WEEKLY, Nov 5, 2022

Hi everyone! You’re reading the weekly Crypto is Macro Now newsletter, where I look at the crypto market and its growing overlap with the macro landscape. I’m Noelle, and I’ve been writing crypto-focused newsletters for over six years now, first for CoinDesk and more recently for Genesis Trading. Now that I’m concentrating on independent research (the theme is in the title), it felt natural to continue. If you find this useful, please consider sharing with friends and colleagues.

If you’d like to receive a premium daily email with more detailed market and news commentary and are not already a subscriber, you can subscribe here:

Some of the topics covered in the daily email this week:

US vs UK central bank messaging

What’s up with market volatility?

Traditional markets testing blockchain settlement and DeFi exchange

More companies launch crypto integrations and services

What might future payments look like?

MARKETS

The message driven home in Chair Powell’s statement and press conference couldn’t be clearer: there is a “ways to go” (he said those words at least five times) on rate hikes, and yet the stock market still seems to be in denial about the path ahead for rates as well as earnings.

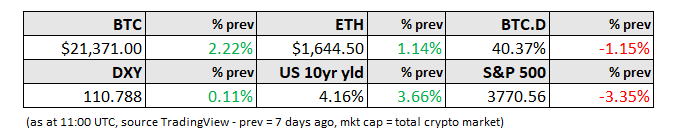

The S&P 500 was down 3.4% on the week, in spite of a still-strong jobs environment, a 10-year yield hovering around 4.15% and a 2 year-10 year yield curve at its most inverted on a daily close since 1981.

(chart via The Federal Reserve of St. Louis)

BTC and ETH, however, are finally bucking the stock market trend and trending up – at time of writing, they are comfortably above $21,000 and $6,400 respectively. Volatility remains muted, while spot volumes are recovering toward their mid-September levels.

(chart via The Block Data)

(Keeping this short for the word count - for more detailed market insight on a daily basis, consider subscribing to the premium Crypto is Macro Now email.)

ESSAY

The Crypto Revolution’s Turning Point

If you haven’t read “Technological Revolutions and Financial Capital” (2002) by Carlota Perez, I thoroughly recommend it. It’s a boring title for a mind-blowing book with beautiful language that is almost guaranteed to trigger a sequence of “a-ha!” moments, whatever industry you happen to be working in.

Her main thesis is that major technological shifts follow a pattern that takes them from creation through to obsolescence, launching “golden ages” of progress and prosperity along the rather bumpy way. She divides the sequence into five sections:

The Irruption Phase begins with an initial surge of interest in the new, shiny thing against a backdrop of stagnation and turmoil.

In the Frenzy Phase, speculation starts to dominate the headlines as financial capital takes over while use case exploration intensifies.

The Turning Point tends to come as the bubble of the Frenzy Phase bursts, leading to a recession, and is usually characterized by greater involvement from regulators as well as other sectors of society.

The Synergy Phase kicks off the “deployment period” which leverages the investment of the Frenzy and the infrastructure progress of the Turning Point into an expansion of economies of scale with financial capital more directly tied to production.

The Maturity Phase is the twilight of the curve as the limitations of the new technology start to generate friction, eventually leading to stagnation and turmoil.

The crypto industry is clearly at the Turning Point in the above framework. It’s not just the recent bursting of the Frenzy Phase that makes this obvious – it’s also the headlines that cross our screens every day, with their emphasis on regulatory exploration, infrastructure build and new ecosystem participants. Some could try to argue that 2018 was the Turning Point, but the technology was still too immature back then, the global acceptance still too thin and the bear market too “dry” in terms of meaningful development. The entrance of institutional and other types of investors in 2021 and the rapid growth of high-yield crypto products triggered a level of speculation much more widespread than the ICO craze of 2017, masking significant progress on crypto deployment which in the Turning Point is taking on a heightened protagonism.

Some of Carlota’s observations about the Turning Point seem eerily prescient (all quotes from the aforementioned book):

“The Turning Point has to do with the balance between individual and social interests within capitalism. It is the swing of the pendulum from the extreme individualism of Frenzy to giving greater attention to collective well-being.”

“This switch does not occur for ideological or voluntaristic reasons but as the result of the way in which the installation of a new paradigm takes place.”

“The Turning Point… is a crucial crossroads, usually a serious recession, involving a recomposition of the whole system, in particular of the regulatory context that enables the resumption of growth and the full fructification of the technological revolution.”

“The Turning Point then is a space for social rethinking and reconsidering.”

It’s important to note that Carlota is not attempting to predict the future. She is condensing the experience of five previous technological revolutions going back to the 1700s (factory production, steam/railway, steel/electricity, oil/cars/mass production, and telecommunication) into recognizable patterns. And yet she could just as easily be talking about the evolution of the crypto industry to date, even though it did not exist at time of publication. If the pattern she describes holds, the stage we are in now is about to unleash a wave of adoption and acceptance that will shape what could be another “golden age” of prosperity – such as those birthed by previous waves of innovation – which includes not just greater efficiencies and access but also a new and more stable social structure.

