth opening in browser if your email client cuts it short.

For more detailed market updates and news commentary and narrative updates, do consider subscribing to the premium daily newsletter - it’s only $8/month. Or take out a free trial! 😊

MARKETS

I hope you’ll allow me a teensy rant about how inefficient it can be to try to be efficient and get weekend newsletters done on a Friday afternoon. This has happened more times than I can count, that what I write on Friday is no longer valid on Saturday and I have to start again. Although truthfully, that is a small price to pay for the privilege of working in a market that is so interesting. Thank you for listening, rant over.

That familiar feeling

Coming hard on the heels of the liquidation of Silvergate Bank, we have the closure of Silicon Valley Bank (SVB), which was not concentrated on the crypto industry but was seen as “crypto friendly”. On Thursday, the day after disclosing a loss of approximately $1.8 billion in pre-emptive bond sales to give more flexibility to the balance sheet in case of withdrawals, those withdrawals materialized to the tune of $42 billion. This led to a negative cash position of approximately $958 million by close of business, and the intervention on Friday of the California Department of Financial Protection and Innovation, which placed the bank into FDIC receivership. This is a harsh reminder of just how fast bank collapses can be, especially when industry associations are advising their members to withdraw funds.

Crypto affiliations aside, we now have the failure of two traditional banks in the space of a week. The SVB failure arguably has a broader impact in that 1) it was much larger in terms of overall deposits, and 2) its clients were largely venture capital-backed technology-focused businesses covering a wider range of activities and impacting a much larger number of companies and their employees.

SVB also marks the second largest US bank collapse in history. Yesterday, while attempting to transmit calm by insisting that “the banking system remains resilient”, Treasury Secretary Janet Yellen convened the heads of the financial regulators to discuss the issue.

The markets whipsawed. Thursday’s big hit to bank stocks continued on Friday, with the KBW bank stock index down almost 16% on the week, reaching levels last seen in 2020. Stocks also dropped sharply, and both the S&P 500 and the Nasdaq have wiped out almost all of their year-to-date gains.

(chart via TradingView)

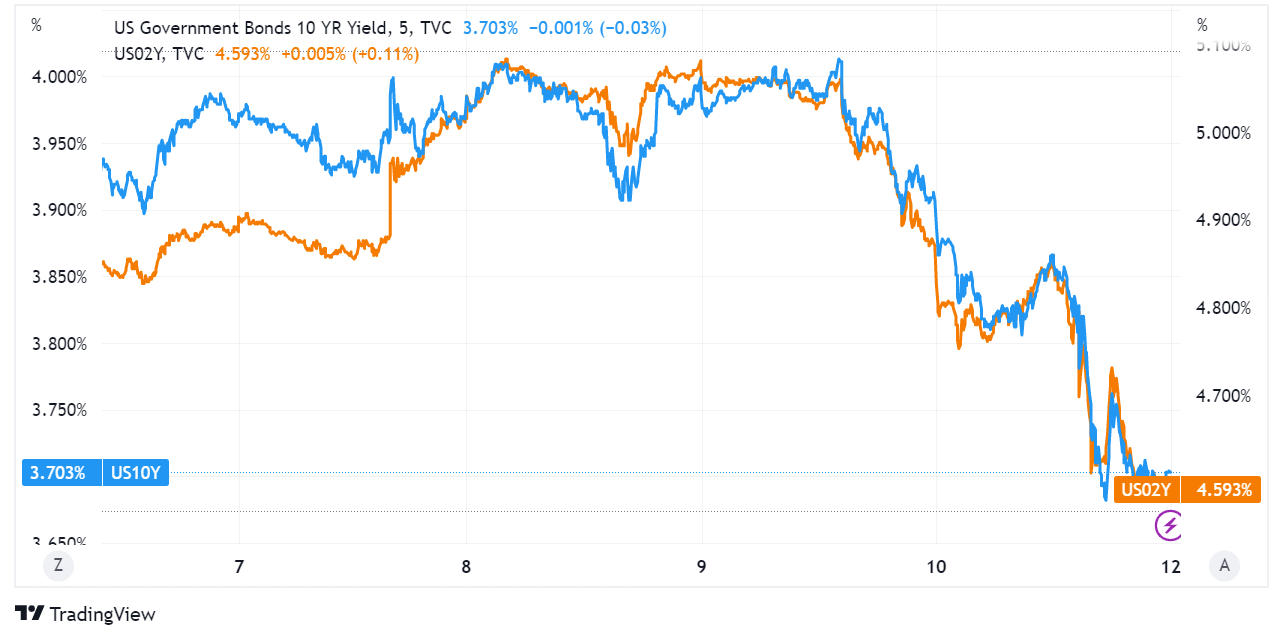

Yields plummeted, with the US 10-year dropping to 3.7% and the 2-year almost hitting 4.5%. As economist David Beckworth quipped, “We are just a few banks away from 3%.”

