The digital euro and the ECB’s desperate PR campaign

plus: Fed independence, far right rising, markets nervy, Venezuelan hot spot and more

“The most difficult thing is the decision to act. The rest is merely tenacity.” – Amelia Earhart ||

Hello everyone, I hope you’re all doing well! Over here in sunny Madrid, the temperature has dropped to gorgeous levels, and the streets are still sultry and much emptier than usual.

A long one today, and even then there’s so much I didn’t get to.

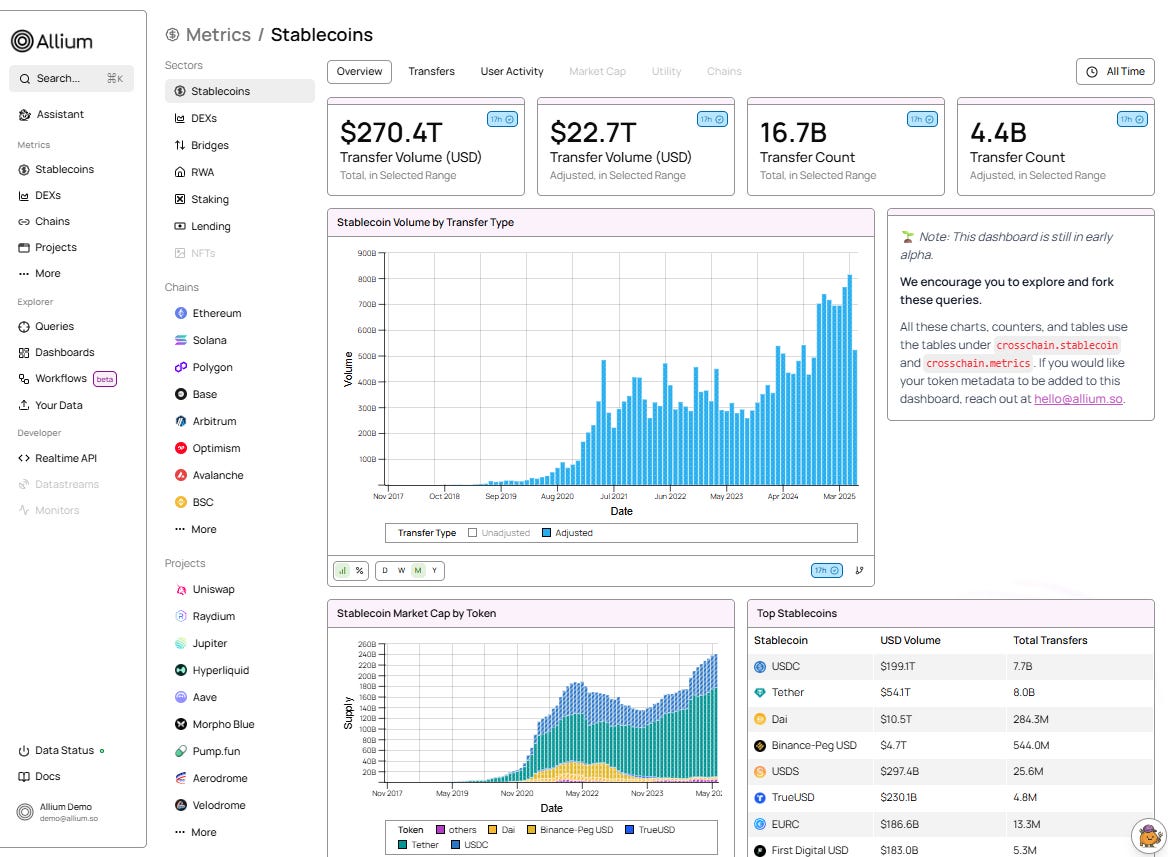

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The digital euro and the ECB’s increasingly desperate PR campaign

Fed independence and next steps

Global shifts: land expropriation, the new “hot spot”, Germany again, far right rising

Macro-Crypto Bits: nerves, crypto outflows, underperformance, crypto myopia again

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The digital euro and the ECB’s desperate PR campaign

Last week, twitterers on X were getting excited about signs that the European Central Bank (ECB) was re-thinking the digital euro strategy. The Financial Times, that venerable ECB mouthpiece, ran an article saying that EU officials were considering issuing the digital euro on a public blockchain.

This is most likely nonsense, unfortunately. What’s more, the article reads like a plant from an increasingly desperate ECB, worried about the lack of digital euro progress on the legislative side, and the weak public interest.

First, the headline – “EU speeds up plans for digital euro after US stablecoin law” – contradicts the content. Last I checked, you don’t completely change the strategy behind a complex technology build in the final stretch in order to speed things up, especially if you’re the European Union which takes at least a year for any procurement decision.

Plus, the EU governing bodies are currently a drag on the digital euro project, showing little enthusiasm for passing the necessary legislation. I haven’t seen any signs that there’s even a draft up for debate, and just a few weeks ago, ECB President Christine Lagarde was begging lawmakers (she actually said “please”) to get a move on. Perhaps the journalist doesn’t understand the difference between the EU and the ECB?

The confusion continues in the opening paragraph, with further ECB-EU conflation as well as a strangely compressed timeline:

“EU officials are accelerating plans for a digital euro [no, they’re not] … after a new US stablecoin law deepened worries about the competitiveness of a European digital currency.”

The ECB has been banging the table about the danger of dollar stablecoins ever since the US election, and especially since the passage of the GENIUS Act. This is not news.

Second, the digital euro pivoting to a public blockchain project is, unfortunately, as likely as the EU becoming a global tech hub within the next five years. In other words, not.

A token on a public blockchain would have greater utility, able to participate (presumably) in the blockchain’s ecosystem of DeFi apps and other web3 applications. It would also be a significant boost to blockchain development, with a flurry of projects requesting official approval for digital euro compatibility. But the ECB, along with all other European Union governing bodies, is obsessed with privacy. Existing public blockchains won’t meet the legally mandated data protection requirements such as the right to erase, and creating a new public blockchain from scratch will take years to achieve anything approaching decentralization. It can be done, but not if you want to “accelerate”.

And the timeframe does matter to ECB Chair Christine Lagarde, as her term ends in 2027 – she’ll want it operational before she and the handful of other pro-CBDC central bank executives leave office, especially since there’s not much sign of equal conviction amongst younger representatives.

The lack of rigor in the FT article suggests that it’s a public relations exercise. One unnamed source reports that the GENIUS Act passage “rattled a lot of people” who are now saying: “Let’s speed up”. Substitute “ECB leadership” for “a lot of people” and you can see both the intent and the communication strategy.

This is not limited to friendly coverage from the FT. Yesterday, Politico reported that the ECB expected the digital euro to “take the payments market by storm” with capacity for “more than 50 billion transactions a year” from day one – for context, traditional payment cards handled roughly 84 billion transactions last year. This is despite several recent surveys showing that the majority of consumers are just not interested.

These reports feel like yet more attempts to keep the digital euro conversation going, as the ECB struggles to get the legislative branch to advance the necessary rules – Lagarde has said in the past that the decision to launch will not be taken without the rules in place, and the October deadline for a decision is coming up fast.

See also:

The digital euro gets shakier (July 2025)

The race to the digital euro is getting tense (June 2025)

The digital euro: more smokescreens (March 2025)