Stablecoins vs tokenized deposits: the philosophical conundrum

more jobs data, stablecoin philosophy

“There is nothing like looking, if you want to find something. You certainly usually find something, if you look, but it is not always quite the something you were after.” ― J.R.R. Tolkien, The Hobbit ||

Hello everyone, and HAPPY FRIDAY!!!! What a week…

I would also say “happy jobs day”, but it might not be so happy after all, because we’re in the phase of bad news is bad news and good news is bad news as well. Yech. More on this below.

Also below, I wax philosophical on the impact stablecoins will have on our understanding of “money”. It’s bigger than it sounds.

You’re reading the premium daily Crypto is Macro Now newsletter, in which I look at the growing overlap between the crypto and macro landscapes. If you’re not a full subscriber, I hope you’ll consider becoming one!

IN THIS NEWSLETTER:

An intense jobs week

Stablecoins vs tokenized deposits: the philosophical conundrum

If you find Crypto is Macro Now in any way useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d be really grateful!

WHAT I’M WATCHING:

An intense jobs week

Since US jobs are the theme of the week (month? rest of year?), here’s some more data that suggests today’s release could disappoint an already wary market.

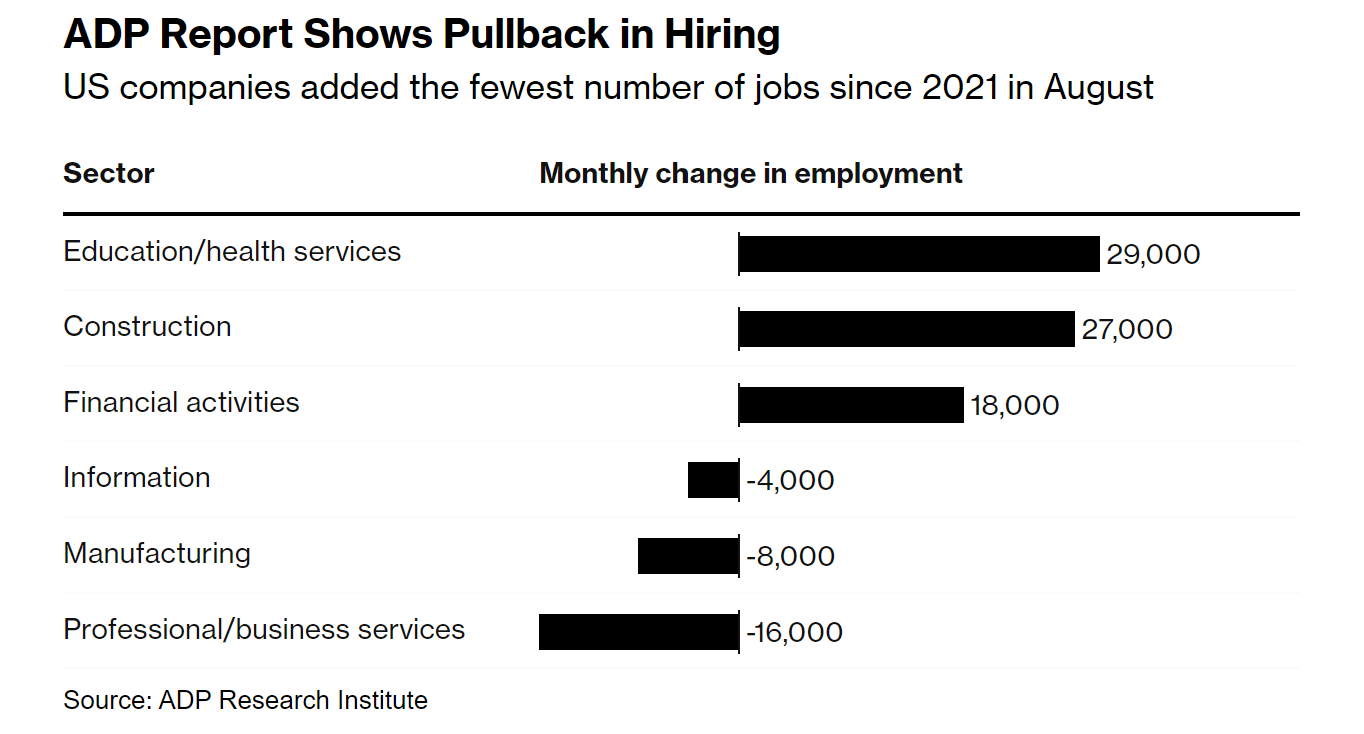

Yesterday’s report on nonfarm private payrolls from ADP came in at 99,000 new jobs added in August, much weaker than the expected 144,000 and weaker than July’s 111,000. The ADP numbers are often taken as a harbinger of the more official and broader BLS numbers due today, but they can differ. ADP Inc is a private company offering payroll solutions – its information comes from its clients, which tend to be larger companies. The BLS data is based on a wider range of companies and some government departments.

(chart via Bloomberg)

The chart above shows that most of the hiring was in education and construction, which highlights the vulnerability – US housing starts for July came in at their lowest level since June 2020.

(chart via Trading Economics)

We also got some insight into hiring and layoff plans from Challenger, Gray and Christmas. In August, almost 76,000 people were laid off, vs just under 26,000 in July (although July’s number was unusually low).

(chart via Investing.com)

Even more ominous were the reasons given. Payroll reductions because of AI substitution could be seen as good news by the market (not so much by the employees affected) as it would show that there are more productivity gains ahead. But these barely make it into the top 10 when adding up year-to-date cuts. Yet there is no positive spin at all on the two main reasons given for letting people go – cost cutting and macro conditions (a semantic difference) imply lower earnings expectations. The stock market is not yet pricing this in.

(chart via Bloomberg)