WEEKLY, Oct 14, 2023

why bitcoin is behaving strangely

Hi everyone! I hope you and your loved ones are well.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them (although today’s are updated with some new parts), so feel free to scroll all the way down for some cool non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! You’ll get a daily update as to the crypto and macro trends that I feel are being overlooked, along with some market commentary. It’s only $8/month for now, and it would allow me to continue to explore the impact the crypto ecosystem will have on the global economy – I really feel this intersection matters, now more than ever.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood. Also, if you love short daily podcasts, I’m now host of the CoinDesk Market Daily, where I give a brief rundown of crypto and macro markets.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Some of the topics discussed this week:

Last weekend’s attacks and the potential impact on markets

Markets are blinkered

Grayscale did the industry a service

A market overreaction

A stablecoin bust

The missed opportunity in tokenized collateral

The shift in Fed messaging

The shift in tone from the US Federal Reserve is getting louder.

On Monday, Dallas Fed president Lorie Logan and Fed Vice Chair Philip Jefferson both suggested that the climb in long-term treasury yields relieved some pressure on the Fed to tighten more. On Tuesday, we heard from Minneapolis Fed President Neel Kashkari who pretty much said the same thing. So did San Francisco Fed President Mary Daly. On Wednesday, Fed Governor Christopher Waller on Wednesday added his voice to the chorus. Atlanta Fed President Raphael Bostic went even further and said the quiet part out loud:

"I actually don't think we need to increase rates anymore."

In reaction, treasury yields dopped in the first half of the week, with the 10-year more than unwinding all of October’s increase. That was interrupted by Thursday’s misunderstood inflation read, but by Friday, the same mood of relief had returned, and yields were again heading down.

(chart via TradingView)

I don’t think this shift in tone is a coincidence. It feels coordinated. It’s not that Fed officials don’t speak their mind - of course they do, their academic reputations are on the line. But they do talk to each other, and that influences opinions to a certain extent, especially in a field as vague and “feely” as forward-looking monetary policy. And it could be that the Chair himself has said internally something along the lines of “things are getting dicey, we need to be very careful”.

What’s more, the speeches this past week would most likely have been crafted before last weekend’s attack on Israel. That changed the landscape by ratcheting up global tension even further. Markets are on edge, and the Fed would probably not want to light the match that started a global meltdown. But the shift in tone was in the works anyway.

This adds a cushion to the signal. The risk always was that, as soon as the Fed signals an indefinite pause, that longer-term rates will come down, adjusting for lower rates expectations. This is happening, and could upend the belief (hope?) that higher rates don’t need more hawkish Fed messaging to tighten conditions enough to bring inflation down. But there are other forces likely to keep rates high.

Despite the scaling back of Fed rhetoric, the bond market is uneasy. Last week’s 30-year auction was notably weak, with big banks - who are required to buy any bonds left over - forced to take more than 18% of the issuance. Typically, they only mop up at most 11%. The week’s 3- and 10-year auctions were also met with less demand than expected, all of which will keep upward pressure on yields as buyers demand more return.

