What an end to the war could mean for markets

plus: a CBDC pivot, what's ahead this week, BTC's move, China's risk aversion and more

“For tribal man, space was the uncontrollable mystery. For technological man, it is time that occupies the same role.” – Marshall McLuhan ||

Hello everyone! I hope you all had a great weekend – here, it was sultry and smooth, how I wish all weekends could be.

I have some days off coming up – this Friday is a public holiday here (La Asunción de la Virgen, for those interested, commemorating the ascension of Mary). And next week I’m in Budapest Wednesday-Sunday for a wedding. Hoping things quieten down so I don’t miss much??

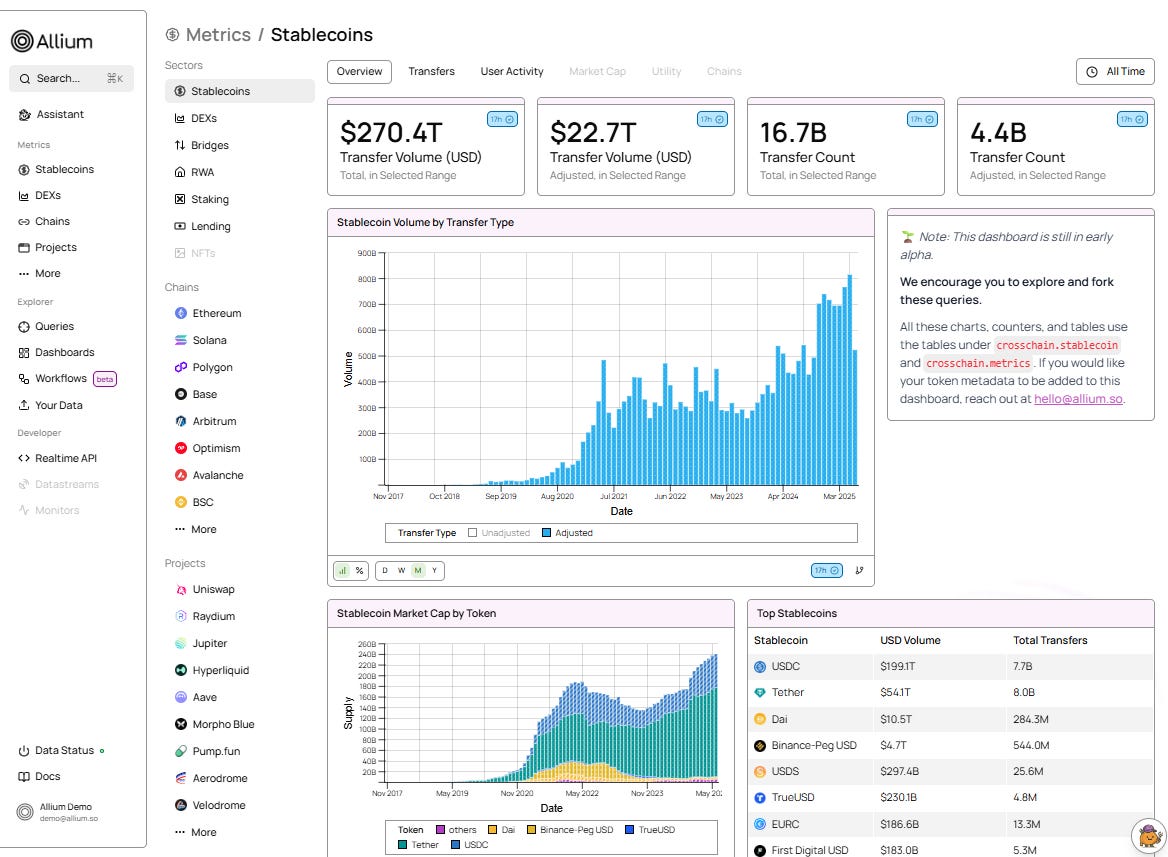

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: US CPI, PPI and retail sales, Alaska, China and more

What an end to the war could mean for markets

Another CBDC pivot

Macro-Crypto Bits: BTC’s move, reverse tariffs, China’s crypto stance

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

Let me help you keep up with the growing crypto and macro overlap.

SUBSCRIBE

WHAT I’M WATCHING:

Coming up this week:

This is stacking up to be a big week, in terms of economic data and potential geopolitical moves.

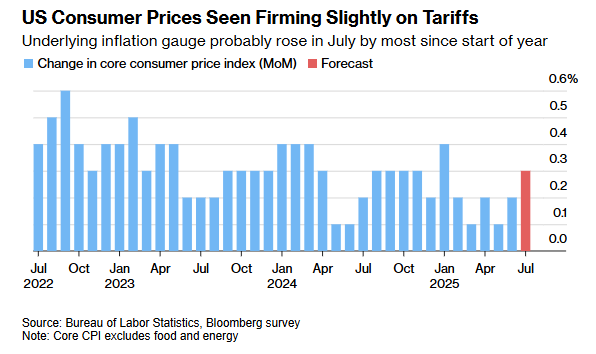

On Tuesday, the big event will be the release of the latest US CPI data, especially tense after the recent employment report indicated a softening jobs market, and after the steep downward revisions of previous months prompted the firing of the head of the Bureau of Labor Statistics, responsible for gathering both employment and consumer inflation data. Signs of continued deceleration could make a September rate cut more likely – but, if good, the quality of the data will almost certainly be questioned.

The average forecast is for a month-on-month acceleration in core inflation (stripping out food and energy) to 0.3% from 0.2% in June, which would be the largest gain since January. This would bring the year-on-year rate for July up to 3.0%, vs the previous month’s 2.9%.

(chart via Bloomberg)

Also on Tuesday, we get the latest report on small business optimism, expected to hold steady at levels lower than earlier this year but higher than 2022-2024.

And the deadline for a trade deal with China expires, although rumblings point to it being extended.

On Thursday, we get the US Producer Price Index, a gauge of wholesale inflation. The month-on-month increase for July is expected to accelerate for both the core and headline indices, to 0.2% from 0.0% in June.

On Friday, we get US retail sales, which are forecast to show a slower month-on-month gain in July, at 0.3% vs June’s 0.5%. We also get US industrial production for July, expected to be flat on the previous month vs an 0.3% increase in June. We get price indices for US exports and imports, which could give a clue as to the impact of tariffs, although it is early days yet.

And, we get the preliminary read of the latest University of Michigan consumer survey report – in July, expectations for inflation one year out dropped from 5.0% to 4.5%. Given the recent climb in consumer and business optimism, we could see this drop further.

Looking across the ocean, we also get a slew of economic reports from China, including unemployment rate, retail sales and industrial production.

Back in the US, on Friday a meeting will take place that could change the map of Europe. More on this below.