WEEKLY, March 9, 2024

volatility is back, a new type of crypto product, a remarkable woman

Hi everyone! I hope you’re all doing well, and taking care of yourselves.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into trends and narratives, market commentary, audio, interesting links and more.

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Welcome to volatility

A new type of crypto product from a new type of market participant

Some of the topics discussed this week:

Gold drivers vs BTC drivers

A BTC breather and do rates expectations even matter?

Arbitrary and capricious, again

Nigeria thinks crypto can bring down the economy

A major traditional exchange launches a crypto desk

A twist in US rates expectations

Significant all-time highs

Reading the tea leaves: China’s Congress

Inflation expectations and the jobs outlook

Welcome to volatility

This past week was quite something. After briefly breaking through to a new all-time high of $69,210 on Tuesday, BTC started dropping, reaching as low as $59,313 on the same day before heading back up again. Quite the round trip – an intra-day drop of over 14% is not something you see every day.

Despite a couple more wobbles, BTC has largely been climbing since then, and as I type is once again close to an all-time high.

(chart via TradingView)

The leverage build-up barely skipped a beat, despite the highest amount of liquidations in at least six months (as far back as my chart goes).

(chart via coinglass)

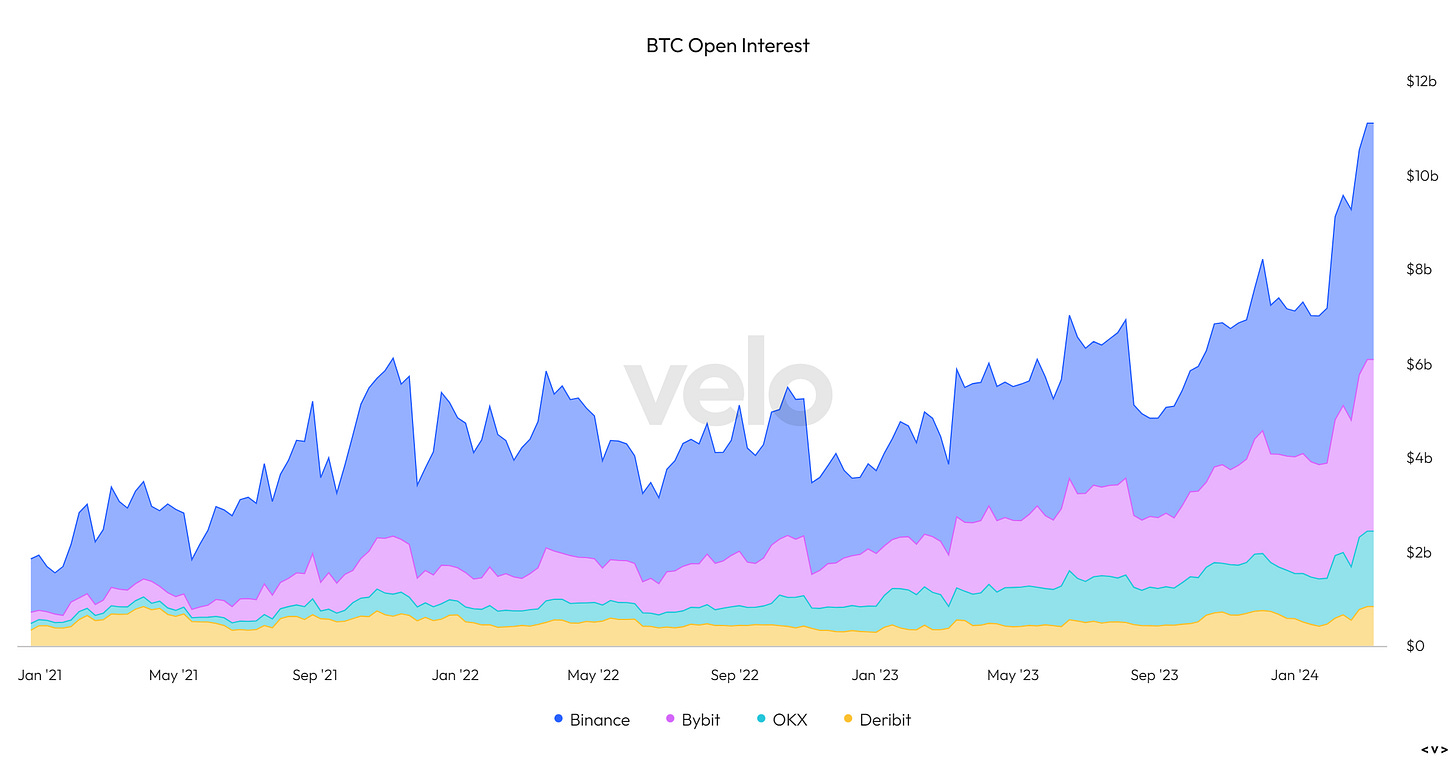

BTC futures open interest on offshore exchanges are currently at an all-time high.

(chart via velodata)

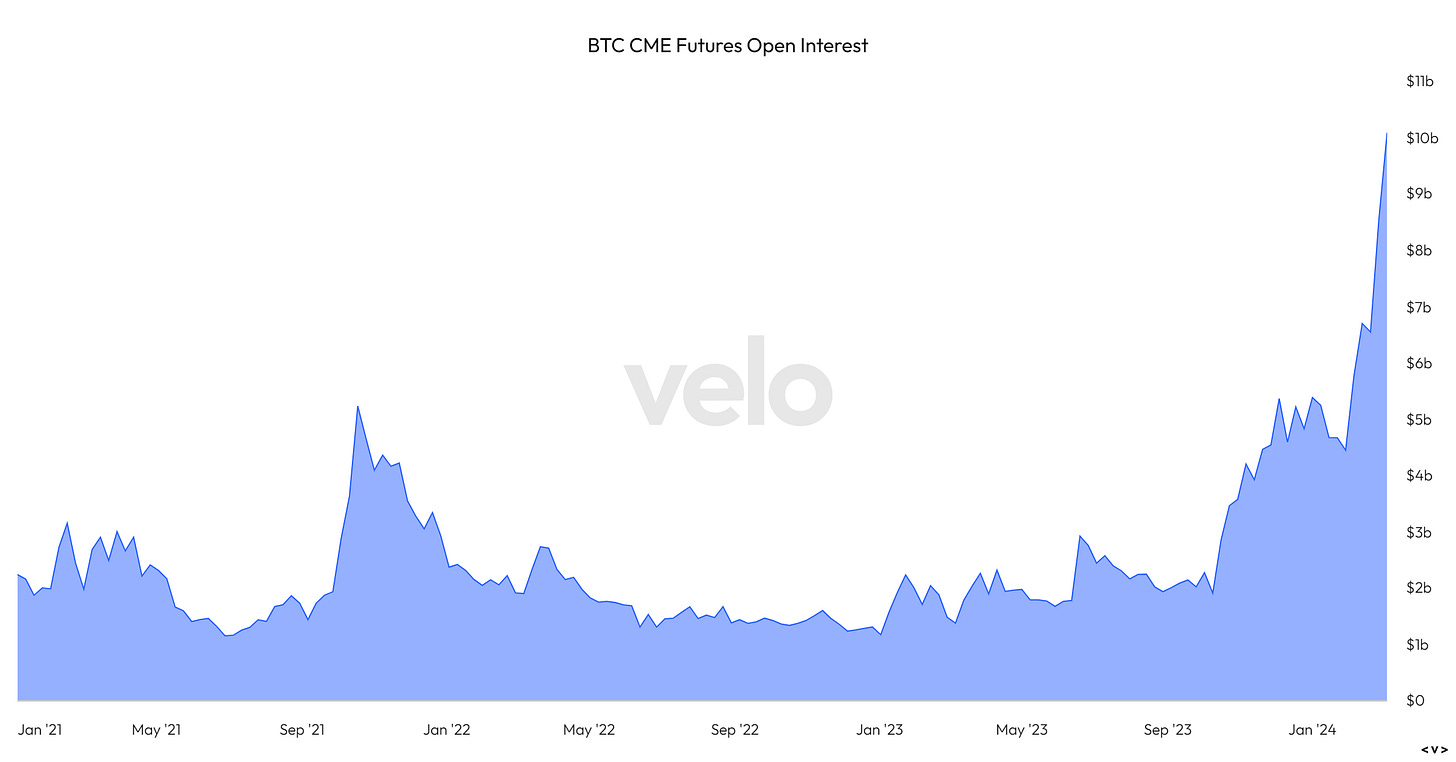

The same can be said for BTC futures on the CME, the preferred exchange for most US institutions.

