WEEKLY, May 18, 2024

SAB 121’s repeal moves forward, tariffs and the coming wave of inflation, the Putin-Xi embrace

Hi everyone! I hope you’re all doing well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links. If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

SAB 121’s repeal moves forward

Tariffs and the coming wave of inflation

The big Putin-Xi embrace

Some of the topics discussed this week:

CME and spot bitcoin

Is the BTC move macro-driven?

Oh no, crypto is a PR tool again

India’s crypto support

The ETF story is not over

Metaverse flop

What GameStop teaches us

CPI’s split personality

A shift in US power

Market sentiment risk-on

… and more!

SAB 121’s repeal moves forward

This week, the Senate passed Joint Resolution 109. This moves to repeal the SEC’s ridiculous accounting guidance SAB 121, which essentially blocks any listed financial company from offering crypto custody. I’ve written about it often before, so feel free to check here and here for background.

This is a big deal.

A total of 12 Democrats, many of them influential, broke party ranks to vote in favour even after President Biden issued a memo last week saying that he would veto the proposal should it come to his desk.

It’s possible that the rebellious Democrats felt emboldened to vote in favour because they knew Biden would veto, and they wanted to signal to their bases that they were pro-innovation without actually having the crypto industry move forward. But I’m not convinced, as the risk of party censure is arguably more professionally painful.

At the risk of buying too much into the crypto echo chamber glee, this does feel like a political signal that suggests a deepening divide in the Democratic party. The hand of Senator Warren was obvious in the “I will veto” memo issued by the President’s office – yes, she who just a year ago promised to raise “an anti-crypto army”. It could be that many ranking members are bristling at her oppressive influence which goes against what constituents seem to want. Even those who don’t care about crypto must feel some embarrassment that the rest of the world is leaving the US in the dust when it comes to accepting that there’s a new type of asset in the market.

And for those of us who live and breathe crypto every day, it’s a refreshing reminder that the “mainstream” world is taking notice of what’s at stake here. It’s not about access to crypto markets. It’s about who gets to decide what banks do, it’s about how far can SEC overreach go, it’s about the sham pretence of investor protection while denying market access, it’s about moving forward rather than smothering progress with bubble wrap.

Now, the bill goes to President Biden’s office. He can go through with his threat to veto, which will be a politically contentious move, essentially giving even more power to Senator Warren. Or, he can do nothing about it for ten days, in which case it becomes law, SAB 121 is overturned, banks can custody crypto, and the SEC gets a welcome public rebuke.

I have a sinking feeling we’ll see the former, since Biden has to balance caving to a faction of rebel Democrats with looking tough and resolute ahead of an election in which his frailty is a key topic. But even so, the message delivered is a positive one. It shows that, slowly, step by step, senator by senator, crypto education is doing its thing.

It also opens the door to potential lawsuits against the SEC for overstepping its mandate and costing the banking sector coveted business while denying crypto investors the protection they deserve.

Whatever happens, the vote this week was a significant political step in the direction of supporting the inclusion of crypto assets in traditional financial infrastructure. It was the first purely crypto bill to make it through both the House and the Senate. That’s a strong signal.

Sure, crypto doesn’t need traditional finance. But being part of it is how the ecosystem will change markets, hopefully nudging them towards broader access and more decentralization, while supporting assets held by a broad range of investors, savers, entrepreneurs and dissidents, around the world.

