The macro stage, and the next act

plus, mBridge enters a new phase, and divergent China narratives

“The reason most people fail instead of succeed is they trade what they want most for what they want at the moment.” – Napoleon Bonaparte ||

Hello everyone, I hope you’re all doing well! Especially since this is likely to be one of the most stressful weeks of the year, in terms of widespread anxiety. In situations like this, I find it essential to remember that the sun will continue to rise each morning, whatever happens, and we’ll be ok. We’ve repeatedly shown that, collectively, we can get through stuff.

Below, I look at macro signals heading into the US election and this week’s FOMC meeting. It’s long and chart-heavy, but important as the narratives are confusing – I do my best to untangle them for you.

I also update on the latest mBridge news, which matters for cross-border CBDCs and tokenization.

Crypto doesn’t get much of a look-in today, which is a pity since there have been a ton of relevant news items over the past few days that reflect continued progress in its impact on the macro landscape. Tomorrow I should be able to share some of those.

IN THIS NEWSLETTER:

The macro stage, and the next act

mBridge update: is sharing possible?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You’ll get ~daily commentary on markets, tokenization, regulation and other signs that crypto is impacting the macro landscape.

WHAT I’M WATCHING:

The macro stage, and the next act

F. Scott Fitzgerald once said: “The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.”

While the first-rate intelligence assumption may be a stretch for a Monday morning, the market is reflecting split narratives, which strangely sort of makes sense.

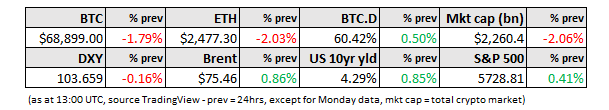

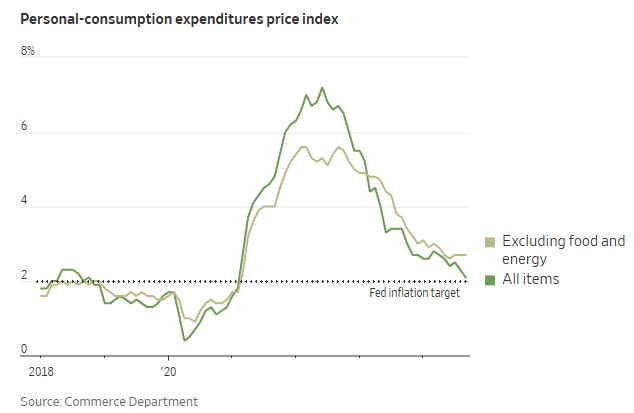

On the one hand, bond yields are projecting well beyond this week. They took one look at the outsized US rate cut in September and started climbing, essentially saying that politics was likely to bring inflation back and getting so far ahead in rate cuts was depleting the arsenal that just might be needed. The 10-year yield is betting that the Fed will not be able to cut rates as much as was initially hoped, and that overall macro uncertainty deserves a higher risk premium. Even the bad US jobs report on Friday (more on this below) produced only a brief hiccup.

(chart of the US 10-year yield via TradingView)

This weekend’s poll shift, however, giving Harris a lead in key swing states, seems to have sent a louder message, hinting that the underlying macro outlook is not as important here as the election outcome.

At issue is the likely debt profile of the two parties, with the Committee for a Responsible Federal Budget estimating that a Trump administration would increase the overall US debt by roughly double what a Harris administration would achieve.

(chart via Bloomberg)

The bond market is telling us that it is concerned about the demand/supply balance for US treasuries.

Rates expectations, however, are focused on short-term Fed policy, a different (but obviously related) target with different (but also related) inputs.

The CME futures market is signalling an almost 100% chance of a 25bp rate cut on Thursday (if you’re wondering why Thursday and not the usual Wednesday statement, it’s been bumped a day because of the election). Another 25bp in December is at a 75% probability.

(chart via CME FedWatch)

Why would the bond market signal both a cut and inflation risk ahead?

In part, it’s because short-term CME futures are signalling what the Fed will do, not what it should do – that’s more the purview of the long-term end of the market.

