WEEKLY, Sept 23, 2023

Hi everyone! You’re reading the free weekly edition of Crypto is Macro Now, where I re-share a couple of things I wrote about in more detail during the week.

To get daily updates on trends I’m seeing in the growing overlap between the crypto and macro landscapes, as well as some market commentary, I hope you’ll consider subscribing to the premium version! It’s only $8/month for now, and it would allow to continue to explore the impact the crypto ecosystem will have on the global economy – I really feel this intersection matters, now more than ever.

CoinDesk TV was kind enough to invite me on their morning show yesterday to talk about the FOMC and the market’s reaction. And in case you missed my news last week, I’m now the host of their Markets Daily podcast – it’s a short dash through global market trends with, of course, an emphasis on crypto market news and trends.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

These are just some of the topics discussed this week:

Why the Mt. Gox delay matters for BTC

Token funding in Japan

Sony takes over blockchain?

Offshore crypto assets

Lots of doom-scrolling charts, plus a couple of hopeful signs

FOMC: It’s the projections that count

The Fed has spoken – why the surprises matter

Bitcoin utility and global democracy

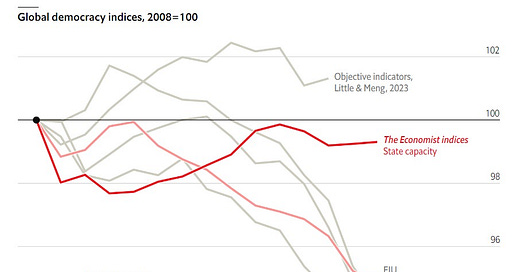

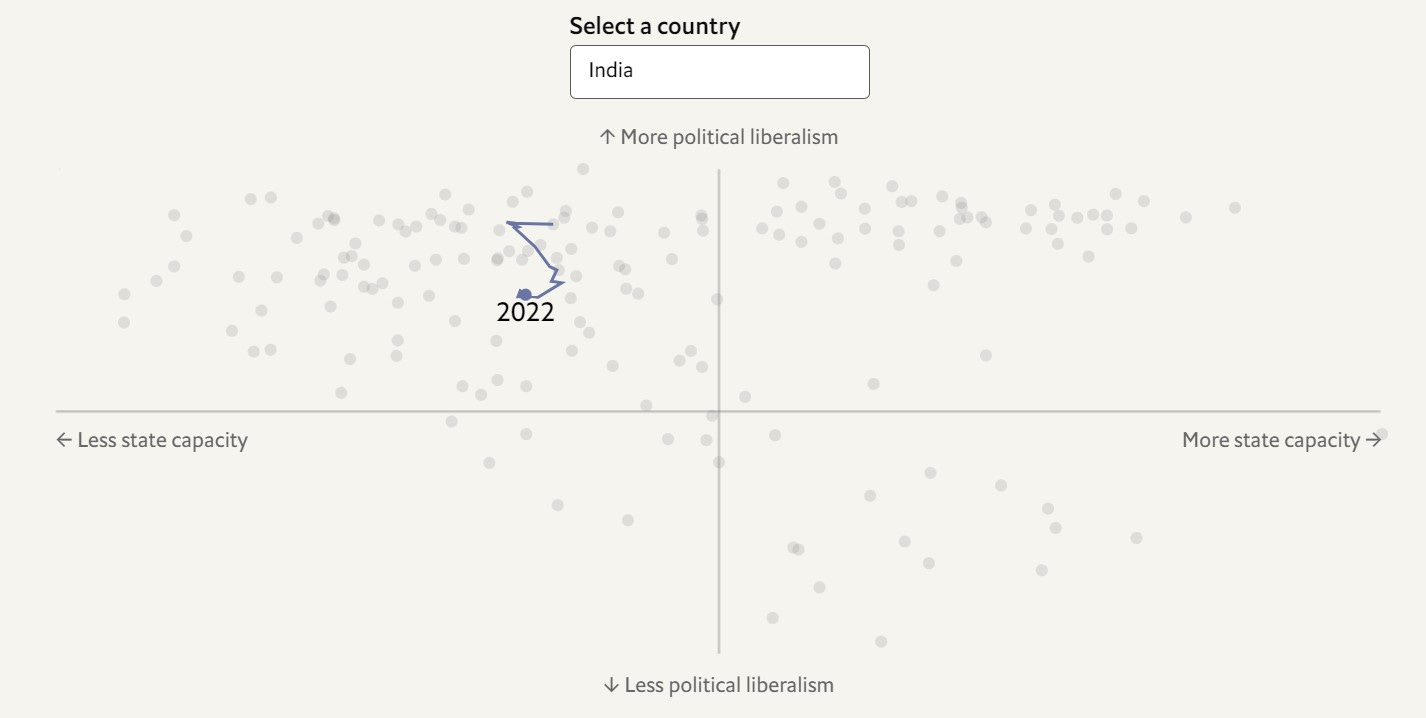

For all those who insist that bitcoin doesn’t have “utility”, I present the following chart:

(chart via The Economist)

The above chart combines various indices that aim to measure trends in global democracy. It is taken from a recent article in The Economist magazine, which presents two new indices (in red) that take a fresh look at the state of democracy in 178 countries around the world.

The Economist’s aim here is to minimize the impact of human bias by condensing the 279 indicators used in other indices into two scores, one corresponding to liberalism, openness and distribution of power, and the other to the state’s capacity to maintain order, manage the economy and provide public services.