Tariffs and the coming wave of inflation

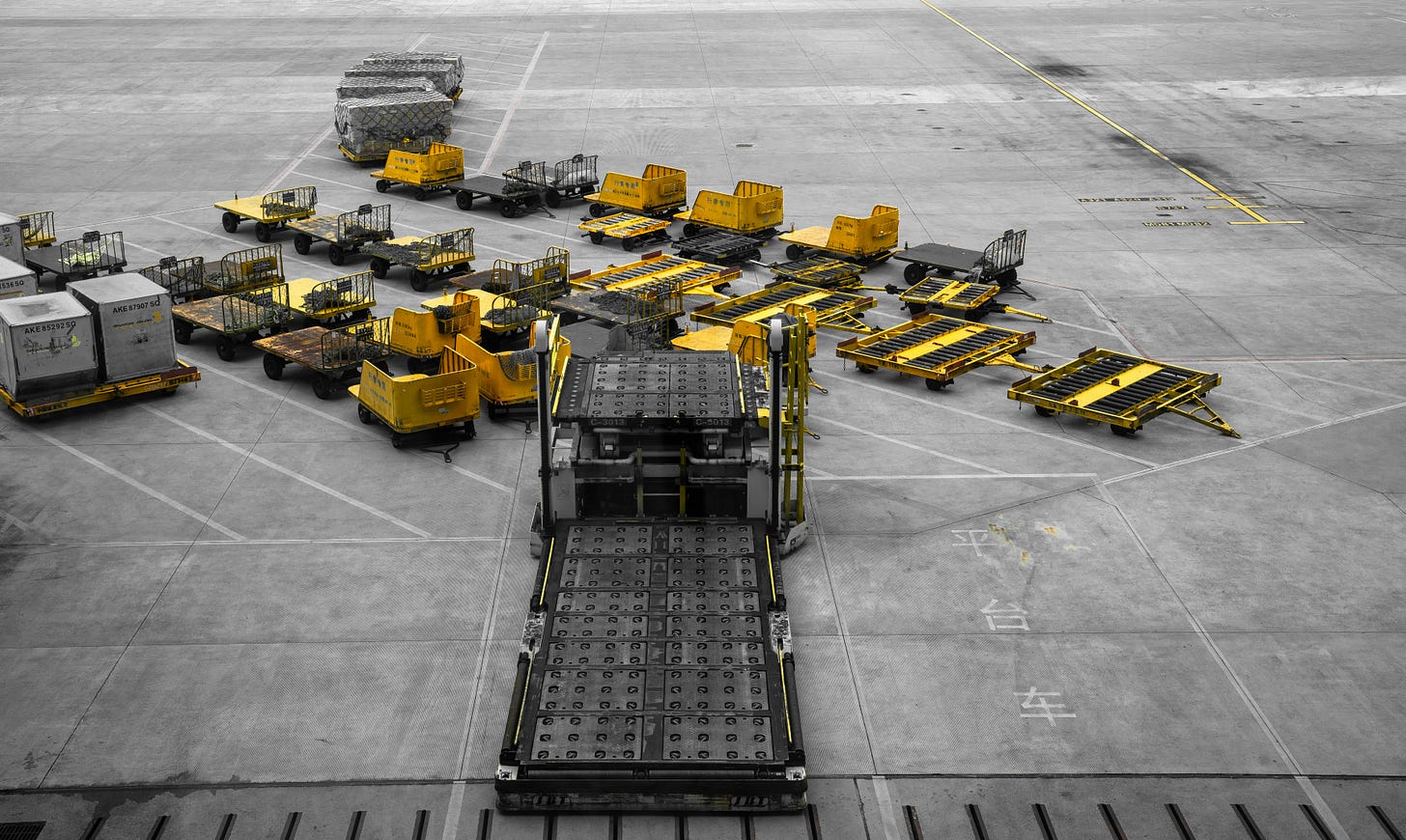

On Tuesday, President Biden unveiled new and increased tariffs on Chinese imports. These continue the punitive taxes imposed by the previous Trump administration, which were roundly criticized by then-candidate Biden on the grounds that “the American people are paying” for them. The new measures also increase most of them while adding new ones, taking the trade war even further than Trump wanted to.

Tariffs more than quadruple on electric vehicles (to 100%!), more than triple on lithium batteries and their components, as well as on some steel and aluminum products. They double on semiconductors and solar panels.

(photo by White.Rainforest ™︎ ∙ 易雨白林. on Unsplash)

New tariffs are imposed on a long list of critical minerals, magnets, ship-to-shore cranes, and medical products including syringes, face masks and respirators.

Fed Chair Jerome Powell must be crying by now. There is no way tariffs aren’t inflationary.

To start with, they increase the cost of essential goods.

They also will spur domestic economic activity, factory growth, employment and – you guessed it – wages. This is also inflationary.

Meanwhile, fiscal stimulus will need to help businesses expected to build out the additional capacity needed to replace the more expensive Chinese supply.

It is especially inflationary since it will invariably lead to another splurge of money printing, with either direct QE or financial repression.

The fiscal stimulus needed to compensate for these tariffs, to “onshore” industries that the US doesn’t really have today, will obviously be paid for in the short term by more government debt, since the US economy is showing signs of slowing – in other words, the US can’t count on GDP growth to pay for all this.