It’s not hard to see a parallel to what Ray Dalio has been saying for some time: that we are near a fundamental paradigm shift as our societal systems become unstable, crumble, and leave room for a new framework to emerge phoenix-like from the ashes.

According to Carlota’s research, the Turning Point lasts anywhere between a few months and a few years, so we could have a way to go yet before the “deployment period” kicks off. But the tone and pace of recent progress suggests that the transition is underway.

The Turning Point initiates a shift from “financial capital”, which prioritizes short-term gain, to “production capital” which focuses more on development. In crypto, production capital has been plugging away all along. But its prominence has recently changed. Rather than celebrations of record prices and AUM growth, headlines these days are more focused on technological leaps forward as much of the recent behind-the-scenes work is brought to light, setting the stage for a new phase of growth.

Ethereum’s Merge is perhaps the most high-profile example. The flurry of projects building on the Lightning Network is another. There’s also progress on cross-chain interoperability, milestones reached by zero-knowledge rollup scaling technology, the launch of new layer-1 blockchains, funding for new types of custody solutions, known financial names launching crypto solutions, legacy banks and investment funds kicking the tires on blockchain-based security issuance, and much more.

Another key feature of Turning Points is the design of regulatory frameworks that have been conspicuously absent during the first two initial phases. We are certainly seeing this now, with the arduous progress of the EU’s set of crypto rules (known as MiCA) and the response of many official US agencies to President Biden’s Executive Order mandating a comprehensive approach to digital asset regulation. There’s also the global focus on stablecoins and many local initiatives regarding crypto asset trading, as well as the recognition that international coordination would make illicit transactions easier to block.

So, why is all this important? Apart from the reassurance that the current turmoil is merely a painful phase on the path to better times,

Because it gives us reassurance that the current turmoil is merely a painful phase on the path to better times. We tend to misunderstand the meaning of the word “revolution” – taken literally, it means the coverage of a full cycle, a return to origin in order to begin anew. While the cycles outlined do not “return to origin”, they do follow a pattern that sketches out the likely evolution of the new technologies we grapple with today. And in so doing, they give our current macro and crypto turmoil a refreshing perspective. Things may look bleak at the moment and many will suffer, which is never good. But the historical context colours the pervasive uncertainty with the comforting rhythm of history.

The patterns described also help us to see the significance of the recent shift in the ecosystem’s expectations. While we may lament the loss of our recent heyday with abundant profits and creative overreach, we can feel reassured that what we are going through is a necessary phase to weed out the hype and focus on real-world impact. We’ve been here before, and through the lens of history, it turned out well.

However, Carlota’s book includes a description of the Turning Point that could be taken as a warning:

“It can establish institutions for increasing social cohesiveness, improving income distribution and general well-being or it can try to reinstate the ‘selfish prosperity’ of the frenzy phase, though more closely connected with real production and finding some means to expand demand.”

We seem to be on the path to the former scenario. The damage done by the collapse of the Terra ecosystem, the Three Arrows hedge fund and some crypto lenders left deep scars which, combined with intensifying regulatory scrutiny as well as self-governance, will no doubt influence risk attitudes for at least a while. Take into account the tone of crypto headlines of late with their heavy emphasis on infrastructure, governance and partnerships, and a picture emerges of an industry with strong conviction, broadening acceptance and the growing involvement of different sections of society.

The Synergy Phase with its optimistic promise may be some ways ahead still. But we are heading toward it.

KEEP AN EYE ON:

(Three main themes from the week, explored in more detail in the daily emails.)

Earnings season is confirming what we already know about the crypto market, that trading volumes across the board are down. But comparing the available data reveals some pockets of resilience:

Coinbase revealed a 27% drop in Q3 trading volume vs Q2 and a 51% drop year-on-year, due to lower global volumes overall but also to a shift out of the US, according to the company (even though Coinbase is available in over 100 countries): the Q3 shareholder letter points out that global crypto spot market volume for the month of September was 18% lower than that for January, while US volume was 50% lower. Coinbase believes that this is largely due to regulatory uncertainty.

Block, on the other hand, suffered comparatively little from a volume decline, with bitcoin revenue only 3% down vs Q2 ’22 and 1% down vs Q3 ‘21. It’s possible that this is related to the outperformance of BTC vs the crypto market as a whole as investors rotated into the relative “safety” of the largest and least volatile non-stablecoin crypto asset, and suggests that bitcoin investors are more resilient than those that focus on altcoins.

Robinhood’s Q3 results revealed a 12% drop in crypto revenue vs Q2, notably less than that of Coinbase. Given that Robinhood is predominantly a retail platform, this suggests that retail investors were more resilient than their professional counterparts, possibly preventing an even sharper drop in Coinbase users. If Coinbase’s calculation that US crypto spot market trading volumes have dropped by half since the beginning of the year, then it could be that Robinhood picked up some retail market share.

Traditional markets testing the crypto waters. The potential impact of crypto markets on global finance continues to take shape with key institutions deepening their exploration of how decentralized finance technologies can improve current processes.

