WEEKLY, Nov 4, 2023

Signs of institutional activity in crypto markets, a powerful dissent, some sunshine music

Hello all! What a week… Beyond the stream of important economic data, it is finally starting to feel like the crypto market is moving toward the closure of a particularly bleak chapter.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some cool non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! You’ll get a daily update as to the crypto and macro trends that I feel are being overlooked, along with some market commentary. There are also charts, links to interesting podcast episodes and long reads, and a running commentary on some of the craziness out there. It’s only $8/month for now, and it would allow me to continue to explore the impact the crypto ecosystem will have on the global economy –this intersection matters, now more than ever.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood. Also, if you love short daily podcasts, I’m now host of the CoinDesk Market Daily, where I give a brief rundown of crypto and macro markets.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Some of the topics discussed this week:

What crypto merging with finance could look like

A CBDC alternative to SWIFT?

Stocks and BTC: not great, but maybe not such a threat

Tokenized gold – more than just another asset

Inflation expectations

Triple-guessing the Fed

Signs the institutions are coming back into the crypto market

Bitcoin continues to bounce around $34,000 with a slight upward bias, despite grey clouds on the economic horizon and jitters in the stock market.

Clues are emerging as to the source of the crypto market support.

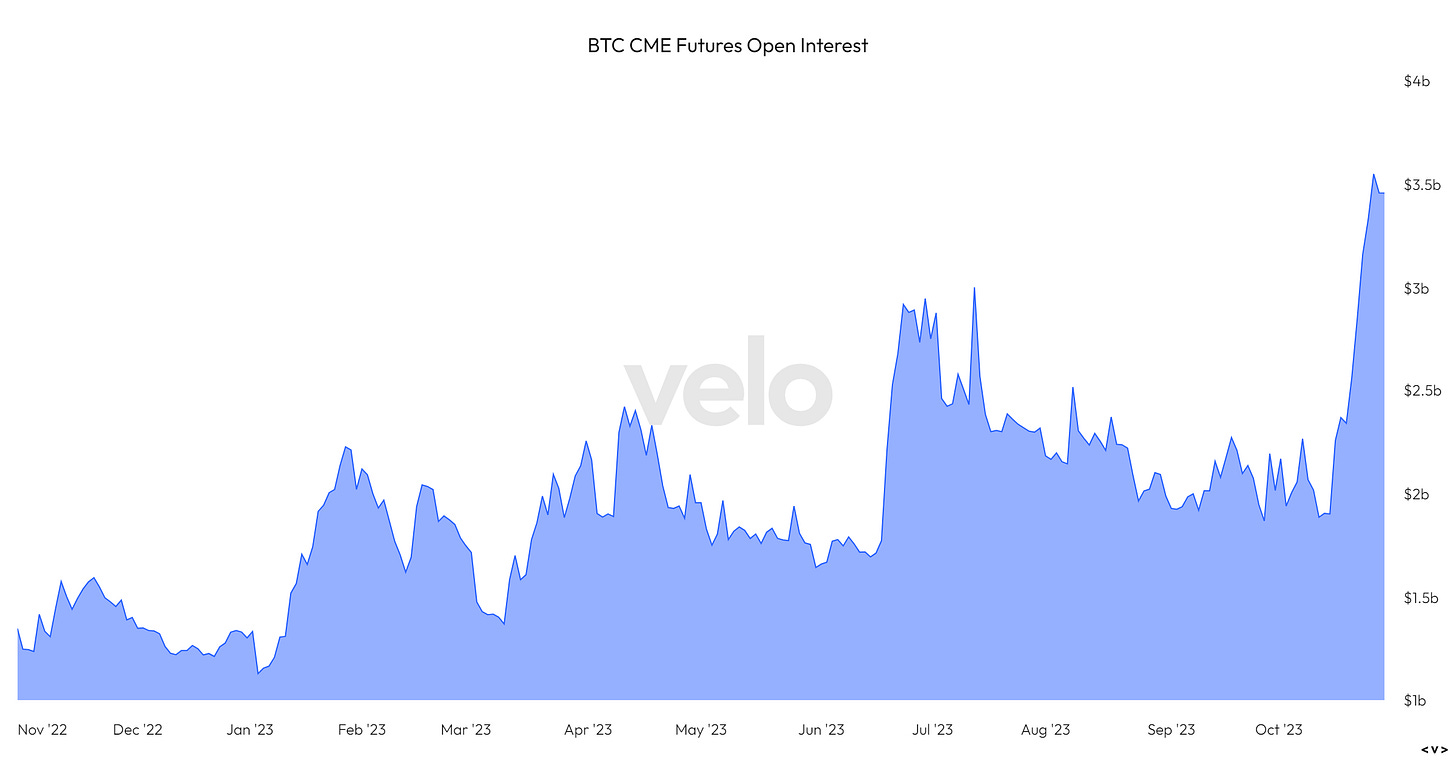

One is the recent surge to record levels in BTC futures open interest on the CME, the preferred crypto derivatives exchange for US-based institutions.

(chart via velodata.app)

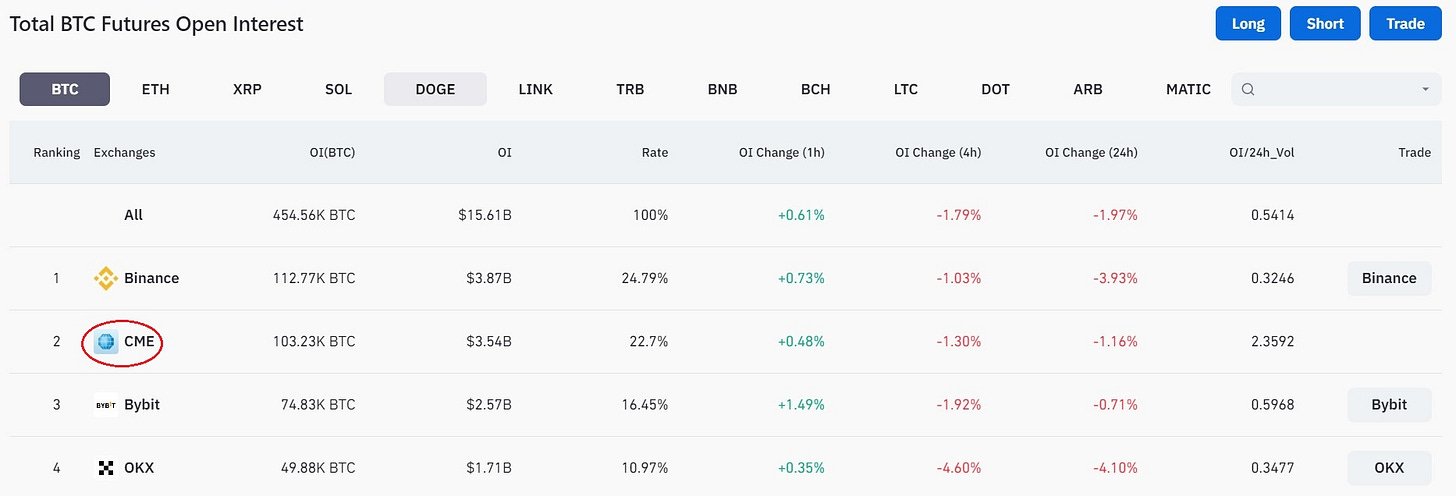

The surge has not been replicated on other platforms – open interest on Binance, for instance, has grown but not nearly to the same extent.

