WEEKLY, Dec 17, 2022

Hi all! This is the last free weekly Crypto is Macro Now of 2022 – this newsletter will be taking December 24th and December 31st off, back on January 7th. The premium daily version will continue to publish throughout, except for December 26th, January 2nd and January 6th.

I want to thank you for being here, truly. In three months, more than 1,000 of you have signed up! I’m humbled and grateful, and I have very much enjoyed writing for you. I hope that you experience plenty of valuable moments this holiday season – it’s been a rough time for most, which makes appreciating the good things in life even more important.

The daily premium Crypto is Macro Now touched on the following topics and much more… I hope you’ll consider subscribing!

Why inflation is not getting down to 2% any time soon

How crypto derivatives leverage has changed

Rates expectations for February

Crypto seller exhaustion

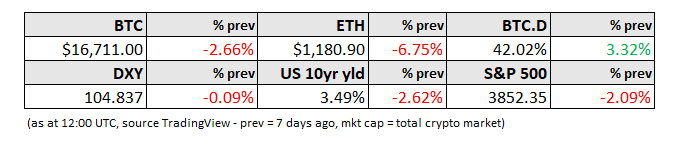

MARKETS

This section is kept brief since I talk about markets all week in the premium daily version, and this free weekly email is already too long (Substack flashes all sorts of warnings at me!).

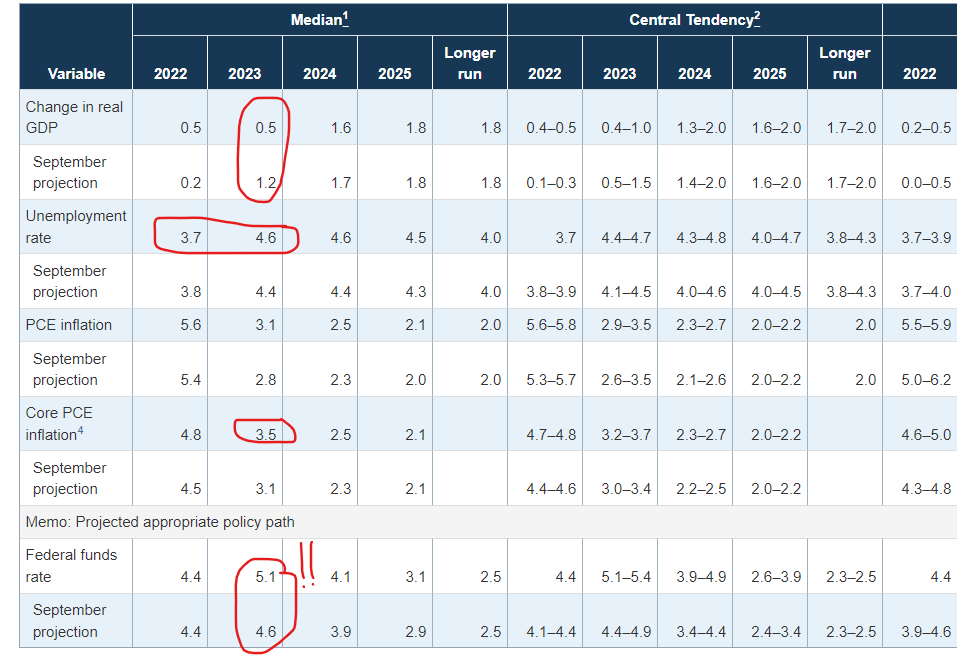

Among the key issues I discussed was the evolution of the FOMC economic projections – the jump in rates expectations in the past year and even between September and December has been breath-taking, and does not inspire much confidence.

(table via the Federal Reserve)

I also went into which I thought would be better for bitcoin in terms of “higher for longer” – a continued ramp and then decline, or a pause that held? Neither are great, but at least the latter removes interest rate uncertainty, which is one of the current market’s headwinds.

