China and stablecoins: there’s more

plus: market pause, manufacturing, stablecoin regulation and more

“Although our intellect always longs for clarity and certainty, our nature often finds uncertainty fascinating.” – Carl von Clausewitz ||

Helloooo everyone! I hope you’re all hanging in there.

Tomorrow at 9am EST I’m appearing on Scott Melker’s daily show with Dave Weisberger, who is always fun to talk to. I don’t have a link to the livestream yet, but you can find Scott’s channel here.

🍂 And if you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, I hope you’ll subscribe to (free!) sister publication Cripto es Macro. 🍂

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

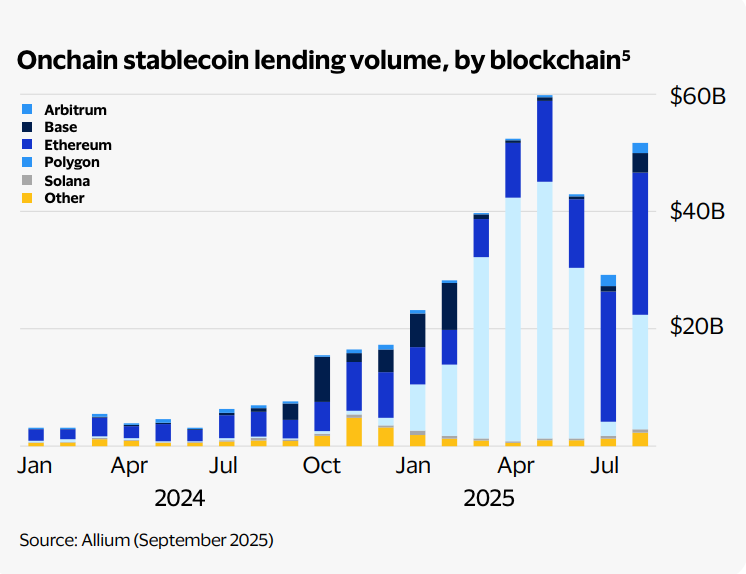

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

China and stablecoins: there’s more

Stablecoins: the regulatory push

Markets: not yet

Macro: US manufacturing

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

China and stablecoins: there’s more

Yesterday, I wrote about adoption of dollar stablecoins in China, citing examples from a recent article in the South China Morning Post. The growing use comes despite frequent public statements from the Chinese central bank (PBOC) that trading in digital currencies of any sort – including stablecoins – is banned.

Of course, one thing is the official stance, which has to be taken in the context of concern around speculation, especially given the imperative to stimulate constructive consumption.

Another thing is enabling export/import businesses hit either directly or indirectly by sanctions to continue operations.

In sum, what the authorities say and what they do regarding stablecoin use don’t have to match.

It’s the same with Bitcoin mining. It’s banned, but Bitcoin mining activity in the country is picking up, and the authorities know this. They’re not clamping down – rather, they see it as a productive use of stranded, cheap energy. But they don’t want to officially encourage it as that could lead to power drains and crypto trading. So, the ban is unlikely to be removed, but some mining operations will be tolerated and perhaps even supported given the potential income.

This split between official attitudes and actual activity doesn’t mean there’s anything underhand going on, just that the authorities understand the power of messaging as well as the risk of momentum in such a large country. They’re feeling out the balance between support and control.

There is no incentive to remove crypto and stablecoin bans just yet: they enable control and put significant speed bumps in the path of adoption, which helps the authorities control economic activity in sectors that underpin the movement of value and that can fuel destabilizing froth.

But that doesn’t mean there isn’t a plan forming. On Friday, after a coordination session on digital asset regulation, the PBOC issued a statement reiterating that virtual currency activity was illegal. But it’s unlikely that the central bank would convene 12 different government departments for a meeting whose sole outcome was a statement saying “don’t” – that’s just the part they want the public to see.

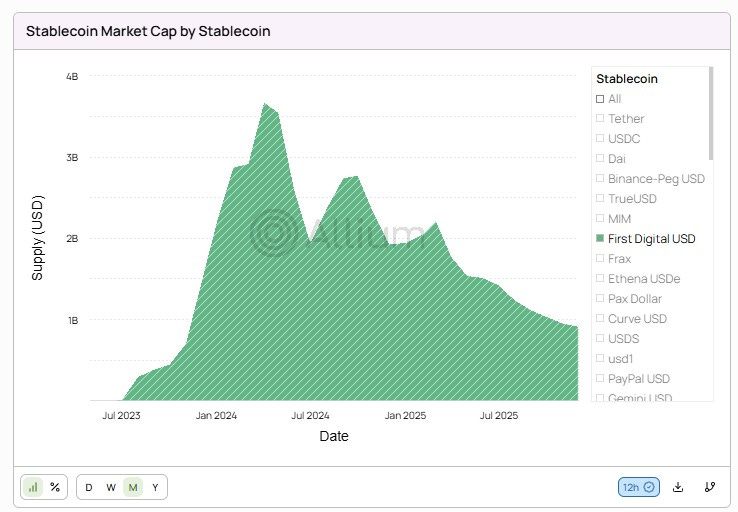

Then, this morning I read about the plan of First Digital Group, issuer of the FDUSD stablecoin, to go public via a SPAC merger. FDUSD is not one of the major dollar stablecoins – its market cap is roughly 0.3% of the total USD stablecoin market, and it has been falling since its early 2024 peak.

(chart via Allium)

Earlier this year allegations started flying about mismanagement of TrueUSD reserves, for which First Digital is fiduciary. Tron founder Justin Sun – who does not exactly have a squeaky-clean reputation – got involved, legal action threats were thrown about, and FDUSD depegged 9%. It recovered, but here we have an example of what the PBOC has been warning about, hoping to list on the Hong Kong Stock Exchange (HKEX).

In theory and in legal code, HKEX is independent when it comes to local company listings. But in practice, the Chinese authorities can wield influence. And the Hong Kong Monetary Authority has not yet granted any issuance licenses under its stablecoin regime, and it has promised to be tough and focus first on financial institutions – so, it’s not clear what First Digital’s business model plan is going forward.

I have no idea whether First Digital will be allowed to list, in a case of “we disapprove officially but we might want to use your stablecoin” – or “getouttahere, we have Chinese institutions working on a more reliable solution”.

Either way, the stablecoin sector in Asia seems to be heating up to a slow simmer, worth keeping an eye on given the market’s potential size.

See also: