Yes, Bitcoin can be volatile AND safe

plus, sticky inflation

“No sensible decision can be made any longer without taking into account not only the world as it is, but the world as it will be.” – Isaac Asimov ||

Hello everyone, I hope you’re taking care of yourselves!

Today I tackle a surprisingly stubborn misconception about BTC’s volatility. I also squint at the latest CPI print and what it says about the likely evolution of rate expectations from here.

IN THIS NEWSLETTER:

Inflation: stickiness turns out to be sticky

Yes, Bitcoin can be volatile AND safe

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Inflation: stickiness turns out to be sticky

The US October CPI data just out delivered no surprises.

The year-on-year increase in headline inflation accelerated to 2.6% from 2.4%, while the month-on-month growth remained steady at 0.2%.

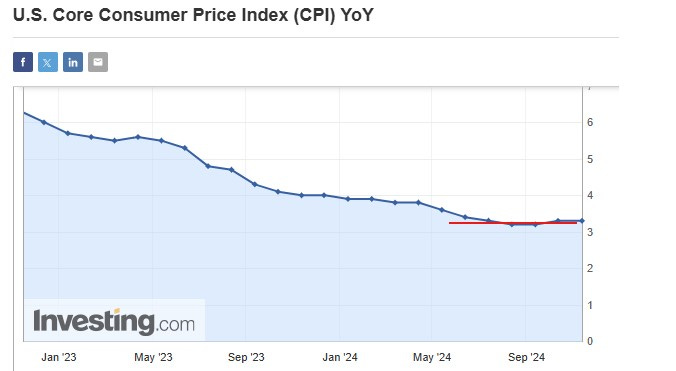

Core inflation held steady at 3.3%. Flat is better than an increase – but, it is higher than the 3.2% we got in July and August, and the same as June’s growth. The three-month annualized core CPI growth picked up from 3.1% to 3.6%.

(chart via Investing.com)

Yet the Federal Reserve continues to insist that inflation is coming down to the 2% target. We haven’t yet seen evidence of this.

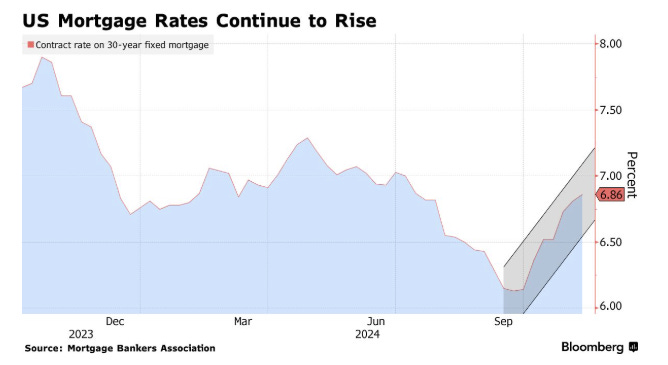

True, much of the stickiness is coming from the housing index, which climbed 0.4% over the month. Rents are in theory going to come down as post-pandemic contracts age out – but mortgage rates have not exactly responded to the rate cuts, so it’s not clear how much room rents have to manoeuvre.

(chart via Bloomberg)

This is not surprising, since mortgage rates are more closely tied to the 10-year yield which is a full 80 basis points higher than where it was at the start of the easing cycle. And, given the likelihood of an inflation pickup next year, it could head higher still.

(US 10-year treasury yield chart via TradingView)

Some good news: the supercore measure, which strips out food, energy and housing, grew by 0.31%, less than September’s 0.4% and slightly below the 0.35% average for the year.

But still, markets will surely start to realize that the Fed’s insistence on inflation moderation from here just might be the next “transitory” narrative?

This matters, since a re-evaluation of rate cut expectations could add more volatility to markets. The below chart shows the move in the expected fed funds level for the end of 2025 before today’s inflation data – I expect it will climb even more from here.