Who is going to be buying this debt? Foreigners to some extent, sure – but if they’re earning fewer dollars because they’re exporting less to the US (because of tariffs), how do they pay for that investment? Put another way, new US tariffs mean trading partners will be earning less US currency, which means they will have less demand for US assets in which to park their dollars.

The tariffs are directed at China for now – but the targets could spread as a new protectionist mentality takes hold. (And if you thought the WTO was irrelevant already, ha, just wait.)

But even if they remain just a US-China thing (very unlikely), China is still the second-largest buyer of US government debt. It has recently been shedding US exposure, with Bloomberg reporting this morning on a record sale from China of Treasury and US agency bonds in the first quarter.

(chart via Bloomberg)

If this trend continues (very likely), that will create a gap in the market. What’s more, it’s a gap that the largest foreign US debt purchaser – Japan – is not exactly in a position to fill. It’s likely Japan will also be cutting its US treasury exposure as it needs dollars to both support the depreciating yen and finance increasingly expensive dollar-priced imports.

So, we can expect to see the US Fed step back into the debt market, reviving QE – at a time when interest rates are still above 5%. Alternatively, we could see the US government insist banks and other institutions buy more – but the banks will need to be compensated somehow through high yields. What’s more, this will incentivize the banks to print money by boosting lending, which is inflationary.

And all this is before Trump comes in and, if he wins, adds even more tariffs because he can’t let Biden have the last word here.

I’ll be coming back to this often, because it is a key factor in what lies ahead. We’ve seen many signs recently of an unravelling of the current global order. This week, that unravelling accelerated, and what lies ahead will reinforce the weakening role of the US dollar on the global stage, and the intensifying search for hard asset hedges to the coming USD depreciation and dilution.

Whether you are a fan of bitcoin’s potential or not, in this environment it’s kind of hard to not be at least glad it exists.

The big Putin-Xi embrace

Russian president Vladimir Putin has wrapped up his visit to China, with what could end up being one of the most consequential diplomatic trips of the year.

I need a bit more time to dive into everything that was said and not said over the past couple of days, but here are some things that jumped out:

The two nations have vowed to “further deepen mutual military trust and cooperation”. Putin’s newly appointed defence minister accompanied him on the trip.

A joint statement also promises deeper collaboration on artificial intelligence, telecommunications, cyber security, satellite navigation systems, space exploration, and other areas that have security implications. The head of the Russian space agency was also part of Putin’s entourage.

This is after the US moved to punish Chinese banks accused of helping Russia evade sanctions by facilitating the sale and transport of military equipment. It looks like that move didn’t have the desired effect.

Nor will further sanctions. According to Putin, 90% of Chinese-Russian trade is settled in yuan and rubles. Kicking China out of the dollar-based system entirely would only further exacerbate the already alarming divestment of dollar assets, such as US government debt.

Xi and Putin pledged a “new era” of partnership, which sounds like a bigger-picture version of last year’s “friendship without limits” promise.

Both countries pretty much accused the US of acting like a hegemonic bully, “guided by the logic of bloc confrontation, putting the security of 'narrow groups' above regional security and stability, which creates a security threat for all countries in the region." Ouch.

The two leaders embraced warmly at the farewell, a gesture that was reported in Chinese media. This is unusual.

None of the above was backroom diplomacy. It was pomp and circumstance and affection, on display for the world to see. If there was any doubt as to which side China was on, they are now dispelled. And if any observing nation was wondering how effective US influence would be in the reshaping of global power, they have their answer.

The US may still have the world’s largest economy and the most advanced military, but that doesn’t seem to frighten either China or Russia. This morning, the South China Morning Post reported on evidence suggesting that China has been building a new type of aircraft carrier for military drones. It is working on chips, airplanes, colonizing the moon and more. The new global power structure is taking shape.

HAVE A GREAT WEEKEND!

My daughter introduced me to Jet Lag, the YouTube game series in which one person hides somewhere in the world, and other contestants have to find him. It’s an astonishingly complex thing to pull off, but the producers manage it, with drama and suspense mixed in with travel, geography and some clever editing.

It’s a charming mix of simple stream-to-video and clever editing, with a knack for storytelling and scenery – I just may be hooked.

Speaking of Switzerland, and kids with great taste, here’s a stupid joke I love:

Son: What are some of Switzerland’s key advantages?

Me: Switzerland? I… don’t know?

Son: Me neither, but the flag is a big plus.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.