WEEKLY - the biggest week for crypto

plus: assorted links, weekend viewing and more

Hello everyone, I hope you’re all doing well! This past week was just EPIC in terms of major crypto and macro news, one of the most consequential this year, and that’s saying something. I’m still hoping for some quiet news days in which to tackle the mounting backlog of big things I have yet to get to. What are my chances?

If you missed my livestream with Maggie Lake on Monday, you can catch it here (YouTube link), or listen here (Spotify link).

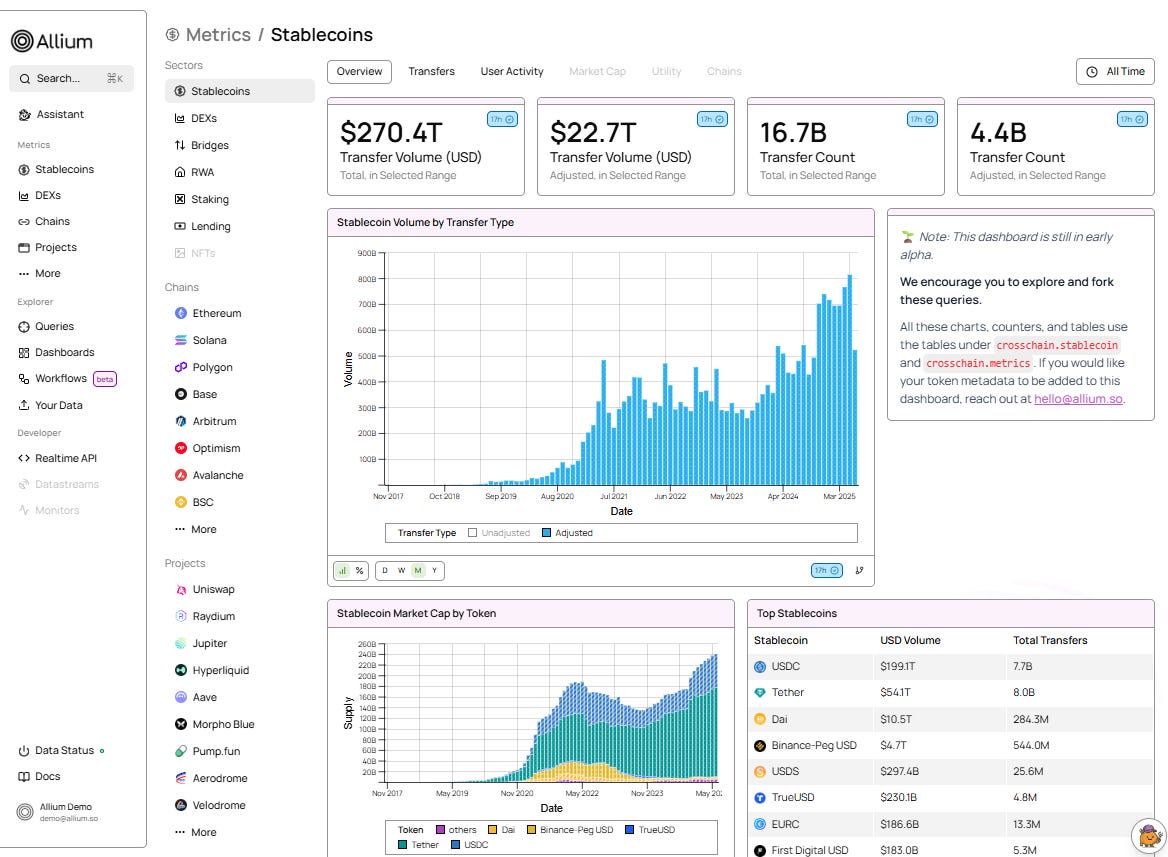

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

In this newsletter:

Crypto: the White House report

Project Crypto: Even more than expected

Assorted link: the merging of media and politics, corridors, parenthood, travel

Weekend: the Foundation visuals

Some of the topics discussed in this week’s premium dailies:

Coming up: negotiations, the Fed, PCE, jobs and a lot more

The EU deal: the end of the beginning, or the beginning of the end?

Macro-Crypto Bits: the Fed, BTC, the dollar and more.

The tokenization pushback

The empty EU DLT Pilot

Macro-Crypto Bits: trade deal theatre, BTC vs DXY

Big crypto market structure changes and why they matter: in-kind redemptions, and IBIT options

Macro-Crypto Bits: FOMC cohesion, US jobs, GDP

No, CBDCs aren’t “stabilizing forces”

Crypto: the White House report

Macro-Crypto Bits: tariff frenzy, FOMC dodging, GDP)

Project Crypto: Even more than expected

Macro-Crypto Bits: market jitters, catalysts, VIX, tariffs 😩, PCE, jobs

Crypto: the White House report

Back in January, just three days after his inauguration, President Trump created the President’s Working Group on Digital Asset Markets, to be led by Crypto & AI Czar David Sacks and staffed by a wide range of cabinet officials and agency heads. He tasked it with producing a report with recommendations for official policy regarding digital assets, and he gave it a deadline of 180 days. On Wednesday, just a week late, it delivered.

