Why South Korea’s crisis matters

plus, the digital euro moves forward

“One thing that’s missing but will soon be developed is a reliable e-cash, a method whereby on the Internet you can transfer funds from A to B without A knowing B or B knowing A.” – Milton Friedman, 1999 ||

Hello everyone, I hope you’re all doing well!

I have a schedule squeeze today, so today’s email will be relatively short for a change (you’re welcome!) – also, apologies, but I won’t be able to do a recording later.

Below, I review what the crypto market’s reaction to yesterday’s drama in South Korea says about infrastructure and sentiment. I also update on the progress of the digital euro, which is looking increasingly inevitable.

Production note: it’s a public holiday here in Spain this coming Friday, so this newsletter will miss publication – I will be publishing the free weekly on Saturday.

IN THIS NEWSLETTER:

Why South Korea’s crisis matters

The digital euro moves forward

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

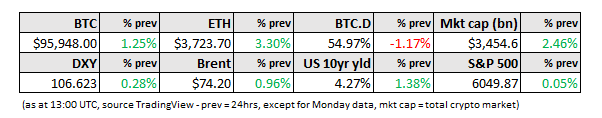

WHAT I’M WATCHING:

Why South Korea’s crisis matters

Well, that was dramatic.

Yesterday, South Korea’s president Yoon Suk Yeol declared martial law, claiming that it was necessary in order to stamp out “anti-democratic forces”, both domestic and from infiltrated North Korean cells. Opponents insist that the move was a ham-fisted attempt to break a political stalemate.

This shocked the world, as South Korea is widely regarded as a stable democracy, is host to some of the world’s largest tech companies, and is a key US ally in the region as well as home to the largest overseas US military base.

Yet here was the president threatening to use military force against his political opponents.