WEEKLY, May 27, 2023

Crypto market headwinds and tailwinds, and why we need a distrust index

Hi everyone! You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

Since many of you are new here (welcome!), I’ll introduce myself again: I’m Noelle, and I’ve been writing investor-focused crypto newsletters for over six years now, first for CoinDesk and more recently as Head of Research at Genesis Trading. Now that I’m focusing on an independent research project (the topic is in the newsletter name), it felt only natural to continue.

If you’re not a premium subscriber, I hope you’ll consider becoming one to support my work and to get a frequent update on how crypto is influencing the macro landscape, and vice versa. You’ll get more in-depth and up-to-date market commentary, a daily big picture look at the broader trends influencing crypto adoption, links to interesting articles and podcasts, cute stick figures on charts (when time allows) and a shared enthusiasm for how the crypto industry is no longer a niche topic that appeals to a limited audience.

Programming note: The premium daily will be taking a break for Memorial Day/Bank Holiday Monday, and also has to miss Tuesday due to a conflict. Back on Wednesday, May 31st! (Earlier this week I mistakenly put Wednesday, June 1 - this calendar stuff is complicated.)

MARKETS

Market headwinds:

Debt ceiling uncertainty.

This week, US government debt markets started to show signs of stress more in line with the tense situation the US Treasury is in. On Thursday, the US 2-year yield broke past 4.5% for the first time since March and continued climbing on Friday, pushing the 10 year-2 year spread back down to -0.74, its most negative this quarter.

(chart via TradingView)

The MOVE volatility index is still far from its elevated March levels, but it is rising and closed on Friday up 14% on the week.

(chart via TradingView)

Understandably, much of this stems from growing concerns about US debt, even if the Democrats and Republicans do manage to reach an agreement to raise the ceiling in time to avoid a default. Negotiators are apparently prepared to work through the Memorial Day weekend to reach a deal, and House Speaker Kevin McCarthy is sounding a bit more optimistic than usual.

But the consequences of letting the situation get this fraught have yet to fully emerge. This week, rating agency Fitch placed US debt on watch for a potential downgrade, a move that is likely to be echoed elsewhere. Indeed, on Thursday Moody’s said that in order to maintain its AAA rating, the US government would need to meet a looming $2 billion interest payment due on June 15. And China’s top rating agency officially downgraded US debt from AAA to AA+, and placed the US on review for a further downgrade. China is the second-largest foreign holder (behind Japan) of US debt, with $867 billion as of January 2023.

So, logically, debt with a lower grade should have a higher risk premium, and a bump in yields in the world’s largest debt market tends to tighten overall liquidity which impacts the price of risk assets such as bitcoin. Also, while some investors see bitcoin as an “alternative” to the troubled fiat system, for many macro funds it is still riskier than downgraded US debt, and with a less certain short-term upside than AI-leveraged equities such as Nvidia (up almost 25% on the week).

Rate expectations.

This week’s bump in yields is not just due to debt ceiling drama – investors are reassessing their conviction that the Fed will cut rates this year.

Economic data has been strong. Yesterday we got the latest read on the US Personal Consumption Expenditure price index, the Fed’s preferred measure of inflation since it relies more on GDP data and reports from suppliers and covers all US households (the CPI is largely based on surveys of urban consumers).

