Why we won’t get a digital euro

despite the ECB's insistence... plus: markets, Coinbase and more

“The concept of progress acts as a protective mechanism to shield us from the terrors of the future.” – Frank Herbert ||

Hello everyone!! Happy Friday, and happy Halloween 🎃, if you celebrate! Be careful out there today…

And, of course, a big Happy Birthday 🎉to the Bitcoin white paper, first published in a cryptography forum 17 years ago today. My, it’s growing up fast.

My latest op-ed for American Banker is out (paywall, sorry)! I look at why the move by JPMorgan to accept crypto collateral is more a big deal for banking than for crypto markets - JPMorgan’s move on crypto collateral is a watershed moment for banks

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

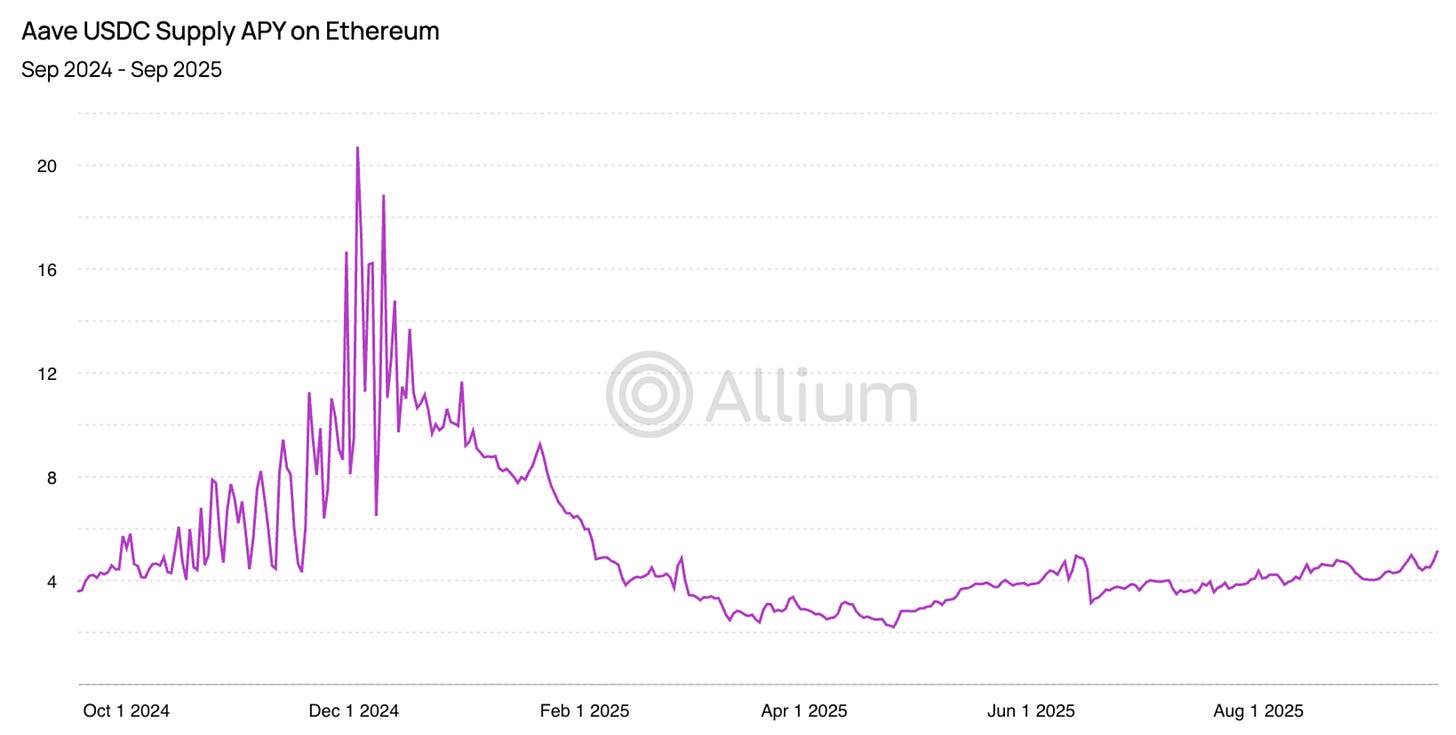

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Why we won’t get a digital euro, despite the ECB’s insistence

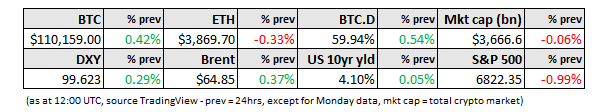

Macro-Crypto Bits: markets, rates, liquidity, Coinbase volumes

Also: a retreat from populism, nuclear testing, Western Union

WHAT I’M WATCHING:

Why we won’t get a digital euro, despite the ECB’s insistence

To the surprise of no-one, the European Central Bank (ECB) has decided to proceed with the digital euro. Today was the deadline for an official decision after two years of design work and opinion-gathering (or rather, public campaigning).

This is not, however, a decision to issue a digital euro. The ECB can’t make that call until the legislative framework has been adopted. Which it hasn’t, not even close.