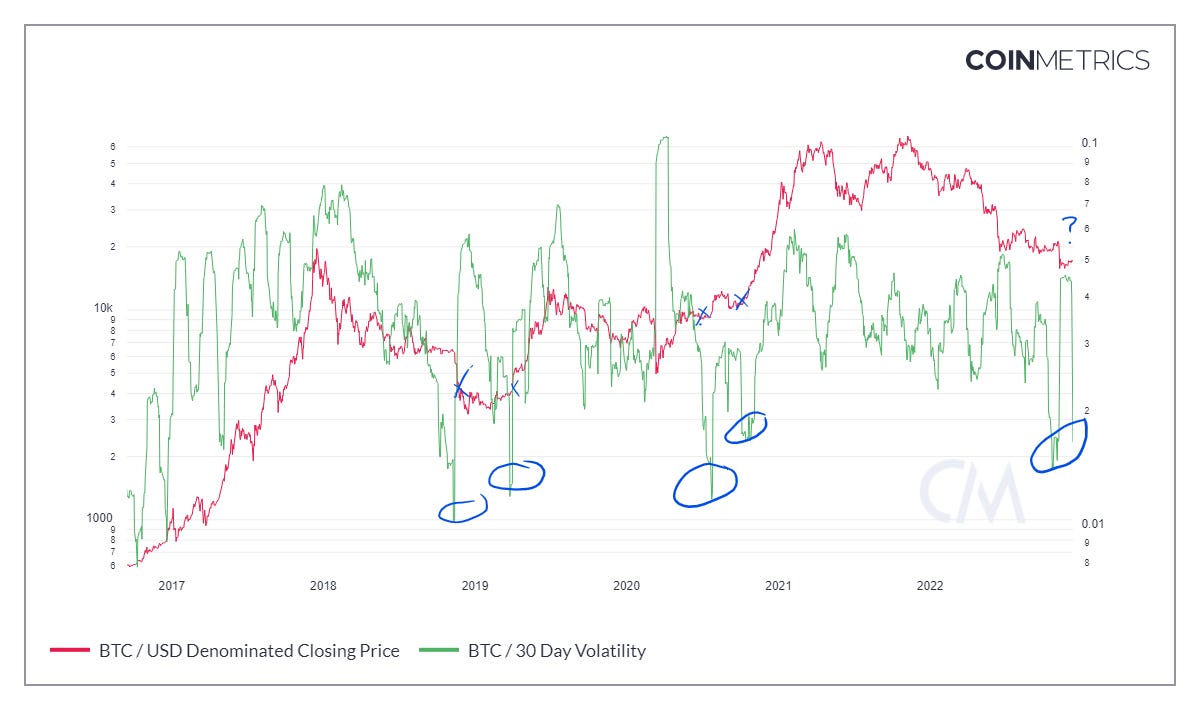

Another trend worth noting is the BTC volatility lows – now that 30 days since the FTX drama has passed, the 30d volatility is back to astonishingly low levels, which in the past has usually preceded price rallies.

(chart via Coin Metrics – volatility not annualized)

COLUMN

Crypto 2023: A Shifting Centre of Gravity

The end of the year is just a date on the calendar, technically no different to the day immediately after it, and yet it always feels like an occasion of promise and introspection. Since this is my last column of 2022, I will succumb to the temptation to look ahead and try to extract a few words that encapsulate the vast changes ahead. My plan was to avoid looking back, we’ve all been doing too much of that recently. But I realized we can’t look ahead without at least acknowledging the impact that this year has had on our collective psyche, and how that is likely to shape much of what we see in the months to come.

The root of what we’ve been through and what is coming is the changing role of emotion in our collective motivation. This shift tells the story of the past couple of years, and will shape our focus and the outlook for prices in the months to come. This may sound simultaneously obvious and also obscure, so I’ll explain.

First, the obvious part: Looking back, the year has been pretty emotional for most in the industry – even if we managed to emerge personally unscathed, we most likely know people who didn’t, and the gloom and fear around us would have been hard to escape. We generally felt betrayed by individuals most looked up to as examples of smart success but who turned out to be abusing people’s trust for self-enrichment, flat out lying and then hiding from taking responsibility.