(chart via velodata)

And derivatives metrics continue to signal a bullish tilt – the perpetual futures funding rate (in which traders holding long positions pay those holding short position) reached the highest levels since BTC touched its previous all-time high at the end of 2021.

(chart via velodata)

One way to appreciate the wild price swings is as a fitting initiation for all the new ETF investors: now they know just how volatile BTC can be. I don’t mean to sound glib – hopefully, they were all warned this could happen, but even so, it was probably startling to many and unfortunately perhaps devastating to a few. If this week’s moves permanently scared away many who do not want this kind of action in their portfolios, then that is good news for them and for the market. The damage could have been worse had the price run up further and faster, bringing in even more retail participants convinced the only risk was in missing out.

The historical BTC volatility index that I keep an eye on, BVOL (30-day rolling annualized), hasn’t been this high since almost a year ago.

(chart via TradingView)

Despite the pick-up in volatility, ETF inflows remained strong all week, and the nine new funds now have more BTC combined than the industry giant Grayscale.

(table via @BitMEXResearch)

So, froth is still with us, despite this week’s rollercoaster, which suggests that the volatility will continue.

One good side effect of the return of volatility is that it should bring even more market makers and high-frequency traders back into the crypto market, which in turn will add more liquidity, making it even more attractive for large institutional players.

Another interesting twist: while mainstream attention has been focused on BTC making a new ATH, ETH has been quietly outperforming in the background. Over the past five days, ETH is up 13% while BTC is up 8%. Over the past month, ETH is up 62% while BTC is up 55%. Year-to-date, ETH is up 72% while BTC is up 62%.

(chart via TradingView)

After the rollercoaster start to the week, the relative stability of the past few days have been a welcome breather and what looks like a bit of sober consolidation before BTC begins the next leg up. Froth and excitement are an inevitable part of any upswing in crypto markets – it just feels a bit too soon in this cycle for runaway giddiness.

A new type of crypto product from a new type of market participant

This caught my eye earlier this week: staking services provider Figment and securities services firm Apex Group are working with Issuance.Swiss AG to launch two new crypto exchange-traded products (ETPs) – one based on ETH (ETHF) and another based on SOL (SOLF). But these are not your typical crypto ETPs: they both combine exposure to the underlying asset with the addition of yield from staking.

The product itself is not completely new, there are already a few other ETPs that offer staking rewards on top of asset appreciation. But the Figment products, which start trading on the SIX Swiss Exchange on March 12, have a couple of twists.

To appreciate these, I need to first sidebar on a couple of concepts. And, since I understand Ethereum better than I understand Solana, I’m going to use Ethereum in the explanations, but I imagine the principles hold for both.

Probably by now most of you understand staking, in which validators for proof-of-stake networks check transaction validity, add blocks to the blockchain, and maintain network consensus. Anyone can become a validator by locking up a pre-set amount of tokens. In exchange, they are paid a certain number of new tokens by the protocol.

A more complicated aspect of blockchain transactions is Maximal Extractable Value, or MEV, which is additional income block validators can earn in exchange for transaction ordering. This is distinct from the block reward which is paid by the Ethereum protocol – MEV comes from Ethereum users who pay extra fees to get their transactions positioned first in a block. For instance, if there’s a large buy order out there, a trader might want to get her order in the block ahead of that buy, in order to sell at a higher price right after. This may sound a bit like front-running, but the difference is that the information being “front-run” is publicly available to those who know how to read it. There is no “insider advantage” here.

So, MEV is additional income paid to validators in exchange for transaction ordering. In reality, intermediaries called “sequencers” often do the block preparation, but they then pay extra fees to the validators to make sure their blocks get chosen, so even indirectly, validators benefit from MEV. But, as far as I’m aware, listed ETP products that stake tokens don’t distribute MEV rewards.

Another aspect to keep in mind here is unstaking, or deciding you don’t want to be a validator any more. The number of validators that can unstake their tokens has a daily limit, to avoid a potentially destabilizing rush to the exit for whatever reason, and so withdrawals can take up to a few days at times of high activity.

