Tuesday, August 6, 2024

a tenuous bounce, an emergency cut, crypto ETFs

“Politicians should read science fiction, not westerns and detective stories.” – Arthur C Clarke ||

Hi everyone! I hope you’re all doing ok and have recovered from the market drama of the past few days. Things may look rough, but there’s plenty of positive developments to focus on as well.

I’m bumping the regular CBDC overview to next week – it is definitely crypto/macro, but there are more timely things to focus on today.

With impeccable timing, I’m on a much-needed summer break as of tomorrow, back in your inboxes on Monday! And maybe sooner, depending on what happens.

If you find Crypto is Macro Now useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d really appreciate it!

IN THIS NEWSLETTER:

A tenuous bounce

Calls for an emergency cut

ETFs held up surprisingly well

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

WHAT I’M WATCHING

A tenuous bounce

So, yesterday ended with some relief. US indices closed above their alarming drops on the open, Japan stocks rebounded in today’s trading (both the Nikkei and the broader Topix indices climbed around 10%), and the yen weakened against the US dollar.

(charts via TradingView)

The trouble is not over, though.

The US is heading into an economic slowdown, probably also a recession. I don’t think it’s here yet, but it’s coming. Current EPS estimates do not seem to take a demand hit into account, and as they get revised down, so too will valuations. This is even before a further re-evaluation of AI expectations.

But rate cut expectations are likely to be disappointed. The economic situation in the US is not yet nearly as bad as you would think from the howls of horror after Friday’s jobs data release and the accusations that the Federal Reserve made a huge mistake by not cutting rates at last week’s FOMC meeting.

As the committee has repeatedly said, it does not yet have enough data to be convinced that a strong slowdown is inevitable, and there are inflation risks to cutting too soon.

Yes, unemployment is moving, but it’s still relatively low. And the jobs data is sending out confusing messages – yesterday I wrote about why Friday’s bad news might not be repeated in August. Also yesterday, we got the release of the latest ISM Purchasing Manager’s Indices: these showed that the gauge for services employment, which accounts for approximately 80% of US jobs, expanded in July to its highest level since October 2023.

(chart via Investing.com)

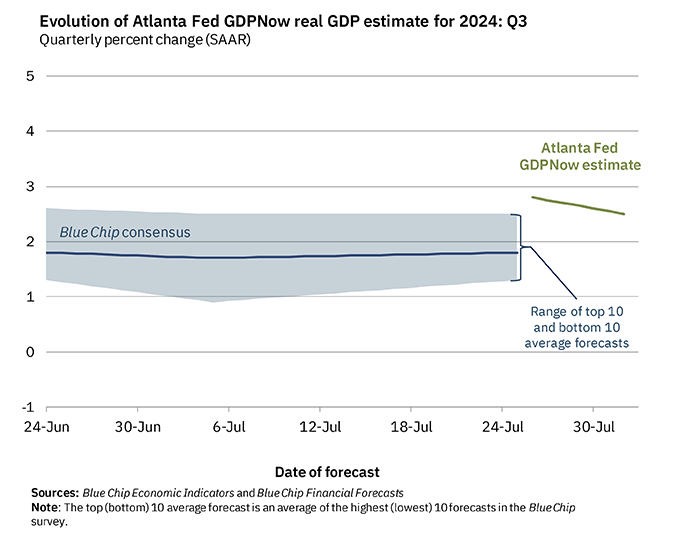

As usual, the Atlanta Fed’s GDPNow model suggests a much higher GDP growth for Q3 than the consensus forecast from economists (and recently, the Atlanta Fed has been more accurate). It’s current data-based expectation is of 2.5%, lower than the previous 2.8%, but still not even close to recession territory.

(chart via the Atlanta Fed)

It’s not just about the US. The Federal Reserve will start cutting rates soon, most likely September, while the Bank of Japan will be raising. We have not yet seen the full unwind of the Japanese carry trade and the hit to retail investment in US assets for currency protection. This also highlights that had the Federal Reserve cut last week, the stock market rout would probably have happened anyway. And that an emergency cut before September’s meeting just might make the situation much worse (more on this below).

Conflict hotspots are still hot. Middle East tension seems to have stepped back from the brink for now, with Iran saying that it wants to hurt Israel but it doesn’t want to start a war. But Russia’s Security Council chief (and former Defense Secretary) is in Tehran today, reportedly to discuss the delivery of air defense systems; the US general in charge of Central Command is in Israel, ostensibly to try to mobilize a regional coalition against Iran; and several US troops were injured yesterday in an attack on a base in Iraq.

We don’t yet know the extent of the weekend’s damage. Sharp moves to the downside can break leveraged portfolios, and we have yet to hear of firms deciding (or having no choice but to) exit. Jump Trading, one of the crypto ecosystem’s largest market makers, was apparently behind much of the weekend selling – this was very strange timing for a market maker, as I wrote yesterday, and we still don’t know what’s going on there. The collapse of other funds or market infrastructure service providers, in either crypto or traditional markets, could trigger more emergency selling and possible market disruption.