The digital euro hits a wall

plus: Bitcoin and hydropower, capitalism, barter, currencies, witchcraft and more

“Yes: I am a dreamer. For a dreamer is one who can only find his way by moonlight, and his punishment is that he sees the dawn before the rest of the world.” – Oscar Wilde ||

Hi all, happy Friday!!!

A programming announcement: this newsletter will be taking a break next week, I’m actually going on HOLIDAY, for the first time in three years. I know I take days off here and there, but I’ve not taken a big block of time in, ooo, ages, and I’m now stressing that I will MISS so much, which I guess is a sign a holiday is needed. Anyway, back on Monday, Sept 29th, and please try not to break anything while I’m gone.

What I’m most looking forward to: Well, getting to know Malta, I’ve never been (recommendations welcome!). But also time to think with less noise – so much has changed in the past few months, and it’s high time to revisit priors, recalibrate expectations, update my timeline (which I’ll share when I get back) and add more shine to my focus. Quiet space on airplanes and looking at gentle waves are great for that.

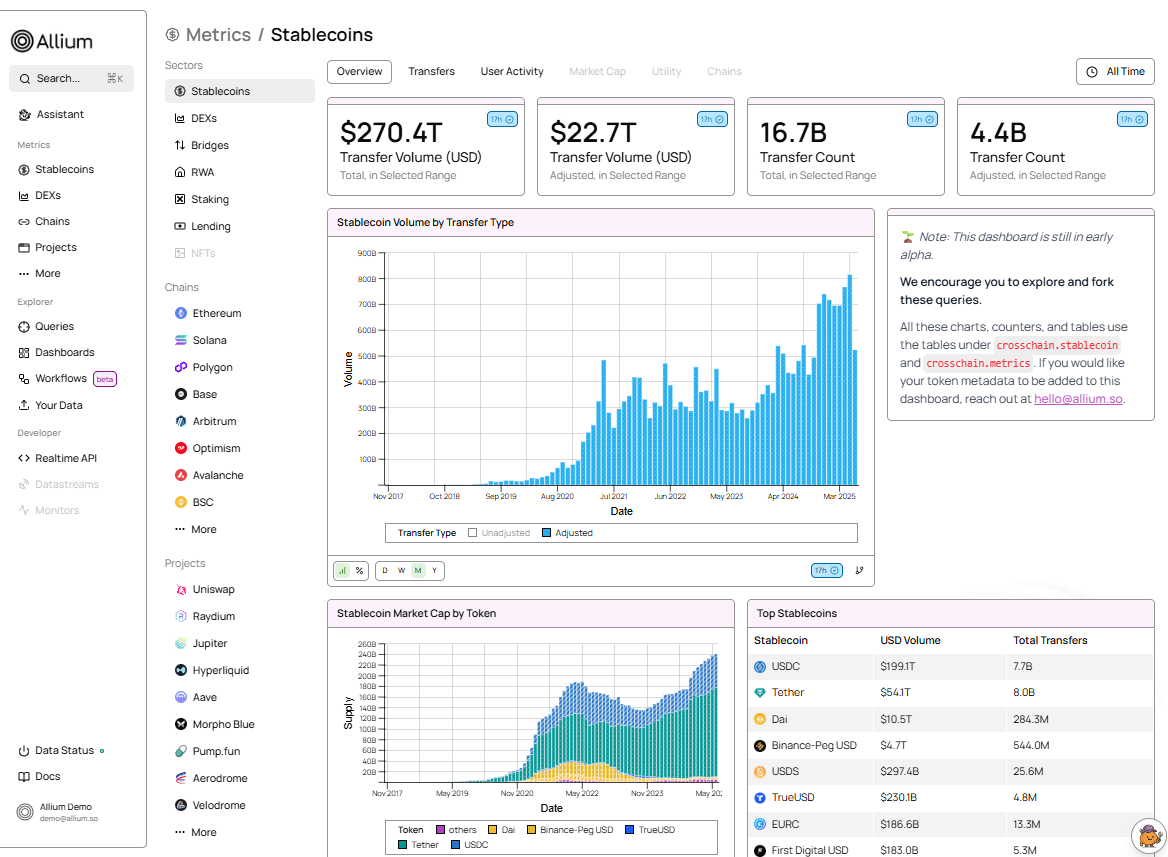

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The digital euro hits a wall

Bitcoin mining and hydropower

An alternative to the barter economy

Capitalism evolves

Also: US mining, currencies, German budgets, witchcraft, Russian assets and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The digital euro hits a wall

Politico ran an article this morning with the encouraging title: “The digital euro has enraged half of Brussels. Here’s what you need to know.”

Regular readers will know I’ve been writing about the digital euro for what feels like ages. At first is was from a somewhat dismissive “we’re going to get one, but no-one will use it” standpoint, which soon morphed into a “we’re going to get one and they’ll make sure we use it” concern. But when the original “rapporteur” (the EU representative charged with ushering the supportive legislation through passage) resigned last year because he didn’t believe in the mission, I started to feel encouraged that there were MEPs willing to take a principled stand.

This got stronger when his replacement – Fernando Navarrete – turned out to also be sceptical but does not seem to have any plans to step down. It got stronger still when it turned out that virtually no progress had been made on even drafting a bill for debate; the ECB has to make a final decision on whether or not to proceed, after two years of loud messaging that everything was full steam ahead, by the end of October. Lagarde has also in the past promised to not make a decision without the rules in place, which they won’t be. The Parliament has said it won’t reach a final position until next May.

What’s more, the European Parliament is not the only legislative body the ECB has to convince. It also has to work with the Council of the European Union, which represents member countries whose ministers are being fiercely lobbied by their respective banking industries. These, rightfully, see the digital euro as an unnecessary threat, a solution looking for a problem that will create many more problems.

And all this is happening at a time when the EU has to be focused on holding itself together. There’s the widening fractures of political polarization, the mounting bill from supporting Ukraine, the need to ramp up defence spending across the bloc but with wavering commitment from some, the need to figure out resilient energy supply, and the realization that their powerful trading partners are starting to flex that power and not to Europe’s advantage. Forcing a disruption on both the banking industry and on consumer payment habits is not going to be a priority, especially when hardly anyone outside the ECB actually wants this. Polls show that there would be some use, sure – but even the more open-minded among us would not care if it didn’t happen. Payments work pretty well within the European Union as it is.

So, hopefully the ECB’s campaign will meet enough resistance to fizzle out, and the EU can pivot to focusing on a wholesale CBDC which will actually bring economic advantages. Then again, when it comes to pride, unelected bureaucrats with little accountability can be unpredictable.

See also:

The digital euro gets shakier (July 2025)

The race to the digital euro is getting tense (June 2025)

The digital euro: more smokescreens (March 2025)

An EU digital euro twist (December 2024)