What BTC volatility has to do with silver

Plus: worthwhile pieces for your reading list

“May your choices reflect your hopes, not your fears.” – Nelson Mandela ||

Hello everyone! It’s good to be back, although not yet full-time.

One of the many advantages of living in Spain is that the festive season does not end until after Epiphany on the 6th of January – so, the choppy publication schedule will continue for a while longer as I continue to cherish the presence of visiting family. This week, I’ll miss the 31st and the 1st, and next week the 5th and the 6th. As of the 7th, back to normal.

Today’s newsletter has a slightly different format as I’m still in clearing-the-decks mode, categorizing my backlog (yes, really), making plans for new features, etc. Since I FINALLY had time to tackle the bulk of my long-open tabs, I offer you a curated list of some strong thought-pieces to end the year.

Tomorrow I’ll share what I’ve been thinking regarding what I want this newsletter to be, why I do what I do, and more – it’s so easy to lose sight of goals when you’re trying to keep up with the treadmill, and it’s important to dust them off every now and then.

🎀

My latest op-ed for American Banker (paywall, sorry!): “What 2025’s big stablecoin trends reveal about the future of payments”

🎀

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

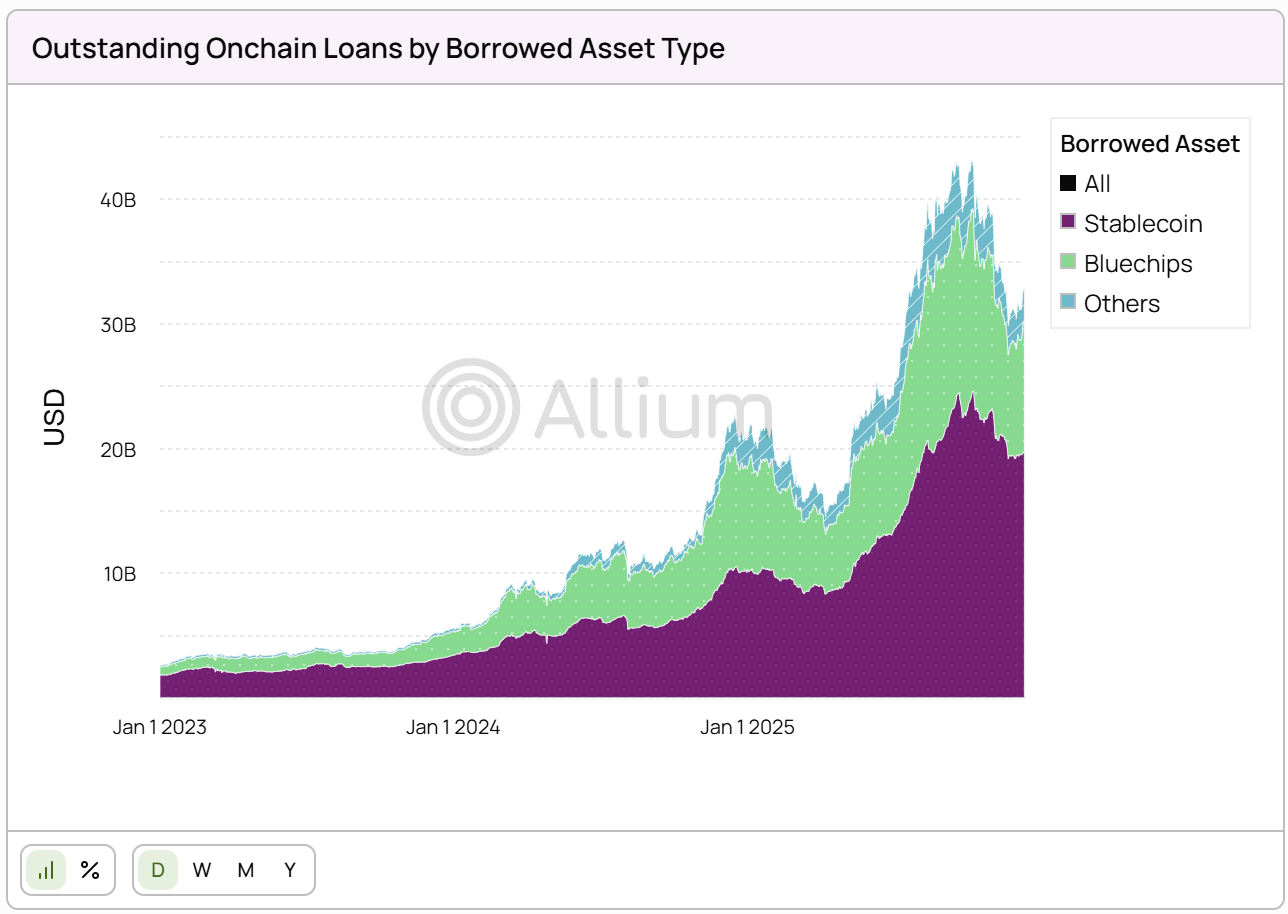

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Worthwhile pieces for your reading list

