What matters?

plus: US GDP

“For last year’s words belong to last year’s language

And next year’s words await another voice.” – TS Eliot, Little Gidding ||

Hello, all! Here we are, the final Crypto is Macro Now of 2025 – I’ll be skipping publication tomorrow and on January 1st, back on the 2nd.

What a year. I’d say that it was one of the most consequential years in the arc of civilizational change we are currently living, but with a dose of cold perspective, there have been a few of those over the past decade, and what’s ahead could end up making 2025 look calm. I don’t mean to be ominous, not at all – rather, I keep reminding myself that wheels are set in motion, randomness will pop up in unexpected places, and that it is a privilege to be living in such interesting times.

On Friday, I’ll offer my 2026 predictions. Today, I share my thoughts on why crypto matters, why I do what I do, and what I want this newsletter to be.

✨✨✨

To one and all, I wish you a HAPPY NEW YEAR! Or, as we say here in Spain, “Feliz salida y entrada”, happy exit and entry.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

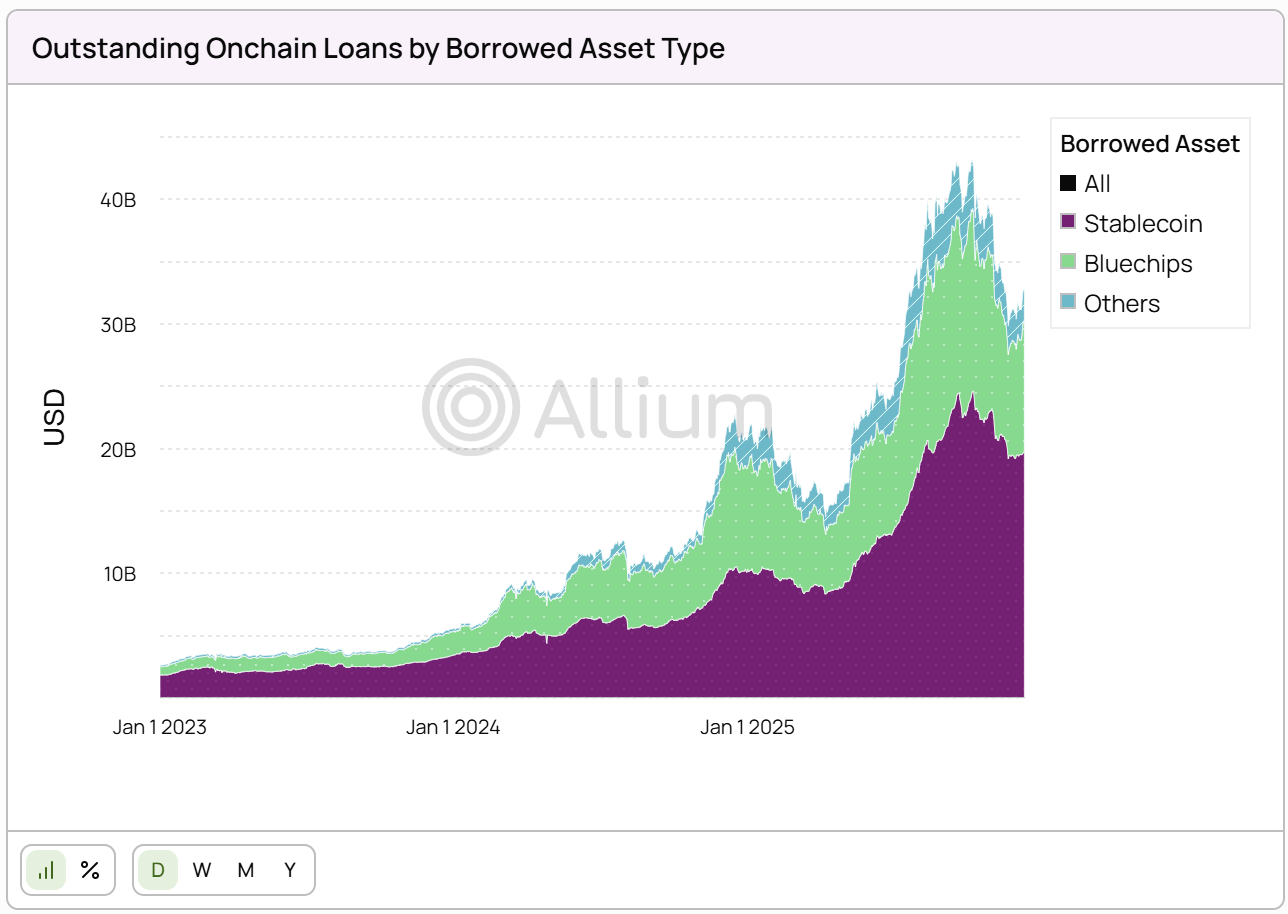

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

What matters?

Macro catch-up: US GDP

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

What matters?

The pause between Christmas and New Year is an ideal breathing space in which to refresh commitments, dust off goals and check that you’re wearing the right shoes for the path ahead.

So, in that spirit, I sat down this weekend in the pre-dawn quiet and asked myself why I do what I do.

It turns out it’s a much harder question than it seems. The easy answer, the one I’ve been telling myself repeatedly since I started this project more than three years ago, is because “it matters”. But what matters? And why?

Many of you have probably gone through this introspective exercise at some point, perhaps as part of a regular psyche cleanse – what do you care about, and how can you contribute? Of course, everyone will have different answers, which is what makes the world work.

Here’s mine: Change matters, because it affects people.

But, while true, that feels inadequate because it’s vague – after all, the world is always changing, and people have always been buffeted by some external force.

So, a more specific, relevant and wordy version: The world is currently undergoing a systemic change to its economic motor; blockchain technology is both a driver of this change and a solution to the resulting dislocation. I want to help people understand what’s happening. Like I said at the beginning, it matters.

