Revisiting Bretton Woods III

Plus: wholesale inflation, US manufacturing, market bounces and more

“It is what you don’t expect... that most needs looking for.” – Neal Stephenson ||

Hello everyone! I hope you’re all taking care of yourselves. Exhausting times, but also, the scale of change is exhilarating. You’ll need stamina.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

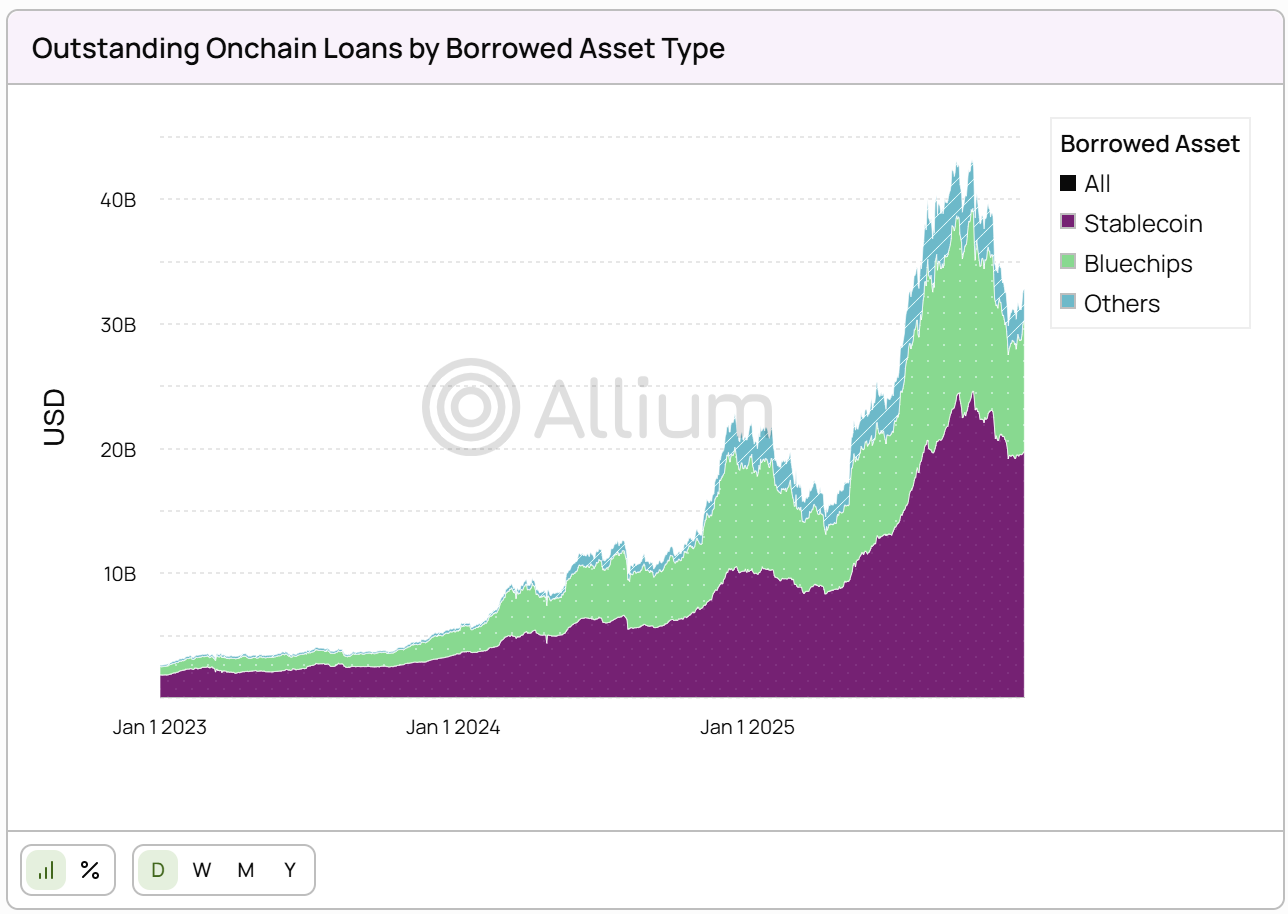

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Revisiting Bretton Woods III

Macro: watch those prices

Markets: all good now?

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Correction on jobs data:

Yesterday, in the “Coming up this week” section, I wrote that we would get the US jobs data for January on Friday. Nope, the Bureau of Labor Statistics (BLS) has announced that publication will be delayed. We also won’t get the scheduled JOLTS report.

It seems the partial government shutdown that everyone assumed would be over in a blink could drag on for a bit, and it looks like the BLS wants to clear the calendar just in case. The BLS is part of the Labor Department which was only funded until January 30. While the Senate passed a funding resolution last Friday, this still has to get voted on by the House of Representatives, hopefully today.

Revisiting Bretton Woods III

Back in March 2022, many of us were fascinated by a theory put out by Zoltan Pozsar, then chief economist at Credit Suisse (his note seems to have gone offline, here I’m going by my notes). The Russian invasion of Ukraine was sending commodity prices haywire and triggering signs of stress in money markets – and Pozsar recommended going long shipping freight rates. Depending on which index you prefer, rates since then have either normalized (Drewry, Baltic Dry) or remained elevated although declining (PPI), but they’re not the point here.

In suggesting going long shipping, Pozsar was drawing our attention to the fundamental shift in global value away from finance and towards physical goods, specifically commodities. What’s more, he predicted this shift would form the basis for a new global monetary order: Bretton Woods III.

Today, his point hits home even harder, as money and financial engineering struggle to solve supply chain vulnerabilities that end up depending on the location and processing of actual atoms.

It also hits home as we see certain jurisdictions increase their stockpiles of commodities. In March 2025, China approved a budget to aggressively accelerate its accumulation of key resources. Its record purchases of oil over the past year are said to be supporting the oil price. China’s nickel stocks have more than doubled since 2024. Some estimates put China’s stockpiles of corn at 70% of global reserves, wheat and rice at 50%. I have not seen reports of the US stockpiling at anything like that scale, although – in what looks like a scramble to catch up – yesterday President Trump announced a $12 billion “critical minerals” accumulation program called Project Vault.

What does that have to do with monetary systems? Pozsar explained it as a shift from “inside money” (assets and debt created by the dollar-dominated financial system) to “outside money” (gold, oil, other commodities).