(chart via coinglass)

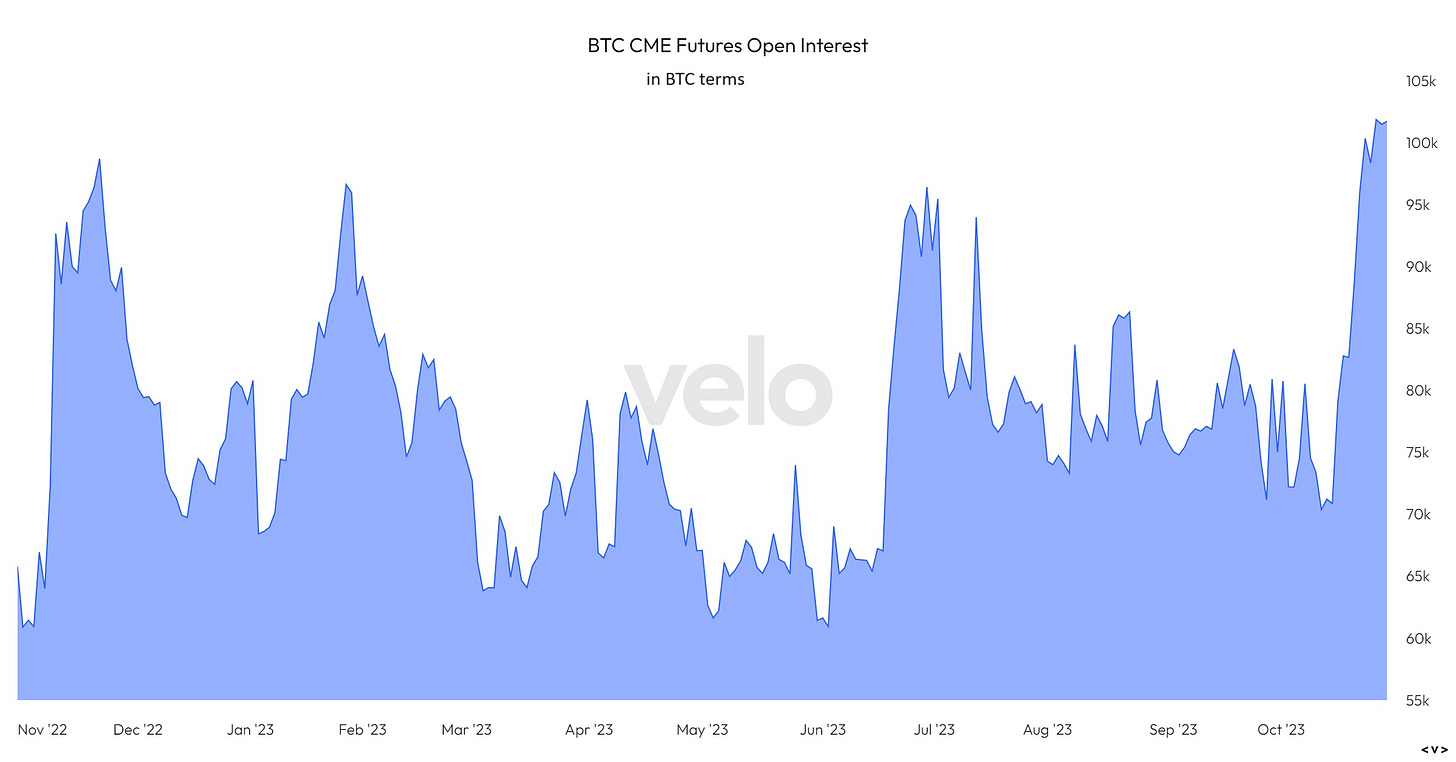

And in BTC terms (rather than USD terms), Binance futures OI has remained largely flat over the past couple of months, while that for the CME has shot up.

(chart via velodata.app)

This move has positioned the CME as the second largest BTC futures platform in terms of open interest. Normally, it’s maybe in fifth place, fourth if there’s interest brewing.

(chart via coinglass)

So, it looks like the institutions are coming into the market.

This is also evident by the growth in the number of on-chain transactions with value of at least $100,000 (this is not necessarily all institutions, it could be wealthy individuals). According to data from IntoTheBlock, this rose to a year-to-date high last week.

(chart by IntoTheBlock via CoinDesk)

And finally, the latest weekly funds report by CoinShares shows the strongest inflow into listed crypto vehicles in well over a year.