And I believe I can contribute there: I’m a markets nerd, applied maths and econ degree, CFA (non-practicing), I worked in tradfi for 10 years, and founded an ecommerce company during the dot-com bust. I grew up across several continents, am comfortable with change and have an annoying drive to understand the “why” of things. I’ve been researching and writing about the crypto industry now for longer than I was in traditional finance, but I can still bridge the two worlds, and I believe in the democratizing power of decentralization as well as in the necessary (but currently over-extended) role of institutions. I love writing, I’m good at pattern recognition, and I want to share what I learn.

That’s why I do what I do: because it allows me to combine what I can do with what I want to do, while hopefully helping others to form new questions and change their minds.

Why this?

But let’s back up and look more closely at why I believe the impact of crypto on the macro landscape, and vice versa, is so important now – why this is what I feel I have to focus on. I won’t lie, there have been days of disillusionment with the “ick” factor that has always been part of the crypto ecosystem and that this past year became more institutional. On those days, I fantasize about pivoting to the space economy, or rare earth extraction. Both are fascinating, ideal for a nerd like me and relevant for what’s ahead. But neither have crypto’s vast potential scope of big-picture impact, which I’d eventually find frustrating. (And no, you will never see me slither over to the shiny field of AI punditry – it doesn’t have anything like the grittiness and hope of crypto’s early days.)

I focus on crypto and macro because we’re not just talking about change here. I believe what we’re going through is the most profound re-alignment of politics and economics since WWII.

Going off the gold standard impacted finance as well as global trade, but the “average” person wasn’t much affected. The spread of the internet was creative, productive, and equalizing just as it facilitated global surveillance – it was a leap in collective intelligence – but it didn’t have as transformative an impact on the relationship between people and their governments as what’s coming.

On the one hand, we now have a technology that can support individual resilience.

Blockchain technology can facilitate totally decentralized transactions that don’t need institutional approval and that can’t be blocked, sanctioned, censored or otherwise stopped. This restores agency and independence to activists and others on the wrong side of “acceptable” thought by enabling off-grid transfers that sidestep institutional repression.

On the other hand, we have the inexorable expansion of institutional power.