Markets: what BTC volatility has to do with silver

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Worthwhile pieces for your reading list

Stone Ridge CEO Ross Stevens’ much-anticipated annual investor letter delivered a characteristic balance of emotion and inspiration, encouraging everyone to follow Bayesian principles and end each day “a little less wrong”. The section on Bitcoin packed a hard-hitting punch on why it matters for so many around the world: it gives activists new powers of resistance while depriving dictators of their chokehold on all economic activity. From me, a full-throated “yes!” – regular readers will know that I often write about how I fear the creeping censorship we’re seeing everywhere means more of us will become threatened activists, willingly or not, as power scrambles to hold on.

This “Crypto is Dead” post by Dougie DeLuca resonated with me as I’ve long argued that we’ll know blockchain has “arrived” when we’re no longer using the term because it has become so normal. The main argument in the piece is that crypto is no longer a stand-alone sector, and that it’s time to move beyond the initial niche and self-referential culture while appreciating how it incubated crypto values and prepared them for export. A well-written and thoughtful piece that ends up being both uplifting and practical, an unusual combination.

“Crypto doesn’t win by turning the world into crypto natives. It wins when nobody has to be crypto-native to benefit from it.”

A well-written and thoughtful piece from Stepan Simkin on the stablecoin industry: where it’s at, what issues it still needs to solve. For instance, privacy vs security (if privacy isn’t built-in, it could become a layered-on risk); development speed vs security; purpose-built payment chains vs battle-tested ones; unsolved issues in agentic finance (eg., who’s liable?). Plus, stablecoins offer global reach from day one. And they’re not without risk, but their risks are more transparent and monitorable than those in traditional finance.

“The stablecoin growth story of 2025 has mostly been about taking what already exists in fintech and running it on better infrastructure. … But stablecoin rails unlock something bigger than just doing the same things more efficiently. … This is our chance to rethink what financial services should actually look like. I’m not seeing enough teams go after this yet. The opportunity is sitting right there, and most of the industry is still running the 2015 fintech playbook on new rails.”

Chuk Okpalugo succinctly lays out the tradeoffs between centralized tokenization and a more decentralized version, and what they each mean for retail investors, institutions as well as broker-dealers. A good read, with easy-to-understand detail (not easy when writing about market structure).

“Without the indirect holding system, liquidity fragments and netting efficiency disappears. Broker services like margin and lending must be reimagined. Operational risk shifts toward holders rather than intermediaries. But the agency that comes with direct ownership allows investors to choose those tradeoffs, rather than inheriting them.”

David Birch points out that the pace of digital innovation in payments and markets shouldn’t be a surprise to anyone, as well as why banks tend to be bad at it. He also suggests that Western institutions could perhaps learn from the cautious and yet practical approach of PBOC, which seems to view stablecoins more as a useful tool for settling digital asset transactions.

Pete Townsend frames stablecoins as “robot money”, the ideal transaction token for machine-to-machine commerce and information swaps, and suggests that AI could end up becoming an even greater use case than cross-border payments and emerging economy savings accounts.

For FX plumbing and bank regulation nerds, DeFi Cheetah makes the excellent point that non-USD stablecoins don’t have a chance at traction without liquidity, and that current Basel rules are heavily stacked against their base currencies ever getting that. Could DeFi help?

Patrick Jenkins in the Financial Times (paywall) wrote about the stablecoin rewiring of traditional finance, overcoming the typical FT scepticism to conclude that:

“The only certainty: life will get tougher for the Luddites.”

The Economist’s Buttonwood column remarks on the irony of banks that bristled at President Biden’s regulatory corset now aligning with trade unions and centre-left think tanks against the threat of stablecoin disruption.

A couple of weeks ago, the US Federal Reserve published an interesting paper on the de-pegging of USDC during the 2023 banking crisis, highlighting how it spread to stablecoin Dai, and through DeFi composability (with permissionless smart contracts connecting applications) could easily spread throughout the ecosystem. I remember at the time keeping a close eye on how unbalanced Curve’s pools were getting. Then again, back then we saw and have since seen both resilience and agility, with key market players stepping in to reassure users, and taking measures to prevent similar stress.