Wednesday, Feb 14, 2024

this CPI reaction is different; BTC a risk-off asset?

“One of the greatest pieces of economic wisdom is to know what you do not know.” – J. K. Galbraith ||

Hi all, and Happy Valentine’s Day to those who celebrate! I’m not a huge fan of this particular calendar landmark, in part because I dislike forced festivities but mainly because I’m one of those hopeless romantics that believe any day you’re in love is worth celebrating.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

**Interested in promoting a webinar, report, event or service to the Crypto is Macro Now community? Drop me an email at noelle@cryptoismacro.com and I’ll send you more information.**

IN THIS NEWSLETTER

The knee-jerk market reaction that didn’t correct

BTC is a risk-on asset, and also a risk-off asset

WHAT I’M WATCHING

The knee-jerk market reaction that didn’t correct

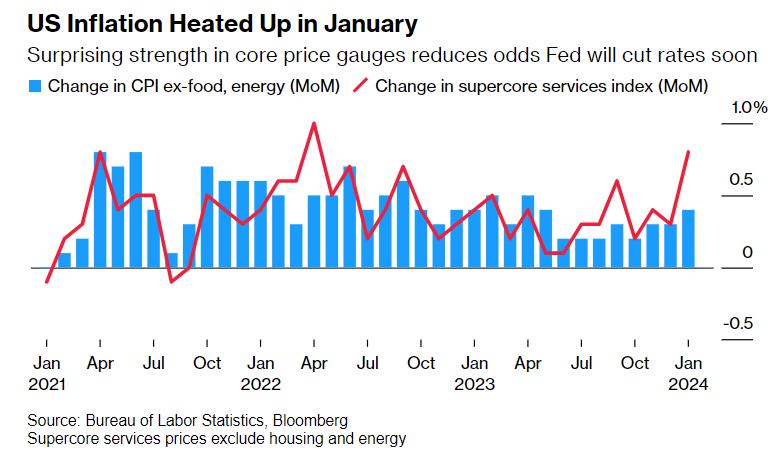

Yesterday, I talked about the significance in January’s CPI data of services inflation, given Fed officials’ recent insistence on the need to see “broad” inflation gains. These comments suggested that they will be looking for the deceleration in goods inflation to start showing up in services. Expectations were for this to be the star of the data drop yesterday, but no… services inflation is actually accelerating.

We got a hint of this in last week’s ISM services price gauge, which blew away consensus forecasts of 57.4 to come in at 64.0, the steepest surge since August 2012.

Yesterday, a gauge of prices measuring services ex-energy increased by 0.7% month-on-month, vs 0.4% in December. The three main sub-components – shelter, transportation and medical care – all increased by more than in the previous month. Even beyond services, price increases in virtually all categories except energy, cars and clothing posted either accelerated gains or held steady.

(data via the Bureau of Labor Statistics)

Perhaps even more worrying, the Fed’s preferred measure of “supercore” inflation, which strips out food, energy and shelter, delivered the highest month-on-month increase since April 2022.

(chart via Bloomberg)

This is not the breadth of disinflation the Fed wants to see.