Hi everyone! Another week of volcanic rumblings with a couple of sulphur plumes to keep the landscape lively. This week we have a guest post from none other than Jeff Dorman, CIO and co-founder of Arca and one of the most thoughtful writers in our ecosystem, in my opinion.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

I’ve been making changes to the formats of the weekly and the premium daily, to manage the content distribution, hopeful utility and the workload. For more detailed market updates and news commentary and narrative updates, plus a lot of charts and some fun links, do consider subscribing to the premium daily newsletter, it’s only $8/month. Or take out a free trial! 😊

COLUMN

What Happened This Week in the Digital Assets Markets?

Summary: Macro factors retake center stage as digital assets thrive amid a banking crisis, policy response, and credibility loss for the Fed and Treasury.

Macro Is Back!

For the past nine months, overall macro conditions have taken a back seat to the idiosyncratic failures (FTX, Luna/UST, BlockFi, Genesis) and success stories (ETH 2.0 Merge, Layer 2 launches) that drove most of the price action. But macro regained its position behind the wheel over the past few weeks. The banking crisis and subsequent policy response have taken center stage—only this time, it is affecting digital assets positively at the expense of other asset classes. A quick look at the BTC price versus the regional banking ETF (KRE) tells you all you need to know about the winners and losers since the first week of March.

Source: Bloomberg

While digital assets gain, macro investors are dipping back into the recession playbook:

Front-end rates are down sharply, while long rates are only slightly lower (bull steepener—a classic recession trade).

Gold is ripping and closing in on an all-time high.

Crude oil is getting smoked.

Small caps and growth stocks are underperforming large caps and value, while defensives are leading cyclicals.

Technology is getting valuation support from falling rates.

The Fed has lost credibility. The 2-year Treasury yield has fallen from an intra-month high of 5.08% to its current 3.75% yield, which is a startling enough move as it is, but even more dramatic when you factor in the Federal Reserve’s decision to raise its benchmark rate 25 basis points to 5.00% at the same time. That’s the market’s way of telling you it’s calling the Fed’s bluff. The Fed Funds rate started the month below 2-year yields, and is currently 125 bps higher… this spread is now the largest between the Fed Funds rate and 2-year Treasury yield since 2007 and has historically led to quick and aggressive rate cuts.

Spread between Fed Funds Rate (upper bound) and 2-year Treasury Yield:

Source: Bloomberg

Further, the “Fed put” is back in play as assets on their balance sheet increased $392 billion over the last two weeks, wiping out 60% of the Quantitative Tightening since last April.

Source: @charliebilello

Not to be outdone, the Treasury has also lost credibility. After joining the Fed and the FDIC in their explicit defense of depositors of a select few failed regional banks, Treasury Secretary Janet Yellen can’t decide whether to offer full support explicitly or instead avoid moral hazard. In the last three days, Yellen has flip-flopped multiple times on her position regarding an increase in deposit insurance. And Yellen’s previous remarks on the state of the economy haven’t aged well. In 2017, she confidently stated that she didn’t believe we would see another financial crisis “in our lifetime.”

And lest we forget about Credit Suisse—a forced shotgun marriage to UBS left shareholders and many CoCo bondholders dead or nearly dead, but the Swiss bank has been a problem child for at least 15 years. As Bloomberg reported:

“Credit Suisse’s failings have included a criminal conviction for allowing drug dealers to launder money in Bulgaria, entanglement in a Mozambique corruption case, a spying scandal involving a former employee and an executive and a massive leak of client data to the media. Its association with disgraced financier Lex Greensill and failed New York-based investment firm Archegos Capital Management compounded the sense of an institution that didn’t have a firm grip on its affairs. Many fed up clients have voted with their feet, leading to unprecedented client outflows in late 2022.”

