What a difference a year makes

plus: market pain, US jobs, services activity and more

“The biggest changes in life occur to variables that no-one watches.” – James Dale Davidson ||

Hi everyone! Markets may be rough and will probably get rougher, but there’s skiing and skating and curling coming up, which will not only show us inspiring human spirit, it will also remind us that everything, even magnificence, is a step towards tomorrow.

Last night I got to chat to the wonderful Maggie Lake on her Talking Markets show – we touched on the crypto rout, the US economy, Bitcoin utility and more – you can see the playback here.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

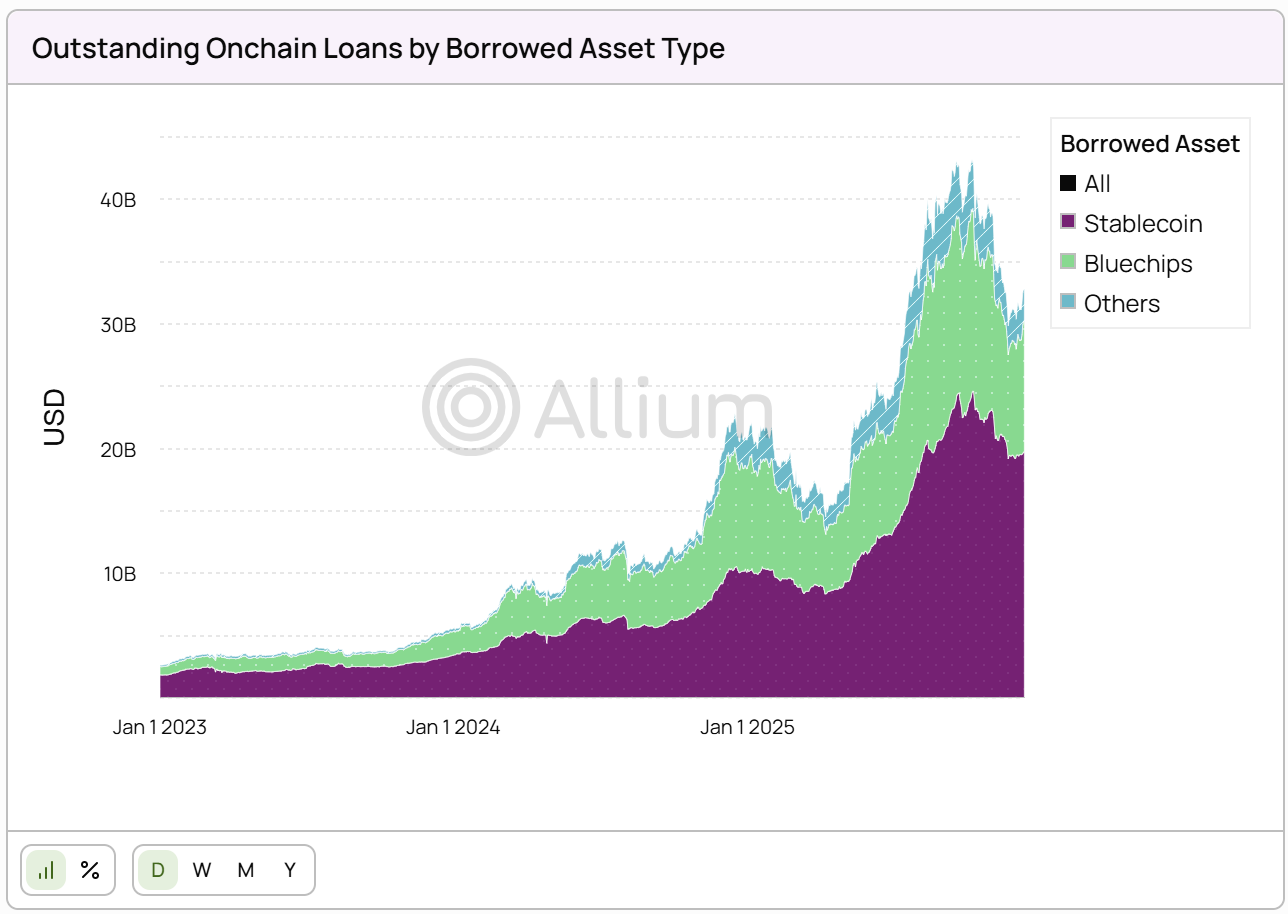

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

January 2025 lookback: What a difference a year makes

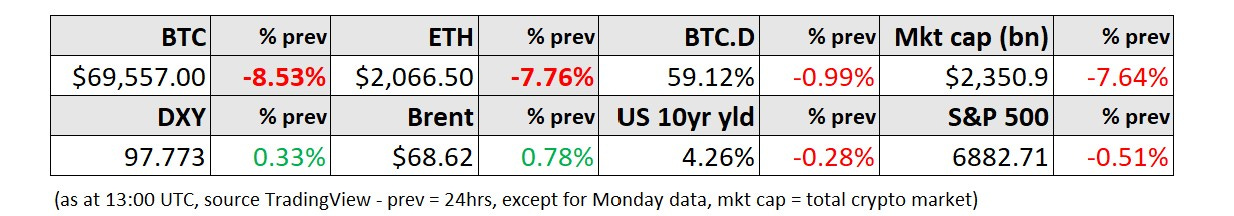

Markets: down

Macro: US jobs

Macro: US services

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

January 2025 lookback: What a difference a year makes

January is often a crazy month in markets, politics and the global landscape as portfolios get shuffled, goals get set and promised developments get set in motion. But there seems to be a general consensus that this past January was way off the crazy charts.

