WEEKLY, Oct 28, 2023

we've been here before, only not really; watch the hodlers

Hello all! I hope you’re doing ok – the news flow feel particularly draining these days.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them (although today’s are updated with some new parts), so feel free to scroll all the way down for some cool non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! You’ll get a daily update as to the crypto and macro trends that I feel are being overlooked, along with some market commentary. There are also charts, links to interesting podcast episodes and long reads, and a running commentary on some of the craziness out there. It’s only $8/month for now, and it would allow me to continue to explore the impact the crypto ecosystem will have on the global economy –this intersection matters, now more than ever.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood. Also, if you love short daily podcasts, I’m now host of the CoinDesk Market Daily, where I give a brief rundown of crypto and macro markets.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Some of the topics discussed this week:

Risk vs volatility

A stark choice in Argentina, and what it means for BTC

Chinese liquidity and crypto

Crypto on the move

How the US GDP data could impact crypto markets

Those GDP numbers: good news or bad?

BTC at $34,000: A different river

For now, BTC seems to be holding at around $34,000, and while I have no idea whether it goes up or down from here, it’s relevant to compare these waters to the last time we were here.

By “here”, I mean around $34,000 and heading up (BTC was also at these levels last May, but comparing now to the panic surrounding the collapse of the Terra/Luna ecosystem is not particularly useful).

So, the last “here” was in July 2021.

There are a couple of variables that are more or less the same as two-and-a-quarter years ago.

The total crypto market cap is eerily similar. So is the level of the S&P 500.

But the differences are more intriguing:

Look at the relative level of US 10-year treasury yields. Back in July 2021, these were at 1.2%! From that level, given what was going on with the stimulus, the most likely direction was up. And yet BTC doubled over the next few months.

Another significant difference is the relative level of ETH which, unlike BTC, is still lower than its July 2021 level. This could mean that ETH has some catching up to do. Or, more likely in my opinion, it could highlight the divergence in short-term narratives between the two leading crypto assets. BTC has the ETF and safe haven narratives as tailwinds. ETH has regulatory chill and upgrade uncertainty as headwinds. For now.

This partially explains the relative difference in bitcoin’s dominance, measured by the BTC.D index. It’s notably higher now, which suggests that this cycle is younger now than it was in July 2021. Bitcoin tends to lead crypto markets in the early part of a cycle, only losing dominance when investors get more comfortable moving out on the risk curve and smaller tokens overtake in performance.

Conclusion: Comparing BTC at $34,000 now to BTC at $34,000 in the previous run-up, it looks like the asset will run even further this time. In other words, the previous high will be easily exceeded. We have the relative stage in the cycle, judging by the dominance index. We have a different rates outlook – the direction from here is more likely down than up, in 2021 it was the reverse.

And I would argue that the potential market now is greater than in 2021. Back then, the interest was coming mainly from institutional investors willing to overlook the bad-for-the-environment narrative in exchange for outsized returns. Now, the pool of institutions that understand crypto markets has grown (many even have in-house crypto analysts! that was not common at all in 2021) and has extended beyond those seeking high return. Now, the environmental concerns have been largely debunked (although someone still needs to tell the UN), removing a public opinion barrier. And the safe haven narrative is stronger than ever, thanks (unfortunately) to world events and to the public validation from well-known investors such as Paul Tudor Jones and Larry Fink.

This is a very back-of-envelope analysis, obviously, and should not be taken too seriously. And, of course, history does not repeat. I do believe it rhymes, however, and while the world has certainly changed over the past two years, markets do like patterns.