With this backdrop—a Fed that has lost control, a Treasury secretary who has lost touch, and an accelerating global banking crisis—it’s perhaps not surprising that crypto app downloads jumped 15% last week while those of banking apps have fallen around 5%. The market is showing its lack of confidence in our governments and financial systems via a renewed interest in a potential alternative—which is hilarious when you consider that this increase in crypto adoption is happening concurrently with the SEC’s war on digital assets. The SEC most recently issued an investor alert urging caution when investing in digital assets, which reads fine and accurate in isolation—you should be cautious when investing in digital assets. But the timing of this statement, amidst a series of other enforcement actions year-to-date, seems disingenuous considering all of the other much larger problems in the global financial markets. Meanwhile, the SEC also sent Coinbase a Wells Notice, setting the stage for an epic court battle between two obstinate behemoths.

Try as the SEC, Treasury, White House and Fed may, there’s just no way to put the genie back in the bottle at this point. The bull case for crypto is on full display as banks shutter, and their depositors and investors hit the eject button. Granted, this will cause operations and the flow of capital to be even more cumbersome for digital asset participants as well. We are already starting to see the effects as liquidity is sucked out of the digital assets spot market. However, the real battle isn’t between digital asset investors and regulators but between banks and stablecoin issuers. Stablecoin issuers still depend on banks to keep their reserves, and banks have been very resistant to help a sector that is trying to put them out of business—which, of course, makes sense. Arthur Hayes wrote a great piece at the end of last year about the friction between banks and stablecoins before any of the banking failures commenced. The very heart of the problem is that rising rates is great for stablecoin issuers since they keep all of the interest income themselves and pass none of it on to token holders, whereas rising rates cause a real problem for banks who lose depositors when they don’t pass along the interest, and also become underwater on their longer-term loans.

“... do you understand why banks HATE these monstrosities? Stablecoins do banking better than banks since they operate on almost 100% profit margins. Any time you read FUD about this or that stablecoin, just remember: the banks are just jealous.”

And getting rid of current iterations of stablecoins in favor of a Central Bank Digital Currency (CBDC) isn’t much better. In a 2022 report, McKinsey estimated that globally banks stand to lose $2.1 trillion in annual revenue if a successful retail CBDC is introduced.

The reality is, even though we are trying to build a digital infrastructure that runs in parallel to the existing financial system, the ecosystem is still very intertwined with the traditional banking system. So, ironically, trying to kill crypto while saving the banks ultimately saves crypto too. It’s a win-win right now for blockchain enthusiasts.

Jeff Dorman, CFA - Chief Investment Officer and Co-founder of Arca. For more information on Arca and to read more of Jeff’s writing, click here. Subscribe to Jeff’s weekly newsletter here.

Disclaimer: This commentary is provided as general information only and is in no way intended as investment advice, investment research, legal advice, tax advice, a research report, or a recommendation. Any decision to invest or take any other action with respect to any investments discussed in this commentary may involve risks not discussed, and therefore, such decisions should not be based solely on the information presented.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed are those of the author, and are made as of the date of this publication.

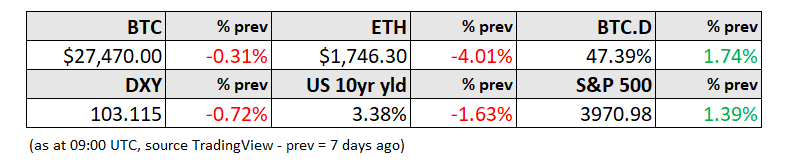

MARKETS

Going forward, this section will be much shorter than it has been recently (you’re welcome!), and I’m playing around with where to position it – I figure that those of you that want more detailed market summaries either already subscribe to the daily emails or will eventually get around to doing so, and those of you that don’t would rather get to the nice pictures section sooner.

But since I just can’t help myself, I will of course be throwing in some comments about what I consider to be the highlights of current narratives, especially since it’s all so interesting these days.

To echo Jeff’s comments above, in macro markets, it’s still mainly about the banks. With the UBS/Credit Suisse merger being slowly digested, the fear focus has shifted to Germany’s Deutsche Bank, whose share price yesterday suffered the steepest drop in three years and whose credit default swaps are spiking. First Republic is also not out of the woods, with more downgrades and its third consecutive week of double-digit losses. And US bank deposits this past week saw the steepest drop in almost a year –this time a year ago, we were all freaking out about war.

