Monday, Mar 13, 2023

The narrative shifts, the impact on crypto, and a couple of distractions...

“When you pray for rain, you have to deal with the mud too.” – Denzel Washington in ‘The Equalizer’ ||

Hi everyone! I’m not going to say I hope you had a restful weekend because I know many of you didn’t… I am going to try to accommodate the North America daylight savings shift (when can we stop with this clock messing??? please???) by sending this earlier European time, but given how much there is to absorb every single day, I can’t promise 😝. And the stick figures will be back when I manage to solve a frustrating tech issue 😖.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems – I’m glad you’re here. I’m making this one free access to all, because we are experiencing an important market shift. Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). You’ll get emails like this every weekday (except for holidays).

MARKETS

So it begins

After a weekend that I don’t think any of us will ever forget, Monday starts us off in a very different market – a lot changed over the past few days, and it feels like we are entering an unwinding of sorts.

Among the irrevocable shifts that are likely to shape prices and policy over the coming months:

1) Three US banks have been wound down over the past five days. Depositors for two of them will recover their funds, but the speed with which it happened, the megaphone of social media and the ease of transferring money online are understandably going to make depositors everywhere, especially those in regional banks, nervous. That said, the measures put in place should help stave off more failures as a result of continued deposit outflows, which in turn should stem the outflows.

The Fed’s new Bank Term Funding Program (BTFP) will allow banks to use any US treasury bond as USD collateral at par for an advance, even if the asset’s market value is well below. This essentially amounts to the Fed advancing money to banks – they could get par for their bonds if they held them to maturity, but if they needed to sell them in the market to raise cash to meet withdrawals, they would do so at a loss. The Fed will temporarily make up that loss, which is pretty much the same as lending unsecured money to banks, which should boost market liquidity.

2) All three banks serviced the crypto industry, and the lack of information regarding the closure of Signature Bank, so close to that of Silvergate, heightens suspicion that this is a frontal attack on the crypto ecosystem. Given the aforementioned megaphones as well as the not inconsiderable crypto influence in Washington DC, this could escalate into a loud political issue, which to some extent will be drowned out by the brewing chaos but which is not going away. A large bear has been poked with a sharp stick.

3) The decentralization and hard asset approach to banking that this large bear advocates will attract more attention as the public inevitably becomes more aware of the opacity and fragility of the traditional banking system, as well as the arbitrary nature of its centralized control. A new narrative tailwind is brewing.

4) The systemic risks of rapid rate hikes are becoming more obvious. Inflation is a problem, yes, but banking failures are a more immediate one, and the Fed’s mandate includes financial stability. With last week’s events, it now has its hands largely tied regarding further hikes to slow down consumption growth. We will probably get another 25bp next week since there is some momentum in play here and the Fed can’t be seen to be panicking – but, Powell may decide that being “reactive” in the face of a crisis trumps being steady in terms of public respect, so a pause is not out of the question. Either way, 50bp is definitely off the table now, and the terminal rate will most likely be lower than we were expecting just a few days ago.

Tomorrow’s inflation data will, as always, be a key macro indicator, although consumer price pressure is temporarily taking a back seat to systemic risk concerns (just as the labour data did on Friday). Unless we get a bad surprise in the form of a strong miss to the upside, it does look like inflation data will allow for a temporary attention pivot. Later today we get the NY Fed’s consumer inflation survey result, which tracks expectations for inflation a year out and has been steady at 5.0% for the past couple of months (down from 6.0% a year ago). Meanwhile, five-year inflation expectations derived from treasury prices have taken a dive recently. Unfortunately, this is probably because the odds of a sharp recession have just gone up.

(chart via the St. Louis Fed)

5) Volatility is back. Last week, volatility for stocks (VIX) and especially for bonds (MOVE) surged to year-to-date highs and, given the fractures appearing in the traditional banking system, they are unlikely to return to January lows. Bond and stock prices are not reacting to the collapse of three banks, they are reacting to a change in the bigger picture. The market has been made painfully aware that earnings are fragile, unemployment is likely to go up and the Fed now has fewer tools with which to fight inflation. While monetary easing should boost some asset values, uncertainty will be high for quite a while.

(chart via TradingView)

The crypto angle

With huge respect for the stress and pain the past few days have inflicted on entrepreneurs, employees, treasurers, bankers and anyone sensing panic in the air, I’ll say this bluntly and almost with regret: All this is good for bitcoin.

There’s the macro outlook: a slower hiking pace and a lower terminal rate, plus the likely injection of liquidity to prop up banks struggling to meet withdrawals (through the BTFP facility outlined above) imply greater market liquidity, even if this could be partially offset by higher volatility. I’ve written before about how BTC is one of the most sensitive assets to market liquidity, since its “risk” profile is unencumbered by earnings or ratings concerns.

And there’s the narrative tailwind: Bitcoin’s potential role as a decentralized, seizure-resistant store of value contrasts what the public has learnt this weekend about traditional banking fragility. Unlike during the last financial crisis, this time investors, treasurers and retail observers have an alternative. Even the possibility that the market could see new inflows on the back of this realization should be enough to attract further inflows as professional investors try to front-run the narrative. Both BTC and ETH have rallied almost 13% and 15% respectively since early Friday, while global stock markets are taking a beating.

