The sausage, the capture and cash equivalence

Plus: African currency politics, watch the yields, US growth and more

“It’s tough to make predictions, especially about the future.” – Yogi Berra ||

Hi all, and Happy Friday!!! This week went by in a blink – I shudder to think what next week will be like. I hope you get some time to touch grass this weekend, I think we’re all going to need it.

Programming note: It’s a US holiday on Monday, and while I’m not in the US, most of my readers are – so, I’m going to take advantage of the lower traffic, skip publication and use the time to catch up on my many half-finished pieces.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

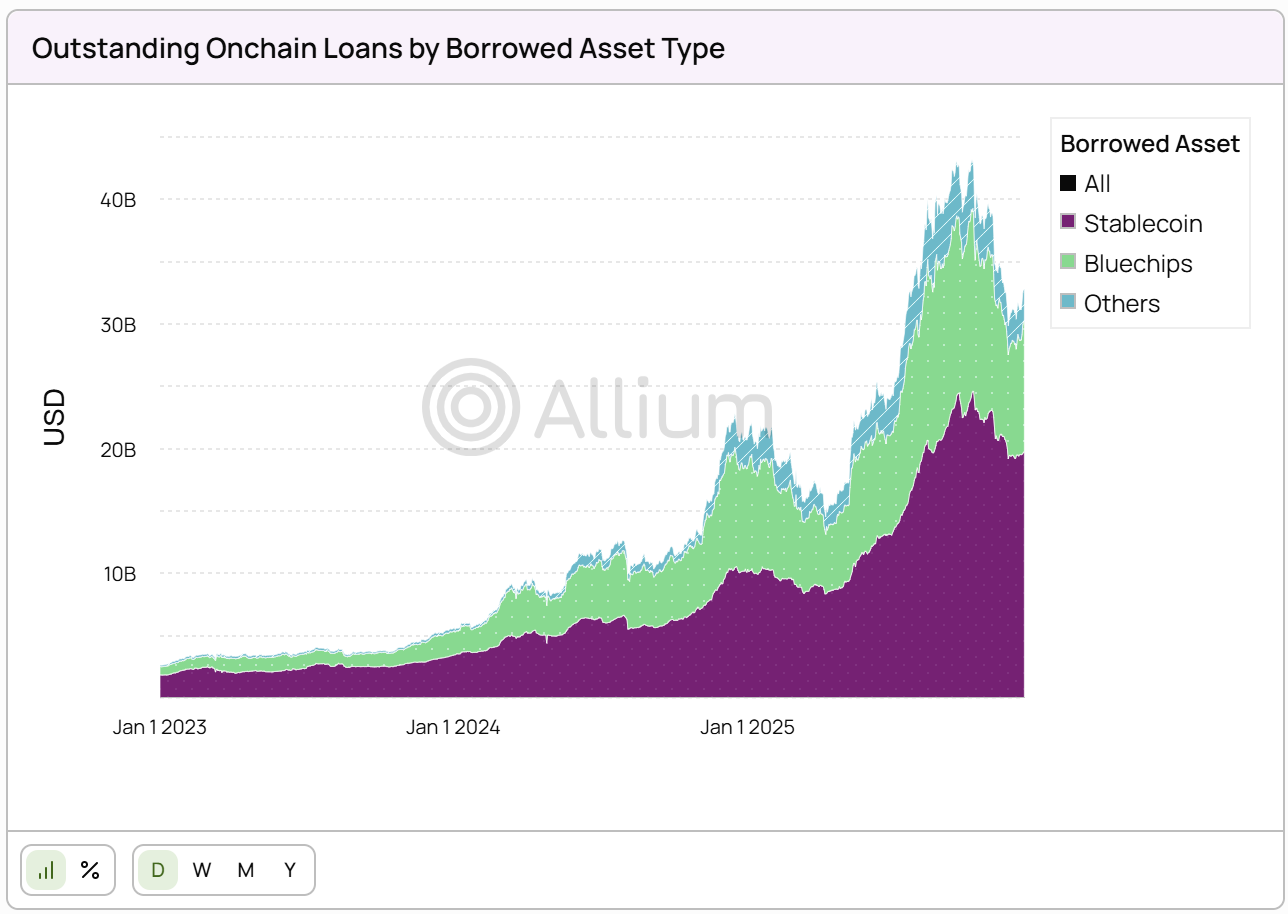

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year,

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The big deal this week: tech regulation

Why cash equivalence matters

Shifting currency politics

Macro: US jobs, again

Markets: the yield curve

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

❤If you’re a premium subscriber, thanks, you are much appreciated!! ❤

WHAT I’M WATCHING:

The big deal this week: tech regulation

(Trying out a new feature in which I have a think about what I see as the most significant development of the week for the crypto-macro narrative. What one thing has shaped the playing field for what’s ahead? Things are moving fast, it’s helpful to sometimes step back from the noise.)