(chart via TradingView)

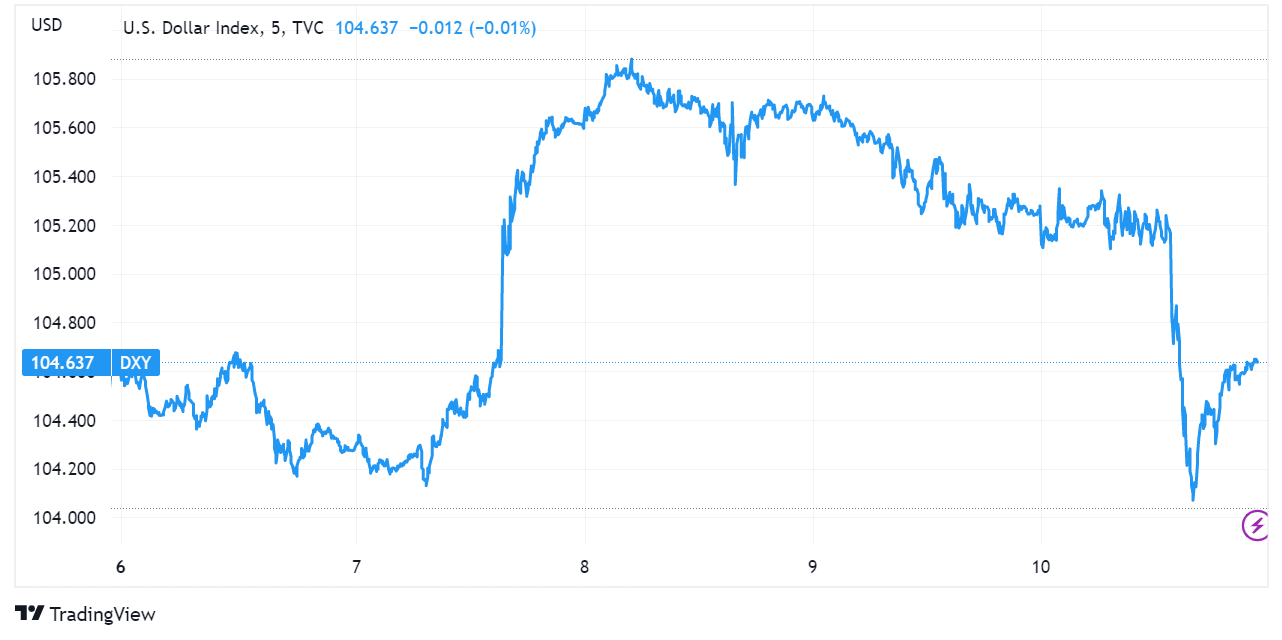

The DXY, which on Wednesday had reached its highest point of the year, drifted lower in the second half of the week up until Friday, whereupon it dropped sharply, bounced sharply, dropped, bounced, well, you get the picture.

(chart via TradingView)

And both stock and bond volatility (as measured by the VIX and MOVE indices, respectively) shot up to 2023 highs.

(chart via TradingView)

The SVB news was enough to eclipse the importance of the eagerly anticipated official non-farm payroll data out earlier in the day, which yet again exceeded expectations, this time for the 11th month in a row. Normally this would be a good thing, but not in the case of a hot job market and disappointed investors eager for signs of cooling. US non-farm payrolls for February grew by 311k, higher than consensus estimates of 205k but lower than January’s 504k (this was a shock upside surprise, but has tellingly been revised down from 517k). Average hourly earnings also showed signs of deceleration, with a 0.2% increase over the month vs a 0.3% increase in January, with the year-on-year figure reaching 4.6%, slightly lower than expected. Even more significant, the official unemployment rate finally edged up after three consecutive declines, reaching 3.6% and beating consensus forecasts by 0.2 percentage points.

(chart via Investing.com)

Rates expectations have been flying all over the place this week, with 25bp back to being the favoured outcome for the March FOMC meeting (at time of writing, anyway), but projections further out swinging so wildly they’re not making much sense at all.

