WEEKLY, Mar 4, 2023

Yes, crypto is still early... plus, Silvergate and why the market dropped yesterday

Hi everyone! It sure looks like March started off with an extra dash of drama, promising an interesting month ahead... We should all be sure to take care of our energy levels, because I have a feeling we’ll need them.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

For more detailed market updates and news commentary and narrative updates, I hope you’ll consider subscribing to the premium daily newsletter. Or take out a free trial! 😊

MARKETS

Wait, what happened?

Every now and then the market needs something to jolt it out of what looks like a stubborn range. This came in the form of a sharp drop in BTC and ETH in the early hours of Friday, after a week of hovering around $23,400 and $1,640 respectively.

(chart via TradingView)

Coming so soon on the heels of the collapse of Silvergate Bank’s share price, most observers assumed it was a market reaction to the bad news (more on this below). I don’t think it is, and here’s why:

1) The timing. Silvergate’s issues affect mainly US-based crypto businesses and investors, and the drop happened at 20:15 ET, well after the US markets had closed. It could have been a US investor working late, but the timing feels off. It does, however, coincide with the beginning of the trading day in Asia.

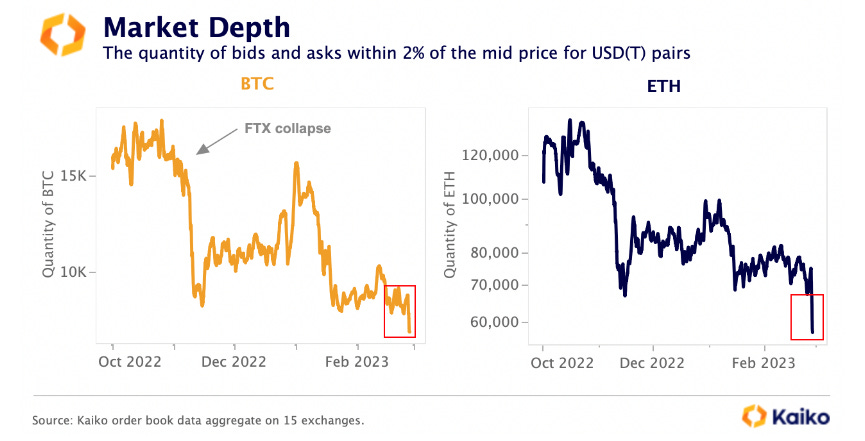

2) The shape of the drop. Sharp and smooth moves tend to be structural, such as a derivatives position being unwound and margin calls triggering a wave of liquidations that – in this relatively tight market (Kaiko reported earlier this week that liquidity in BTC and ETH is the lowest it’s been since May 2022) – pushed asset prices down fast. A sentiment-driven drop would be much messier, bumping its way down.

(chart via Kaiko Research)

3) The lack of further falls. Since the drop, the prices of BTC and ETH have been bumping along in a relatively steady fashion. If this were a Silvergate-driven exodus or a related sentiment hit, prices would have continued to drift lower. Sentiment does not seem to have been the driver here.

4) Shared pain. The drop was also equally spread between BTC and ETH, rather than concentrated in one or the other – the ratio between the two prices remained relatively steady. This suggests that the unwind came from a “basket”, a holder (or holders) of positions in the two leading crypto assets who was (were) unable to meet margin calls.