Just like biological organisms, political institutions have to grow to survive. Invading neighbours is frowned upon, so growth is focused downward, into deeper participation in citizens’ lives. Governments can’t keep us safe from new threats without more surveillance, and they can’t stay in power without greater relevance. Both imply more control over what we do.

What’s more, regulators have to keep regulating which means slapping more restrictions on more aspects of human activity. No head of an official department ever turned down the opportunity for a higher budget.

In sum, governments will keep on growing until they come up against a force that stops them. Regrettably, this affects all of us as technology drags the historical struggle between will and might from the battlefield into our homes.

Today, the clash between the human instinct for agency and the institutional instinct for control is breaking the boundaries of politics and muscling its way into economics, education, employment, even culture. We’re already seeing it play out in violent protests around the world, in more censorship and in the entrenched insistence from those in power that they need more of it in order to protect us.

Put differently, those in power will fight to hold on while people push back against increasing suffocation – the story of revolutions throughout history. This one is spreading everywhere as greater connectivity delivers a more powerful lever for censorship of speech and economic activity. But, finally, there’s a new tool in the box: a digital way around that.

Meanwhile, we have new markets emerging with fewer gates, and institutions recognizing that greater efficiency is a net benefit. The creation of wealth is an unalloyed positive if it can be distributed according to contribution and risk acceptance. More agile marketplaces can feed that creation, with more pronounced impact in overlooked corners of the world’s economy. Put differently, blockchain can help financial institutions operate more efficiently, and spin up new marketplaces that can put savings to work for more granular, community-focused opportunities.

So, to summarize this rambling:

I care about change because of how it affects people, both the opportunity and the threat – and I care about blockchain technology’s role in reform and resistance.

That is what this newsletter hopes to convey: why blockchain and other crypto technologies matter. Not because of the money to be made (you won’t ever see me make trading suggestions or investment recommendations) – I’ve nothing at all against making money, but I care so much more about the bigger picture, the longer-term impact, the promise and the peril.

This means regular comments on crypto market narratives, how they drive and are driven by prices. It means regular updates on macro developments, since they impact both investment drivers and individual opportunity. Geopolitics will feature, as blockchain is a tool for countries as well as people and businesses. There will be a lot of stablecoin pieces, as they are one of the key active vectors of blockchain impact on established systems. I’ll cover tokenization trends and CBDC frustrations. I’m looking forward to writing more about defi’s escape from its crypto-native bounds. Identity is a massive yet overlooked piece of the connectivity and resilience puzzle.

In sum, no shortage of things to talk about.

I hope you’ll stick with me on this journey, and am beyond grateful that you’ve joined me for at least part of it. Thank you. I love what I do, and writing for you is an honour.

As for next year, I’m looking forward to pulling on more threads, unpacking more trends, sharing more concerns, trying out new features, bringing back old ones and, most of all, working towards a better understanding of what’s coming and what’s on the other side.

It’s not going to be easy. But, as the saying goes, “bring it”. We’re in this together.

🎀 If you find this newsletter useful, or even if you just like my excellent music recommendations, would you consider sharing it with friends and colleagues? Thanks! 🎀

Macro catch-up: US GDP

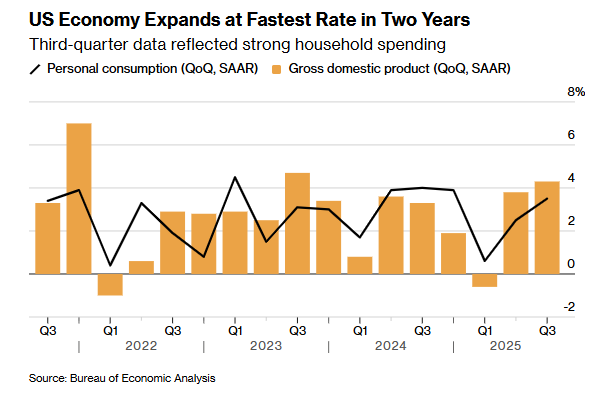

Last week delivered a strong US Q3 GDP report – quarter-on-quarter growth came in at 4.3%, well above the consensus estimate of 3.3% and Q2’s 3.9%.

(chart via Bloomberg)

All good in the US, then?