Slightly less obvious is how we got in the position of such betrayal in the first place. In 2021, the industry made a lot of money. Values and volumes were rising, funding was fluid, and we were all feeling pretty good. Emboldened by the validating price performance, we relaxed our instinctive safeguards and looked up to those who were getting really rich, because surely that meant that what they were doing was constructive. We assumed fiat-based metrics had meaning, and the jarring realization that they don’t, at least not to the extent we thought, further sets the stage for what’s ahead.

So, number-go-up made us feel good, that evaporated (as it always eventually does) and the high-profile betrayals compounded the emotional hurt, leaving us scrambling for a positive replacement.

This brings us to the more obscure part, which is the role of emotion in technology. Software and data structures are not normally associated with feelings, but the ideology underpinning the dedication of many early bitcoiners and those driving the growth of other blockchain ecosystems has incited levels of passion not seen in other sectors. This is not surprising – any technological contribution that can make a profound and positive difference to humanity triggers feelings of fulfilment that stem from the gratification of belonging. You can see this in control rooms when rockets successfully take off, in labs when a vaccine breakthrough is achieved, and in the eloquence of dreamers of a better world.

Many of us who are old enough will remember the moving rhetoric of John Perry Barlow’s “A Declaration of the Independence of Cyberspace”, which united readers in defiance of those that did not understand the societal change unfolding in lines of code.

This “us vs them” staging was carried over into the emerging crypto universe, growing on the back of “permissionless innovation” and the dawning realization that philosophy had just been given a new set of tools through which to express itself. Collective determination took hold not just because of the humanitarian potential but also because of the dismissive resistance from legacy participants that either saw the threat or didn’t care enough to bother. The common cause created emotional bonds that fuelled resilience and rapid progress, and persists today because most of us feel strongly that what we are working on matters.

To weave the above threads together: Trading profits are good but they’re not exactly going to change the world, nor do they build focused communities. The thrill derived from winning shrinks in consolidating and tainted markets, and with that source of stimulation losing its lustre, the emotional centre of gravity shifts toward the satisfaction of creation.

This is the scene set for 2023:

A greater focus on the technological potential of crypto while the market’s spirits heal.

A back-to-basics iteration on the building that has been going on all along, while narratives have been largely focused on shorter-term gratification.

Signs of even deeper integration with human progress through applications related to other developing technologies.

The renewed attention will highlight much more than the evolution of new blockchains, the growth of scaling solutions and the evolving security of bridges. It will build on the importance of markets by revealing new custody solutions, decentralized order books and tokenization tools. This will link to the emergence of new types of assets as experimentation continues among private and public issuers, with political progress on central bank digital currencies an influencing factor. It will also tie into the global drive for more secure, rapid and low-cost payments, both local and cross-border. And crypto-based technologies will continue to support the development of renewable energy generation, just as energy politics becomes an even more flammable touchpoint for everyone.

Moving off this earthly plane, the rapid deployment of space and extra-planetary exploration, with public and private entities engaged in low-orbit commercial initiatives and governments in a race to colonize the moon and Mars, will place an urgency on the need for resilient decentralized communication and data storage. The explosion of interest in and capability of artificial intelligence protocols could play an intriguing role in metaverse development, and the role of NFTs will move well beyond that of collectible images at a time when international insurance, property and credentialing industries struggle with transparency issues.

These trends have a very different emotional feel from the rollercoaster of markets, just the kind of emotional feel the industry needs after the hurt of recent months – constructive investment that reminds us why what we’re doing matters. Focusing on the work and the societal benefit will help us reconnect with each other, to better engage with critics and weather the regulation pipeline.

With this, we can put a pitiful year behind us, excise selfish individuals from our consciousness, and look forward to continuing our collective effort to make the world a better place. Whatever happens in markets, 2023 will deliver plenty to feel good about.