I thought about titling this week’s topic “regulatory capture”, but I don’t want to give the impression I’m against Coinbase’s blowing up the CLARITY Act markup – it was a ballsy move that could either go spectacularly wrong or set a more solid base for the industry going forward.

“How the sausage is made” is also not quite right, as well as too wordy (and likely to make readers hungry if they haven’t had breakfast). The big deal this week wasn’t the discovery of how messy US lawmaking is, we all knew that, even if the closest we’ve come to Capitol Hill is a few episodes of The West Wing.

No, stepping back and cleaning up the noise a bit, the takeaway is how unusual the CLARITY Act is, and how it is yet another example of blockchain technology’s transformative potential. It’s even changing how laws are made.

A clue is in the level of detail on how the technology and related assets should work.

It’s unusual for a bill to be so “prescriptive”, offering details on how crypto assets should be structured and what can be considered “decentralized” – essentially, telling builders how to build. Usually, bills focus on outcomes and risk mitigation.

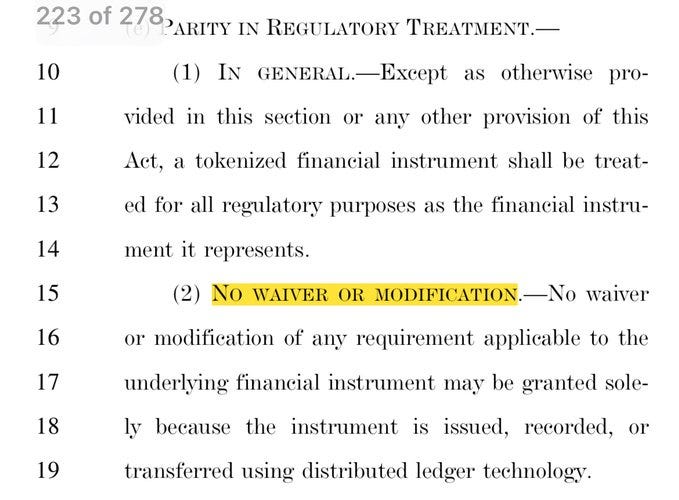

When a bill focuses on a new technology or its application, most of the details are left to the agencies to fill in via rulemaking. CLARITY doesn’t do that, it dives right in – there is some scope for the SEC and the CFTC (and plenty of study requests), but it’s surprisingly limited. For instance, as TuongVy Le pointed out, a provision in the Tokenized Assets section blocks, forever, the SEC’s ability to offer exemptive relief where appropriate – she (an experienced crypto lawyer who used to work for the SEC) does not recall ever seeing this type of limitation before, and it’s especially surprising given how the technology and its application are still evolving.

(screengrab via @TuongvyLe12)

Another twist to rulemaking here is the whiff of “regulatory capture” – I touched on this yesterday, positing that Coinbase’s gamble might turn out to be a win… but maybe not. Either way, a more disconcerting takeaway is the power of one company in a new space. In US lawmaking, industry participation is essential for both education and making sure a bill is workable, especially relevant here given how new and complex blockchain technology is. Coinbase has done great things for the industry in this respect over the years (and has spent a fortune on lobbying), but so have many, many other firms. That one business can delay a hard-fought markup should give us all pause, especially when most industry participants were eager to maintain the momentum. Put differently, Coinbase wants different rules from the rest of the sector, it has different priorities. It may be right in setting a higher bar, as potentially all will benefit. But as industry leader, should it be that influential in what is a key step that supposedly levels the playing field?

In sum, this is all new, not just the technology being regulated, but also the way the regulation is being crafted. I’m not a lawyer and I’m sure there are details and nuances I’m overlooking – but there’s more at stake here than most realize.

Why cash equivalence matters

Here’s an item I’ve had on my list to dig into for at least a couple of weeks now (one of the many downsides to a hectic news flow, important things get pushed): crypto accounting.

Hang on, don’t tune out, it’s more important than most realize, and is an overlooked and potentially significant tailwind for the crypto industry.