(chart by CoinShares)

Almost $340 million dollars was invested in listed crypto funds last week, with around 87% going into long bitcoin holdings, 7% into Solana and 4% into short bitcoin funds. Only two types of funds saw outflows – ether and multiasset – and the amounts were small.

(table by CoinShares)

With an uptick in institutional interest, we should start to see an improvement in market liquidity, which should encourage others to step in. The relative lack of liquidity is the main barrier to strong inflows for now, as it raises the risk of slippage coming in and the ability to exit if necessary. What would it take to improve liquidity? Signs of institutional investors coming back in. It’s circular, but it’s starting.

A powerful dissent

One day, there might be a reckoning as to the damage the US Securities and Exchange Commission has done to the spirit of innovation that made the US securities market the largest in the world. Probably not, though.

Nevertheless, we should appreciate that SEC commissioners are allowed to talk in public about their disagreements with agency decisions.

On Friday, SEC Commissioner Hester Peirce published her dissent to the case the agency brought against LBRY, a decentralized file-sharing and payment network launched in 2016 to give creators greater control of the distribution of their work. Commissioner Peirce is known to be insightful and eloquent, even by those that don’t agree with her views on crypto regulation. Her latest dissent is a particularly powerful example of her conviction and clarity of expression, and will hopefully go a long way toward helping other jurisdictions craft more supportive regimes.

Here are some choice excerpts:

“Are investors and the market really better off now after the Commission’s litigation contributed to the demise of a company that had built a functioning blockchain with a real-world application running on top of it? This case illustrates the arbitrariness and real-life consequences of the Commission’s misguided enforcement-driven approach to crypto." (My emphasis.)

“Why go after a company that sold a token for a functioning blockchain with an established use when we could have pursued plenty of other projects that were outright frauds and did not attempt to comply with the securities laws?”

“The time and resources we expended on this case could have been devoted to building a workable regulatory framework that companies like LBRY could have followed. Then the market could have decided LBRY’s fate.”

“Our disproportionate reaction in this case will dissuade people from experimenting with blockchain technology, which LBRY aptly describes as “technology that enables dissent.” A government of a free people should welcome dissent and the technologies that enable it.” (My emphasis.)

It can be argued that the SEC is not against dissent, it is against fraudulent securities issuance. And fair, we can all get behind protecting investors from fraud by designing dissuading incentives. But no-one accused LBRY of fraud. LBRY was regarded in the industry as one of the projects that really tried to “do things right” by disclosing everything they could think of.

While frustration over the SEC’s heavy-handed and wasteful approach mounts, it is worth appreciating that the US allows representatives to publicly disagree with their agencies – that is not the case everywhere. And we can also appreciate the opportunity Commissioner Peirce’s dissent presents.

Her difference of opinion with her agency is, as usual, a well-worded support for reasonable and constructive innovation. But it’s also more than that – it is a call to arms for the entire ecosystem. It’s worth asking just what the SEC is so afraid of.

HAVE A GREAT WEEKEND!

Back to my series of music links 😊, this week three “old-style” latin songs I love, perfect for bringing a ray of sunshine into a rainy and blustery day:

Si Tú Me Dices Ven – Los Panchos. From their first album in the 1940s up to their most recent one just a few years ago, the popularity of Los Panchos rapidly spread from their original base in Mexico to make them one of the most influential Latin American groups of all time. Very hard to not sing along to this one.

Melao de Caña – Celia Cruz. When people think “Cuban music”, they often tend to think of Celia Cruz, born in Havana and in the 1950s one of the most successful Cuban artists of her time. After the revolution, she moved to Mexico and then the US, but even to this day, is credited with extending the popularity of Cuban music around the world.

Tus Ojitos – Natalia LaFourcade. The most “modern” of the trio, Mexico-born Natalia LaFourcade has been singing professionally since 2002, but her work has a wistful folk style reminiscent of the acoustic charm of the previous century.