(chart via CME FedWatch)

The confusion is understandable. On the one hand, Fed Chair Powell’s hawkish testimony before the House Financial Services Committee earlier this week – so soon after data from highly interest rate-sensitive areas of the economy came in surprisingly hot – sent traders scurrying to position for a 50bp hike in a couple of weeks, a possibility that was almost totally dismissed just a couple of weeks ago. Then Powell managed to calm markets down slightly by insisting a decision on the March raise hadn’t been taken yet. Signs of cooling labour data on Wednesday and Thursday further helped, and Friday’s non-farm payroll report suggested that the impact of rate hikes could be starting to show.

The next key economic catalyst, and the last one before the March FOMC meeting, is the core CPI increase for February which next Tuesday is expected to show a continued but slowing deceleration with a year-on-year increase of 5.5%, 0.1 percentage points lower than January’s figure. Its resilience suggests that the recent Fedspeak of “higher for longer” should in theory still hold, especially given recent indications that consumption and production are still strong… only now we have disturbance in the banking sector. Rising rates places maturity mismatch strains on banks, especially with record yield curve inversions. The big question at the moment is whether Powell will dare to continue to hike given the emerging systemic risk.

You may remember that, at the beginning of the current hiking cycle, the mantra was “the Fed will hike until something breaks”. Are we there yet?

A bad week

Both BTC and ETH had a grim week, both at one point down 12% from last weekend in what looks like a mix of spot selling and derivative liquidations.

Among the big blows:

Silvergate announced a voluntary liquidation on Wednesday, shattering hopes that it could pull through and resume its place as a key fiat nexus for the industry. Its closure has left crypto businesses scrambling to find other banking relationships – for many, given the current regulatory “disapproval” associated with crypto exposure for traditional institutions – that could be insurmountably difficult, causing further closures and/or pushing businesses offshore. This could impact crypto prices if companies that decide to wind down have assets to sell.

On Thursday, the New York Attorney General’s Office filed an action against crypto exchange KuCoin which contained text alleging ETH is a security. This hits a crypto nerve as the debate around ETH’s status has been brewing for some time, fuelled by SEC Chair Gensler’s refusal to officially pronounce on the issue. Nevertheless, the NYAG can say whatever it wants in its documents – it doesn’t mean that ETH is a security. Even if the SEC were to back the NYAG on this, the issue would probably end up in court. Some clarity on this issue would be good news, and the NYAG’s move means we might be closer to getting that. Meanwhile, the uncertainty – on top of already building uncertainty given the approaching network upgrade – is not great.

Also on Thursday, we learned that, buried in the details of President Biden’s 2023 budget, was a proposed 30% tax on electricity used for cryptocurrency mining. Some media reports suggested that this was responsible for part of the price slump, but it’s actually not very material: 1) it’s just a proposal for now and a pretty crazy one at that (likely to get shot down), 2) it won’t impact BTC supply or BTC demand, the worst it could do is push crypto mining offshore.

On Wednesday, the US government had transferred a significant amount of BTC (almost 10,000) to Coinbase. The potential sell pressure most likely created more sell pressure, especially given the thin market depth and the relative lack of buyers in such an uncertain market.

Liquidity 2.0

Oddly, BTC started to recover on Friday, just as traditional markets were dropping fast, although it has since corrected again. Or perhaps not so oddly – this looks like BTC showing signs of reasserting its role as the most sensitive liquidity play out there.

As commentators digest the fallout of the SVB collapse, many are suggesting that Monday could bring a Fed rate cut. In my opinion, this would be a drastic action that could trigger further panic and could add fuel to the inflation threat. Then again, a wave of bank failures would do deep damage to the US financial system and the already fragile economic outlook, not to mention Fed credibility.

Should the Fed need to inject liquidity into the market, BTC would benefit as – unlike most other liquidity plays – it is not sensitive to declining earnings, credit revisions and other traditional market risks. It could also benefit from the unfortunate narrative boost of traditional economy failures that highlight the advantages of an alternative system of self-custody and decentralized transfers.

Unless…

There are signs of trouble in crypto liquidity. Circle, the issuer of the second largest stablecoin USDC, held approximately $3.3 billion of USDC reserves at SVB, and it was not able to withdraw that amount in time. This amounts to just over 8% of the firm’s total reserves, which means that USDC is currently not 100% backed by liquid collateral. This has hit the USDC peg, which at one point sent the stablecoin price down to $0.80. USDC is being further hit by USDC:USD conversion restrictions over the weekend on major exchanges such as Coinbase, at least until banks open on Monday. Ironically, users are rotating into Tether’s USDT, normally seen as the “less safe” centralized stablecoin, which is currently trading at a premium.