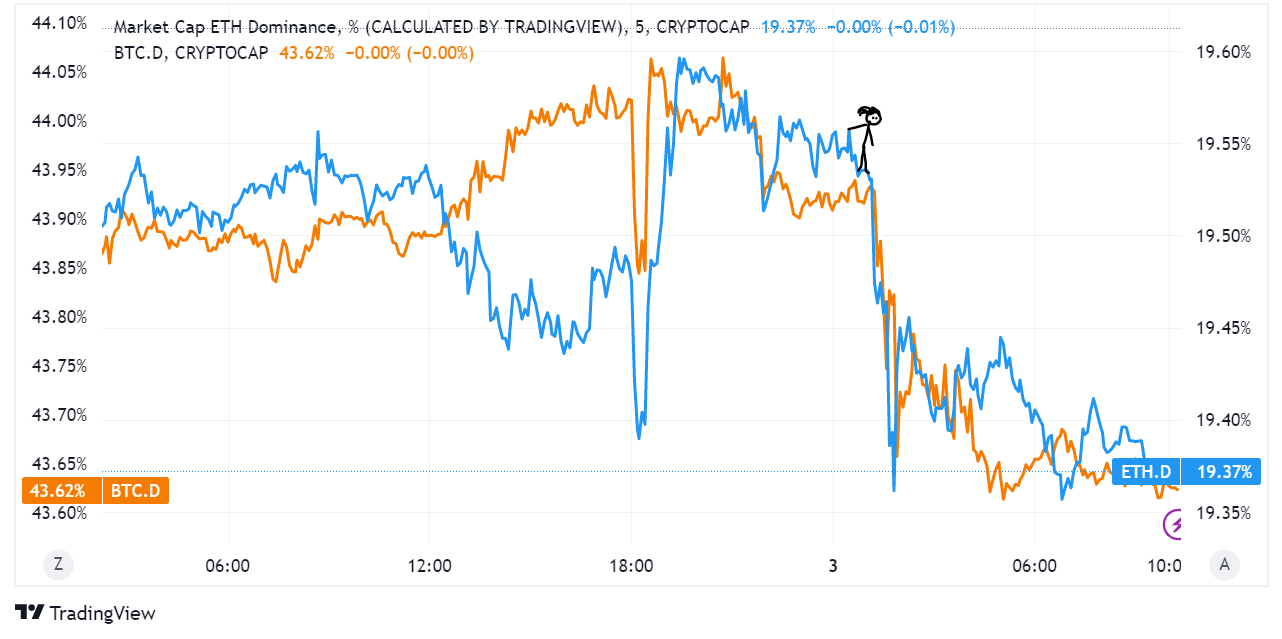

(chart via TradingView)

5) Contained. It was largely limited to just BTC and ETH, as can be seen from the drop in market dominance of the two assets. Were this a “crypto” move rather than a structural move, we would have seen more sharp drops across the board.

(chart via TradingView)

6) Derivatives data. Further evidence that this was an Asia-based move comes from the drops in BTC futures open interest on the leading derivatives exchanges. Looking at the moves at the time of the drop, in BTC terms, we see that Bybit took the biggest hit, which is odd since it is not the largest exchange.

(data via coinglass)

7) Chinese liquidity. Silvergate wasn’t the only bad news that hit the crypto ecosystem this week. There are the US moves against Binance, although the timing doesn’t really fit there, either. Yesterday, Bloomberg reported that yuan 5-year non-deliverable interest-rate swaps climbed to almost 3% this week, the highest since December 2019 (pre-pandemic!) and up from as low as 2.38% in October. This suggests a tilt toward tightening rather than easing in coming months, and – as I’ve written about before – bitcoin is one of the most sensitive assets to shifts in liquidity outlooks.

Silvergate. Sigh.

While I don’t think that Silvergate triggered the sharp drop in BTC and ETH yesterday, I do think it is very bad news for the ecosystem.

On Thursday, Silvergate Bank submitted a request with the SEC to delay its 10-K filing for 2022, citing regulatory enquiries and warning that recent events could impact the bank’s ability to continue as a “going concern”. The stock plummeted 48% on opening (it’s a horrible chart, don’t look), and closed over 57% lower than the previous day’s close.

I confess I didn’t see this coming – not because I thought the contagion was over (I don’t), but because I thought that, as a regulated bank, Silvergate would be able to withstand the sharp drop in crypto-related business. It looks like I underappreciated just how much it had shifted resources from its traditional businesses of business and real estate lending and into crypto, and how sensitive it was to the loss of business from FTX, Blockfi and other bankruptcies, as well as to the broad contraction in crypto activity post-3AC. Industry jitters and some targeted short-seller campaigns triggered strong withdrawals late last year, and despite high-profile votes of confidence via investment from the likes of BlackRock, State Street and others, the withdrawals continued, especially in the light of a DOJ investigation and other regulatory enquiries regarding their handling of FTX accounts.

