Tuesday, Feb 27, 2024

BTC's jump, crypto activism wins again, how African institutions see crypto

“Almost all really new ideas have a certain aspect of foolishness when they are just produced.” – Alfred North Whitehead ||

Hi everyone! I’m trying out a new format, shortening the intro and moving the description and disclaimers to the bottom. After all, most of you just jump over that part, right? I know I would. Let me know if you think it’s better like this!

**Interested in promoting a webinar, report, event or service to the Crypto is Macro Now community? Drop me an email at noelle@cryptoismacro.com and I’ll send you more information.**

IN THIS NEWSLETTER:

BTC’s jump

Crypto activists win again

The crypto opportunity for African institutions

If you’re not a subscriber, I hope you’ll consider becoming one!

WHAT I’M WATCHING:

BTC’s jump

Well, so much for my plan to write more today about the ETH breakout we saw over the weekend… Yesterday afternoon, after a few days of doing not very much even while ETH climbed, BTC started to move. Early this morning (UTC time), BTC briefly broke through $57,000, and as I type is hovering around $56,600, an increase of more than 10% over the past 24 hours.

(chart via TradingView)

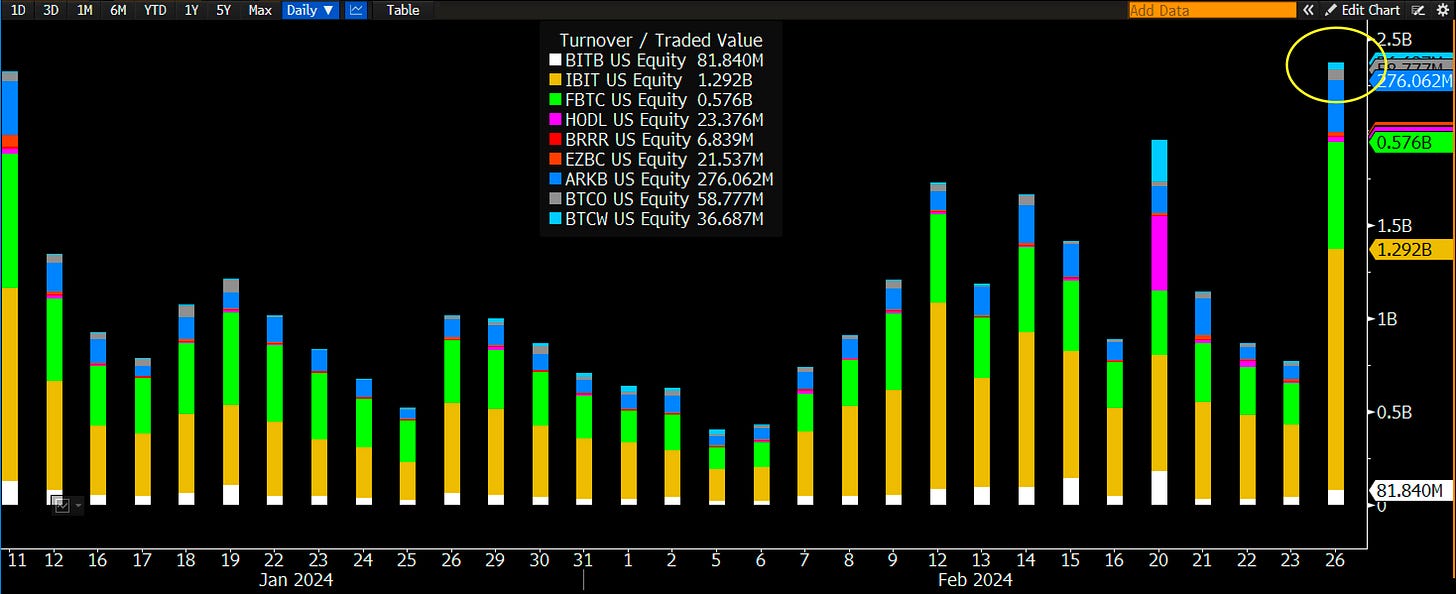

The main driver appears to be ETF flows. Yesterday, BlackRock’s IBIT saw almost $1.3 billion in trading volume, and while this is not the same as net flows, we can assume that the bulk was incoming. The other BTC ETFs also had remarkably strong volumes, pushing the total for the “new nine” beyond that achieved on Day 1.

(chart via @EricBalchunas)

This serves a strong purpose: it reminds us that the ETF impact is not a short-term, “sell-the-news” event. It is a longer-term gain, as access broadens and awareness deepens. Many investment platforms are still getting set up to offer the ETFs to their clients, and macro funds are still working on their Bitcoin strategy. Why didn’t they do this before the ETFs launched? Because, right up until they actually started trading, it wasn’t clear that they would, and it’s hard to justify spending resources on a “maybe”, especially when other markets are doing so well anyway.

Last month, just before the ETFs started trading, I wrote about a new survey by Bitwise and VettaFi that showed that less than 40% of participating investment advisors expected a BTC spot ETF in 2024. For most of the investing world, crypto is still niche and carries regulatory risk. I was chatting last week to an investment advisor who is still hung up on the fact that it is used for crime. We still have so much work to do.

But it is being done, which underscores the longer-term impact of the ETF approvals. The big-name issuer marketing teams are gearing up, with the enthusiasm injection that success brings. And mainstream media is doing their bit by putting the price climb in headlines, which (unfortunately) always attracts new participants (I say unfortunately because we all know that investing purely based on price appreciation creates froth in which many get hurt).

The almost 4% climb (as I type) since the US market closed yesterday is obviously not due to ETF flows, but rather to anticipation of ETF flows, among other factors. In crypto markets, momentum breeds momentum, and given the vast sea of potential inflows relative to the available supply, this could move fast. As much as we love to see the price climb, this is not necessarily good news as we know that crypto markets can get unstable quickly.

For now, leverage is pouring back in: BTC futures open interest in USD terms is at an all-time high.

(chart via coinglass)

A lot of the increase comes from the CME, where US institutions trade.

(chart via coinglass)