What the young are telling us and why we have to listen

Plus: JPMorgan and Ethereum, market pain and more

“We make a living by what we get, but we make a life by what we give.” – Winston Churchill ||

Hi everyone! I hope you’re all doing well, remembering to pace yourself and touch grass…

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

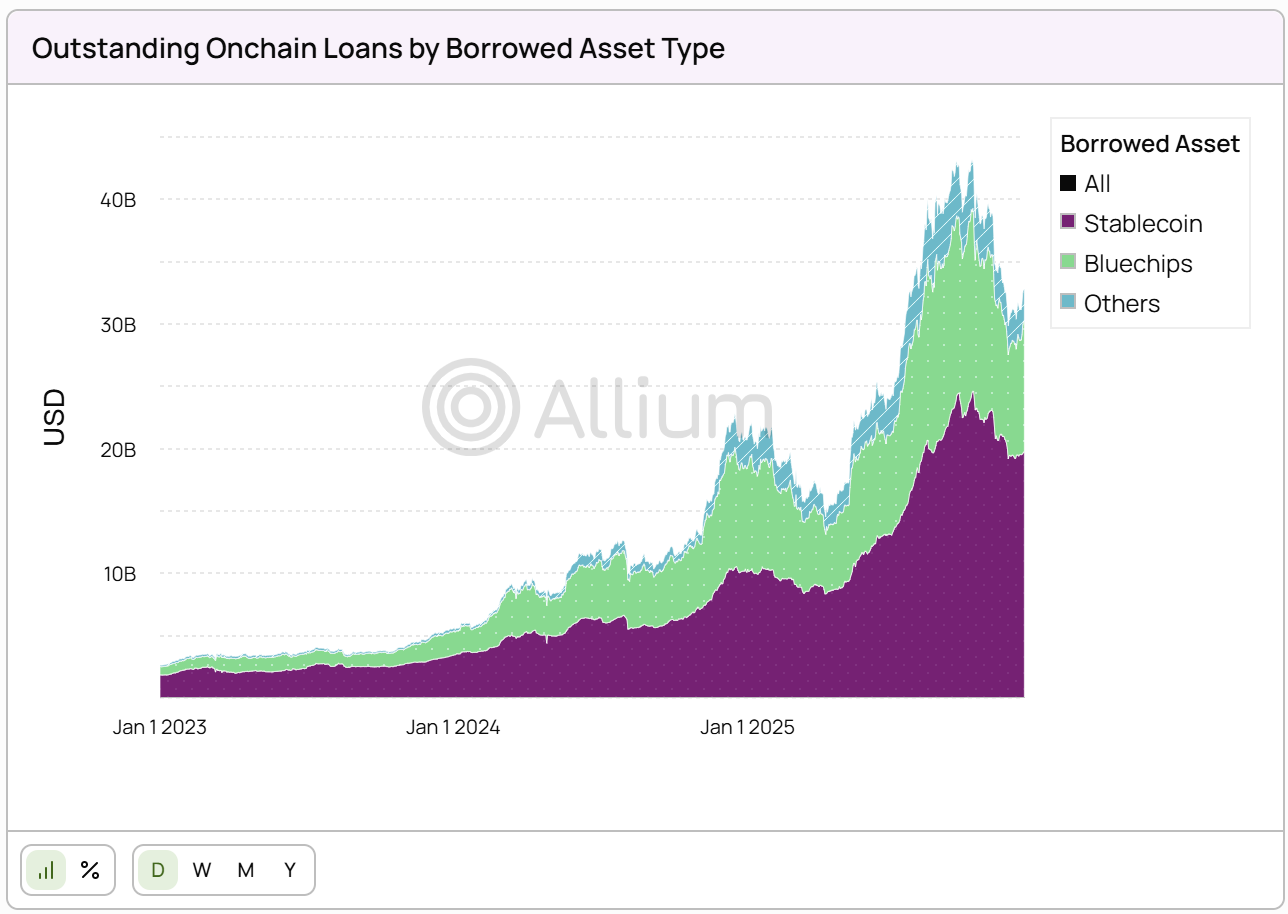

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

What the young are telling us and why we have to listen

JPMorgan and Ethereum

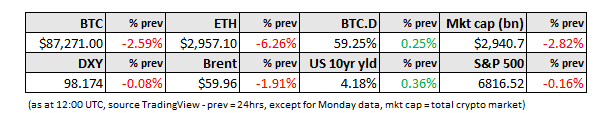

Markets: ouch

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

What the young are telling us and why we have to listen

I’ve written before about the youth protests roiling both emerging and developed economies – they have already toppled several leaders, and last week triggered the resignation of Bulgaria’s minority government. Politicians everywhere are worried about who’s next. This morning I read about public protests in Honduras, yesterday it was Romania, the day before that in Tunisia.

Politicians should worry. Young people are angry. It’s not just the lack of job security and affordable housing. It’s also the diminishing trust in institutions, democracy, capitalism and country, at a time globalization is unwinding and geopolitical tension is rising.

This is relevant for the cost of military build-up – if a nation can’t call on patriotism to boost troop recruitment, it will have to pay up to entice unenthusiastic volunteers or risk unrest spilling over should conscription become mandatory.

It’s also relevant for the economy, as young people see little point in saving, which boosts consumption, inflation and the neutral interest rate.

And it’s relevant for markets, as a digital-first and disenfranchised youth sees little point in investing on fundamentals, encouraging more speculation and blurring the lines between investing and gambling, especially as prediction markets march onto traditional and new platforms.

You’ve probably heard many of these narratives already, so much so that none of them feel new. It’s disconcerting, then, to see survey after survey put numbers around a problem politics feels inadequate to deal with, but which threatens the foundations on which financial structures rest.