Zelle + stablecoins: it’s the utility, not the tech

plus: geopolitical shifts + crypto, market breather, gold, Fed Chair and more

“The day will come when the man at the telephone will be able to see the distant person to whom he is speaking.” – Alexander Graham Bell (a reminder that what is normal today once seemed like a farfetched idea) ||

Hello everyone! I hope you’re all taking care of yourselves.

If any of you have questions you’d like me to dive into, feel free to let me know, either here or in the Substack subscribers’ chat.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

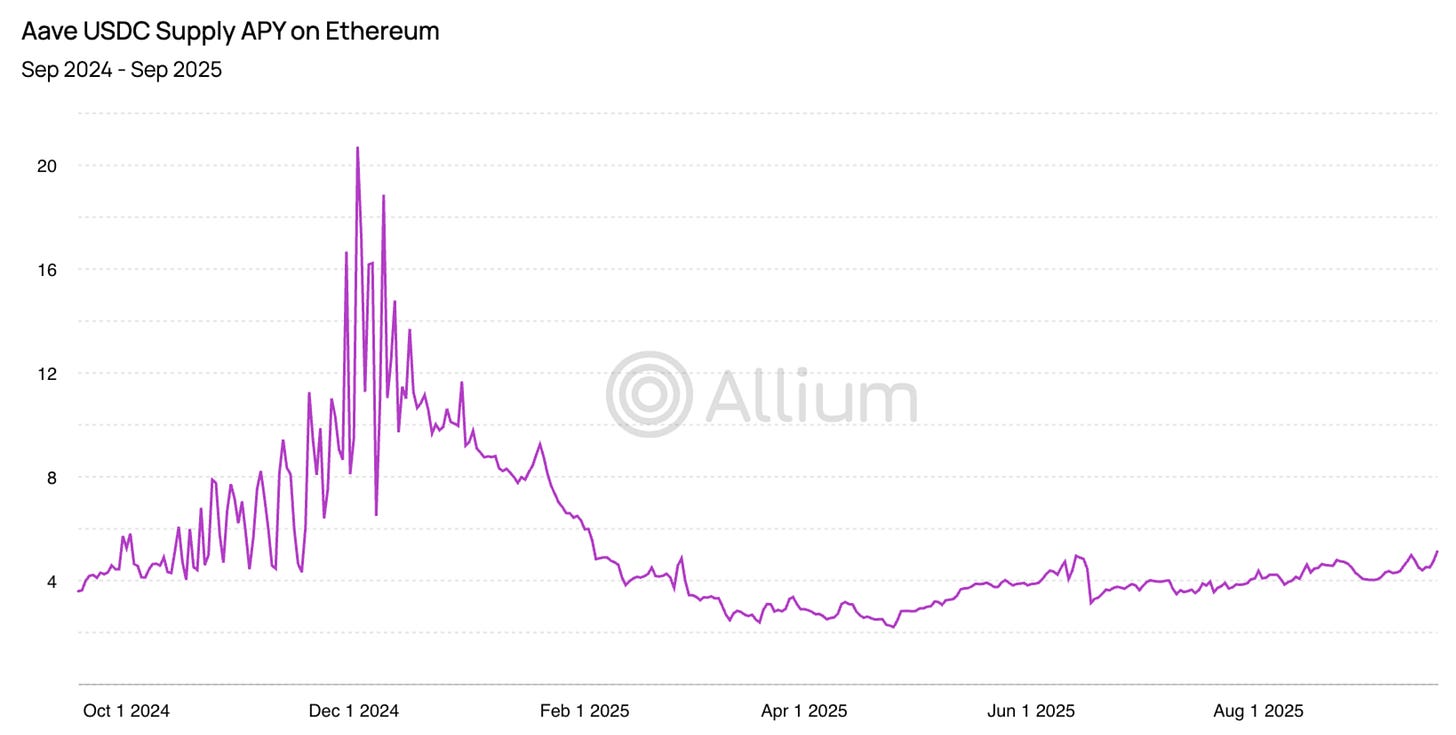

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Zelle + blockchain: it’s the utility, not the tech

Geopolitics: an axis shift and the impact on crypto

Macro-Crypto Bits: a breather for markets, gold, the next Fed Chair

Also: Asian trade deals, Nigerian infrastructure, Chinese stablecoins and more

WHAT I’M WATCHING:

Zelle + blockchain: it’s the utility, not the tech

Back in 2017, a consortium of the largest banks in the US launched Zelle, a real-time payments platform built to compete with Venmo, a fintech payments platform acquired by PayPal in 2013. Today, Zelle has 78.4 million active users, and last year processed $1 trillion in payments distributed across 3.6 billion transactions. In other words, it’s done well.