Wednesday, August 28, 2024

crypto’s drop, stablecoin developments

“Vast ills have followed a belief in certainty.” – Peter L. Bernstein ||

Hi everyone! Well, so much for hoping for a nice quiet day in crypto/macro…

Below, I talk about last night’s crypto market dump, and (finally!) I share the monthly roundup of key developments in stablecoins.

Other recent roundups, in case you missed them:

You’re reading the premium daily Crypto is Macro Now newsletter, in which I look at the growing overlap between the crypto and macro landscapes. If you’re not a subscriber, I hope you’ll consider becoming one?

IN THIS NEWSLETTER:

Ouch: yesterday’s crypto market drop

Stablecoins: key developments from the past month – Tether, Russia, treasury tokens and e-commerce stablecoins

If you find Crypto is Macro Now in any way useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d be really grateful!

WHAT I’M WATCHING:

Ouch: yesterday’s crypto market drop

Late yesterday, BTC had a notable wobble, dropping more than 6% in just over an hour.

(chart via TradingView)

While no clear catalyst jumps out, there are plenty of potential triggers to choose from.

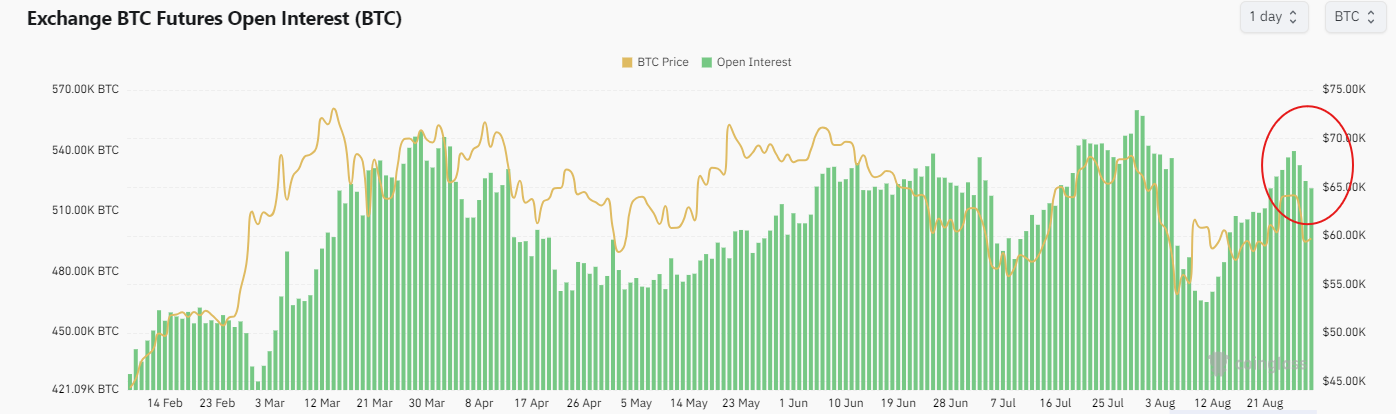

It doesn’t feel like it was a leverage flush – BTC futures open interest dipped a bit, but not that much, and while it had been climbing in BTC terms (to strip out the price effect), the moves weren’t flashing warning signals.

(chart via coinglass)

Liquidations jumped, which exacerbated the move, but they weren’t anywhere near recent highs.

(chart via coinglass)