As we have seen, the Fed’s moves don’t matter that much for either monetary liquidity or economic activity, at least not directly. During the steepest hiking cycle in decades, economic growth has been fine, and liquidity conditions have been loose. Fed moves matter more for expectations management, which does have an indirect impact on spending and saving.

Even Fed Chair Powell has acknowledged that a big part of his job is messaging. The Fed needs to transmit control and stability, else expectations could come unmoored which would put the treasury market at risk, and that is not allowed to happen. As it is, the MOVE treasury volatility index is signalling stress, and on Friday touched its highest point since October 2023.

(chart of the MOVE treasury volatility index via TradingView)

So, while I don’t think the Fed should cut rates this week based on economic signals, I think it will, for the appearance of stability. A 50bp cut was rash (and produced the first dissent from a Fed governor in decades), but to abruptly stop might create more uncertainty than to continue at a slower speed.

Plus, the Fed has not at this stage sent any hints that short-term rates expectations are wrong, and it won’t want to surprise the market. Officials are currently in the pre-FOMC meeting blackout period when they cannot make public statements, but Fed Chair Powell would find a way to get a message out if he wanted to.

Divergent paths

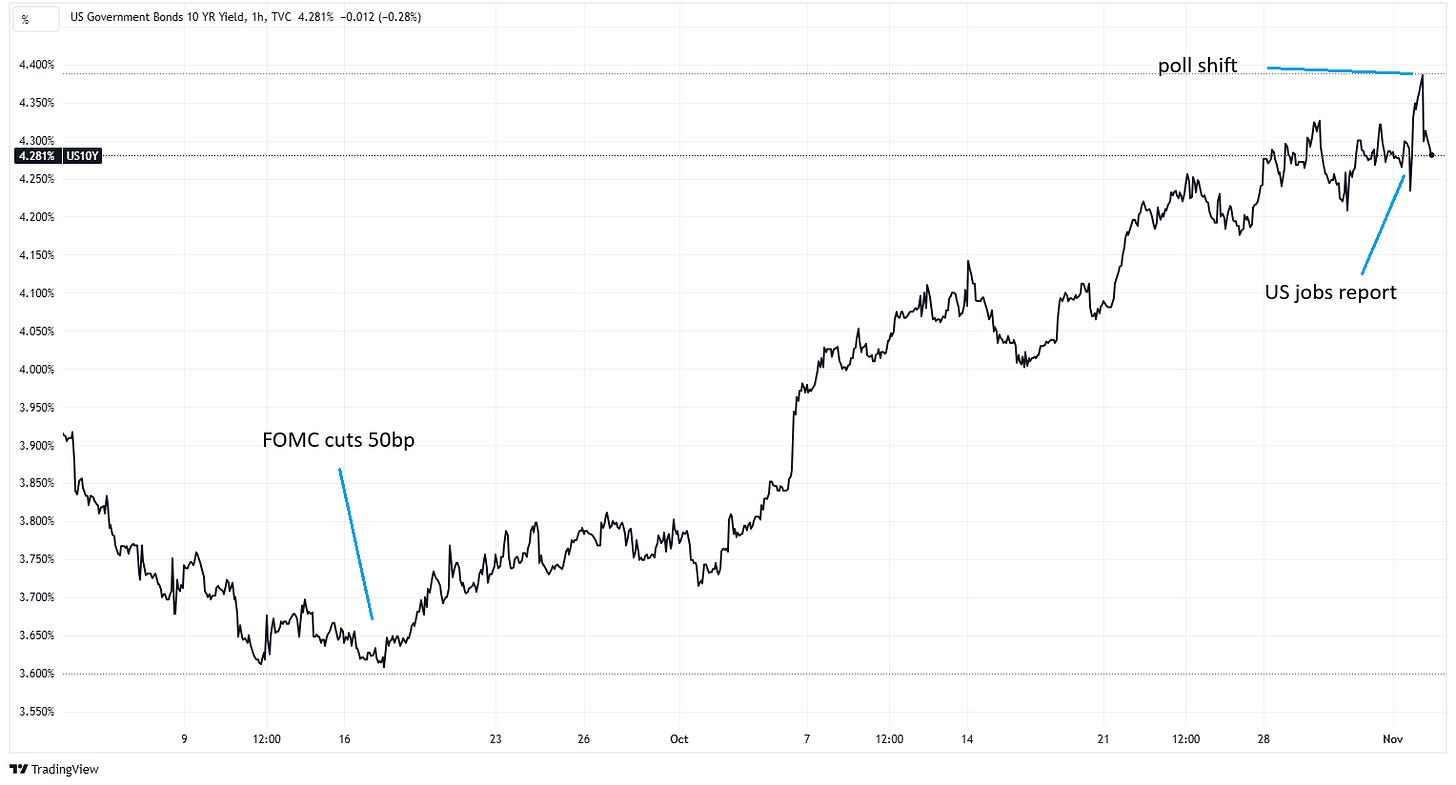

Now, a fed funds cut with climbing yields sounds unnatural – surely something will snap? Not necessarily.

An intuitive assumption is that fed funds and the 10-year yield should follow each other – that holds more for the 2-year yield, however, as the fed funds is a short-term instrument and the 10-year government bond yield is more a reflection of longer-term expectations. There have been many occasions in the past when the two have diverged, and a few when the 10-year yield dropped below the fed funds rate – after all, the bond market can react much more quickly than can the Federal Reserve.

However, these occasions have, for the past few decades, only occurred just before a recession.

(chart via TradingView)

This of course rhymes with the attention on the inversion signal of the 10yr-2yr yield curve, which recently uninverted to much fanfare as analysts start asking if maybe “this time is different”. Maybe this time that heuristic move does not signal a recession is around the corner.

(chart of the 10yr-2yr yield difference via TradingView)

Wishful thinking, perhaps – it’s what most people say just before a recession hits, right?

