What’s ahead for macro in Q4?

plus, jobs, shutdown, nominations withdrawn, stablecoins and more

“Technology always has unforeseen consequences, and it is not always clear, at the beginning, who or what will win, and who or what will lose...” – Neil Postman ||

Hellooooo October!!! Hellooooo Q4!!! And, I guess, hello autumn? 🍂

Still working through the backlog of crypto-related developments from the past week, and this week is turning out to be a flurry of stablecoin announcements…

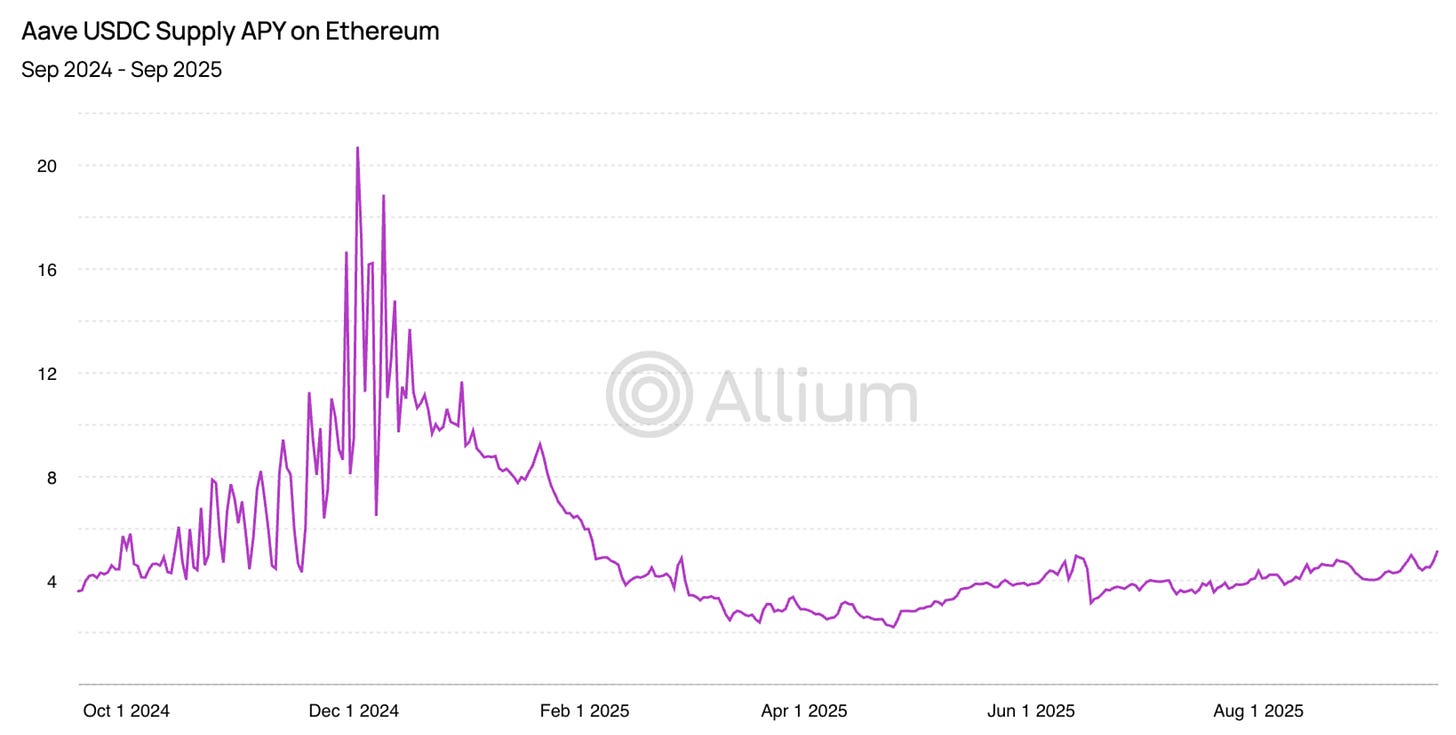

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

What’s ahead for macro in Q4?

What did the last BLS jobs report of the week tell us?

How did the market react to the private ADP payrolls report?

Why is the Visa Direct stablecoin pilot significant?

Why is the withdrawal of Trump’s nomination for CFTC chief bad news?

… and more!

WHAT I’M WATCHING:

The Q4 macro outlook

(Yesterday I shared my Q4 outlook for the crypto market.)

Talking about macro is so complex, any attempt to paint a holistic picture invariably ends up in knots and contradictions.

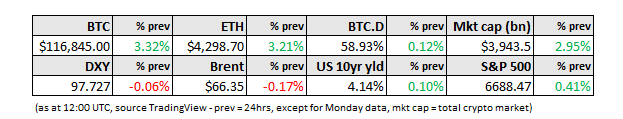

So, I’ll do my best here to keep it simple, which means filtering out a lot of the noise and focusing on themes and directions: higher inflation, softening employment, higher bond yields, a weaker dollar, weakening stock market confidence, and decent growth.