(chart via TradingView)

This could deliver a significant blow to already-low crypto market liquidity, were a main stablecoin to be impaired. It is also likely to have negative repercussions for DeFi platforms, as USDC was the mainstay of many applications (developers preferred USDC rather than USDT for its perceived safety). On Curve, for example, its popular 3pool – which allows users to swap one stablecoin for another – saw balances move completely out of whack as users deposited USDC to take out USDT. Normally, the three stablecoins should each account for a third of the pool balance. As you can see, USDT is now almost totally depleted. Algorithmic stablecoin DAI, the other leg of the pool, is not an attractive alternative for now as most of its collateral is made up of USDC.

(screengrab from Curve at 09:00UTC)

Where from here?

It’s likely the USDC situation will rectify. Monday should bring news on a solution for SVB depositors, and Circle will be able to recover at least some funds in the short term, while getting notes exchangeable for the rest (these notes themselves could probably be used as collateral). In the worst case, Circle should be able to raise any shortfall, especially at these interest rates (which in theory makes the organization particularly profitable).

Also, the depegging on some exchanges is most likely due to the rapid shifts on major decentralized exchanges, which should calm down as pool incentives kick in and arbitrage works its magic. Friday’s activity had all the signs of an emotional over-reaction to admittedly very bad news, but crypto markets now are working in a haze of supposition and worst-case expectations. As more information about SVB and possible solutions emerges over the weekend, it’s possible investors start to realize that USDC is not in existential danger.

Mainstream observers as well as crypto insiders could emerge from this weekend with two new pillars of understanding:

crypto markets may offer 24/7 liquidity, but sometimes a market taking a breather for a couple of days can be a good thing

DeFi could by Monday yet again demonstrate its resilience in the face of extreme market stress

COLUMN

It’s Not Just Fraud that Chilled Crypto Regulation

What a difference a year makes. On March 9, 2022, President Biden’s office released its Executive Order on digital assets, marking the first official sign of a comprehensive approach to the regulation of the crypto ecosystem. At the time, I and many others saw this as a very big deal, not least because of the strong signal that crypto had “arrived”. It was now significant enough to warrant attention from the leader of the world’s largest economy, and the surprisingly supportive tone of the document surely meant that a constructive regulatory approach was brewing. How wrong I was.

A year later, the supportive tone has pretty much disappeared. The comprehensive approach we hoped for turned out to be more of a threat than we anticipated, and the focus is now on erecting barriers rather than building a guiding framework. What happened in the interim?

Part of that answer is unfortunately obvious. The ball of fraud-fuelled fire that was the collapse of FTX in November of last year was a spectacular embarrassment to not only crypto businesses that had confided in Sam Bankman-Fried and his team – it was also an embarrassment to the politicians that had sat down with him, had posed for the photo-op and had entertained his ideas about crypto regulation. With a few brave exceptions, politicians understandably closed ranks and scrambled to distance themselves from anything to do with crypto risks.

But the shift is more complex than it might seem. Even before the FTX revelations, the tone from the White House was sounding more antagonistic. Absent from the Executive Order were calls for a clampdown; it was more about requesting investigation and reports, more about gathering information and ideas. In September, however, the White House published an update, which mentioned the implosion of the Terra ecosystem in the first paragraph. Further down, the update stressed the loss of value in the market, how sellers “commonly” mislead consumers and how non-compliance with existing laws is still “widespread”. Already this was sounding very different.

The update also set out some White House recommendations, the first of which was that the SEC and the CFTC “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.” The second recommendation was that the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) “redouble their efforts to monitor consumer complaints and to enforce against unfair, deceptive, or abusive practices.” The third was that agencies should “issue guidance and rules to address current and emergent risks in the digital asset ecosystem.” You get the drift.

The rest of the report emphasizes support of FedNow, the Federal Reserve’s instant payment network due to launch in mid-2023, as a solution for financial exclusion – in other words, the US doesn’t need crypto payments efficiency, it has the Fed.

And then we have the official document released in January of this year, titled “The Administration’s Roadmap to Mitigate Cryptocurrencies’ Risks”. You almost don’t need to read it to know what it contains – the last sentence of the very first paragraph spelled it out: “As an administration, our focus is on continuing to ensure that cryptocurrencies cannot undermine financial stability, to protect investors, and to hold bad actors accountable.” The tone had moved from supportive to antagonistic to somewhat panicked.

But to blame the shift in the US regulatory tone on crypto fraudsters is simplistic. Another significant change in the regulatory backdrop between the Executive Order and the two updates is the economic mood, and this is more significant than many realize.