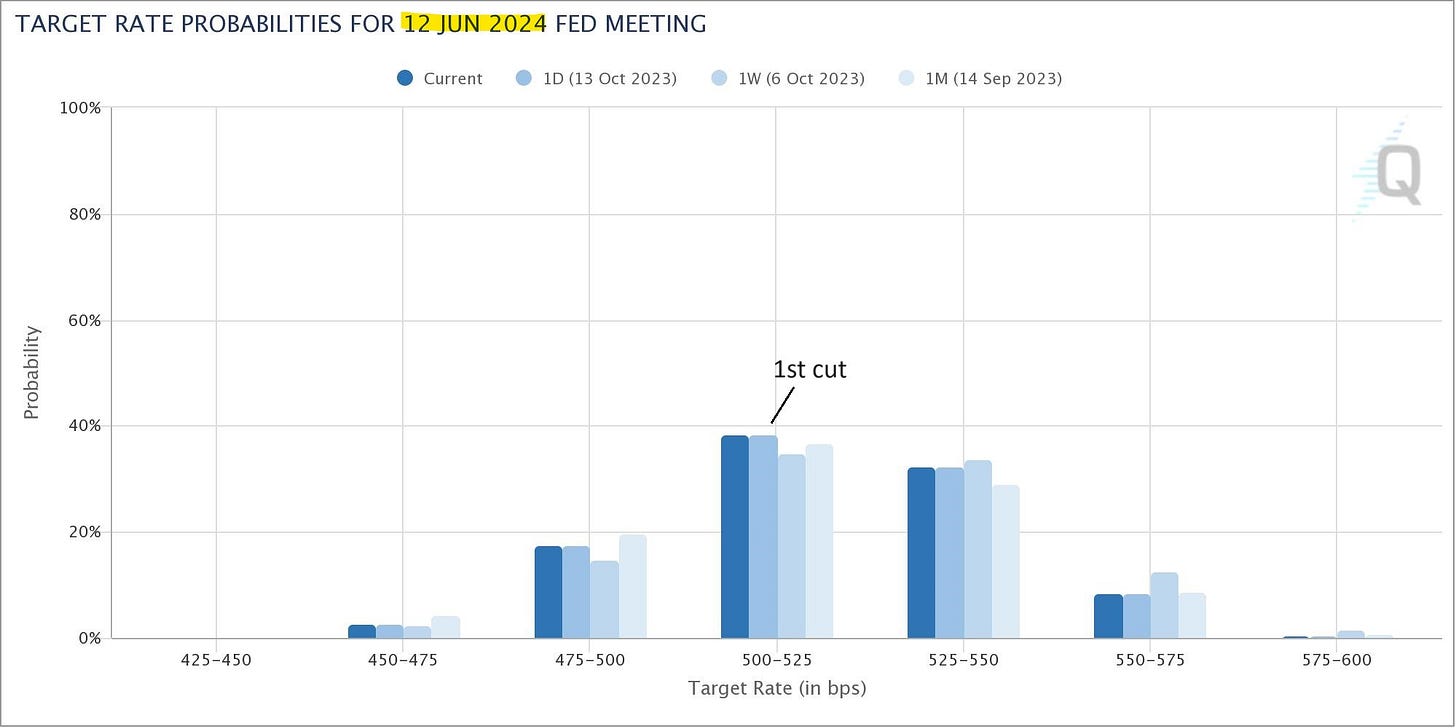

This continued upward pressure will add further strain to global financial markets, but it will reinforce the Fed’s new messaging that rate hikes can pause indefinitely. The market is taking this on board, and CME futures are now pricing in no more hikes, and cuts starting next June.

(chart via CME FedWatch)

Crypto should benefit

This is a good set-up for a climb in crypto prices.

Bitcoin, in particular, is especially sensitive to rate expectations. US rates are one of the main drivers of global liquidity. As such, they are the key macro variable for crypto investors. Bitcoin is not sensitive to wage pressures or climbing input costs. Nor is it impacted by weakening consumer demand or global trade. It has no revenue, it has no earnings, it is only driven by sentiment which is heavily impacted by liquidity expectations, which in turn are largely driven by interest rates.

So, with softening expectations of US rates, bitcoin should be catching a tailwind here.

But it’s not:

(chart via TradingView)

There are other factors that in theory should be supporting bitcoin here.

One is the increasing likelihood that the market will get its first US-listed spot BTC ETF within the next few months. Yesterday was the deadline for the SEC to appeal the ruling in the Grayscale suit, in which the judges called the agency’s denial of the Grayscale request to convert its GBTC trust into an ETF “arbitrary and capricious”. As far as I know, the SEC did not appeal, which means it now has to reconsider its ruling. It could deny again, for different reasons - but the agency is reportedly engaging with other potential issuers, which is unusual. It is starting to feel like it is getting ready to let them list.

Another is technological progress.

It’s possible that soon we will be able to build smart contracts on Bitcoin. A paper was published this week that outlines “BitVM”, a way to enable more complex functionality on the Bitcoin network without requiring a change to the underlying code. Computations would be performed off-chain and then verified on-chain, similar to the mechanics of optimistic rollups on Ethereum.

A third is, unfortunately, the geopolitical situation. Paul Tudor Jones said earlier this week that he’s never seen it this bad (and he's been doing this for a long time). Gold is finally starting to act like a safe haven, and there's no reason why bitcoin shouldn't also. Bitcoin is a provably hard cap asset in an environment when the supply stability of most stores of value is in question (currencies, bonds, even gold). Bitcoin is a seizure-resistant reserve asset in a time when reserves could become vulnerable. Bitcoin is more portable and easier to spend than gold.

(chart via TradingView)

Yet bitcoin remains under continued pressure. It could be fears of another regulatory action that would add further chill to the crypto market in the US. It could be a large seller in the market that I haven’t yet heard about. Given the building tailwinds, the lacklustre performance is strange.

SOME NON-CRYPTO, NON-FINANCIAL STUFF

In this section, I like to take a break from thinking about markets or political dysfunction or outright conflict. I usually title it “Have a Great Weekend”, as weekends in theory are for reconnecting with what makes life worth living. That exhortation doesn’t feel appropriate when so many are going to have an awful weekend - war doesn’t take mental health breaks.

The links I share here are usually either photography or music, two universal stimulants that remind us of how beautiful life can be.

Since this week was Hispanic Day where I live, where we celebrate being Spanish (with a surprisingly moving military parade), today I’m going to share some songs by Joaquín Sabina. His work came to represent the heart of iconic Madrid culture, focusing on love and betrayal and hope and a good bar on every corner. A bit like Bruce Springsteen but even more poetic.

My nephews tell me that one cannot like songs by Joaquín Sabina and be cool, but I’m actually fine with that. His lyrics have powerful words and memorable tunes that I come back to time and time again.

So, here are three of my favourites, with a sample of their lyrics, roughly translated.

19 días y 500 noches

“Our relationship lasted as long as two ice cubes in a whisky on the rocks.”

“She said hello and goodbye. And the slam of the door sounded like a question mark.”

Y nos dieron las 10

“I wanted to sleep with you and you didn’t want to sleep alone.”

“Summer ended. Autumn lasted as long as winter took to arrive.”

Noches de boda

“May being brave not end up so expensive. May being a coward not be worth it.”

“May no-one sell you love without thorns. May no-one lull you to sleep with fairy tales.”

Dare to be square. ;-)