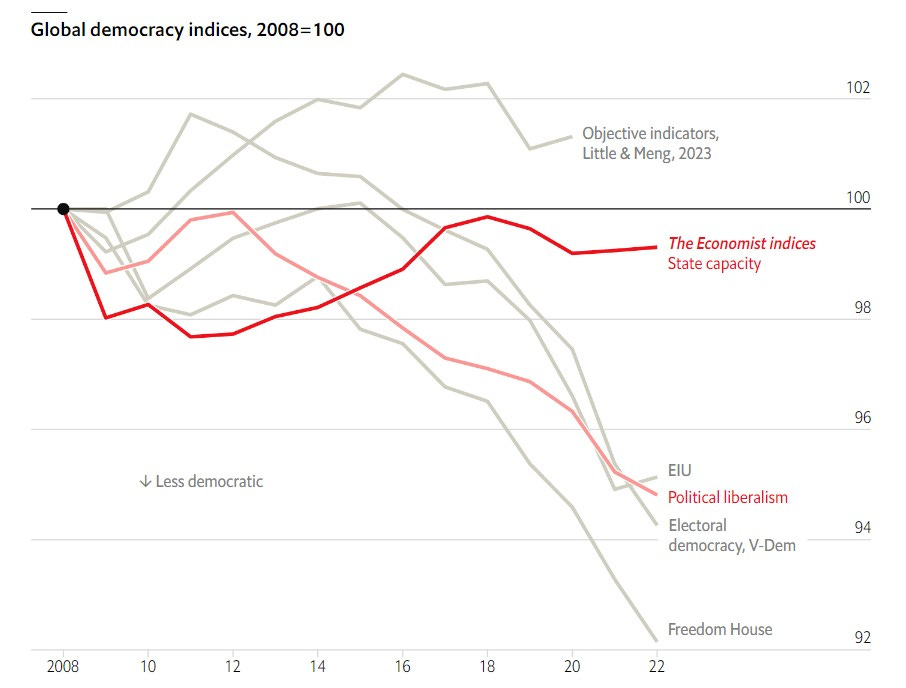

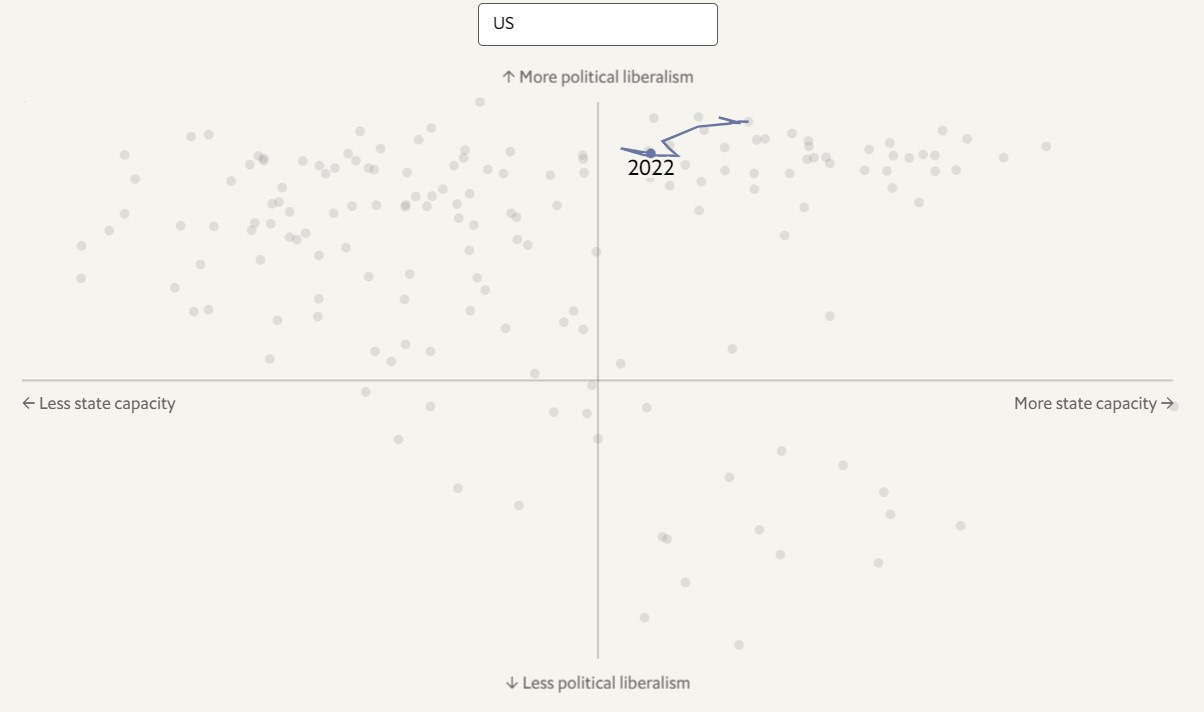

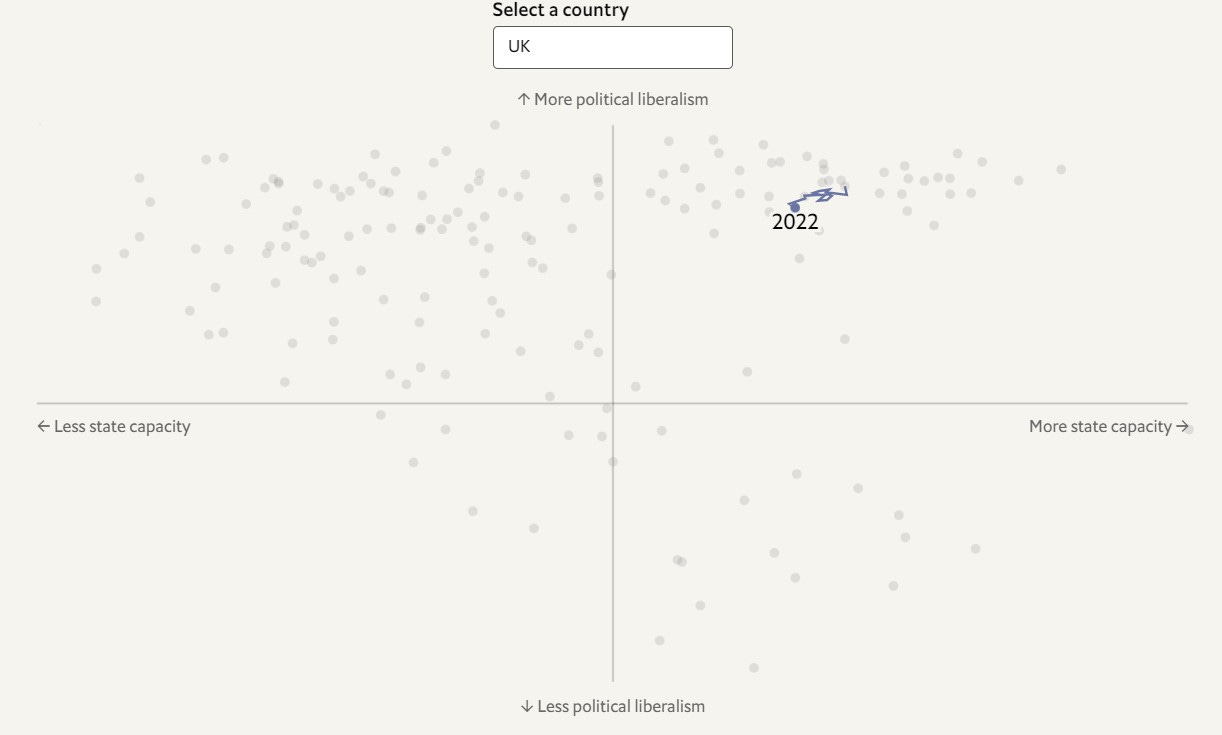

It still finds that democracy is declining. Even in global bastions of the idea such as the United States and the United Kingdom, there has been some backsliding.