It's a long report (166 pages!!), and I confess I’ve only skimmed it. But I caught enough to see that it’s a powerful roadmap. Of course there will be gaps and proposals that crypto lawyers, builders and investors will object to – but it establishes signposts on the road.

It doesn’t explicitly endorse the accumulation of more BTC for a strategic stockpile, which some were hoping to see. But it does reiterate the general outline: the stockpile will hold forfeited BTC that is not needed for other purposes, will be managed by Treasury, and will not be sold. Good enough, in my opinion.

The recommendations for other areas of digital asset policy include:

Congress should confirm that individuals can self-custody digital assets.

It should also codify how an entity’s control over an asset impacts Bank Secrecy Act obligations – not everyone who handles digital assets is a money transmitter.

Bank regulators should be technology neutral.

The CFTC should get clear authority to regulate spot markets for non-security digital assets.

The CFTC should allow firms to offer both trading and custody, and should establish rules regarding digital asset collateral haircuts.

The CFTC should allow blockchains to satisfy recordkeeping obligations.

The SEC should establish exemptions from security registration rules for certain types of digital asset distributions, and for decentralized finance service providers.

The SEC should update rules to allow transfer agents to use blockchain technology.

The Administration should help both public and private institutions develop a “robust insurance market for digital assets”.

There’s a LOT more besides, but if the Administration delivers on even half of these, that will be significant progress.

Of course, this is just a guideline; execution of the recommendations is going to be complex and slow. But the document was put together by crypto experts as well as senior representatives from Treasury, Homeland Security, the Attorney General’s office, Commerce, the SEC and the CFTC, to name just a few of the involved agencies. The most notable part is that it is thorough and thoughtful, appreciative of the challenges in applying old rules to new technologies as well as of the potential of these technologies to improve current systems.

If you’re not a subscriber to the premium daily, I do hope you’ll consider becoming one!

Project Crypto: Even more than expected

Just amazing. Hard on the heels of the President’s Working Group crypto report released on Wednesday (see above), on Thursday we heard from SEC Chair Paul Atkins on his expectations for market reform. They are deeper and broader than most of us expected or even dared to hope for.

Regular readers will know that I got into this industry back in 2014 out of interest in marketplace evolution, and that I’ve been saying for ages the US has a lot of catching up to do in the exploration of tokenization. I’ve also argued hopefully that digital asset progress in other regions such as the Middle East and Asia will encourage the emergence of a multipolar world in terms of securities market hegemony, which in turn will have an impact on where innovation flourishes.

That thesis got overturned this week. We knew that the US would eventually get around to rethinking outdated securities laws to allow for greater experimentation in not just tokenization but also onchain issuance. I confess I didn’t expect it to happen so quickly, or with such thoroughness.

On Thursday, Chair Atkins gave a speech introducing “Project Crypto”, an SEC commitment to “swiftly develop” proposals to implement the recommendations in the White House crypto document released the day before.

This involves drafting “clear and simple rules of the road for crypto asset distributions, custody, and trading for public notice and comment.” It involves “using interpretative, exemptive, and other authorities to make sure that archaic rules and regulations do not smother innovation and entrepreneurship in America.”

Those sentiments may sound familiar, but Project Crypto is more than the encouraging statements we’ve heard so far – it gives them substance and clarity. The commitment is gob-smacking in the scope of its embrace of new market technologies, and outlines an acceleration of the pace at which the boundaries between traditional and new markets are blurring:

“Many of the Commission’s legacy rules and regulations do not make sense in the twenty-first century—let alone for on-chain markets. The Commission must revamp its rulebook so that regulatory moats do not hinder progress and competition—from both new entrants and incumbents—to the detriment of Main Street.” (my emphasis)

Atkins outlined four main areas of focus, each of which are long-standing pain points for crypto builders and investors everywhere.

1) Crypto asset distributions. Atkins wants to “bring crypto asset distributions back to America”, and has asked his team to set guidelines for all types of onchain distributions including tokenization, ICOs, airdrops and rewards. In complete contradiction to the previous SEC, Atkins declared that “most crypto assets are not securities”, but clear rules are needed to determine which are, and how they could “flourish within American markets”.

2) Choice in custody services. Atkins has asked staff to work on adapting the existing web of rules to facilitate greater user-centric choice, including self-custody which he considers “a core American value”. He acknowledges that current custody regulations just don’t work for crypto assets.

3) Service flexibility. Not only does Atkins believe that custody should not have to be separate from trading, he wants to remove rules that channel types of trading into narrow licenses. There’s no reason, he argues, that non-security crypto assets shouldn’t be able to trade on the same platforms as security crypto assets. And he wants this to extend beyond the SEC’s authority to include CFTC-regulated services and platforms.

