Sanctions on a stablecoin

plus: betting vs trading, gold, tokenized deposits, hoping for peace and more

“The growth of knowledge depends entirely upon disagreement.” – Karl Popper ||

Hi everyone! I hope you’re all doing well.

As I mentioned earlier in the week, I had to skip yesterday’s publication due to a teaching obligation: it was to give an extremely brief overview of why crypto matters for the banking sector to a group of senior executives from one of Spain’s leading banks. I’ve been doing this on and off for years, and yesterday’s group was one of the more engaged and aware that I’ve seen – a good vibe.

That’s significant, since some sessions have felt outright hostile (“crypto is useless” kind of thing), and others were deep in the “blockchain not bitcoin” trenches. This one was more open, heavy on the curiosity, with pushback limited to the building risk in tokenized assets.

(NOTE: I enjoy teaching, and I’m good at it, so if you’d like your team to be brought more up to date on the crypto/macro overlap, I’d love to help! Shoot me an email at: noelle@cryptoismacro.com.)

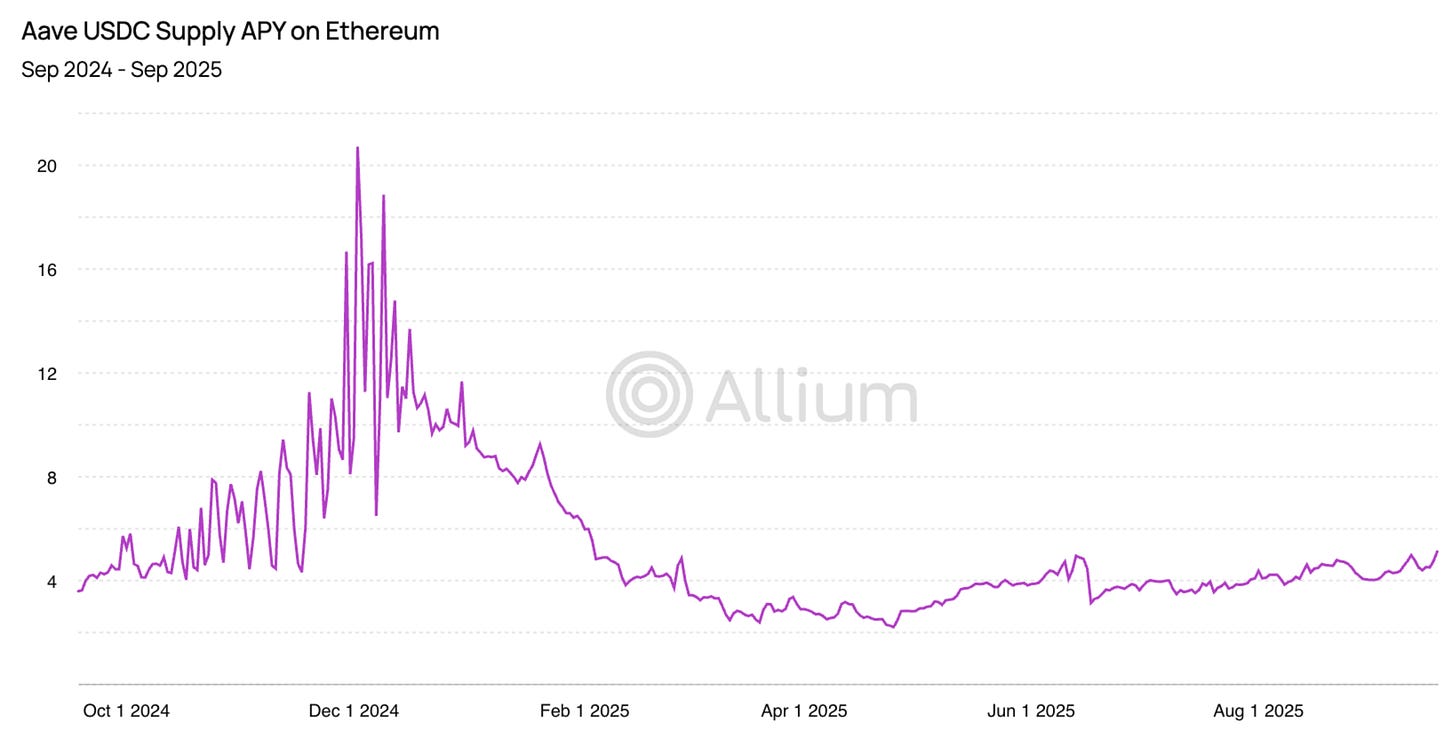

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Sanctions on a stablecoin

Betting vs trading

Macro-Crypto Bits: gold, inflation expectations and political priorities

Also: peace in Gaza?, France tries again, China weaponizes exports, BNY tokenization

WHAT I’M WATCHING:

Sanctions on a stablecoin

It looks like we’re about to see the first official sanctions imposed on a stablecoin! This is a huge conceptual leap for both sanctions and what stablecoins represent.

Some background: The European Union is reportedly proposing sanctions on A7A5, the largest non-dollar stablecoin in the market, which happens to be backed by roubles.

A7A5 was a platinum sponsor of the recent Token2049 conference in Singapore (touted as the largest crypto conference in the world), its team manned a booth on the showroom floor, and one of its directors spoke on stage – all this, despite the developers behind it and other related businesses currently under sanctions from the US and the UK.

The token was developed by a sanctioned cross-border payments company called A7, owned by Moldovan fugitive banker Ilan Shor (who played a role from the sidelines in the recent Moldovan elections) and the sanctioned Russian state-owned lender Promsvyazbank (PSB).

Given its ownership structure, you can imagine the type of cross-border payments A7 handles – these are usually executed via entities such as sanctioned Russian crypto exchange Garantex, and alleged affiliate Grinex.

Despite sanctions, A7’s business has been growing as there seems to be considerable demand for its services. It recently started offering digital bills of exchange that can change hands up to three times, and be paid out in the A7A5 stablecoin. (Who could have guessed sanctions wouldn’t work here?)

(For more detail, I wrote about this token in June: “The story of Garantex, Grinex and A7A5 is really a story of the dark side of technological evolution colliding with financial incentives, with users as well as officials scrambling to figure this all out.”)