Why Pizza Day matters

plus: mistaken BTC narratives, a different stablecoin bill, currency talks and more

“Other things being equal, the more widely dispersed key technologies are, the more widely dispersed power will be, and the smaller the optimum scale of government.” - James Dale Davidson ||

Hi all, and happy Pizza Day! For those of you new to crypto, below I explain why it is important, and why we should ignore mainstream reporting on the occasion.

The podcast version of the latest Bits & Bips is out! James Seyffart, Alex Kruger, Ram Ahluwalia and myself argue about the macro and crypto outlook. You can watch here (YouTube), or listen here (Spotify).

🌻Hey all! I’m thinking about taking on sponsors, to help keep this newsletter going. If you have a webinar, report, event or service you’d like me to feature, let me know! Reach out at noelle@cryptoismacro.com and I’ll send you more information.🌻

IN THIS NEWSLETTER:

Why Pizza Day matters

The easy but mistaken BTC narrative

A stablecoin bill passes

Macro-Crypto Bits: jittery markets, currency agreements and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Why Pizza Day matters

The 22nd of May holds special significance in crypto lore as, on this day in 2010, a software developer called Laszlo Hanyecz spent 10,000 BTC on two pizzas. Back then, it was worth roughly $40. Today, it’s the equivalent of over $1.1 billion.

This last fact is what most Bitcoin Pizza Day reporting focuses on: who in their right mind would spend something with such appreciation potential on food?! Imagine if he had held on to those BTC instead!

Yet that is shallow, clickbaity, and totally misses the point of what he did, which was pretty epic.

First, let’s look at how hard it was for Laszlo to spend his BTC. Back then, there were no Bitcoin payment platforms and the first Bitcoin exchanges, Bitcoinmarket and Mt. Gox, were just emerging. So, Laszlo posted his idea on the Bitcointalk chat forum: he would pay 10,000 BTC to anyone who would arrange for two pizzas to be delivered to his home. A student named Jeremy Sturdivant saw the post and accepted the challenge. Laszlo transferred the BTC to Jeremy, who then called up the pizza delivery service and arranged for the delivery, paying in fiat.

At the time, 1 BTC was worth $0.0041.

Jeremy held on to the BTC for a bit, but eventually sold it for a 10x gain and spent the $400 on a trip with his girlfriend.

Laszlo went on to repeat his pizza exercise several more times that year, but May 22 marked the first time that anyone had used Bitcoin for a “practical” transaction.

Remember that Bitcoin was so young back then, no-one knew what was ahead. But Laszlo understood, arguably better than most, that if BTC isn’t shown to be a substitute for money, it won’t go anywhere. He showed, in an admittedly clunky way, that BTC would be accepted for commerce.

True, a lot of trust went into the transaction, ironic for a technology that was created to minimize its need. Laszlo took a bet that Jeremy would go through with his end of the deal. He did, which also highlights the sense of community at the time – Bitcointalk participants were figuring this out together. There was a collective interest and a will for the technology to succeed. Monetary gain was secondary to moving the adoption needle.

So, today, help me push back against anyone using the occasion to gleefully dwell on what Laszlo lost, as if his “sacrifice” would make us feel better about our missed opportunities. And when you hear any privileged westerners whine that “Bitcoin isn’t used for anything”, raise a glass in his honour.

The easy but mistaken BTC narrative

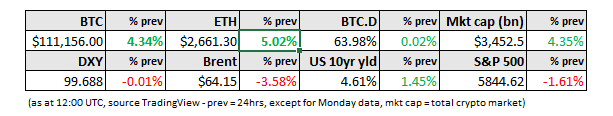

So far today, I’ve seen both FT and Bloomberg attribute BTC’s rise to the prospect of regulation, and I was asked about the “sell the news” risk for BTC in an interview the other day. (See below for the price chart and other market moves.)

It’s interesting to try to unpack why that’s the narrative mainstream commenters are reaching for.

The logic, I assume, is that with more regulatory clarity, institutional buyers will feel more confident about taking BTC positions, and will bring new flows into the market.

Only, the GENIUS Act currently working its way through Congress is about stablecoins – no direct impact on BTC, and the indirect impact (more institutions using stablecoins to trade?) is residual at best, as any institution that wants to trade in BTC with either stables or fiat can do so today.

The crypto market infrastructure bill that will hopefully follow (months away at best) will deliver clarity to all the tokens whose security status has been unclear – that does not include BTC, which no-one classifies as a security. Tighter guardrails around crypto platforms should make investors more confident, but there are already many regulated vehicles offering BTC exposure.

In sum, the regulatory process under way won’t change much for BTC’s outlook. A year ago, the regulatory shift was a big tailwind; now, it’s priced in.

So, why do people think the regulatory narrative is the driver for BTC’s climb?

It’s a head-scratcher, but it could be that it’s easy to understand – simplicity tends to stick. Never mind that not long ago many mainstream commenters were convinced that regulation was precisely what we didn’t want. Now, anticipation of the new investors regulation will encourage is apparently pushing BTC to all-time highs.

For sure, it is easier to get one’s head around than the mix of safe-haven and risk-asset demand that I wrote about yesterday: BTC is rising because it expects a market “event” from rising bond yields, which will lead to a liquidity “fix”. It is also benefitting from increased safe haven demand as the global reset accelerates and as liquidity fixes tend to dilute currencies.

But experienced traders know that “easy” is a trap.

Another possibility is that attributing BTC’s rise to the coming regulation keeps its performance isolated to crypto-specific developments, which is certainly more comfortable than accepting that BTC is now a macro asset – we know that it has been for some time, but for most, that’s too much of a cognitive leap.

This highlights just how far we have yet to go for “mainstream” to understand the huge shift that has taken place around BTC narratives in recent years, especially since the entrance of institutional money.

That in turn highlights an overlooked tailwind: deeper understanding of BTC’s complexity, and its role on the macro stage.