But the data is not yet weak enough to send a recession flare, not even the jobs data.

The employment spin

Consensus is that Friday’s official US employment report was dreadful, and should worry Fed officials.

According to the Bureau of Labor Statistics, the number of US jobs increased by a paltry 12,000 in October, much less than average expectations and the lowest level since 2020, although some economists had been warning that we could see a negative print.

(chart via Bloomberg)

Stripping out the substantial 40,000 increase in government jobs, that is indeed what we got, with a private sector loss of 28,000 jobs.

What’s more, the employment gains for August and September were revised down by a whopping 112,000.

Another sign that the jobs market is weakening lies in survey reliability. Beyond the frequent revisions, there is the drop in the response rate. The employment report draws from two surveys. One is for households – this is used to determine the unemployment rate. The other is for businesses, known as the establishment survey, which delivers the payrolls number. This had a response rate in October of only 47%, the lowest since January 1991, and well down from September’s 62%.

So, a more reliable indicator of employment growth could come from the household survey, which also produces an employment estimate but one based on working individuals, who can hold more than one job – for this reason, it tends to undershoot the establishment survey number, which reports from the employer’s point of view.

In October, the household survey showed a 368,000 hit to the number of jobs, wiping out a significant chunk of September’s 430,000 increase.

Despite this, due to a dip in the labour force participation rate (the percentage of the population working or looking for work), the unemployment rate held steady at 4.1%. Rounding out to two decimal points, it increased by almost 10 basis points to 4.145%. (Although, the reason only one decimal point is reported is that – given the survey’s inherent noise – two decimal points aren’t any more accurate than one.)

How can this be spun into not-so-bad news?

One factor is the impact of hurricanes and strikes, which makes the drop not necessarily part of a trend. Given the uncertainty around the numbers, we could see a revision upward at the next read. Of course, it could also be yet another revision down.

But hiring, although slowing, is still robust. The JOLTS report earlier in the week showed that the ratio of open positions to unemployed workers is 1.1, in line with the strong labour market of 2019.

Also, last week’s initial jobless claims tally was the lowest since May, and the number of continuing claims is holding steady.