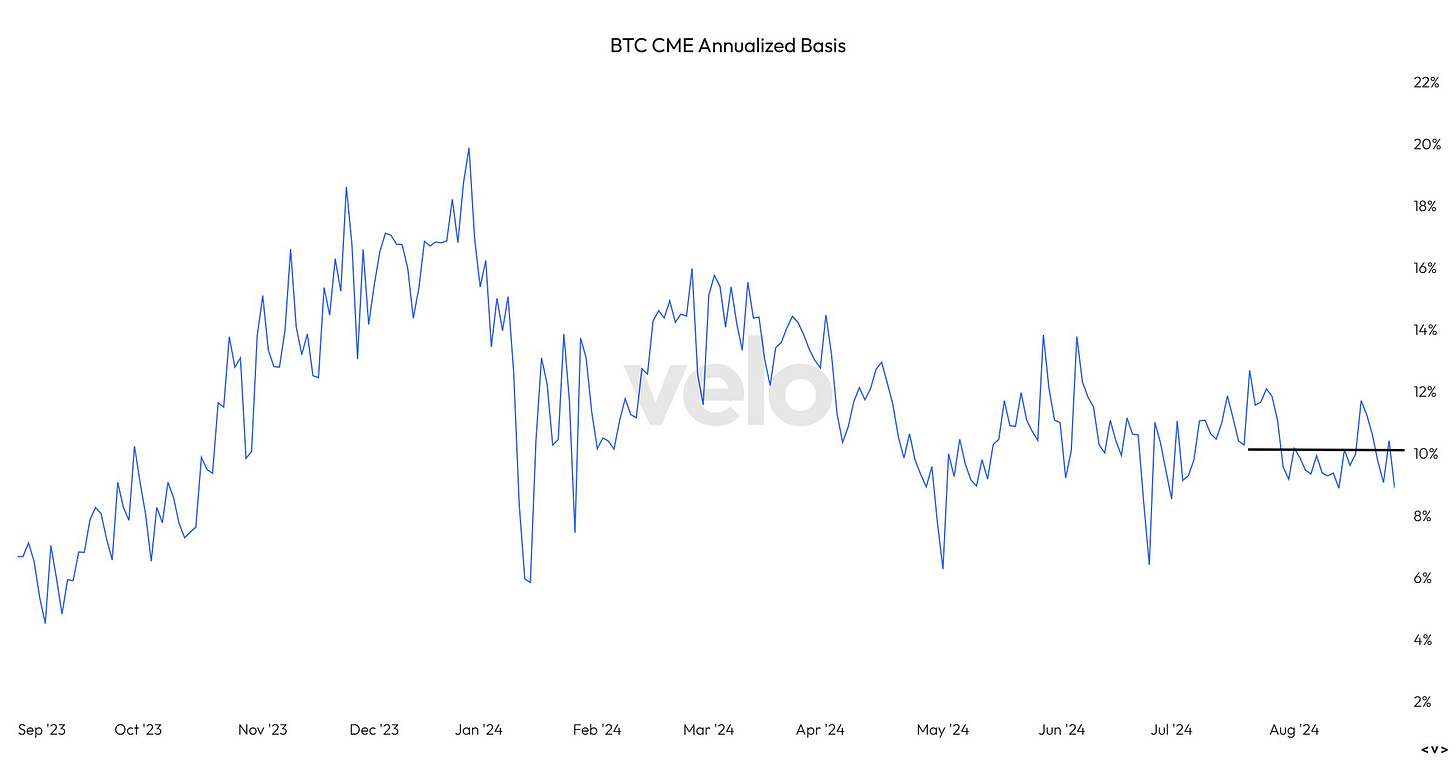

And the annualized basis on the CME – currently the bitcoin market’s largest derivatives exchange in terms of open interest – has been holding steady over the past month at around 10%.

(chart via velodata)

So, if not a build-up of leverage, what? It could be pre-NVIDIA nerves, with the chip giant due to report earnings later today. I wrote yesterday that bad news on the earnings front could send the entire stock market tumbling (NVIDIA is now 6% of the S&P 500, and if it’s doing worse than expected, so are many other tech companies). This could also hit crypto assets as in risk-off moves, traders and investors tend to sell whatever they can.

If NVIDIA earnings beat expectations, however, we could also see muted crypto performance even while the stock market surges, as AI-related tech stocks are (for now) a more mainstream way of increasing a portfolio’s risk, and for many investors, NVIDIA is easier to understand and justify than BTC or ETH.

