WEEKLY, May 4, 2024

the Fed pause, stablecoins vs sanctions, cathartic jazz piano

Hi everyone! I hope you’re all doing well. And, of course, May the Fourth be with you! 😃

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links. If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Giving pause for thought

Stablecoins vs sanctions

Some of the topics discussed this week:

The crypto market lull

Crypto in Asia

DTCC gets firm

Franklin Templeton takes a tiny crypto step

Chinese hedging

More crypto ETFs

FOMC reactions: Some good, some bad

PCE disappointment and crypto jitters

Sanctions, intervention and the Japanese yen

Treasury market tension

Giving pause for thought

In Tuesday’s newsletter, I talked about the best-, not-so-terrible- and worst-case scenarios for Powell’s FOMC statement and press conference.

On Wednesday, we got something pretty close to the best-case.

In his post-FOMC press conference, Powell insisted that rate hikes were not being considered, but that rate cuts would most likely take longer to get consensus. The central bank committee will continue to be “data-dependent”, no surprise there, while keeping a close eye on employment (its other key mandate). And you’ll be pleased to hear that the Fed is convinced that its policy is restrictive (despite plenty of evidence to the contrary).

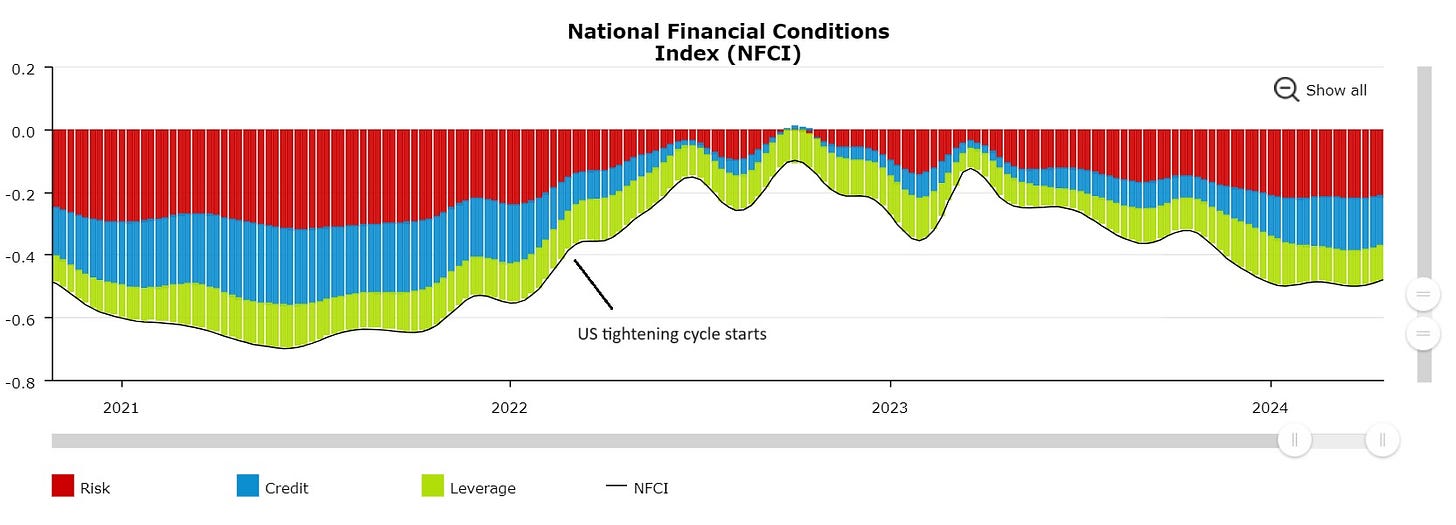

(chart via the Chicago Fed)

All that is reassuring, but there were some worrying signs, mainly in what Powell didn’t say: in March, his opening statement signaled rate cuts “at some point this year” – there was no such phrase this time. Also, in March, Powell said: “we believe that our policy rate is likely at its peak for this tightening cycle”. That was absent in Wednesday’s statement.