(chart via Investing.com)

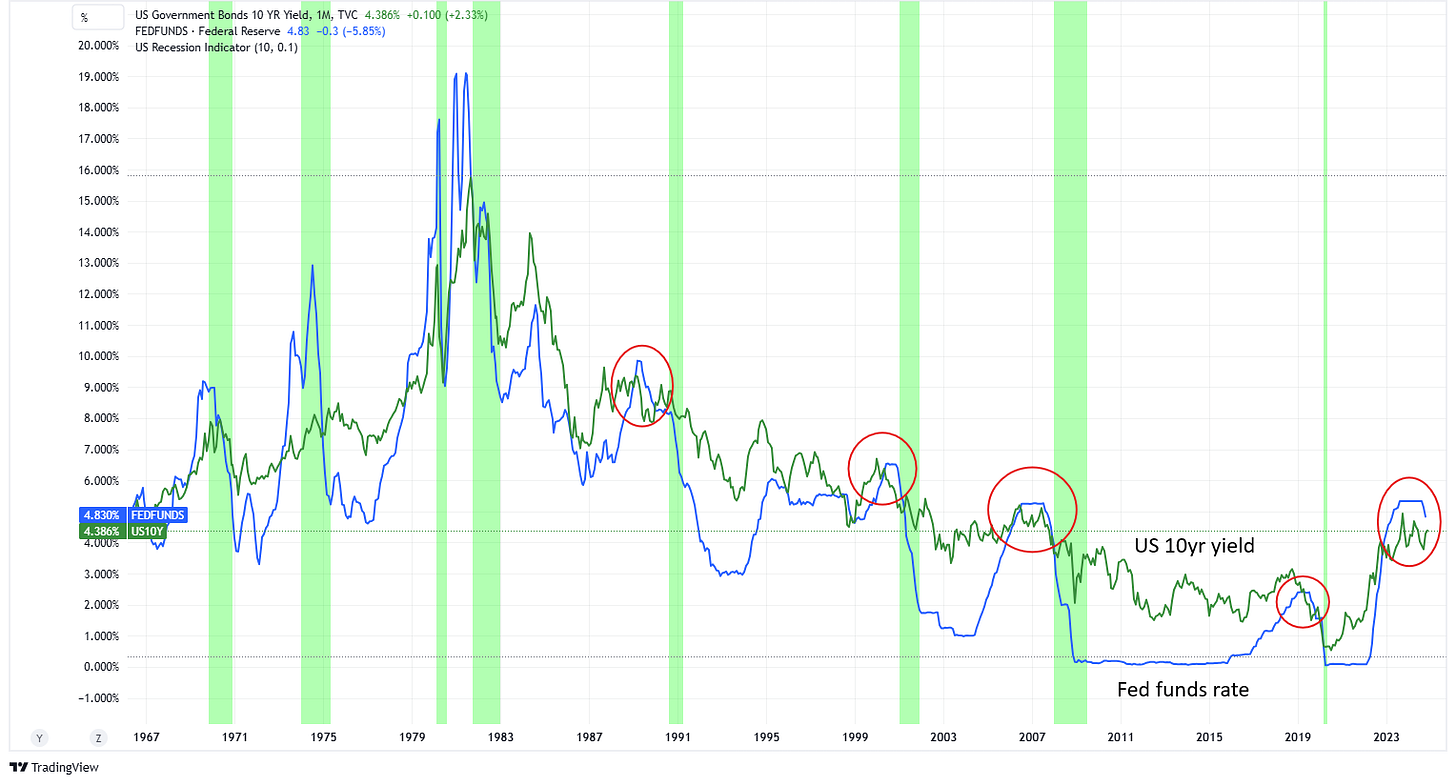

Inflation is stubborn

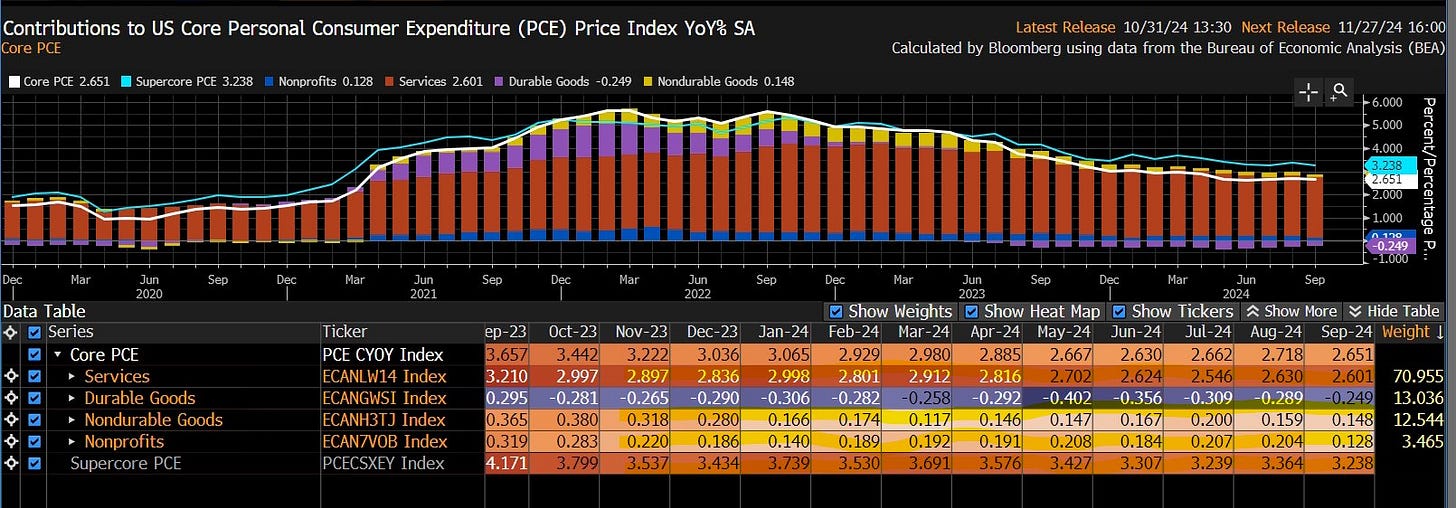

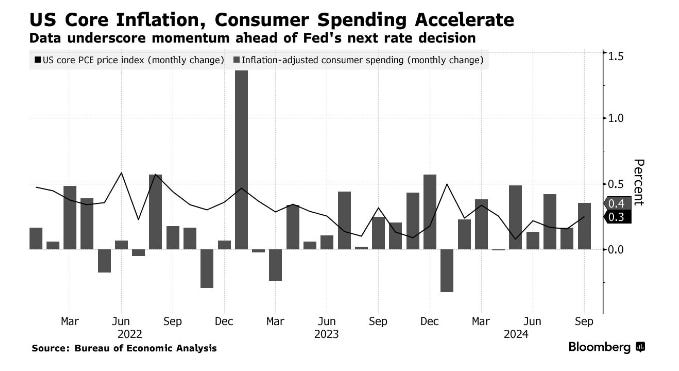

Moving on to inflation, there are signs of stickiness. The latest Personal Consumption Expenditure release for September, released last Thursday, showed an acceleration in month-on-month growth in the headline index, from 0.1% to 0.2%. The more significant core index growth accelerated from 0.2% to 0.3%, the highest rate since April, keeping the year-on-year growth flat at 2.7%.

(chart via the Wall Street Journal)

The Fed’s preferred measure of supercore PCE, which strips out the impact from energy, food and housing, declined slightly year-on-year to 3.2% from 3.4%, but that is still a long way from 2.0%. What’s more, along with core PCE, its annualized growth has been relatively flat for the past few months. Like I said, sticky.

(chart via @dlacalle_IA)

Much of this is driven by housing, which is a slow-moving index but one that is unlikely to budge much with mortgage rates climbing – last week, we saw that these have climbed back up to 6.72% for a 30-year loan. How can mortgage rates be climbing when fed funds are dropping? Because they are more tied to long-term bond yields, which are climbing (see above).

What’s more, consumers are not yet showing signs of concern. On a monthly basis, US personal spending increased by 0.5% month-on-month in September, higher than the expected 0.4% and the previous month’s 0.3% increase. Adjusted for inflation, consumer expenditure accelerated at double the upwardly revised rate for August.