A dividend suspension and a wave of analyst downgrades later, the very words “ongoing concern” in an official filing triggered even more withdrawals, with some known names jumping ship. It’s rare that a bank manages to survive after publicly disclosing doubts about its solvency.

A bank collapse because of its crypto activities will give antagonistic regulators much more ammunition to argue “systemic risk”. Before Silvergate, we could have pointed out that the main damage from the FTX fallout and the earlier Three Arrows Capital collapse was limited to the crypto industry. Yet the impact on a traditional bank could encourage higher barriers for other banks interested in servicing the sector, especially given the recent regulatory chill. This is not good for business or investors, since no matter how “crypto” a business may be, it needs banking services. Out of desperation, we may see companies move offshore, and/or into riskier banks that could end up causing a new suite of problems (eg Tether’s issues a few years ago).

What’s more, the loss of Silvergate’s services and SEN network would be an ecosystem blow. Most of the industry used Silvergate as it was one of the very few regulated banks with an open door for crypto businesses. The SEN network, which allowed customers to transfer fiat to other network members 24/7, was not only convenient – it also supported financial transactions during crypto hours rather than traditional banking hours. Its absence will hurt.

Whatever you may think of Silvergate’s management and the choices they made, this is sad for the market in that fiat banking is the lifeblood of any business, even those focusing on decentralized financial technology – salaries need to be paid, as do electricity bills, hosting fees, rent, etc. It could end up becoming even more difficult for crypto businesses to operate in the US, dampening innovation and limiting choice for US consumers.

COLUMN

Yes, crypto is still early

They say patience is a virtue. But markets, at least the parts and participants that we hear about every day, like quick hits. Long-term investors may sleep better at night, but they don’t get much attention.

When it comes to crypto development, however, patience has paid off. Networks that launched in beta with big promises of fast growth have ended up floundering because of hasty design. Others that have grown slowly and organically have withstood the test of time, despite acute stress-testing and powerful enemies, and even these slow-moving networks have shown significant progress in terms of user growth and global awareness. Nevertheless, the arc of growth and global understanding of this new technology is barely getting started.

Critics accuse the crypto ecosystem of failing to come up with a clear utility (in spite of global evidence to the contrary). They accuse us of hiding behind the “we’re still early” excuse. These are generally people steeped in traditional market ethics who expect clear and tangible results after just a few years of evolution, and they believe the perceived fact that these results haven’t materialized means they never will. I even recently heard someone insist that the internet didn’t take so long to get off the ground.

Well, not quite: ARPANET, the precursor to today’s vast network, sent its first message in 1969 – html and the first globally accessible websites didn’t appear until 22 years later. Seven years after that, a renowned economist was still insisting that the internet was unlikely to be relevant. We are only 14 years into the development path that was triggered with the processing of the first bitcoin transaction in 2009. Just imagine where the industry will be in 2031, 22 years after blockchain’s equivalent “first message”, and what kind of dismissals it will still be getting seven years after that. We are still early.

For further proof of this, we need look no further than a casual scan of crypto headlines on any day we care to choose. There will invariably be several talking about the evolution of existing blockchains, new blockchain designs, use case controversy and so on.

Even the longest-running blockchain, Bitcoin, is still evolving. The community is currently caught up in a debate over whether it should be used for non-fungible tokens – on one side we have those that believe in the power of evolution, experimentation and the lack of gate-keepers. On the other, we have those that worry about “silly pictures” clogging the network and detracting from its payments use case. On the periphery are those that insist Bitcoin will never be used for payments. In emerging as well as not-so-emerging markets are many who already do. In sum, even Bitcoin’s utility is still being debated, just as its technological potential is being probed and stretched.

Other large networks such as Ethereum are in even greater stages of flux: upgrades to alter its functionality, radical changes to something as fundamental as address management, rapid layer-2 growth, fierce experimentation with security and privacy technologies, new applications, revised versions of existing ones, and ambitious “Ethereum killer” competitors still emerging.