(chart via TradingView)

However, there are headwinds: a lack of convenient fiat access for businesses operating in the crypto ecosystem, either as service providers or investors. With the closure of Silvergate Bank’s SEN network, which offered 24/7 fiat transfer, many businesses pivoted to Signature’s Signet network. Now that this is out of commission, there is no convenient alternative. This could slow down the development of useful services, which should be a drag on US adoption. Fortunately, other jurisdictions do not have the same limitations, and progress will probably accelerate outside the US as talent and capital migrate.

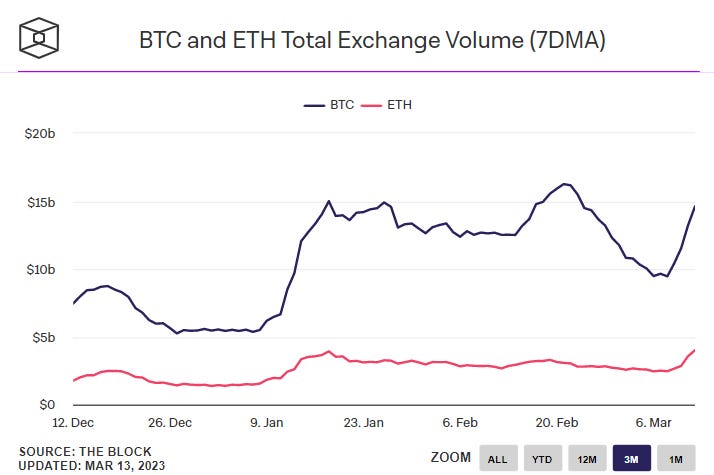

Meanwhile, spot volumes are rising sharply, and Binance’s announcement of the deployment into the market of $1 billion BUSD most likely triggered some short covering.

(insert The Block Data)

Even given the macro and narrative support, crypto markets still have a significant uncertainty overhang. BTC annualized daily basis on Binance took a dive, signalling expectations of lower future prices.

(chart via The Block Data)

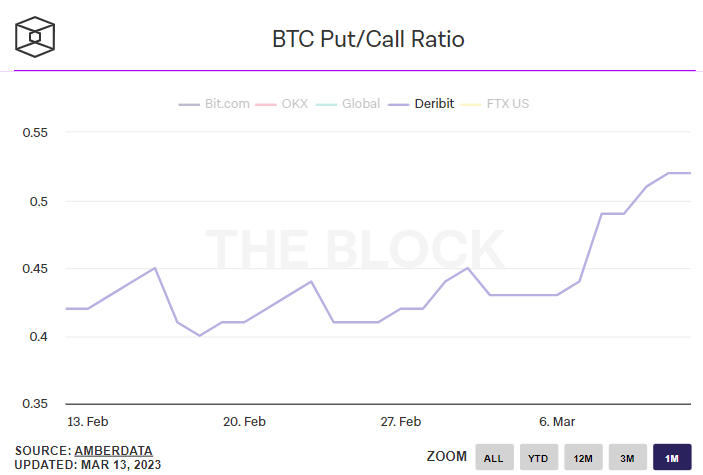

And the BTC put/call ratio is jumping, which hints at an increase in positioning for a price drop.

(chart via The Block Data)

Buckle up, this will be a volatile week.

NEWS

A technical premium. CoinDesk’s Omkar Godbole yesterday highlighted an interesting crypto market structure glitch: for much of the weekend, BTC was trading at a higher price on Coinbase than it was on Binance. You would think this discrepancy would close immediately, given the arbitrage opportunity (buy on Binance, transfer over to Coinbase to sell), but its persistence shows that it wasn’t just about market pricing. Last July, Coinbase merged its USDC book with its USD book, effectively combining BTC/USDC and BTC/USD trades into one data feed. Over the weekend, USDC was trading at a discount to par which pushed BTC/USDC (and consequently also BTC/USD) up relative to the same pair on other exchanges, and even relative to Coinbase’s BTC/USDT pair. This isn’t really material, since were you to sell your BTC for USD on Coinbase over the weekend, you might have gotten more USDC than you would have had you sold on Binance for USDT, but they would have been worth less, so in theory the actual USD amount would have evened out. It is an intriguing twist to crypto markets, however, and another way in which they are so very different from traditional venues.

(chart via TradingView)

Why privacy is important. This is not news, and I hardly ever include items based on “thinking about” doing something or even “plans” to do something (I prefer to wait until it is actually being done) – but this piece was too delightful to not include. The Belgian digital minister is talking about proposing a custom-built EU blockchain for supply chains, document registration and public services, which would have privacy baked in. As he pointed out, you don’t want people to know if you’re taking your mistress out to dinner, now do you?

Also:

Here’s something totally unrelated, because why not, some of us could use a distraction: According to The Verge, vinyl sales beat CD sales last year. The surprising thing here is that people are still buying CDs (vinyl I get, even if only for the album covers).