Friday, August 23, 2024

Jackson Hole, ATMs, Sony, Mercado Libre, Franklin Templeton

“Time is an illusion. Lunchtime doubly so.” – Douglas Adams ||

Hello everyone, and happy Friday! I hope you’re all doing well.

Apologies for the late delivery today! Below, I look at why Jackson Hole’s symposium matters (it’s not Powell’s speech), and how ATMs are helping to bring about the end of cash. Also, there’s some epic stuff going on with corporate stablecoins and blockchains.

If you find Crypto is Macro Now in any way useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d be really grateful!

IN THIS NEWSLETTER:

Why Jackson Hole matters (it’s not Powell’s speech)

How ATMs can accelerate the decline of cash

Sony’s blockchain

Mercado Libre and stablecoins

Franklin Templeton adds more chains

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

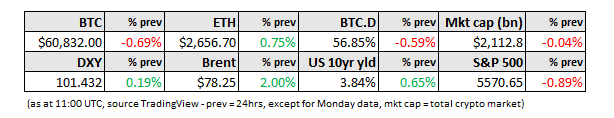

WHAT I’M WATCHING:

Why Jackson Hole matters (it’s not Powell’s speech)

The Jackson Hole symposium kicks off today with Fed Chair Jerome Powell the first key speaker to take the stage, at the refreshingly early hour of 8:00am Mountain Time/10:00am Eastern Time. Notably, this is the only speech of the closed-door event that is broadcast to the public.

Earlier this week, I wrote about how the market’s and the media’s obsession with what Powell says is misplaced – he’s not going to hint at a 50bp cut because the data doesn’t yet warrant that and he won’t want to rattle markets. The more likely 25bp cut in September is already priced in, and doesn’t matter that much for overall sentiment anyway.

However, the overall conference is significant. Central bankers have several opportunities during the year to hang out together, but the two most high-octane ones are Jackson Hole in Wyoming, hosted by the Kansas City Fed, and the more European-focused equivalent in Sintra, Portugal, hosted by the European Central Bank.

The Jackson Hole conference has a much longer history than its European counterpart – it started in Kansas City in 1978, organized by the regional Federal Reserve Bank to focus on agricultural issues. In 1982, it moved to Jackson Hole because Federal Reserve Chair Paul Volcker liked fly fishing, and over time, its scope broadened to include macro and global economic issues.

(photo by Judy Beth Morris on Unsplash)

What’s more, the event has in the past been a forum from which to announce controversial ideas as well as major policy shifts. In 2005, then-Economic Counsellor to the IMF Raghuram Rajan delivered a presentation warning that increasingly complex markets were setting the global economy up for a leverage-fuelled accident. Two years later, he was proven right, and in the aftermath of the 2008 financial crisis, Fed Chair Ben Bernanke used Jackson Hole to introduce the concept of “quantitative easing”.

This year’s event is especially relevant – its theme is "Reassessing the Effectiveness and Transmission of Monetary Policy," and I’m hoping Powell’s speech touches on the long-term implications of the interplay between monetary tightening and fiscal stimulus. Other talks and panels include an analysis of the recent inflation surge (we’re still waiting for a reckoning on why the signals were ignored for so long), as well as how financial markets and also bank balance sheets impact the transmission of monetary policy. Many of the speakers are well-known economists from academia, but the group will also hear from governors and representatives of the central banks of Brazil, Norway, the EU and the UK. I hear the huckleberry cocktails are particularly delicious.