Also, the Fed announced a tapering of its quantitative tightening program, in which proceeds from maturing treasuries are not reinvested, effectively shrinking the size of the Fed’s balance sheet. As of June, the limit on the amount of roll-off will be more than halved, from $60 billion a month to $25 billion, a larger reduction than most had been expecting. This should lend some support to the market, in that the Fed will not be as strong a net “seller” (counting not reinvesting matured bonds as selling).

Meanwhile, however, economic data continues to send conflicting signals.

On Wednesday, we got the latest read from the ISM manufacturing activity indicator, which dropped back into contraction territory after signalling expansion last month for the first time since 2022. Even more worrying, inflationary pressures from the manufacturing sector picked up, with a much higher read on the prices index than economists had been expecting.

On Friday, we saw a similar trend in the ISM non-manufacturing data, which covers a much broader swathe of the US economy. Services activity dropped into contraction territory for the first time since December 2022, well below expectations. The prices index, however, jumped to a three-month high.

So, slowing activity with rising prices? One of my favourite moments from Powell’s press conference on Wednesday was when he said: “I’m not seeing any stag and I’m not seeing any flation.” 😂

Employment data out this week confirmed the divergent trends. The April employment data released on Friday surprised to the downside, with non-farm payroll growth of 175,000, the smallest gain in six months and notably lower than both expectations and March’s number. What’s more, the growth in average hourly earnings slowed more than expected, to 3.9% from 4.1% in March, delivering the lowest annual gain since June 2021.

(chart via Bloomberg)

Also, the number of posted position openings and the quits rate (the number of people who have voluntarily left their jobs) both dropped in March, with the latter reaching the lowest since August 2020. This suggests a weaker employment market with a lower rate of hiring, and less confidence from workers in a job that they will get better conditions elsewhere.

On the other hand, the quarterly Economic Cost Index, which measures salaries and benefits to give a broad indicator of wage inflation, came in at 1.2%, the highest jump in a year and notably higher than both the expected 1.0% and Q4’s 0.9%. And Q1 unit labor costs increased by the most on an annualized basis since the second quarter of 2022 (although this was preliminary data and could be revised downwards). Maybe wage growth is slowing, maybe it’s not.

For now, markets are happy that rate cuts seem to be back on the table, with swaps pricing in two cuts for 2024 versus one just a couple of days ago, with the first coming in September.

BTC and other risk assets have rallied, as have US treasuries.

(chart via TradingView)

But the coast is far from clear for the cuts the market is expecting. One month of weakening employment data will not be enough to convince the Fed that there is enough of a problem there to act, and inflation expectations are still signalling a worrying resistance. The Cleveland Fed’s InflationNow model points to headline CPI growth for April of 3.5%, the same as for March (which surprised to the upside for the fourth month in a row), with a soft moderation in the core index increase. We find out on May 15.

And yesterday, Federal Reserve Governor Michelle Bowman warned that inflation will likely remain elevated for “some time”, and that she is fine with hiking again if necessary.

I don’t think it will come to that – things would need to be really bad to get enough consensus to warrant such a drastic policy shift. And I do think that 1-2 cuts this year are likely. But, meanwhile, there is a lot of macro uncertainty, and the problem with the Fed’s data-dependence is the wide swings in expectations as the data continues to send contradictory messages.

Bitcoin and other crypto assets will continue to be impacted by general investor mood, as they are sensitive to liquidity expectations. But, meanwhile, other narratives continue to build support – the longer-term store-of-value story is no longer just for emerging markets struggling with currency volatility. It’s also for economies getting increasingly worried about currency dilution ahead.

Stablecoins vs sanctions

This week, I belatedly tucked into a recent article published in Brookings, written by former CFTC chair Timothy Massad. I’ve heard him speak at crypto events, and found him to be unusually thoughtful about crypto for someone so representative of traditional finance, but nevertheless, I approached the article with some reservations.

The title is “Stablecoins and national security: Learning the lessons of Eurodollars”, so I expected a screed about the need to control who has access to dollar-based tokens in order to prevent runaway growth and the potential financing of terrorism.

I was wrong: Massad does detail how the Eurodollar market grew to be so big that it could have become a threat but instead ended up extending the financial power of the United States. And he does point out that the decentralized transferability of stablecoins make them much harder to monitor let alone control. But rather than stress the risks in allowing the financing of terrorism, he focuses more on the potential disruption to sanctions.

This is especially interesting and relevant given the seeming desperation with which the US is throwing sanctions around, causing economic inconvenience but not necessarily crippling the target economies. It’s true that the thousands of sanctions applied to date have meant that Russian consumers, farmers, mechanics, entrepreneurs and others struggle to get US and EU goods; but the economy is not exactly on its knees and the war is well into its third year and tragically looks like it will continue for some time yet.

The US seems to believe that’s because it’s not wielding a big enough club: earlier this week, the Treasury department announced yet another wave of sanctions, this time with roughly 300 targets.

Only now the US is stepping up sanctions to non-US businesses for conducting trade with other non-US businesses; it feels empowered to do so even when the target jurisdictions are not exactly allies. The latest list includes dozens of actors based in or linked to China, that are accused of helping Russia acquire foreign goods. It’s a “we’ll tell you who you can do business with” vibe.

Also, Senator Elizabeth Warren has asked the Biden Administration to do something about Iran’s bitcoin mining, because that is obviously how it is getting around its sanctions barriers.

Crypto for sanctions evasion?

Back to Massad’s piece. He acknowledges for now that crypto assets are not large or liquid enough to have a meaningful impact on sanctions evasion – they may have some uses, but they do not yet function at a scale that could make a difference. But his concern is for what the world looks like when they do.

Rather than advocate for imposing strict stablecoin controls right away, he recognizes that doing so would drive users into less regulated corners of the market.

He also recognizes that there will be little the United States can do to totally stamp that out, as the relative ease with which crypto exchange platforms can be spun up means that they could appear in relatively unregulated jurisdictions to facilitate the kind of trades the US does not want to see.

Massad also points out that there are other tools available, such as multi-CBDC platforms – but these are still in experimentation phase (with China-led mBridge the most advanced), and there are plenty of technological and governance issues to be ironed out. What’s more, they don’t settle in much-desired dollars.

Sanctions are a complex topic. It can be argued that they are preferrable to military intervention, but it can also be argued that the US attitude that it rules the world is a colossal abuse of financial clout. Massad sensibly avoids opining whether sanctions are a good idea – his position is that the US really wants the necessary global heft to be able to employ effective sanctions, and it will craft regulation to help it do so. This could spell trouble for stablecoins.

For example, the Wall Street Journal reported last month that Russian weapons makers had been using tether to funnel payments to suppliers in order to meet orders. Could Tether be next on the ever-expanding sanctions list?

Could Tether be in trouble?

On the one hand, it’s possible that the Treasury department does not want to see Tether dump its more than $90 billion of US treasuries (according to the latest attestation released this week). On the other hand, the Treasury market is roughly $27 trillion, with average daily volume of almost $890 billion in March, and so could presumably withstand a Tether-sized fire sale.

Maybe Treasury sensibly realizes that if Tether disappeared, another less-regulated alternative would rise to take its place? At least Tether is generally cooperative, seizing USDT held in sanctioned addresses when possible. On Thursday, the firm announced a cooperation agreement with blockchain forensics firm Chainalysis to better identify “risky” addresses.

With the sanctions hammer getting particularly heavy-handed, and geopolitical alliances fragmenting and coalescing around new power centres, the future efficacy of sanctions is in doubt. The US dollar will continue to be the world’s reserve currency for decades yet – it’s just too deeply entrenched in the vast majority of trading channels to be replaced any time soon.

But, the more the dollar is weaponized, the more interested parties will look for alternatives. Sanctions will continue to bite for a while at least, but the day will come when they are less feared. After all, Bloomberg reported a couple of weeks ago that the Russian economy is reported to be in danger of “over-heating”, despite a constant barrage of sanctions – Tether cannot take credit for that.

HAVE A GREAT WEEKEND!

My daughter introduced me to pianist Hiromi Uehara, and if you’ve never heard cathartic jazz before, or athletic jazz, you should check this out – just listening is both exhilarating and exhausting.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

I like the jazz! I’d call it Thrash Jazz, after Thrash Metal.