Tuesday, Mar 21, 2023

Duelling BTC narratives, a pause from the Fed, what we were looking at a year ago, and more...

“With freedom, books, flowers, and the moon, who could not be happy?” – Oscar Wilde ||

Hi all! I’m sending this earlier today since I have to be away from my desk at the usual time. Now, if only I could manage to get it out earlier every day…

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem – I’m glad you’re here. Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the like button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

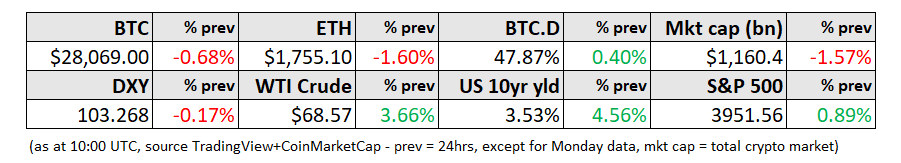

MARKET

Taking a break

Of all the weeks for the Fed to have its pre-FOMC “blackout period”, it had to be during the most intense banking drama in decades. For those of you who love detail, the blackout period – which limits public comments from central bank officials ahead of rate-setting meetings – runs from the second Saturday preceding an FOMC meeting, to the following Thursday, unless otherwise specified. Just imagine if we’d been able to pore over the tapes and transcripts of dozens of “the system is sound!” speeches over the past days. The absence of hints as to what the Fed is thinking after the banking stress is no doubt contributing to the wildest fed funds futures swings I’ve ever seen. Depending on how long it has been since your last screen refresh, CME data goes from suggesting a strong likelihood of a 25bp increase to an even probability of no hike at all. Analysts and economists seem divided, and some are even predicting a cut tomorrow.

As I briefly sketched out yesterday, I believe we’ll get a pause. Inflation is still nowhere near the target 2%, but the danger of causing further banking strain far outweighs that of waiting a month for more economic data. Bank stocks are flashing pain signals – after a rebound on yesterday’s open as the weekend’s “rescue” of Credit Suisse was digested, the BKX bank stock index again headed down, closing around 27% lower than at the beginning of the month.

(chart via TradingView)

While the US had a week without any banking collapse, as my husband has reminded me: “There’s never only one cockroach.” (I know, eewww!) First Republic Bank seems to still be operating for now, although both S&P and Moody’s downgraded the company’s debt over the past few days which is, to put it mildly, not a good sign. Its share price, which lost more than 70% last week, dropped a further 40% yesterday. I am not inferring that FRB is a cockroach (again, eewww!), merely suggesting that its woes are not yet over, and that we as yet have no idea just how far the contagion of the bank closures so far will go. There’s also the likely spillover into other areas of finance, such as funds, fintechs and real estate companies to keep an eye on.