What even is CPI for?

plus: signs inflation is picking up, the market reaction, and more

“Courage is what it takes to stand up and speak. Courage is also what it takes to sit down and listen.” – Winston Churchill ||

Hello everyone! I hope you’re all well.

A chart-heavy email today, there’s the inflation data to parse and the market reaction, and a rant about why we even bother. I had to punt several of the topics I wanted to touch on until tomorrow.

Production note: It’s a national holiday on Friday where I live and this newsletter will skip publication day, but back with the free weekly on Saturday! I’ve got a few days coming up next week as well, more details on Monday.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

What even is CPI for?

Inflation is picking up

The market reaction

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

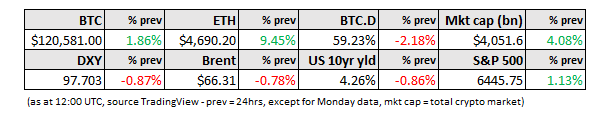

WHAT I’M WATCHING:

What even is CPI for?

I don’t think I’ve ever seen the market this divided over an interpretation of reported CPI data. That is much more puzzling than the data itself, but in retrospect shouldn’t be surprising – it’s not just the Administration that seems keen to politicize data, it’s also us, the observers, that tend to see information through a particular lens, and often twist it to conform to our strongly held bias. This may feel familiar: the glass-half-full or glass-half-empty paradigm has been around for ever. But the current mood is more than that – it’s a lack of agreement on what a glass even is.

Regular readers will know I often comment on how the “change” we’re going through is much deeper than most realize. I believe the turmoil, even if unacknowledged, is seeping through into what we think economic data is even about. True, economists are often a contentious bunch anyway, and disagreement is part of the job (although now we apparently have President Trump pressuring private businesses to fire economists he doesn’t agree with, so maybe not for much longer). But now we are all economists, everyone with an X or Telegram account gets to opine on data, amplifying echo chambers and drowning out impartiality in a wall of noise.

All this is a roundabout way of saying the actual numbers matter less and less, as they are mercilessly spun into narratives that support whatever measure we would like to see: yesterday, my feed was divided between those insisting the CPI data was mild which reinforces the likelihood of a cut in September, and those pointing out that inflation pressures are intensifying and what’s ahead is going to be ugly.

In this light, the proposal from Trump’s nominee to lead the BLS, E. J. Antoni, makes some sense: he thinks the organization should suspend monthly jobs data until a new method can be devised and installed. Quarterly reports should be fine, he says. If the data doesn’t matter anyway, why do we need so much of it?

As much as I would love less noise, the idea is a terrible one as the monthly reports were always more about frequent signals and historical trends than they were about accuracy. Information that will be revised is better than no information, especially when the Federal Reserve is under pressure to make key monetary policy decisions every few weeks. And, a key service of public data reporting is the maintenance of historical records – the monthly data goes back to 1915, especially useful if you agree short-term economics matters less for the big picture than longer-term trends.

But I digress: the CPI release yesterday showed that inflation is not only sticky, it’s ticking up. And yet the market continues to be confident that we will get a rate cut in September. US Treasury Secretary Scott Bessent was yesterday insisting that the cut should be 50bp, which perhaps could give cover for the Fed to cut 25bp while saving some face. I’m still in the “careful what you wish for” camp and believe cutting in September would kick up the likelihood of hikes early next year. But I’ve seen analysts say that would be preferable to holding steady, which is just crazy on so many levels.

Ok, let’s look at the data…