When the Executive Order was published, the Fed had not yet started its hiking campaign; it would kick this off with the first 25bp hike at the FOMC meeting the following week. The market knew rate hikes were coming – US headline CPI was rising rapidly, reaching 7.9% for February (this would be reported the following day) – but it was seriously underestimating how high they would go. The implied rate 12 months out, according to the Fed funds futures market, was a now-laughable 2.87%.

At the time of the Executive Order, dark clouds were already building for equities. The S&P 500 was round 4270, 10% down year-to-date. By the time of the update in September, it had fallen almost another 10%, and tech company layoffs were starting to populate headlines. Understandably, with investors hurting, the government had to seem tough on risky, largely unregulated assets that had caused deep losses. In other words, the markets needed a “bad guy” to distract from what was shaping up to be a bleak scenario in all asset groups.

November delivered the ultimate “bad guy” as the FTX fraud shocked both the crypto ecosystem and mainstream observers. For a while, it was an unwelcome distraction from a core inflation rate that had reached the highest level in four decades, a dollar that was at its highest relative to a basket of other currencies in two decades, and US treasury market volatility not seen since the Great Financial Crisis of 2008-9. Things were looking bad on macroeconomic screens, but the crypto fallout had presented Washington DC with a problem it could be seen to be doing something about.

The current hostility is about more than the political satisfaction of prosecuting criminals, however. It’s a natural reaction to broader concerns. When times get bad, we seek comfort, and new, complicated and disruptive technologies are never comfortable. When times get bad, we instinctively magnify external threats, as that makes us feel more connected to our tribe. When times get bad, we focus more on surviving today and less on building a productive tomorrow. When times get bad, the leadership manuals tell us to act stronger than we feel, in order to inspire trust.

And on a more practical level, if the economy is about to enter a downturn, the administration would probably prefer that businesses and individuals invest in more traditional, high-employment endeavours than in this newfangled notion that seeks to disintermediate authority and that does not need to respect national boundaries.

I’m not suggesting that this Administration’s hostility toward crypto assets is just for show – I do think, however, that it is not just because of the brutal hits to investors over the past 10 months. It is also because of the darkening clouds over the US economy.

This has a silver lining. Just as administrations change, so do economic cycles. And the antagonism is far from uniform – Thursday’s House Financial Services Committee hearing provocatively titled “Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem” is a case in point. There was a fair amount of scepticism and outright distrust among some representatives and one of the witnesses. But most of the witnesses and many of the elected officials present were eloquent advocates for clearer rules and a usable framework. All agreed that regulation was good, and most seemed to support the idea of market reform and the need to keep crypto business in the US.

Hearings rarely achieve anything in the short-term, but they are a staging ground for points of view as well as an opportunity to stick political stakes in the ground. The initial approach of the new House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion is encouraging in its seemingly critical take on current policy and political process. Its chair, Representative French Hill of Arkansas, made a sharp point in his written statement after articulating the need to support innovation for the sake of leadership and competitiveness while ensuring appropriate controls and accountability:

“These are the Administration’s own principles articulated in its Executive Order, though their recent actions seem to conflict with these principles.” (my emphasis)

Indeed they do. The authors of the latest official White House statements will argue that recent industry events have shown that suppression of US crypto activity is in Americans’ best interests. But this lamentable shift is about much more than protecting investors from fraud – it’s a reflexive reaction to the broader economic threats gathering on the rapidly approaching horizon. Because of that, we know this will pass, as all cycles do. Meanwhile, however, the US will continue to cede relevance in the next wave of market disruption, and will eventually find itself scrambling to attract crypto businesses and talent that have been shaped by rules set in other jurisdictions. Then again, plenty of other factors in play across our headlines and behind closed doors also point to shifting power bases as the global economy redraws alliances and priorities. In this environment, US crypto policy says much more about political fear than it does about crypto.

GOOD READS/LISTENS

The Bankless team talks to Eric Peters, founder and CIO of One River Asset Management, about the role of crypto assets in macro portfolios, the sentiment shifts in macro and crypto markets, and the regulatory mood from an investor’s point of view.

Matt Levine had an unsurprisingly sharp take on the Silvergate liquidation.

In his latest Bitcoin Fundamentals episode, Preston Pysh delivers a motivating reminder of Bitcoin’s big-picture thesis and evolution.

In the most recent What Bitcoin Did episode, Lyn Alden (always worth listening to) gives a masterclass in central banking.

Have a good weekend!

This is easily one of the most extraordinary music videos I’ve seen, and it’s absolutely stunning on so many levels (the mountains! the instruments! the makeup!). It features traditional throat singing combined with house and techno, and, fair warning, it’s likely to change the way you dance.