Monday, Dec 5, 2022

“Nearly all men can stand adversity, but if you want to test a man's character, give him power.” – Abraham Lincoln ||

Hello everyone! I hope you’re gearing up for an interesting week. (Does anyone remember what boring feels like?) You’re reading the premium Crypto is Macro Now, where I look at macro and crypto trends as well as the growing overlap between the two landscapes. I’m glad you’re here. If you find this useful, please consider sharing with friends and colleagues.

And if this was shared with you, or you arrived from somewhere other than your inbox, I hope you’ll consider taking out a subscription to receive daily updates and market insight. I don’t repeat headlines – I do try to tease out overlooked messages.

Programming note: There are two national public holidays where I live this week, on Tuesday and Thursday, which makes no sense – couldn’t they combine them into a nice long weekend? No, apparently they couldn’t. Anyway, this newsletter will only take Thursday off – there’ll be a daily on the other weekdays.

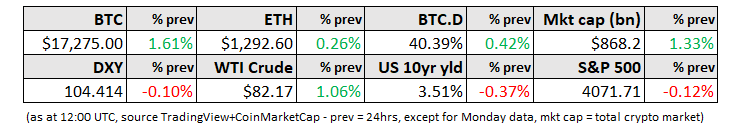

MARKET

Oil market shifts

This week should see some interesting moves in energy markets. Today, the ban on imports into the EU (except Bulgaria) of Russian crude oil via sea transport kicks in. Also, as of today, no maritime services headquartered in the UK or EU can transport Russian oil, even to countries outside the region, unless the crude is sold at less than $60/barrel.

This is significant, not as much for the impact on oil supply as for the headline departure from economic orthodoxy. Here we have buyers dictating the price of a crucial commodity. This is arguably the most disruptive shift in global trade since the outbreak of the war in Ukraine.

The situation is somewhat confusing, so a couple of points need to be clarified:

The EU will not import Russian crude at any price (there are a couple of country exceptions).

Shipments to other areas will continue to be covered by EU and UK services only if the oil price cap of $60 is respected.

This is a big deal, since the London-based International Group of Protection & Indemnity Clubs (IGPIC), made up of 13 mutual underwriting associations, covers 95% of the global tanker fleet and relies on Europe for reinsurance.

Russia has effectively said “hahahaha no”, and is apparently drawing up a decree that will prohibit Russian producers and traders from selling crude to any nation participating in the price cap.

For now, it is unclear what impact that would have on global shipments. Over the past few months, Russia has reportedly been boosting its “shadow fleet” with the purchase of over 100 second-hand tankers. Alternative insurance networks will take time and capital to set up, but it is not impossible to do so, and some may already be in place.

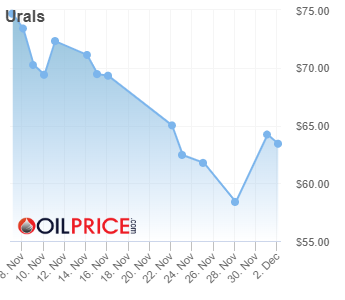

Urals is typically used as the price benchmark for Russian oil exports. Last week it dipped below $60/barrel but has since recovered to around $63. Most recent Russian crude sales have reportedly been below the $60/barrel cap, regardless of the quoted urals price.

(chart via oilprice.com)

Bigger picture, here we have political interference in free trade on an unprecedented scale, with a large bloc of buyers issuing an ultimatum to a key seller. By attempting to set a price cap, the G7 and EU are introducing centralized control into a global commodity market, not dissimilar to the “cartel behaviour” they accuse OPEC+ of.

There’s also the shift from weaponizing trade to weaponizing transport and insurance, which highlights the risk of concentrating services in one geographical area. The likely fragmentation of the industry going forward will raise costs for all, as well as reduce transparency into volumes and routes. It will also facilitate trade with other sanctioned countries such as Iran and Venezuela.

And there’s the heightened risk of an environmental disaster. The tankers acquired by Russia are not new and do not have to hold to European compliance standards – many were originally destined for the scrap heap. Furthermore, the servicing they will receive is unlikely to be as experienced as with EU/UK firms.