Friday, Oct 11, 2024

all macro today - CPI and jobs

“Good questions outrank easy answers.” – Paul Samuelson ||

Hi everyone, and HAPPY FRIDAY!!!

A super-short email today as, well, it’s Friday and I’m sure a lot of you are as exhausted as I am if not more so. Also, it’s macro-heavy, with a ton of charts on yesterday’s CPI and jobs data, plus a quick peek at what’s depressing BTC.

There’ll be no recording today since it’s mainly charts, and I’m making this free for all to read.

Scott Melker invited me on to his Wolf of All Streets show yesterday for a fun chat about the macro outlook and what’s going on in crypto, you can see that here.

Programming note: I’m in London and Edinburgh next week, and so I’ll have to miss a few days of publication – for now, I’m planning to publish on Monday and Wednesday, and will be taking the rest of the week off. Thanks for your understanding! 😊

IN THIS NEWSLETTER:

CPI: a whole pot of confusing tea leaves

Jobs data would like a word

WHAT I’M WATCHING:

CPI: a whole pot of confusing tea leaves

As is becoming the norm, yesterday’s CPI data had something for everyone.

There was the good news in that the headline CPI index for September decelerated to 2.4% from 2.5% in August, led by a 6.8% drop in energy prices.

(chart via the Financial Times)

Shelter inflation, typically one of the “stickier” components, also helped with its deceleration to 2.7% annualized, from 6.4% in August.

(chart via @VincentDeluard)

There was bad news in that, while down, the headline CPI growth was higher than the expected 2.3%. Month-on-month, headline inflation held steady at 0.2% – but the consensus forecast was for it to slow to 0.1%.

More than 75% of the advance came two sensitive areas. One is food – this is not good at all, as it’s the last CPI read before the US election in November, and food inflation is something voters care about.

The other is shelter – as I mentioned above, this has decelerated but it’s still high. And if you look at the month-on-month figures, it could pick up again, especially if house prices (reflected in the “owners’ equivalent rent” component) start to recover along with an uptick in demand triggered by lower mortgage rates.

(chart via @ericwallerstein)

More bad news was embedded in the core CPI, which strips out the more volatile components of food and energy. This accelerated from 3.2% in August to 3.3%, the first acceleration in 18 months. Expectations were for it to hold steady. Month-on-month, core inflation increased by 0.3% for the second month, while the consensus forecast was for the index growth to decelerate to 0.2%.

(chart via Bloomberg)

Drilling down further, the Fed’s preferred “supercore” inflation measure, which strips out food, energy and housing to get a wage-sensitive index, climbed on a month-on-month basis by the most since April, in its third consecutive acceleration – this is not moving in the right direction.

(chart via @LizThomasStrat)

On a year-on-year basis, it looks stuck.

(chart via Bloomberg)

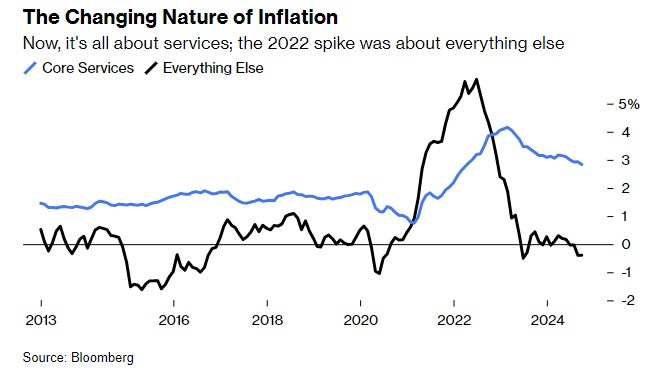

The message here is that wage pressure is still inflationary, and that core services inflation will be difficult to bring down further. Not impossible, but it is unlikely to happen quickly without a sharp recession and/or a spike in unemployment.

(chart via Bloomberg)

And the breadth of high increases is concerning. It’s not just the size of CPI moves that matters, since one outsized jump can distort the read – the breadth matters, too, as in how many categories are increasing and at what pace? On this, the news is not good. In the latest data set, more categories than usual are increasing faster than 1.5% month-on-month.