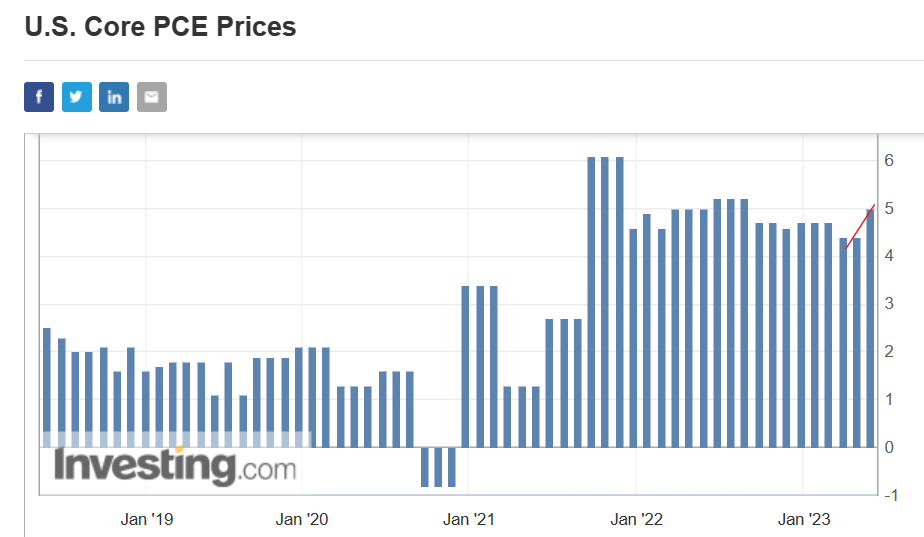

The core PCE price index for April came in slightly higher than expected at 4.7% year-on-year, an uptick from March’s 4.6%. This not only reveals a worrying stickiness, it is moving in the wrong direction despite the record pace of rate increases over the past year. The core PCE price index year-on-year increase is back to January levels.

(chart via Investing.com)

What’s more, personal spending for April grew 0.8% month-on-month, double the consensus forecast and much higher than March’s 0.1% growth. And the core PCE price index for Q1 was revised up to 5.0%, well above the original consensus forecast of 4.7% and Q4’s figure of 4.4%. This does not bode well for Fed rate cuts any time soon.

(chart via Investing.com)

US GDP growth for the first quarter was also revised up this week, to 1.3% from 1.1%. This is lower than Q4’s 2.6%, but it shows an economy that is not yet showing clear signs of the slowdown that will be necessary to bring inflation closer to the target. Real consumer spending for Q1, also revised up, grew at the highest rate since the second quarter of 2021, which suggests that inflation could remain sticky for a while longer. And the latest University of Michigan survey shows that consumers slightly raised their five-year inflation expectations to 3.1%.

(chart via Investing.com)

This stronger-than-expected growth is starting to move trader conviction around a rate hike pause in June. Yesterday, CME pricing showed a less than 35% probability of a another hike in June – today, that number is up to almost 65%, with the probability of another hike in July up to 30%. These moves are so abrupt you’d be forgiven for complaining of whiplash. And they do not create a favourable environment for risk assets, bank balance sheets or the global economy more broadly.

(chart via CME FedWatch)

Low implied volatility.

BTC’s 30-day options-priced implied volatility (IV) continues to deflate, and this week touched its lowest point since early January. ETH’s 30-day IV went further and reached its lowest point on record.

(chart via TradingView)

What’s more, ETH 30-day IV is now back down to BTC levels. While this is a relatively common feature so far this year, historically it is unusual – ETH has been a higher-volatility asset, which intuitively makes sense given its youth, lower market cap and more radical technological changes on the roadmap.

There are many factors behind this shift, and I plan to go into this in more detail next week. But for now, the low levels in IV for both leading crypto assets signal a reluctance of investors and traders to take positions in either spot or derivatives.

Since there is currently no strong selling catalyst (although keep an eye on overall market risk sentiment), this lack of interest translates into range-bound behaviour which further consolidates expectations of continued low volatility.

Market tailwinds:

Hong Kong support.

This week we got confirmation that Hong Kong will allow retail trading of BTC and ETH on licensed digital asset platforms as of June 1. This is a very big deal. The Hong Kong market itself is not that large, but it is a gateway between China and western markets, the rules have been drafted with tacit Chinese approval, and the Chinese market is massive.

I’ve written before on the significance of the legal framework emerging around digital assets in Asia – in sum, it’s huge, and the resulting BTC and ETH price bump in such a bleak market validates that.

This news doesn’t mean that a flood of retail buying power will enter the market at the beginning of June – that date marks the activation of the “Guidelines for Virtual Asset Trading Platform Operators”, which sets out the licensing process, custody rules, cybersecurity practices, etc.

Not long after the statement from Hong Kong’s Securities and Futures Commission (SFC), Binance CEO CZ tweeted that state broadcaster China Central Television had covered the news of Hong Kong’s digital asset framework. CryptoHub210 helpfully provided a translation (unverified) that sounds both informative and cautionary (with a reminder of trading restrictions and the need for digital asset platforms to either get a license or leave Hong Kong).

China easing.

What’s more, retail as well as institutional interest from China could be boosted by monetary easing.

The Chinese stock market is sending a strong signal that investors have significantly reduced their expectations of an economic rebound, with the CSI 300 Index this week reaching its lowest level so far this year.

(chart via TradingView)

Recent data suggests GDP growth this year will be closer to the government’s target of about 5%, which was at time of release regarded to be absurdly low. Manufacturing indices declined in April, the housing market is showing signs of weakness, and the rapid spread of the new XBB Covid variant is a cloud hanging over consumer spending. What’s more, the probability of a wave of property company defaults is increasing, as are concerns about levels of municipal debt.

This week, the People’s Bank of China kept rates unchanged, although traders are raising their bets on Chinese monetary easing, given the political importance of exceeding the growth target – interest rate swaps point to an expected cut of almost 65 basis points over the next 12 months.

(chart via Bloomberg)

While this would not help liquidity in US markets, it should have an impact on Chinese markets, and particularly on risk assets such as BTC and ETH.

Politics.

The US presidential campaign is gearing up to elevate the political discourse around bitcoin.

Another presidential candidate, Vivek Ramaswamy, has some issues with Ron DeSantis’ apparently superficial understanding of crypto (eg. bitcoin isn’t something you “do”). While it is probably true that Ramaswamy has a better grasp of the technology and the potential, and while we can bristle at the idea of crypto being used as a politically convenient slogan only to be ditched once it’s had the desired effect, the end impact will be positive. More public dialogue from politicians around how crypto can strengthen the financial system (Ramaswamy) and how bitcoin is more about civil liberties than speculation (Kennedy, DeSantis) could be enough to shift some understanding and maybe even start to change the overall tone in Washington DC. On a broader canvas, it could even boost awareness of the power behind a tradeable asset that also represents a political philosophy rooted in hope. US politics could use some more of that.

COLUMN

(I published this earlier this week as part of one of the daily emails, so by all means skip if you’re a premium subscriber.)

Distrust escalates

If there were such a thing as a “distrust index”, it would be off the charts. A cursory skim through any particular day’s headlines can confirm the widening divide between and within leading nations, with no solutions in sight.

In the US, the political chasm is now such that it divides families, can impact work prospects and influences decisions on education. A recent paper shows that it can even impact economic data, with consumer surveys skewed according to whether or not the respondents are aligned with the party in power.

It could even end up deciding if the US defaults on its debt, since the Republican Party is now casting doubt on the Treasury Department’s calculation that its account will run out of money in early June.

And the worsening relations between the US and China, one of the pillars of this century’s global trade, bodes ill for economic growth in both countries going forward.

There’s also the realization that central banks manipulated a key interest rate, record low levels of trust in the Supreme Court, and an alarming decline in confidence in journalists, elected officials and even the military, according to a recent Pew Research survey.

Under no circumstances is this good. Not even for those who believe in bitcoin.

Okay, bitcoin does represent an alternative to the fiat system, and its decentralized network and self-custody embody a lack of trust in centralized control. In much of the world, this can mean the difference between life and death, or at least between opportunity and subjugation.

For this reason alone, those that say they care about human rights should be glad it exists.

But we’ve always known that the day bitcoin’s underlying use case – that of a decentralized store of value and payments mechanism – becomes mainstream-level obvious would be a pretty bleak day. In other words, if bitcoin becomes appreciated by the majority of people living in the world’s leading democratic economy, it will be because trust in institutions has broken down even further.

This always leads to conflict and shattered lives. Always.

True, humans are smart and resilient and wired for survival. They also know that community is key and connections can be renewed. But centuries of cycles have taught us that societies sometimes need to break down before they can rebuild. This tends to hurt people.

Yet renewed entrepreneurial vigour and political hope always emerges from the rubble of damaged supply chains and broken balance sheets.

For this reason, the hypothetical “distrust index” is a key economic variable and the gathering clouds are worth watching.

Also, for this reason, we can be glad there are resilient alternatives to centralized systems. They may not be as convenient, but prudence dictates that we should never lose sight of the possibility that may one day not be important, even in efficient financial regimes.

Have a great weekend!

Tina Turner passed away this week. More than a talented, innovative musician with a powerful voice and range, she was also a tough woman, a style icon and an inspiration to generations. I will be spending at least part of the weekend listening to my favourites on loop:

Excellent as always.

Hey, did you happen to listen to this pod with luke gromen? Love to hear your thoughts on first 10 minutes. Have a great weekend!

https://podcasts.apple.com/us/podcast/on-the-margin/id1558223079?i=1000614293150