When Bitcoin’s narratives merge

plus: diversification away from the dollar, the BTC basis trade, and more

“It is the framework which changes with each new technology and not just the picture within the frame.” – Marshall McLuhan ||

Hi everyone! I hope you’re all doing well and getting ready to enjoy some good weather. If you’re in the northern hemisphere of course. And if you like warm sunshine, not everyone does. Weird, I know.

I forgot yesterday to share the link to Monday’s livestream of Bits & Bips, where James Seyffart, Alex Kruger, Ram Ahluwalia and myself argued about the macro and crypto outlook. You can see that here.

Also, yesterday I was on Yahoo Finance’s Catalysts show talking about the GENIUS Act, its potential impact and the BTC reaction. I don’t have a link to the show, but here’s a clip.

🌻Hey all! I’m thinking about taking on sponsors, to help keep this newsletter going. If you have a webinar, report, event or service you’d like me to feature, let me know! Reach out at noelle@cryptoismacro.com and I’ll send you more information.🌻

IN THIS NEWSLETTER:

When Bitcoin’s narratives merge

Debt issuance diversifies

Macro-Crypto Bits: the basis trade is back, foreign buyers of US bonds

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

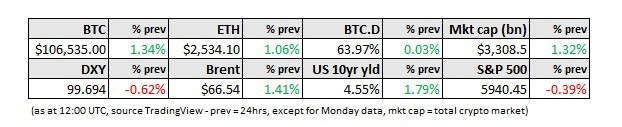

WHAT I’M WATCHING:

When Bitcoin’s narratives merge

Hunh, that’s interesting… BTC is climbing while we also have rising bond yields and oil prices.

(BTC/USD chart via TradingView)

All else equal, you’d expect the tightening of conditions represented by higher yields and energy prices to weaken risk appetite and hit liquidity-sensitive assets such as BTC.

Before anyone cries “decoupling!”, it’s worth zooming out.

We could be, in part, seeing a boost from the safe-haven narrative – but that is generally a slower trend, more on this below.

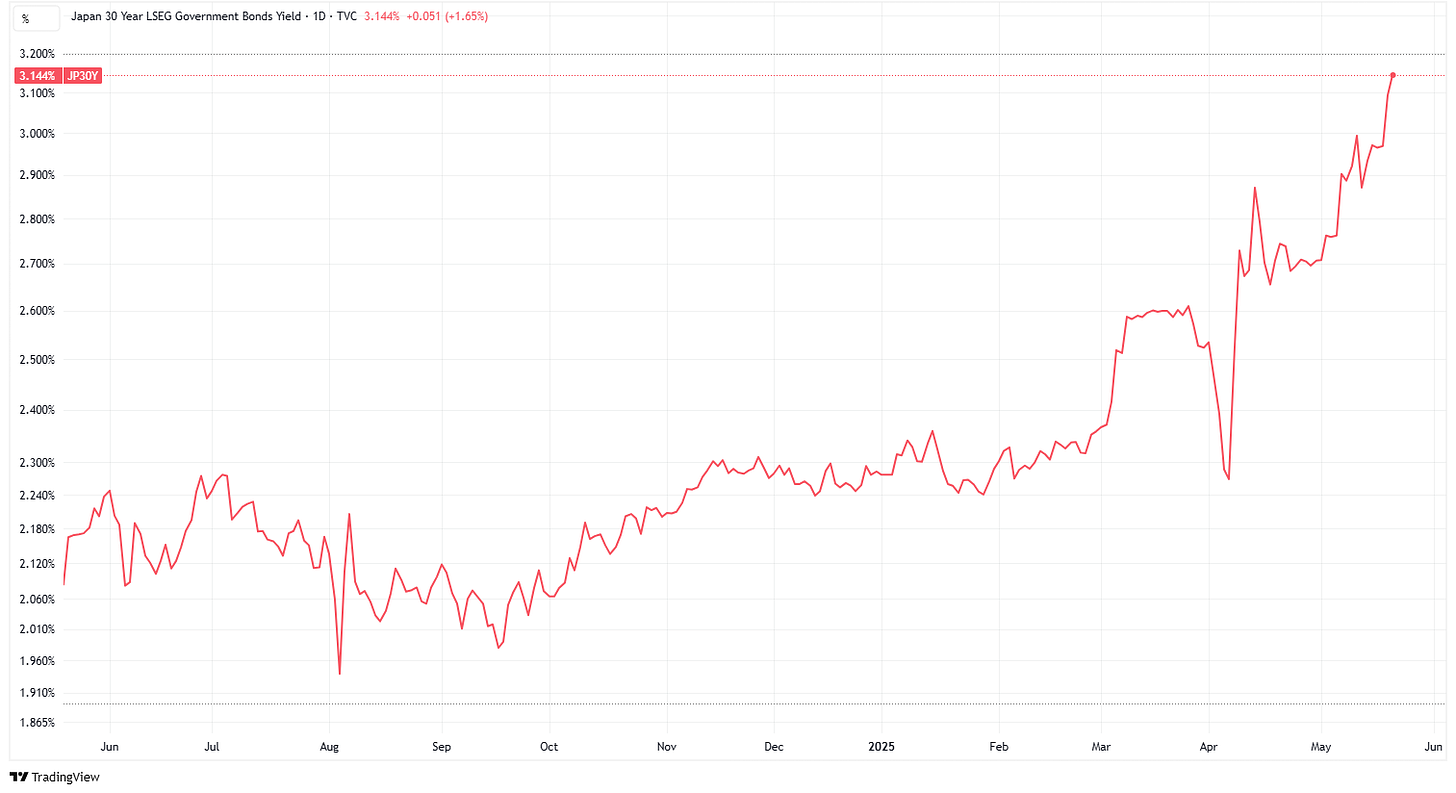

More likely, we’re seeing building concern about a bond market “event” triggered by Japan. The yield on its 30- and 40-year government debt has shot up over the past few days, and is now at record highs.

(Japan 30-year yield, chart via TradingView)

Japan concern

This latest move is an extension of a multi-year rising trend that highlights the deeper risks of extended yield curve control (otherwise known as a race to the bottom). But the recent acceleration is most likely a culmination of factors including a tapering of government purchases at the long end, rising yields in the US, and Prime Minister Shigeru Ishiba’s comment earlier this week that Japan’s fiscal situation was “worse than Greece’s”.

Apart from this being technically not true – Greece’s debt/GDP ratio is high at 153%, but nowhere near as bad as that of Japan’s 263% (for context, that of the US is around 120%) – it’s a strange thing to say as markets still remember the recent Greek debt crisis. And it has left investors wondering what the prime minister meant, and what we’re not being told.

Meanwhile, this is surfacing even more pressing concerns, such as the health of Japanese banks. These hold large positions in longer-term Japanese government debt which has plummeted in value – will we see intervention, which would pump more liquidity into the Japanese, and by extension, the global markets?

And what about the impact on US treasuries? Will Japanese holders need to unwind their carry trades? These involve borrowing at low rates in Japan in order to invest in higher-rate debt, with a big chunk going to US treasuries. Or, would Japanese funds in trouble need to offload whatever they can? This is particularly worrying as Japan is the largest foreign holder of US government debt by a wide margin.

(table via the US Treasury)

Which narrative is the driver?

This brings us to the blurring boundary between the two main BTC narratives: risk asset vs safe haven.