This makes staking a relatively safe way to earn crypto yield and enhance overall asset return, but at the price of exit risk. Unstaked ETH can be sold at any time – staked ETH has to wait for a while.

This brings us to the twists in the Figment products. As far as I can tell, they are the only ones to include MEV in the returns. And, a higher-than-usual percentage of their held tokens is staked.

In this case, it’s up to 50%. Most existing listed staked ETH products, to pick an example, have around 20% of their held ETH locked up in staking contracts, earning rewards – the rest are held in custody. This limit is influenced by market makers who are understandably not happy with high exit risk. If a wave of ETP redemption orders come in, the market makers want to know they can be satisfied right away, which means they need to know the underlying ETH can be sold at a moment’s notice. This is not possible with staked tokens, hence the product-imposed limit.

This is one of the key advantages of holding a staking ETP vs the underlying asset. Investors would be better off handling their own ETH holdings with full staking, as they would get 100% of the staking rewards plus MEV plus any price upside, while the yield would cushion any price drops. But staking is a hassle, with many complex steps that add risk for those who just want simple exposure. They can of course outsource the staking to specialized services, but investors still wouldn’t have total liquidity in that they would need to wait for the unstaking to work through the process before being able to sell. An ETP guarantees immediate liquidity. Investors get a more diluted yield in exchange for greater peace-of-mind.

So, how come market makers are ok with 50% staking on these new products? Because, unlike other staking ETP issuers, Figment is a staking infrastructure provider. This is also why it can offer the additional MEV income.

And this is why the announcement made me sit up in my chair. At first, to be honest, I was intrigued by the idea of a crypto product with the cushion of additional income being offered into a market that loves yield. A way for European institutions to dip their sizeable toes into an innovative and higher-volatility corner while still being able to say they are yield-focused.

Digging deeper into the plumbing, I realized that this is more about a shifting market structure.

It’s not just a new type of product in the market. It’s a new type of market participant. Figment is known for providing blockchain infrastructure and staking services. The virtual wires, pipes and buckets, if you will. Now they are involved in the issuance of a market-traded product, that could not exist without them.

I’ve been trying to think of a traditional market analogy, and the best I can come up with on only one cup of coffee is a stock exchange software provider that harnesses collected data into a tradeable product, but even that is woefully inadequate. Send in suggestions, please! Bottom line, it is yet another example of how blockchain technology combined with demand for crypto assets is changing traditional markets.

A final intriguing takeaway is the timing. Speculation is starting to build in the US about the listing of ETH spot ETFs sometime this year, and although some issuers have the possibility of staking reward distribution in their proposals, hardly anyone expects the SEC to allow that. I think we’ll get US-listed ETH spot ETFs but without staking, which will make them an inferior product. (I’ll expand more on this another time, plenty to say here.)

In Europe, however, institutional investors can get access to ETH and staking and now also additional MEV income.

The contrast is especially stark given Europe’s reputation for conservatism when it comes to markets, vs the US dominion of innovation and size. While the US is for sure still winning in size, the fact that Europe now has a wide range of products that are favoured by even conservative institutional investors yet are deemed “too risky” for the US market, suggests that the innovation center of gravity when it comes to markets just might be heading across the Atlantic.

HAVE A GREAT WEEKEND!

Iris Apfel passed away on March 1, at 102 years old – or, 102-and-a-half, as she boasted on X the day before (underscoring that the half years matter a lot more in the early and later years than they do in between).

I’d been a follower of hers on X and in the media for years, in part because she reminded me of my mother (also a wildly colourful personality), but mainly because her apparent fearlessness was an inspiring beacon that celebrated womanhood refusing to conform to tropes.

Women of all ages, even the very young, have told me how much they looked up to her, envied her courage, marvelled at her sense of style and loved her irreverence.

She made the world more colourful, while reminding us that we can find beauty in unexpected corners and combinations. For that we should all be grateful. RIP, brave woman. Your name and memory live on.

Hey Noel, on a crypto note, I’m seeing very different takes on the so-called Athena stable coin. Wondering if you’re going to weigh in on this topic?

It’s certainly not really a stable coin, but probably more like a derivative of Ethereum that will be minimal price fluctuations if they can manage it well. Anyway pretty fascinating experiment in my opinion.

Yay Iris. You are still great in your new chapter merged into the All…!