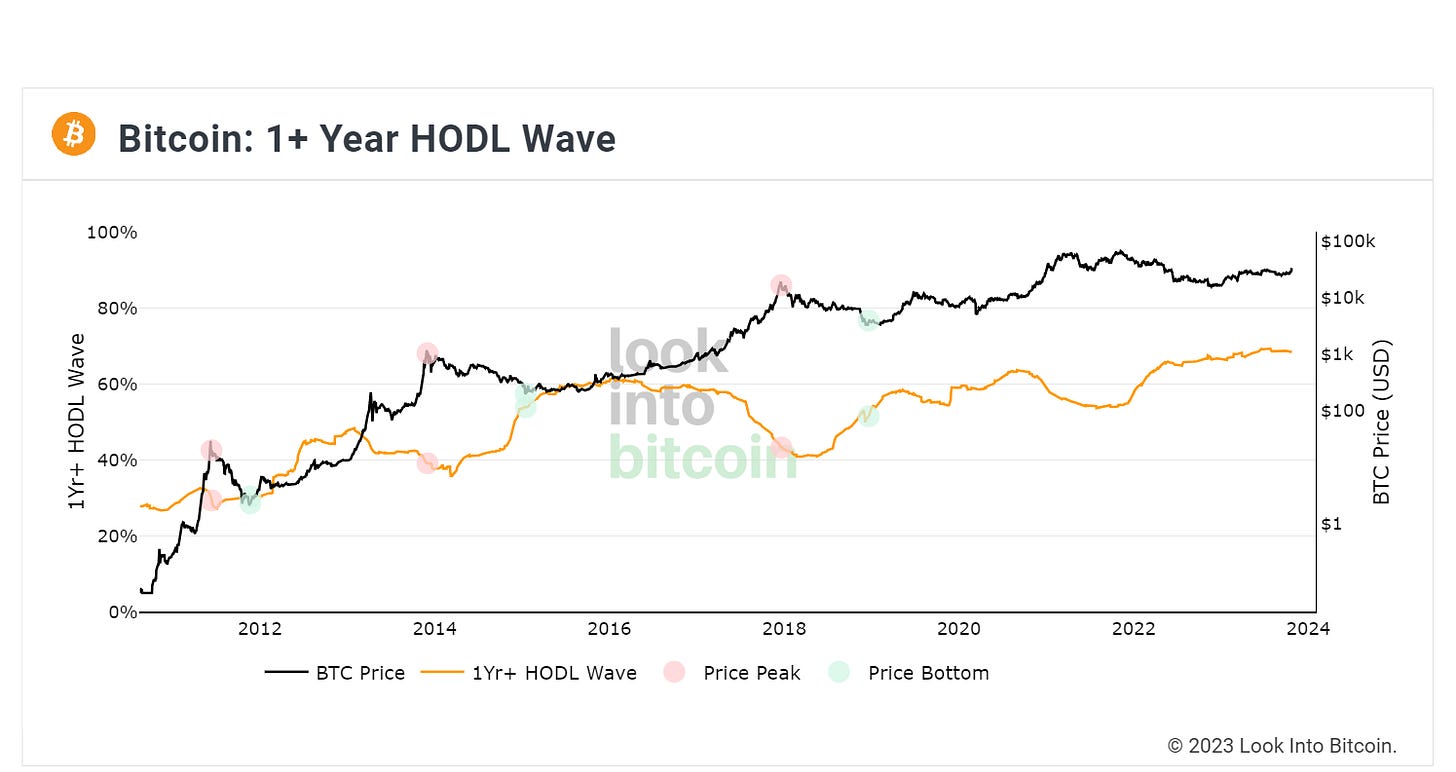

Keep an eye on the long-term holders

It’s been a while since I looked at the holding (hodling!) behaviour for BTC. One of the many fascinating aspects of crypto assets is the ability to track the movements of assets going back to when they were created. On-chain analysis also gives us insight into the behaviour of individual addresses – what the holder of that address has bought, at what price, what they did with it after.

I’m generally skeptical of reports that show tokens moving on and off exchanges, because exchange labelling is not an exact science, and tokens that look like they’re moving off an exchange may just be going to another previously unidentified exchange address. Plus, after the trauma of last year, many investors are now aware of the importance of custody resilience, either through self-custody or at least through distributing tokens among several service providers. So, focusing on token movements is also potentially misleading – a holder could be transferring tokens from one custody solution to another, and on-chain that can look like a sale.

But I do like to keep an eye on the average age of holdings. More specifically, the amount of BTC that hasn’t moved in a specified time period. I focus on the percentage of BTC that has not moved in over a year, and also a longer time period, usually three or five years.

The percentage of BTC that has not moved in over a year is at 68%, close to the all-time high of 69% reached three months ago.

(chart via lookintobitcoin.com)

Part of this could belong to investors who are waiting to get back into profit in order to sell, so it wouldn’t be surprising to see this come down as prices rise.

A more interesting data point is the percentage of BTC that hasn’t moved in over three years, even though any one of those holders could have sold at a profit at any time in 2023. This is now at an all-time high of 41%.

(chart via lookintobitcoin.com)

These are real long-term holders. Now, roughly 15% hasn’t moved in over 10 years, and can probably be presumed lost. Blockchain forensics firm Chainalysis estimates that roughly 20% of BTC is irretrievable, but they make the assumption that any BTC held for more than five years is gone, which I know to be not true. Then again, it doesn’t hurt to be conservative on this.

Either way, the amount of BTC socked away in longer-term addresses is rising, which means there will be less readily available BTC for new entrants. Of course, more will be incentivized to sell as prices rise, so this balance will shift. But the longer-term accumulating of an asset that has a verifiable hard cap does generate a scarcity premium.

HAVE A GOOD WEEKEND!

Taking a break from music links this weekend, I have a series recommendation for you: The Gold, available on the BBC, or Amazon Prime, or maybe somewhere else depending on where you are. It’s about the Brinks Mat gold bullion robbery, to date the largest theft of physical gold in British history. The acting is phenomenal, and I’m especially enjoying the 80s vibe, so well done you barely notice it.

This (below) was my favourite scene so far: how to launder pure gold. With the current AML/KYC banking rules, this would be almost impossible today, which I guess is some small consolation.