KEEP AN EYE ON

(A handful of the main themes from the week, explored in more detail in the daily emails – just a limited selection of topics I find interesting, by no means comprehensive!)

An explanation may be due. I feel I should clarify why I don’t talk about FTX much in this space. The drama is gripping, sure, but it has very little to do – so far, anyway – with the overlap of the crypto and macro landscapes, the focus of this newsletter. And there’s plenty of coverage pretty much everywhere else. Of course, I will surface any SBF-related developments should they become, you know, big-picture relevant. But I hope they don’t. And on an unrelated note, I don’t know about you, but I sure am looking forward to not seeing his face all over my news feed.

Proof of what? One positive consequence of the recent crypto drama is the mounting scepticism around how crypto platforms handle their customer balances, and the scramble among these platforms to demonstrate that assets match liabilities through a process called “proof of reserves”. This involves a cryptographic and audit demonstration that each clients’ account is included in the liabilities, and that the assets meet or exceed the total amount. This has given rise to a new problem, however – the manipulation of what the public understands to be “proof of reserves”. It turns out that, as is common in crypto, there is not an established definition, so exchanges can claim they are offering this service when in fact there are no guarantees established at all. Furthermore, proof of reserves does not necessarily show that customer assets are unencumbered. Users might not appreciate this, leading them to trust platforms that perhaps are not employing best practices.

Last week, Binance offered a “proof of reserves” attestation conducted by accounting firm Mazars. However, analysts and insiders have pointed out that the report is incomplete and that the messaging is a “red flag”. What’s more, this summer the Financial Reporting Council flagged Mazars’ audit quality and approach to risk. On Friday, Crypto[dot]com announced a proof of reserves carried out by Mazars, also publicly criticized, and KuCoin is about to do the same.

Then, to further complicate the issue, on Friday we find out that Mazars has discontinued its crypto platform service, deleting its website and links to the relevant proofs. Accounting firm Armanino, which has been providing proof of reserves services to Kraken, CoinShares, Nexo and others, is reportedly ending its crypto practice. The firm was the accountant for FTX.US, and has been named in a class action suit which could be spooking non-crypto clients. It is not clear if Armanino’s decision will impact the proof of reserves service. And the Wall Street Journal reported late yesterday that BDO, the firm that had been signing off reserve reports for Tether, is “evaluating” its crypto work.

This is a blow because few firms have been willing to audit crypto companies, largely due to the lack of clear accounting standards. This is likely to change soon, with FASB deciding in the spring on new rules that could clarify the treatment of crypto assets on balance sheets. Meanwhile, however, it’s unlikely that any of the large firms will risk their reputations on either misadvising a client or overlooking a vulnerability. Proofs of reserves are not audits, but still require an auditor with enough reputation and confidence to attest to a situation. And the scarcity of attestations and the reluctance of venture funds to invest in projects that have not been audited by a risk-averse large firm will slow down the industry’s recovery.

Looking on the bright side, I believe that no proof of reserves is better than an unreliable one, since customers could assume the latter means there is no risk and act accordingly. But the market needs confidence building now, and this situation is another dent in platforms’ credibility.

Blockchain funds with a twist. WisdomTree has announced nine new funds that will invest in traditional assets but will be tokenized, will trade on a blockchain (the press release doesn’t specify which one, but an earlier blockchain-based fund filing mentioned Ethereum and Stellar) and can be held in the soon-to-launch wallet (the target date is some time in early 2023). So far this year, we have seen several high-profile traditional asset managers (such as Apollo, KKR, Hamilton Lane) issue tokenized funds – whatever the take-up, the breadth of the offerings and the support of big brands is an encouraging step toward further experimentation with a potentially more transparent and efficient trading rail.

