The geopolitical drums

plus: the market reaction, is BTC still a macro indicator?, and more

“Almost all really new ideas have a certain aspect of foolishness when they are just produced.” – Alfred North Whitehead ||

Hey everyone!! I know I’m not supposed to be publishing today – it’s the day of the Cabalgata when the three kings arrive in Madrid bearing gifts, a big deal in my extended family and I’m supposed to be in the kitchen cooking for the hordes of nieces and nephews and their many small children that are descending on our fortunately-positioned apartment at any moment.

But, stuff has happened that falls smack into my overarching thesis, so my fingers found their way to the keyboard and here we are.

✨✨

Production note: I will be skipping publication tomorrow as it’s Epiphany and the seasonal marathon of cooking for lots of people continues. I’ll be back at my desk on the 7th, probably tearful after the goodbyes but also looking forward to some quiet.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

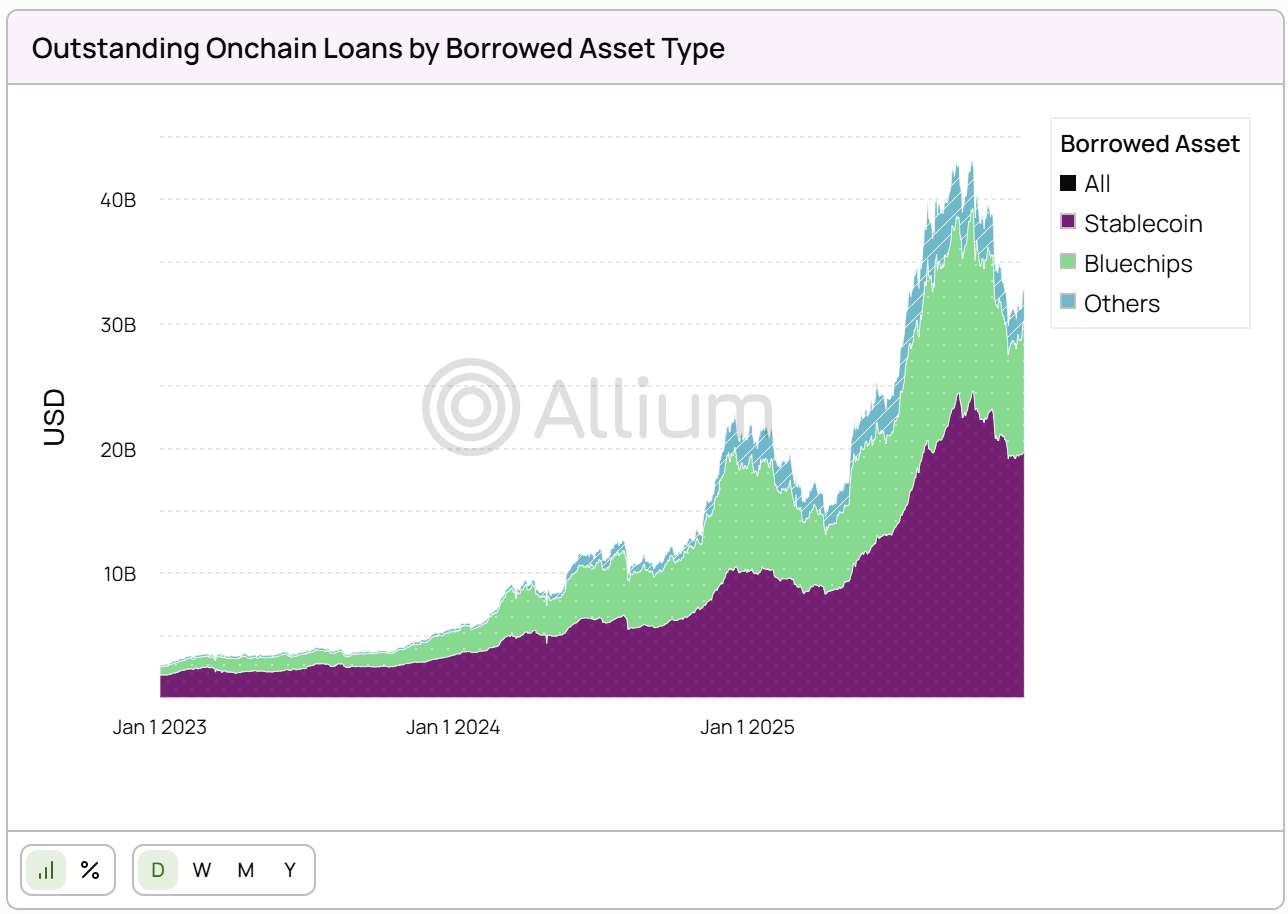

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up: US jobs, economic activity and more

The geopolitical drums

The market reaction: numb?

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

Coming up this week:

Jobs week! Plus, US economic activity. And probably a fair amount of geopolitical shouting.

Today, we get the US manufacturing PMI from the Institute of Supply Management (ISM), expected to show continued contraction with another uptick in prices.

Nvidia holds a press conference which could rekindle AI spirits.

On Tuesday, we get the US services and composite PMIs from S&P Global, forecast to show a softening expansion.

Wednesday brings more indicators of US services activity, this time from the ISM, also expected to show continued but slightly softer expansion.