As systemic as this may feel right now, it is still relatively contained in terms of market impact – it’s when we start to hear about hedge funds in trouble that we should start worrying. Oh, wait…

(I’ll talk more about hedge funds on Monday, there are some disquieting things going on there.)

What’s happening in the banking sector matters for crypto through its impact on the outlook for interest rates – central banks are tasked with price stability but they also usually have a mandate for financial stability, and when rate hikes are causing strains in bank liquidity and solvency, they will have to choose.

For now, the Fed seems to believe it can keep rates high for the short term while “monitoring the situation”. The market disagrees. With the expected-but-controversial 25bp hike now (thankfully!) in the rear view mirror, traders are back to telling the Fed that they don’t trust its forecasts, not at all. CME futures are now pricing in a pause in May and June and then cuts from July, even though Fed Chair Powell categorically ruled that out in his press conference. The market is currently assigning a more than 90% [edited] probability that end-2023 rates will be at least a full percentage point below the Fed’s official forecast.

(chart via CME FedWatch)

While interest rates are only part of the monetary liquidity equation, they are a high-profile part and expectations of monetary easing should boost risk assets, especially those such as bitcoin that are not tied to the actual economy other than through sentiment. Furthermore, the exposed fragility of the traditional banking system is boosting bitcoin’s “insurance” narrative, and the likely emergency rescues as more banks fail is highlighting the “store of value” thread. It’s not a coincidence that this week gold broke through $2,000/oz for the first time in a year.

The seismic move in the crypto industry this week was the Wells notice delivered to Coinbase informing them of an imminent enforcement action. I wrote about it here and here, but in brief, CEO Brian Armstrong has said that the company is ready to fight this in the court, which is the “game on” moment we’ve been waiting for. I confess I’m surprised that SEC Chair Gensler is so eager to take on yet another high profile and expensive legal battle that he might not win (the others are the ones against Ripple and Grayscale). But personally, I think it’s net good news that he has, because the industry will finally have a chance to highlight, in an official venue, the regulatory inconsistencies and hostilities that have been among the most significant headwinds in recent months.

Nevertheless, it does add another veil of uncertainty to the crypto market, especially for mainstream observers. BTC and ETH have both shown remarkable resilience, however, buoyed by the aforementioned macro narratives – both were slightly up on the week with BTC continuing its outperformance.

(chart via TradingView)

I'll be joining Jeff for a Twitter Live discussion on Tuesday at 4pm ET, where we’ll go over the trends we’re seeing in crypto markets, where macro could be heading, and why all this matters.

GOOD READS/LISTENS

A fascinating Forward Guidance interview with Crossborder capital’s Michael Howell on the inner workings of liquidity, and why we are in for higher-than-target inflation for a very long time.

Peter McCormack sits down with none other than Doomberg, to discuss banking access, free speech and the gradual erosion of liberty.

The Bankless podcast team talk to SEC Commissioner Hester Peirce about what the SEC is getting right and wrong about crypto regulation, and about Gary Gensler’s penchant for rom-coms.

Galaxy Digital Research has published a thoughtful and easy-to-digest report looking at market and on-chain evolution over the past few months, and what the data suggests about what’s ahead (spoiler: things are looking positive).

Have a good weekend!

🌸I can think of few things more uplifting for the spirit than flowering trees, so – with cherry blossom festivals kicking off around the world this week – here are some key links. 🌸

Cherry blossoms in Tokyo reached full bloom on Wednesday, nine days earlier than usual.

You can watch a live “bloom-cam” of the Tidal Basin in Washington D.C, and a livestream of the opening ceremony later today.

The Brooklyn Botanic Garden has an online “CherryWatch” where you can check to see which of the park’s 200 trees are flowering.

And here in Spain, the Fiesta del Cerezo en Flor reached its peak this week with thousands of cherry trees in full blossom in the Valle del Jerte.

(Photo by Koji via mymodernmet.com)