(charts via The Economist)

You can dismiss many of the backwards moves as small shifts due to extenuating circumstances, but it’s hard to deny that the overall trend is alarming. And as the chart shows, it’s not new, which leads to the conclusion that it’s not necessarily going to reverse just because we want it to. The set-up so far for the upcoming elections in the US does not look hopeful for tolerance of those who don’t agree with the winner. And there’s the expanding geopolitical influence of decidedly undemocratic states such as China and Saudi Arabia, not to mention the growing status of India.

(chart via The Economist)

Why it matters:

Against the backdrop of declining democratic values, the importance of a seizure- and censorship-resistant store of value and payment rail becomes even more acute. History teaches us that exclusion from financial access is a tool often used to marginalize “troublemakers” such as activists and protestors. And we can fervently hope that their ranks swell should individual rights and fair treatment be further eroded.

Bitcoin presents itself as a way to ensure that, whatever happens, activists will be able to preserve at least some of their savings and ability to transact. While not foolproof, the technology enables people to operate totally off the established (and controlled) financial grid, continuing to pay for goods and services and, if necessary, start over elsewhere. A applicable term you might have heard before is “dissident tech”.

This type of utility is under-appreciated by those of us used to reliable freedom and financial access. Hopefully, most of us will continue to be able to take that for granted. It’s a risky assumption to bet everything on, though.

NYDFS wants to set more rules

According to a report in the Wall Street Journal earlier this week, the New York State Department of Financial Services (NYDFS) has published proposed guidance for crypto exchange token listing and delisting policies. The proposal is open for comment until Oct. 20.

Why it matters:

The immediate impact on crypto markets could be further rotation into BTC. Bitcoin’s dominance (its market cap as a percentage of the total crypto market cap) has climbed from 42% to over 50% since the start of the year, concentrating market weight in what is seen as the “safe” crypto asset.

(chart via TradingView)

The reasoning behind this rotation, and its longer-term impact, however, do not bode well for the ecosystem as a whole, for many reasons:

1) We have a state regulator taking control of the criteria used by exchanges as to which tokens are robust enough to be granted access to the New York market. This is a state regulator that has not demonstrated a deep understanding of the potential or the underlying technology. It is also a state regulator that wants to dampen risk by gating access rather than by ensuring the fair distribution of relevant information.

2) We have a state regulator trying to influence national crypto policy. While rules set by the NYDFS will only apply to platforms operating in New York, most platforms will choose to apply these rules for all states, rather than have to implement complex (and unreliable) geofencing.

3) Over-prescribed standards limit innovation. Even if the rules drawn up today do allow for tokens with certain criteria to be listed, going forward new listings will be limited to tokens that satisfy those criteria. Those with new features will be forced offshore.

4) The reduction in actual and potential listings is likely to end up reducing market diversity and activity. While this should be good for BTC, it could end up dampening overall crypto investment as the ecosystem becomes “less interesting” in the eyes of professional investors.

5) This further increases the costs for any crypto business operating in New York. Lawyers are expensive.

6) It questions the utility of a BitLicense, by suggesting the difficult-to-achieve and expensive approval does not ensure reasonable listing standards.

HAVE A GREAT WEEKEND!

By now, you probably know that I am a fan of great photography. It’s more than the aesthetic appeal. Beautiful images that show parts of the world we don’t often get to see, even if they were shot nearby, broaden horizons and instil a deep gratitude for how varied and changing this world is.

I find nature photography especially moving – the patience required, the implicit luck of the timing, seeing our world as a landscape and the horizon as a line on a canvas…

The Standard Chartered Weather Photographer of the Year 2023 shortlist showcases some amazing examples of colour and change. And, until tomorrow, you get to vote on your favourite to win this year’s prize.

They’re all stunning, but here are some that took my breath away:

Fire on Man-Made Jungle by Mahmudul Hasan

Snowflake Fall by Diana Neves

Frozen Silence by Alan Percy