We also get the ADP payroll data for December, with consensus forecast pointing to a 47,000 increase vs a 32,000 drop in November. And we get the December Job Openings and Labor Turnover Survey report, expected to show a slight drop.

Thursday delivers US trade data for November, the Challenger job cuts, the weekly unemployment claims, as well as the New York Fed’s consumer inflation expectations for one year out – this has held at 3.2% for the previous two months.

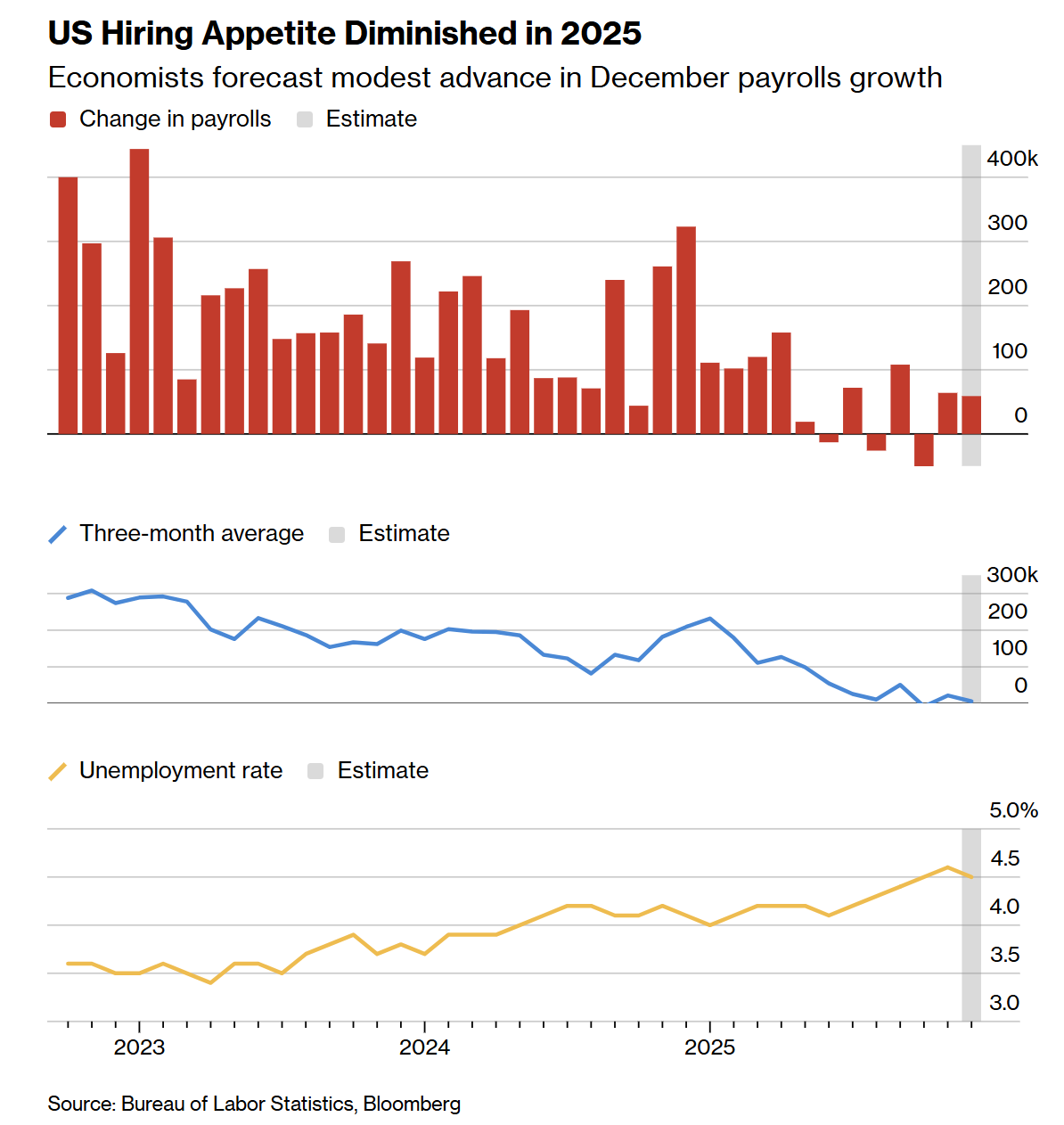

And on Friday, we see the official US jobs data, with new payrolls for December expected to come in at 57,000, slightly under November’s 64,000. That would bring the total number of jobs gained in 2025 to just under 670,000, the lowest outside the pandemic since 2009. The unemployment rate is forecast to soften slightly from 4.6% to 4.5%.

(chart via Bloomberg)

We also get the preliminary consumer confidence report for January from the University of Michigan.

And China’s CPI is expected to tick up slightly to 0.8% year-on-year.

The geopolitical drums

So, 2026 has sure started off on an interesting foot.

The US move on Venezuela can hardly be called a surprise – it was loudly telegraphed via the movement of military assets and the speech of Administration officials – and yet it came as a shock to pretty much all of us. Most leaders and observers around the world assumed that some adherence to diplomatic decorum and a “rules-based order” would stop Trump from ordering a military assault, despite plenty of evidence that he cares little for either. Yet even those of us who were confident he’d somehow engineer a regime change in the oil-rich nation were surprised and disconcerted at the speed with which a line was crossed. Few are sad that Nicolás Maduro has lost power; yet the celebratory mood is dampened by concern about what comes next.