So, I did a quick review of what I was writing about this time last year and, yup, this January makes last year’s look calm in comparison.

Not so much on the economic front: last January, the US core PCE index was growing at a year-on-year rate of 2.8%, and it still is. The core Producer Price Index was growing at a year-on-year rate of 3.5%, and it still is. The US unemployment rate was 4.0%, it has since climbed to 4.4%. The Federal Funds Effective Rate was at 4.3%, it has been cut down to 3.6%.

In markets, we reeled when DeepSeek burst onto the scene, we shrieked when the $TRUMP memecoin dropped the weekend before the inauguration, we applauded when the Crypto Executive Order put government agencies to work on drafting rules. January 2026 has also had its share of AI blindsides, “ick” moments and regulatory wins.

No, the biggest changes, and indicators of what’s ahead, were in geopolitics, and that’s even after January 2025 gave us a US inauguration, the whiplash of Executive Orders that followed, domestic terrorism in New Orleans, catastrophic fires in California and the beginning of the tariffs-as-foreign-policy strategy with 10% on Canada and Mexico and 25% on China.

The jaw-dropping developments of the past month have been on a different scale and with a different rhythm. We had an alarming escalation of domestic conflict in Minnesota, a public assault on the independence of the Federal Reserve, military intervention in Venezuela, threats to seize Greenland, mass protests in Iran, wider cracks in NATO, Carney’s “rupture” speech in Davos, more flip-flops on trade and an eyewatering precious metals market.

Last January, we knew change was coming; but this January nestled into a world that feels unfamiliar. I’ve heard some refer to last month as a “tipping point” – I don’t agree, we’re not there yet, but we’re getting closer.

The crypto landscape has also taken on a different rhythm. For one, the mood couldn’t be more different: excitement last year, frustration and despair now. And that’s despite the regulatory and infrastructure progress. Understandable – prices set narrative, and they’re lower and heading down.

But the building has accelerated. True, this doesn’t feed through to token prices, not directly anyway, and investors are exiting. But it matters for the ultimate goal of better markets.

The past month’s announcements of actual and planned stablecoin launches, the tokenization progress (more on this tomorrow), the progress in crypto market infrastructure and the closing of the gap with traditional assets… strong, dizzying stuff, and certainly noisier than a year ago.

Last January, what crypto development moves was I interested in? And did expectations pan out?

SAB121 repealed

Days after the inauguration, SAB 121 – the mindbogglingly unreasonable Gensler-era “guidance” that banks could not custody crypto for clients without an equal capital offset, making it uneconomical – was repealed. Reaction from financial institutions has been slow, but significant. Since then, US Bank re-launched crypto custody, partnering with NYDIG. PNC Bank launched Bitcoin trading and custody, partnering with Coinbase. They join BNY, which has been offering the service to HNW clients since before the repeal due to special dispensation. Both Citi and State Street are planning to launch the service this year. I may have missed one or two, but we haven’t exactly seen a stampede into the service – nothing from JPMorgan, Bank of America, Wells Fargo and other financial giants. Still, the gate is open, and banks move slowly.

Clearing the way: SAB 121 repealed (Jan 2025)

Tether and Rumble

Just over a year ago, Tether made a $775 million strategic investment in decentralized video platform Rumble – this actually happened in late December 2024, but I didn’t get around to looking at it until early January, so it gets included here. At the time I thought this could be a path towards a new form of media monetization, and there has been progress on that front. Last month, Rumble and Tether launched the Rumble Wallet, a non-custodial crypto wallet integrated directly into the media platform, with support for USDT, Tether Gold (XAUt) and Bitcoin. The initial use case is for tipping content creators, but developments late last year hint at where this could go.

In November, Rumble announced the acquisition of Northern Data, a European AI infrastructure company into which Tether had made a strategic investment in 2023. Tether has committed to purchasing up to $150 million of GPU services over two years from the company. Rumble also announced a $100 million advertising commitment from Tether, to start in Q1 2026.

I won’t claim to fully understand the strategy here, but I’m putting distributed media, AI, stablecoins and an embedded non-custodial crypto wallet together and coming up with what looks like an intriguing AI-driven decentralized content ecosystem.

Tether and Rumble: what’s really going on? (Jan 2025)

Tokenized MMFs + stablecoins

Last January, Circle bought tokenized money market fund issuer Hashnote – I mused at the time that this was a step towards blending stablecoins with yield-generating stable tokens. We haven’t advanced much on that, largely due to antiquated securities laws (tokenized money market fund access is still restricted), but tokenization seems to be one of the key priorities of the SEC this year, so I’m optimistic.

There are more developments I’m glossing over, but these three were the “big picture” moves from January 2025 that jumped out at me. I’ll continue to do these lookbacks, as it’s good context for understanding how far we’ve come, what I got wrong, and what we collectively could push harder on.