(I know, this overlooks the store of value narrative, but “mainstream” still tends to associate that with gold.)

So, the crypto asset drop could be investors raising cash in order to play the post-NVIDIA earnings market move.

Or, this could be related to the US dollar. Earlier this week, the DXY index (which measures USD against a basket of currencies) reached its lowest point in over a year. Could a melt-up adjustment be around the corner?

(chart via TradingView)

Over time, BTC tends to move inversely to the dollar – there’s the signal about relative interest rates (lower DXY = lower expected US rates, in theory), the denominator effect (BTC/USD is the most-quoted pair), and the heightened importance of a store of value. A DXY surge on technical reasons (since US rates are still likely to come down relative to EU and Chinese rates) could hit BTC sentiment.

Plus, maybe some selling pressure from the Mt. Gox distributions or the US government holdings?

Bottom line, the summer has been “meh” in terms of sentiment, liquidity is thin, and while tailwinds are building, there is as yet no clear upside catalyst.

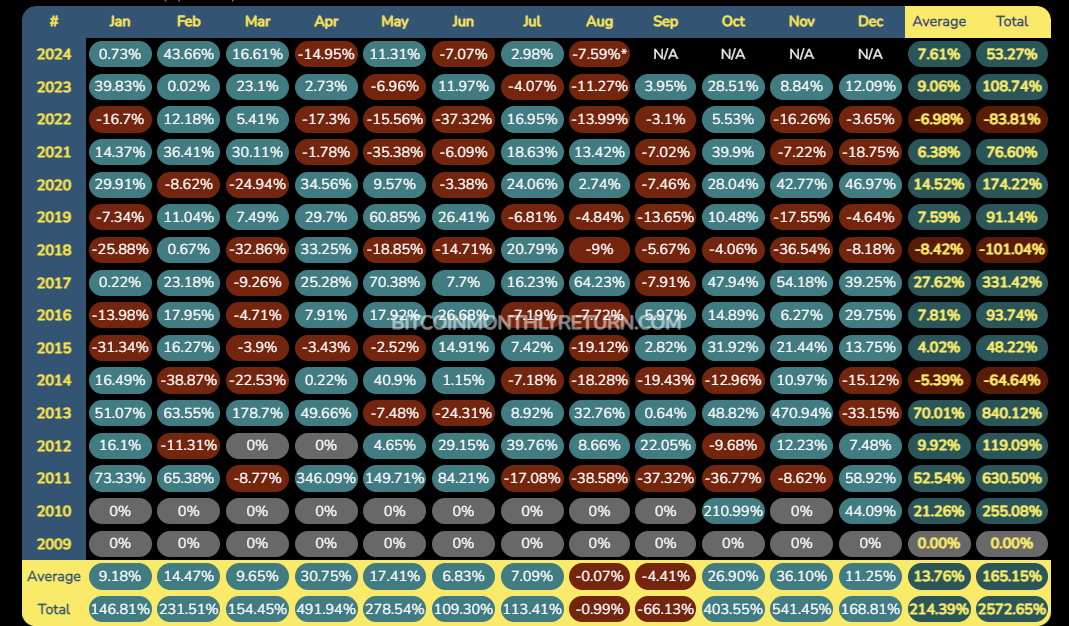

And for some historical perspective, August and September tend to be the worst months for BTC performance.

(chart via bitcoinmonthlyreturn)

This suggests that the usual summer prescription still holds: patience.

For more on why NVIDIA earnings matter for markets and crypto, see yesterday’s newsletter.

Stablecoins: key developments from the past month

As with other roundups this month, activity in the stablecoin sector has been relatively muted compared to non-summer periods – I say “relatively” because there is still solid progress, intriguing twists and meaningful trials. For instance, Tether is evolving, Russia is gearing up to use stablecoins for trade, Singapore’s largest bank is testing treasury tokens, and Latin America’s largest ecommerce site has launched its own stablecoin.