Stable prices, or stable inflation?

time to think about the goalposts

“It is a paradoxical but profoundly true and important principle of life that the most likely way to reach a goal is to be aiming not at that goal itself but at some more ambitious goal beyond it.” – Arnold Joseph Toynbee ||

Hello everyone! Half-way through January, we got this…

Actually, January is turning out to be a lot less bleak than I had feared. Markets have been so interesting and there is so much to dive into that I haven’t had time to mourn the turning off of my city’s sparkly lights, the dispersal of family members and the notable lack of a calendar festive holiday to look forward to. So far, the month has flown by, and with the US Presidential inauguration next week, I suspect the speed is about to accelerate.

Below, I dive into economics and markets, as today’s CPI release will be significant.

Coming up later this week, I have a review of significant moves in tokenization over the past few weeks, and a lookback at what was going on a year ago.

Sorry I missed audio yesterday, I was planning to because I have some voice back, but it turned out I didn’t have enough to record. Today there won’t be a recording as it’s a chart-heavy post, but hopefully tomorrow things should be back on track.

IN THIS NEWSLETTER:

Stable prices, or stable inflation?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Stable prices, or stable inflation?

After the expectation and drama around last Friday’s jobs data release, now we get to repeat the same emotional roller coaster for inflation, with the release soon after you get this email of December’s CPI.

Consensus expectations are for growth in the core index to hold steady at 3.3% – far from the official target of 2.0% (true, that’s for the PCE index, but CPI feeds into the PCE). Headline CPI growth is forecast to accelerate from 2.7% to 2.9%.

According to the Cleveland Fed’s inflation nowcast model, growth in both indices should decelerate slightly for the next release in February.

(table via the Cleveland Fed)

As I wrote on Monday, this is feeding into interest rate expectations, with the market-priced probability of a rate hike this year ticking up to an eye-opening 35%.

(chart by Goldman Sachs, via @MikeZaccardi)

Regular readers will know I’ve been skeptical for a while now on the market’s rate predictions, as in they’ve been too low. But the expectations of a hike are also strange, and reveal a bias to action that is characteristic of traders but not central banks.

Inflation is sticky – but there’s less of a danger it will accelerate to worrying levels than that it will stubbornly stay too high for the Fed’s comfort.

The oil price continues to be a concern, but that is likely to fluctuate for a while based on geopolitical moves such as the war in Ukraine, changes in sanctions, Chinese stimulus and other factors beyond the control of markets.

And tariffs are inflationary, although recent headlines suggest that Trump is aware of this and could adjust his stance accordingly.

Meanwhile, I am coming around to the argument that greater productivity resulting from capex, tech investment, innovation and/or incentives could help companies avoid price hikes.

While the latest National Federation of Independent Business (NFIB) survey shows that business owners still list inflation as their most pressing issue, recent and planned price changes appear to be stabilizing.

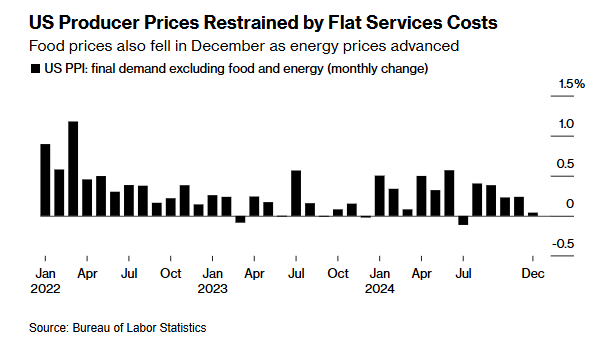

And yesterday’s release of US producer prices (PPI), a gauge of wholesale inflation, came in cooler than expected. The core index growth was expected to accelerate by 3.8% year-on-year – it came in steady on November’s number, at 3.5%. Headline PPI growth was forecast to accelerate to 3.5% from 3.0%; it increased to 3.3%.

(chart via Bloomberg)

In both cases, these are the highest year-on-year increases since February 2023, which is not great. But the data so far suggests that there might be some stabilization on the horizon. Overall goods prices increased 0.6% in December, after advancing 0.7% the previous month. Goods prices excluding the more volatile food and energy components were unchanged. And normally problematic services prices were unchanged on the previous month, one of the tamest monthly moves of the year.

What’s more, as I wrote on Monday, the climb in bond yields is delivering the restrictive conditions that the Fed couldn’t. According to a Goldman Sachs index, financial conditions have notably tightened since the Fed started cutting rates in September.

(chart by Goldman Sachs, via @ISABELNET)

There are some caveats to the above, however.