4) Decentralized finance. Although he prefers to call them “onchain software systems”, Atkins has directed staff to update regulations in order to encourage the use of decentralized finance (DeFi) applications in financial markets. The SEC should not, he argues, “interpose intermediaries for the sake of forcing intermediation where the markets can function without them”. He advocates for a reworking of Reg NMS, a broad market access and order execution framework that he dissented against when it was enacted in 2005: his objections back then included the overbearing and limiting nature of market structure uniformity, the unnecessary complexity and the redundant regulatory costs. Now, he is proposing a rethink that removes distortions and supports innovation.

This last point for me is the most jaw-dropping. Atkins is essentially saying that current market regulation will be totally rewritten, that DeFi will be a feature of financial markets, and that he’s not going to wait around for the CLARITY Act to pass Congress before amending archaic rules.

When you combine the potential of greater DeFi use with more flexible markets and with greater encouragement for tokenization and onchain issuance of a range of asset types, you are looking at an almost unrecognizable market landscape. Of course there will be new risks; but the speed at which financial innovation can now build on itself should deliver sufficient opportunity and efficiency to warrant easing up on the brakes.

I know I’ve often said that finance evolves slowly, as it should given its systemic nature.

But when surrounded by radical change anyway, in politics, trade and centres of influence, arguably the biggest risk is losing the competitive edge of size.

And new innovation in US markets will boost markets everywhere, not just because market regulators in many other competitive jurisdictions are likely now to follow the SEC’s example. It’s also because funds flow to opportunities wherever they may be, and the more to choose from, the better for all.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Here's a gut-punching piece from Oliver Bateman on how explaining Trump’s victories and polarizing effect through his unrestrained domination of social media misses the bigger point: it’s that politics has become media, and vice versa. And not just politics:

“the interesting question for a new political science isn't what advertising tells us about society. It's how advertising logic, working in tune with technological change, becomes society's operating system.”

Bateman argues that, in this flat environment, “every political position becomes a brand identity”, and:

“When everyone has internalized advertising logic, when everyone is their own marketing department, then the most shameless self-promoter wins. Not because they have better ideas, but because they understand the game everyone is already playing.”

“If we wanted to actually understand modern politics, we'd start by admitting that the "marketplace of ideas" isn't a metaphor. … And in any marketplace, what America’s top ad men and marketeers have proven decade after decade is that the best product doesn't win. The best marketed product wins.”

(The Work of the Self-Marketing Machine, Oliver Bateman Does the Work)

How many of us have actually spent time thinking about the logic of a corridor? Not me – I assumed they’d always been a thing, but it turns out they only emerged around 1600 and didn’t become a common feature of buildings until the 1800s. This wakes up the question of: why? George Dillard explains that it has to do with the concept of privacy. In earlier times, this was associated with selfishness and deprivation, but in the Victorian Era, privacy started to become associated with respectability, and corridors helped to keep interactions between the privileged and their servants to a minimum. It makes sense: in a house with corridors, you can go into your room and shut the door, no-one will bother you. But in a house with interconnected rooms, people are coming in and out all the time, a more convivial set-up. So, next time you’re in a historical house, check out the layout: it will tell you something about the people that designed it and lived there. (How the Corridor Changed the Way We Live Together, Looking Through the Past)

I believe this is the first time I’m sharing a LinkedIn post here (largely because I rarely read them myself), but this one is both heart-warming and eye-opening. John Dagostino writes what appears to be a post about fatherhood, but is actually about listening to those we love and learning from them. This resonated with me as I’ve always felt privileged to have kids I would be honoured to know as people, even if we weren’t related. Life’s ultimate luxuries come in unexpected ways. (Getting To Peak Dad - One Round At A Time, John Dagostino)

This is an old article I came across this morning when I was looking for some literary escapism – my way of dealing with noise overwhelm. I share it here anyway in case you, too, would like a brief window in which to pretend things aren’t getting even crazier than expected out there. It’s a compilation from Condé Nast Traveller magazine of all-time travel writing classics, and I now have several of these on my summer reading list. If you have any good recommendations, please send them my way! (The Best Travel Books of All Time, According to Authors, Condé Nast Traveller)

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

It’s been a while since I shared a series recommendation. Here’s one for those of you who have Apple+ and love either science fiction or cinematic beauty – enjoying both is, of course, a bonus.

Last year I finally got around to reading Isaac Asimov’s Foundation, but I confess I couldn’t get into it – I found it too confusing, with a disjointed narrative and elusive characters. So it was with some trepidation I started watching the series – just a few minutes in, I was mesmerized. The plot is still confusing, although a bit easier to follow than the book. But that doesn’t matter: for me, it’s the visuals. The design is stunning, from the scenography to the special effects to the wardrobe and makeup to the colouring of the photography. Almost worth watching on silent.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.