(chart via @jnordvig)

Nevertheless, September’s CPI report shouldn’t change the Fed’s conviction that inflation is on a downward path – put differently, at worst we’ll get a pause in rate cuts in November, as the FOMC waits for more data.

In an interview yesterday, Atlanta Fed President Raphael Bostic said that he was “open” to a pause in November, and that he thinks the Fed will only implement one more cut this year. The FOMC minutes released on Wednesday showed that there was heated debate over cutting 50bp, and the decision produced the first dissent from a Fed governor since 2005. It’s likely that those preferring more caution in September will push for redress at the next meeting, especially given this CPI read as well as uncertainty regarding the impact of the now resolved dockworkers’ strike and the devastating hurricanes.

I’m in the camp that we’ll get no cut at all (I went into more detail on this here) – markets will be volatile that week anyway (the election is two days before the FOMC statement), and the data is not presenting a compelling enough reason to rock the boat further with another contentious decision.

Jobs data would like a word

Yesterday’s CPI read supports what I wrote earlier this week, about how inflation is still relevant to rates watchers and that sooner or later it would find a way to remind us of that.

Jobs data is still the main focus, however, and yesterday delivered on that front as well. The weekly read of initial jobless claims came in way higher than expected, 258,000 vs a median forecast of 231,000.

(chart via Bloomberg)

This can be largely attributed to the hurricanes Helene and Milton, so are probably not indicative of a rapidly worsening trend. For that reason, this bad number is unlikely to have much influence on the Federal Reserve’s November decision. But it does push jobs data even more into the foreground, while further obfuscating its signal.

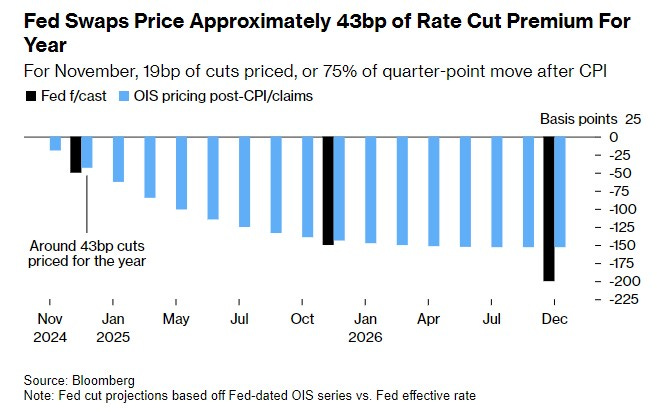

Markets are repricing rate cut expectations for the year, and are starting to show doubts that even the Fed’s own projections of two more cuts will be realized.

(chart via Bloomberg)

And US treasury yields are signalling rate stickiness ahead, with the 10-year now comfortably above 4.0% and at its highest since August, before September’s surprise double cut.

(US 10-year treasury yield, via TradingView)

BTC, meanwhile, got hit yesterday with the double-whammy of rate expectations adjustments, and concerns that the US government could soon start to sell the 69,370 BTC it seized from the Silk Road marketplace.

(BTC/USD chart via TradingView)

What’s more, yesterday’s news that the SEC has charged Cumberland DRW, one of the ecosystem’s largest market makers, with acting as an unregistered dealer. Cumberland has said it will fight back, and it will probably win – but this move is not helping the mood.

October is usually a strong month for BTC, hence the term “uptober”. We’re not seeing signs of that yet – month-to-date, BTC is down over 3%, while the average performance for the month is around 26%.

Sure, this particular October has some unique characteristics – regulatory as well as macro uncertainty, and some overhangs of potential selling, to name just two.

We may have to wait until November to see these headwinds dissipate.

LISTEN/READ:

Blockworks published an excellent rant by Jake Chervinsky and Amanda Tuminelli on the SEC’s egregious disregard for process and, well, the law.

WHAT I’M LISTENING TO: This is a great Friday song, a welcome pick-up kindly shared by a reader yesterday (thanks, Robert!) – Piranhanana, by Ropes & Shovels.

HAVE A GREAT WEEKEND!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.