(chart via Bloomberg)

And the dramatically named “misery index”, which adds together inflation and unemployment, is lower than in any other election year going back to the 1970s, with the exception of 2016.

(chart via Bloomberg)

GDP still strong

Then there’s last week’s US GDP report for the third quarter, which showed that US economy grew an annualized 2.8% – this is slower than Q2’s 3.0%, but it’s not bad.

Year-on-year, GDP was up 2.7%, marking the sixth consecutive quarter above 2.5%, the longest such stretch since 2026.

(chart via Bloomberg)

Growth in inflation-adjusted consumer expenditure accelerated from 2.8% to 3.7%, the fastest quarterly growth since Q1 2023. True, this is a preliminary read and could be revised down. And we certainly can’t say the growth is even, with the bulk of spending coming from upper income households buoyed by a rising stock market.

The Fed mindset

In sum, things may be slowing, but slowly, and there are still large pockets of strength. Plus, the outcome of this week’s US election will have a notable impact on the market’s expectations of inflation, bond issuance, even stock market returns.

So, why does a “data dependent” Fed think it wise to continue with its September policy error?

As I mentioned above, part could be to do with the image of consistency, necessary for market and expectations stability.

Part could also be that “data dependent” doesn’t mean succumbing to the influence of noise, and the data has been noisy recently.

Also, it could be that the Fed does not think it is cutting as much as it is “normalizing”. It may be data dependent but it thinks longer term, and will be more driven by its methodical mindset than by market pressure.

BTC still uncertain

What does all this mean for BTC?

The pullback in US yields has triggered a correction in the DXY dollar index, which should support the BTC price.

But, for now, economic and regulatory uncertainty are keeping a lid on market spirits, despite the brief glimpse of excitement we saw last week.

(BTC/USD chart via TradingView)

This is healthy – without it, we would be bracing for a strong sell-the-news or disappointment correction (with a Harris win seen as not nearly as supportive for the industry). Of course, that doesn’t mean this week won’t be volatile anyway.

Longer-term, the narrative for BTC is strong, especially given the likely currency debasement ahead, and not just for the US dollar. On the regulatory front, any change of administration is likely to be positive, as even just a new SEC chief would be an opportunity for dialogue and progress toward greater clarity. And there are more potential upside surprises lurking in the wings than there are downside shocks.

mBridge update: is sharing possible?

It’s official: the BIS is handing over management of the mBridge cross-border CBDC platform to its participants. Going forward, the central banks of China, Hong Kong, Thailand, the UAE and Saudi Arabia will handle the governance and development of the project.

There are plenty of undercurrents here – as I wrote last week, the IMF, World Bank and the BIS have voiced concern that mBridge could be a springboard for the launch of a similar platform for BRICS countries as a way to reduce dependence on the dollar (and, for Russia, to get around sanctions).

Now, the spin is that mBridge is doing so well that BIS involvement is no longer necessary.

This was not the impression given the previous week at SWIFT’s Sibos conference in Beijing, where PBoC officials spoke of the difficulty of reaching agreement among participants with different priorities. It also mentioned some technical issues, and the unspoken implication is that governance is hard, especially when national interests are at stake and geopolitical issues need to be deftly navigated.

Hopefully development will continue without the BIS’s mediating influence, as the potential is significant – a multi-CBDC platform would open up not just more efficient trade opportunities between participants, but also would be a big step forward in asset tokenization.

Whether it would influence the BRICS decision to develop an alternative payments system for the group, well, that’s a more complicated issue.

See also:

LISTEN/READ:

A strong argument and an excellent read from Gavekal Research (front of paywell) on why China’s economy is stronger than most Western analysts are saying. Put differently, there’s the internal narrative within China, and then the exported narrative that Western research and media focuses on, and we should be asking why there’s such a difference.

WHAT I’M LISTENING TO: This one feels appropriate for today – The Times They Are A-Changin’, by Bob Dylan.

HAVE A GREAT DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.