The Bank of International Settlements unveiled Project Mariana, an effort between the Bank’s Innovation Hub and the central banks of France, Singapore and Switzerland. The aim is to explore the use of automated market makers for the cross-border exchange of CBDCs as part of the G20 push for more efficient global payments.

Project Guardian, a project launched this summer by the Monetary Authority of Singapore (MAS) with participation from JPMorgan, Singapore’s leading consumer bank DBS, Japan’s SBI Digital and the Singapore exchange’s digital asset platform Marketnode, performed a live test earlier this week of the trading of tokenized assets across liquidity pools.

The MAS announced two new pilot projects involving blockchain-based assets, one led by Standard Chartered to explore the use of tokens in trade finance, and another with HSBC to look at the tokenization of wealth management products.

UBS issued a CHF 375 million ($370 million), three-year 2.33% bond that will be traded on SIX Digital’s blockchain platform SDX as well as on the SIX Swiss Exchange. The bond will settle on the blockchain platform, but clients can use the traditional agent via an operational link.

This is reminiscent of a period a few years ago when pilots and proofs of concept by big enterprise names were emerging with astonishing frequency. Most went nowhere, but we can hope that the learnings from that period will inform the experimentation going on today. And the need for greater fluidity and transparency in global flows is arguably much greater today than it was back then, given the strains on international commerce and the growing concerns around market plumbing fragility.

Funding drought. According to a report by JPMorgan, venture capital funding for crypto companies is running at the equivalent of about $10 billion a year, less than a third of the pace seen in 2021. The amount invested by VC funds in crypto operations hit $4.4 billion, barely above the level of Q1 ’21. Deals are happening, but they tend to be small and not as frequent. This segues nicely into the next section…

(chart via Bloomberg)

A YEAR AGO:

(This section looks back at what was going on this time last year, so we can see how far we’ve come and how far we haven’t.)

We saw above that crypto funding in Q3 ‘22 was drastically lower than in Q3 ‘21. This is painfully obvious on a more granular level, comparing this week to the same period a year ago, which saw several fundings of $100 million or more:

Blockchain infrastructure provider Alchemy raised $250 million in a round led by a16z

Blockchain gaming startup Mythical Games raised $150 million in a round led by a16z (this week The Block reported that the company had laid off 10% of its staff the day after the departure of three top executives)

African remittance company Chipper Cash raised $150 million in a round led by FTX

NFT gaming firm The Sandbox raised $93 million in round led by SoftBank

Layer-1 blockchain Avalanche launched a $220 million investment fund

Investing firm Sfermion closed a $100 million metaverse fund

Solana Ventures, FTX, and Lightspeed Venture Partners launched a $100 million blockchain gaming fund

The Tron Foundation and NFT marketplace APENFT launched a $100 million fund for NFT projects

Blockchain gaming company Enjin unveiled a $100 million metaverse fund

The number of ~$100 million funding rounds this past week? Zero. The highest I could find was interoperability protocol Evmos at $27 million. Also note that of the nine examples cited above, all but three were related to gaming, NFTs and the metaverse. This past week, I couldn’t find any.

GOOD READS/LISTENS

Podcast: What Bitcoin Did – I’m giving Peter McCormack lots of love this week, with two of my four top listens coming from his stable. What can I say, I’m loving the philosophical angle he’s taking these days. One must-listen is the interview with Andrew Bailey on the philosophy of money – obviously, they go into so much more besides, but a worthwhile takeaway is how important it is to understand the role that culture plays in our reactions to new ideas.

Another is the talk with Nic Carter and Lane Rettig, which takes a deep look at how the Ethereum post-Merge narrative impacts Bitcoin.

Podcast: Forward Guidance – Blockworks’ Jack Farley talks to Jim Bianco and Joseph Wang about the Federal Reserve’s options and limitations, and how its plumbing might impact its policy.

Podcast: Bankless – Ryan Sean Adams and David Hoffman moderate a debate between Erik Voorhees and Sam Bankman-Fried on the state of and outlook for crypto regulation. One of the most compelling debates I’ve heard.

New Yorker: Was Jack Welch the Greatest CEO of His Day – or the Worst? Not crypto-related, but a rollicking good read.

Twitter: @Punk6259 – A sobering thread that serves as a reminder that, while a crypto ban is very unlikely, we should never take our eye off of what regulators are doing.

Have a Good Weekend!

Come for the Bored Ape, stay for the animation. And the tune is good, too. Last Friday, BAYC #9797, aka “Jimbo”, released his (its?) latest music video with cameos from a host of other Bored Apes and some compelling visual scene-setting. This one was so much more entertaining than Jimbo’s previous effort, released in December 2021, which was flat visually and way too self-referential to be interesting (which could make me sound like a boomer, I guess…). This one I really liked.

Beyond the poses and the flashiness, it does say a lot about the cultural experimentation that does not seem to care about BAYC prices (down, no surprise). This is not the first music released by a non-human – anyone here old enough to remember The Archies?

But the difference is in the ownership structure. Jimbo’s owner did not create him, and yet is profiting from his image while adding a considerable amount of additional and original creativity. That this video is released at a time when the NFT industry is re-examining royalties and revenue structures feels somehow relevant.