Structural limitations. This week, Binance paused withdrawals of stablecoin USDC from its platform due to inadequate reserves, but has since resumed processing requests. The interesting part here is not that Binance had to temporarily suspend withdrawals just as rumours around its solvency are swirling in an unusually suspicious market. It’s that it could not convert its stablecoin BUSD into USDC without sending funds to a New York-based bank which was not open at the time of need. Assuming this is true, it does detract from the “instant transfer” promise of stablecoins, and reminds us that traditional financial market structure still plays a significant role in the functioning of crypto markets. This is something that stablecoin users perhaps don’t fully grasp. It also calls into question Binance’s strategy of insisting that all USDC entering its platform be converted into BUSD – this weakens the service for users, and leaves the exchange vulnerable to even more reputational hits.

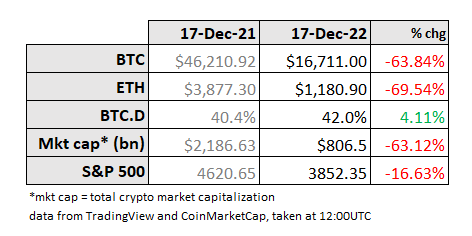

A YEAR AGO

(This section looks back at what was going on this time last year, so we can see how far we’ve come and how far we haven’t.)

This time a year ago, NFTs continued to grab the flashy headlines. Several new platforms either launched or were announced, such as from FTX.US (!!), Reddit, Instagram, Kraken, Fractal, Dr. Seuss (yes, really) and others.

Elsewhere in NFT-land, former First Lady Melania Trump issued NFTs (a full year before her husband), Yuga Labs announced a forthcoming BAYC game, Nike bought NFT fashion startup RTFKT, Adidas netted $23.4 million in a single afternoon from its debut NFT drop, congressional candidate Shrina Kurani included NFTs in her campaign (unfortunately it was not enough to win her the seat), and Bitwise launched an NFT-tracking index fund for accredited investors.

In less colourful news, BitMEX announced an airdrop scheduled for February of its native token BMEX. And The Block reported that institutional crypto custodians raised more than $3 billion in 2021, more than 3x the amount raised in 2020 – this was even before custody became such a key focus on market infrastructure after the centralized vulnerabilities surfaced in 2022.

GOOD READS/LISTENS

In his latest memo, Howard Marks labels the current investment landscape shift one of the most profound he’s seen in his 53 years in the business.

Podcast: Michael Casey and Sheila Warren talk to economists and professors Simon Johnson and Tyler Cowen about what the recent crypto drama says about the industry, in an episode with way too many thought-provoking takes to summarize here.

Podcast: The latest Village Global episode with Ian Bremmer shares eye-opening insight on the role of technology in the geopolitical plans of China, the politicization of AI, and more. I listened to this one twice.

Podcast: This What Bitcoin Did episode with Troy Cross goes deep into the “utility” of bitcoin mining – it’s not what you think.

Podcast: Preston Pysh’s conversation with Alex Gladstein and Sam Callahan about Alex’s eye-opening recent article on the World Bank and the IMF makes me really look forward to the forthcoming book.

Have a good weekend!

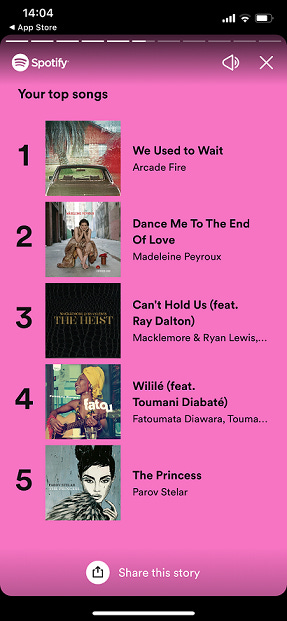

Who am I to argue with the Spotify algorithm, but I really don’t remember listening that much to Arcade Fire or Parov Stelar that much this year (I mean, I love those songs songs, but there are plenty of others on my playlist that better capture my recent moods).

So, here are some of my favourite listens that I think should have been on my most-listened list:

Garbage - #1 Crush

Vivaldi – La Follia

Maneskin – Torna a casa

Geoffrey Oryema – Market Day

Linkin Park – In the End

HAPPY HOLIDAYS, EVERYONE!