How can we not be early when we are still debating technology standards, let alone applications? Historian and economist Carlota Perez talks about cycles of technological adoption: first comes the installation phase, in which the infrastructure is built; then comes the deployment phase when the technology is broadly adopted. Obviously, we are far from broad adoption – we don’t even agree yet on what that means. Not only are we still in the early phase of installation; we’re trying to establish a new technological base with fragmented initiatives pursuing emerging use cases on a global, fragmented stage.

What’s more, we’re doing so with strong regulatory resistance. This is frustrating but understandable: blockchain technology is not trying to improve widgets or help us move faster. One of its main aims is to transform how we transact, and thus the technology is perceived as a threat by today’s gate-keepers. Arguably, finance should change slowly, since there’s so much at risk. But resistance to change also poses a material danger to societal cohesion.

People with at least a passing acquaintance with history know that our civilization moves in cycles, each driven by a radically new technological innovation. It remains to be seen whether blockchain technology will usher in a new cycle or continue to build on that initiated with the rollout of the internet – I personally believe the former, but either way, only 14 years in, we’re early.

Critics are right in calling us out for sometimes hiding behind the “early” excuse to explain bad behaviour and lax code vetting. Just because we’re a young ecosystem doesn’t mean we can’t do better.

In turn, however, we can call out those who stand on the outside looking in while criticizing us for not doing more, for not trying harder and for not succeeding despite the audacity of the change we want to see, and the colossal obstacles that have been in our way from the beginning. We can call out vested interests, those that put the static before the dynamic, and those more interested in the convenient than the meaningful.

Back in 2014, venture capitalist Marc Andreessen compared the state of Bitcoin then to that of the internet in 1994. I disagree with his diagnosis: when he made his comments, Bitcoin was more like the internet in the 1980s, still figuring out what it wanted to be and how it could become useful.

But here’s the thing: most of us couldn’t have invested in early internet businesses. That generational opportunity was limited to venture capitalists and their accredited investors. With the blockchain ecosystem, however, investment in early opportunities is open to anyone with an internet connection, anywhere in the world. And often, the investment is not – as in the 1990s – in a shell or wrapper that represents the technology. Now, the investment can be in the technology itself.

When will we no longer be early? When mainstream coverage is about adoption and new applications rather than asset price moves. When the technology ceases to intimidate the crypto curious. When regulators see even financial applications as opportunities rather than threats.

That day may seem very far away at the moment. But it’s not – whether it’s five, 10 or 20 from years from now, the crypto ecosystem is unlikely to give up or even slow down. Anyone who has ever built anything lasting knows that persistence, at scale, wins. And that change may seem a long time coming, right up until the moment it starts happening fast.

GOOD READS/LISTENS

The pseudonymous writer N.S. Lyons (who publishes a highly recommended Substack) delivers a sober and reasonably sobering perspective on China’s involvement in the Ukraine war, and in so doing sketches out what the geopolitical map could look like afterwards.

Arthur Hayes published a must-read (with an nice long drink to hand) opus magnus on the energy industry, its potential impact on monetary policy, and what that could mean for bitcoin.

For the energy wonks among you that want more oil and gas detail, this Macro Voices interview with Anas Alhajji offers a ton of not-well-known information and insight about the energy industry.

Bloomberg’s Merryn Talks Money podcast this week features a discussion with Dr. Pippa Malmgren on why inflation is very unlikely to come down to 2%.

Have a good weekend!

Pretty much all of us who live in cities have been driven up the wall by car alarms going off in the street, often in the middle of the night. Some people have a much more proactive attitude to the piercing annoyance, though. Pianist Tony Ann, for example, composed an entire piece around the rhythm. I’m sharing this not in the expectation that we all have his talent, but in the hopes that it will help you overcome the temptation to throw eggs at the offending vehicle the next time you find yourself in that situation. (I should clarify that I have never done that.. not yet, anyway.)